join us telegram A channel to stay up to date on breaking news coverage

Binance, the leading exchange by trading volume, officially removed Monero from its platform as of Tuesday, February 20th. This move follows the announcement made on February 10 and marks the end of XMR’s presence on the leading global trading platform. Amid these developments, Binance is navigating difficult times to meet regulatory requirements around the world. The exchange’s former CEO, Chanpeng Zhao, is under investigation in the United States and subject to travel restrictions despite being based in the UAE.

The decision to delist Monero did not come out of nowhere. In 2023, Binance announced its intention to remove XMR and other privacy-focused cryptocurrencies from the European Union to comply with regulatory standards. However, the exchange withdrew its decision a month later.

Known for its privacy-enhancing features that make transactions untraceable, Monero is increasingly attracting the attention of regulators. These authorities claim that the coin’s anonymity feature could facilitate the financing of illegal activities.

Major exchanges that currently continue to support XMR include Kraken International, KuCoin, and Bitfinex. Binance did not provide detailed rationale for the removal of Monero. The exchange said:

At Binance, we regularly review each listed digital asset to ensure that it continues to meet our high standards and industry requirements. If a coin or token no longer meets these standards or the industry landscape changes, we will conduct a more in-depth review and potentially delist that coin or token.

This scenario is not unprecedented within the Monero community. Other exchanges have previously delisted the coin for legal reasons. Kraken removed Monero from its UK platform in 2021, Huobi followed suit in 2022, and OKX announced its decision to stop supporting the coin as a trading pair on January 4, 2024.

As the delisting process progresses, all Monero trading orders will be automatically canceled after trading ceases. Binance has hinted at the possibility of converting the delisted tokens into stablecoins for users after May 21, 2024, but this has not yet been confirmed. In anticipation of the delisting, Binance withdrew XMR from its “monetization” program and stopped lending the cryptocurrency.

Monero users experiencing difficulties during the delisting process

However, Monero holders faced difficulties during the delisting process. Users have reported having difficulty withdrawing their coins from Binance, even though the withdrawal deadline has not been reached. One user complained about

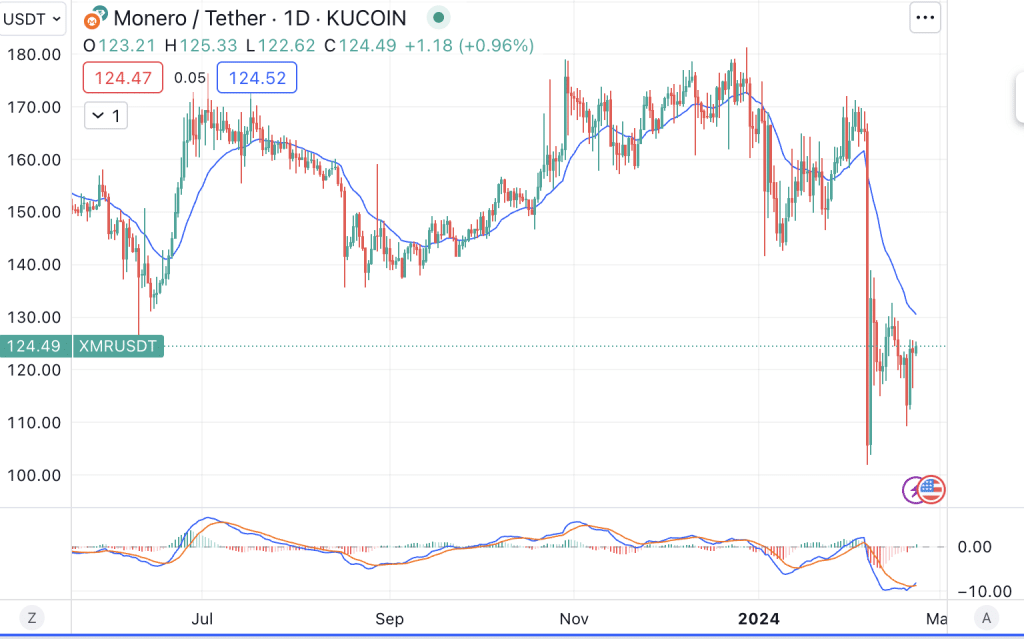

Monero’s price plummeted 36% on the day of the announcement and continued trading sideways for a while. Traders sold coins in anticipation of the delisting, causing the price of XMR to fall from $121.8 to $113.1. However, day traders appear to be taking advantage of the decline, with the coin recovering 6.4% to reach the current price of $120.45 and almost canceling out yesterday’s losses.

$XMR I refused to cucked to stay at cucked CEX. XMR leaves Binance because it does not recognize privacy. This is very optimistic, and a stance like this will keep Monero in the top 5 in the long run and eventually rise to number one.

It is one of the only coins that is actually used like money. Very active.— Goku (@xmrGoku) February 7, 2024

The outlook for Monero remains bearish, especially after the crash on February 6th. The coin is testing resistance set by the average price over the past 10 days, an obstacle that has proven difficult to overcome over the past week. Additionally, the coin is severely oversold, indicating fear in the market and a trend where sellers outnumber buyers (a relative strength index or RSI of 39 indicates that out of 100 traders, 39 want to buy the coin and the rest want to sell it) . , the bearish trend continues.

Related news

A new cryptocurrency mining platform – Bitcoin Minetrix

- Thanks to Coinsult

- Decentralized, secure cloud mining

- Get free Bitcoin every day

- Native token currently in pre-sale – BTCMTX

- Staking Rewards – APY 50% or more

join us telegram A channel to stay up to date on breaking news coverage