Share this article

![]()

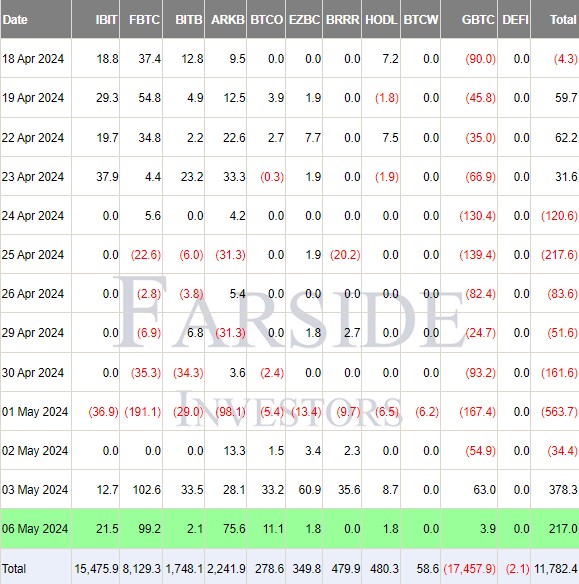

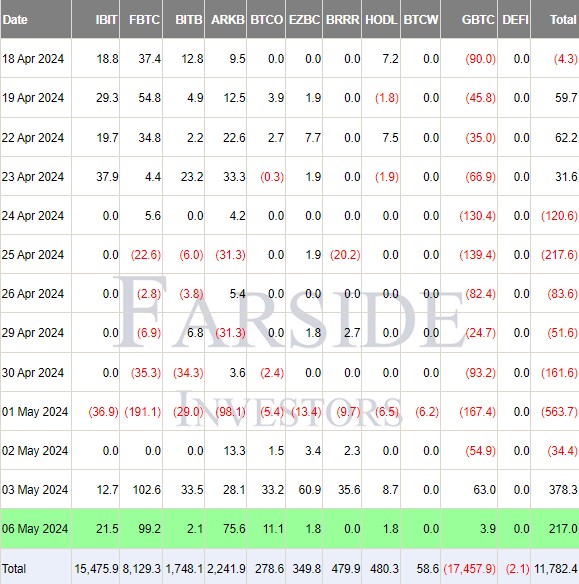

Grayscale Bitcoin Trust (GBTC), Grayscale’s spot Bitcoin exchange-traded fund, recorded net inflows of $3.9 million during Monday’s trading session, according to data from Farside Investors. Leading the charge was Fidelity’s Wise Origin Bitcoin Fund (FBTC), which reported significant inflows of approximately $99 million, surpassing BlackRock’s iShares Bitcoin Trust (IBIT), which saw inflows of approximately $21.5 million.

This is not the first time Fidelity has surpassed BlackRock in daily Bitcoin ETF inflows. The biggest difference was observed last Friday, when FBTC’s inflows exceeded $102 million compared to IBIT’s $13 million.

But the spotlight is on GBTC. Last Friday, for the first time since the conversion, the fund recorded inflows of $63 million, ending a long period of outflows.

Despite the influx, Nate Geraci, president of The ETF Store, expressed skepticism about its sustainability.

“It’s difficult to know what’s behind the flows into GBTC,” Geraci said. “ETF buyers are a very diverse group with different motivations. That said, I would be surprised if the influx becomes a trend.”

The high fee of 1.5% charged by GBTC was cited as the reason for the outflow of fund assets. This is a noticeably higher level than the 10 competitors in the U.S. market.

Additionally, the liquidation of the holdings of bankrupt lender Genesis also contributed to the decline in GBTC’s assets.

Nonetheless, Grayscale remains the leader in assets under management in the category, with GBTC managing approximately $17.4 billion, while IBIT comes in second with approximately $15.4 billion.

In total, U.S. spot Bitcoin ETFs enjoyed net inflows totaling $217 million.

Despite the positive movement in the spot Bitcoin ETF, the Bitcoin price did not show a corresponding increase. Historically, Bitcoin prices have risen due to significant ETF inflows. However, at the time of reporting, the price of Bitcoin was hovering around $63,400, down 1.5% over the past 24 hours, according to CoinGecko.

Share this article

![]()

![]()