- Hashdex files for first index-based US cryptocurrency ETF, holding Bitcoin and Ethereum

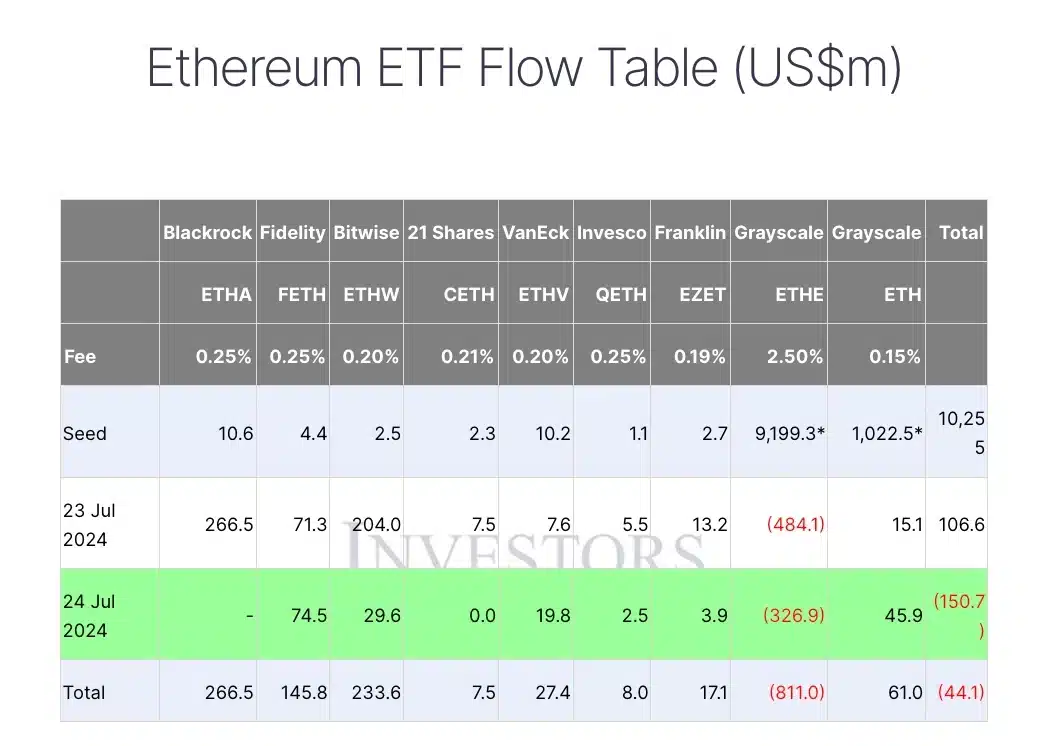

- ETH ETFs saw inflows of $176.2 million, while Grayscale saw outflows of $326.9 million.

Hashdex, a cryptocurrency asset management firm, has taken a major step towards launching a groundbreaking exchange-traded fund (ETF) that directly holds physical Bitcoin (BTC) and Ethereum (ETH).

As part of its move to establish the first index-based cryptocurrency ETF in the United States, Hashdex has filed an S-1 registration statement with the U.S. Securities and Exchange Commission.

Hashdex’s ETF Plan

The fund, called the Hashdex Nasdaq Crypto Index US ETF, initially aims to include BTC and ETH, with the potential to include more assets as regulatory requirements evolve.

This milestone comes after weeks of preparation and represents a significant advancement in Hashdex’s vision for the cryptocurrency investment space.

Expanding on the same content, Hashdex’s S-1 filing states:

“If crypto assets other than Bitcoin and Ether become eligible for inclusion in the index, the Sponsor will switch to a sample replication strategy that includes only Bitcoin and Ether in the same proportions determined by the index.”

Echoing the same sentiment, Bloomberg ETF analyst James Seyffart said of X:

“Starting with #Bitcoin and #Ethereum, but could add other assets if SEC approves.”

In a separate post, the analyst stressed that the move was not unexpected, adding:

“It won’t come as a surprise to anyone. It’s quite natural.”

What else is there?

Seifert also hinted at a potential date for the SEC to make a final decision on the Hashdex Nasdaq Crypto Index US ETF, saying the approval deadline could be “around the first week of March 2025.”

That said, Hashdex’s recent filing coincides with the final approval of a spot Ethereum ETF that began trading just two days ago.

Additionally, unlike these newly approved ETFs, the spot cryptocurrency integrated ETF proposed by Hashdex excludes Ether staking from its offerings.

Bitcoin & Ethereum ETF Analysis

Meanwhile, ETH ETFs have seen significant inflows, while Grayscale Ethereum Trust experienced significant outflows of $326.9 million on July 24. BlackRock’s ETH ETF, on the other hand, reported no activity.

Source: Farside Investors

On the Bitcoin side, the BTC ETF saw inflows of $44.5 million, while Grayscale’s GBTC attracted $26.2 million and BlackRock’s IBIT attracted $66 million on the same day, according to Farside Investors.