- Ethereum shows a slightly more bullish bias next week.

- The Bitcoin consolidation phase is still ongoing and a return to $60,000 is looking increasingly likely.

Bitcoin (BTC) traders have been going through a relatively difficult time following the usual easy, straightforward rally since last October.

Ethereum (ETH) has been more complex, but BTC’s halving event last month has shaped and scoped market conditions across the market.

AMBCrypto looked into what market sentiment was like over the weekend and where price action could go this week.

In either one, there are speculators who are hoping for bullish returns in the short term.

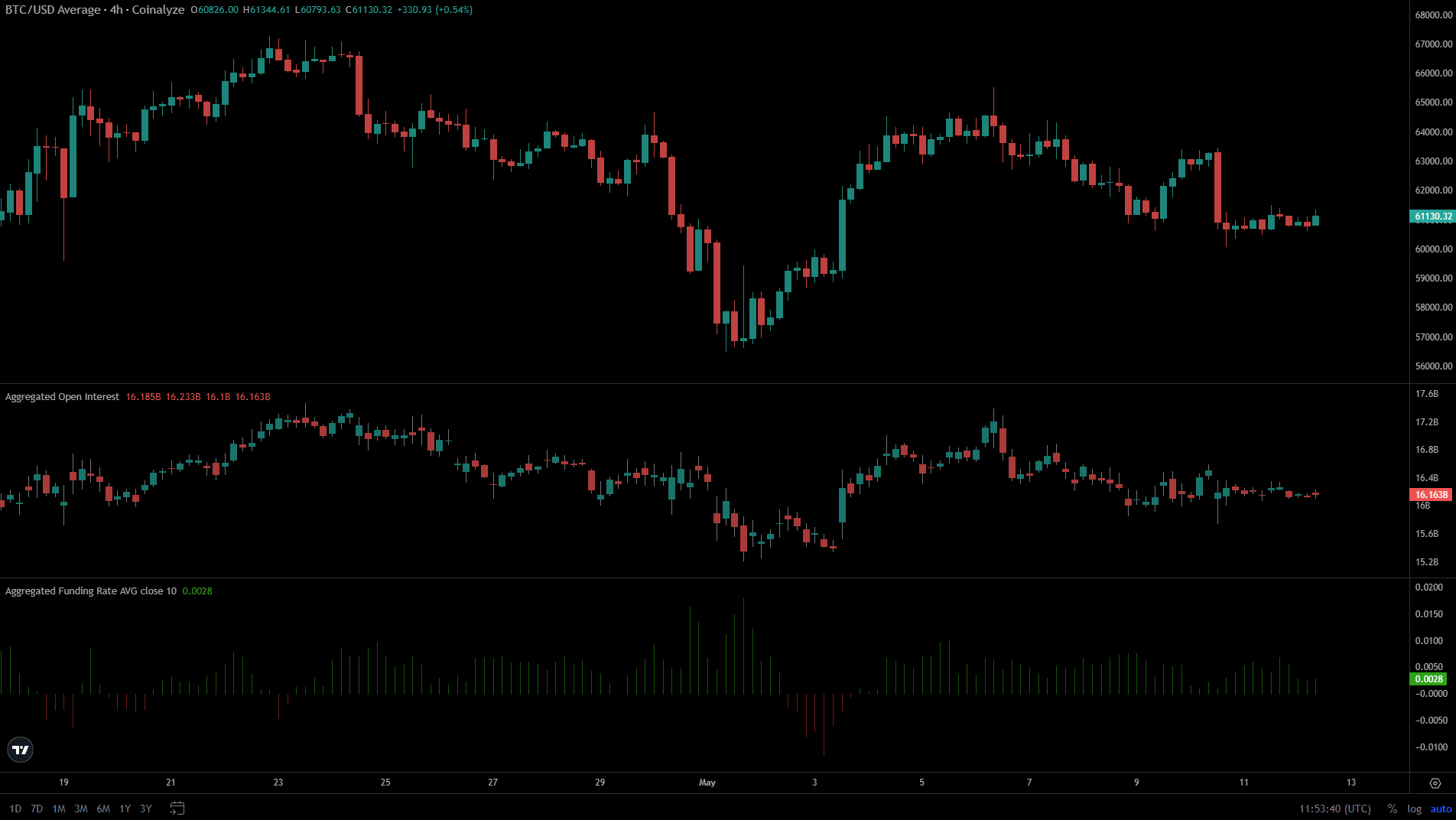

Source: Coin Analysis

Bitcoin open interest increased on May 10th, but OI has been trending downward since the price surge on May 6th.

Meanwhile, the price has made a series of highs over the past week, falling from $64,000 to $61,100 at press time.

The funding rate was negative in early May when Bitcoin plummeted to $56,000. The funding rate has since recovered.

However, over the past few days, this number has been barely above zero, indicating that sentiment is not very optimistic.

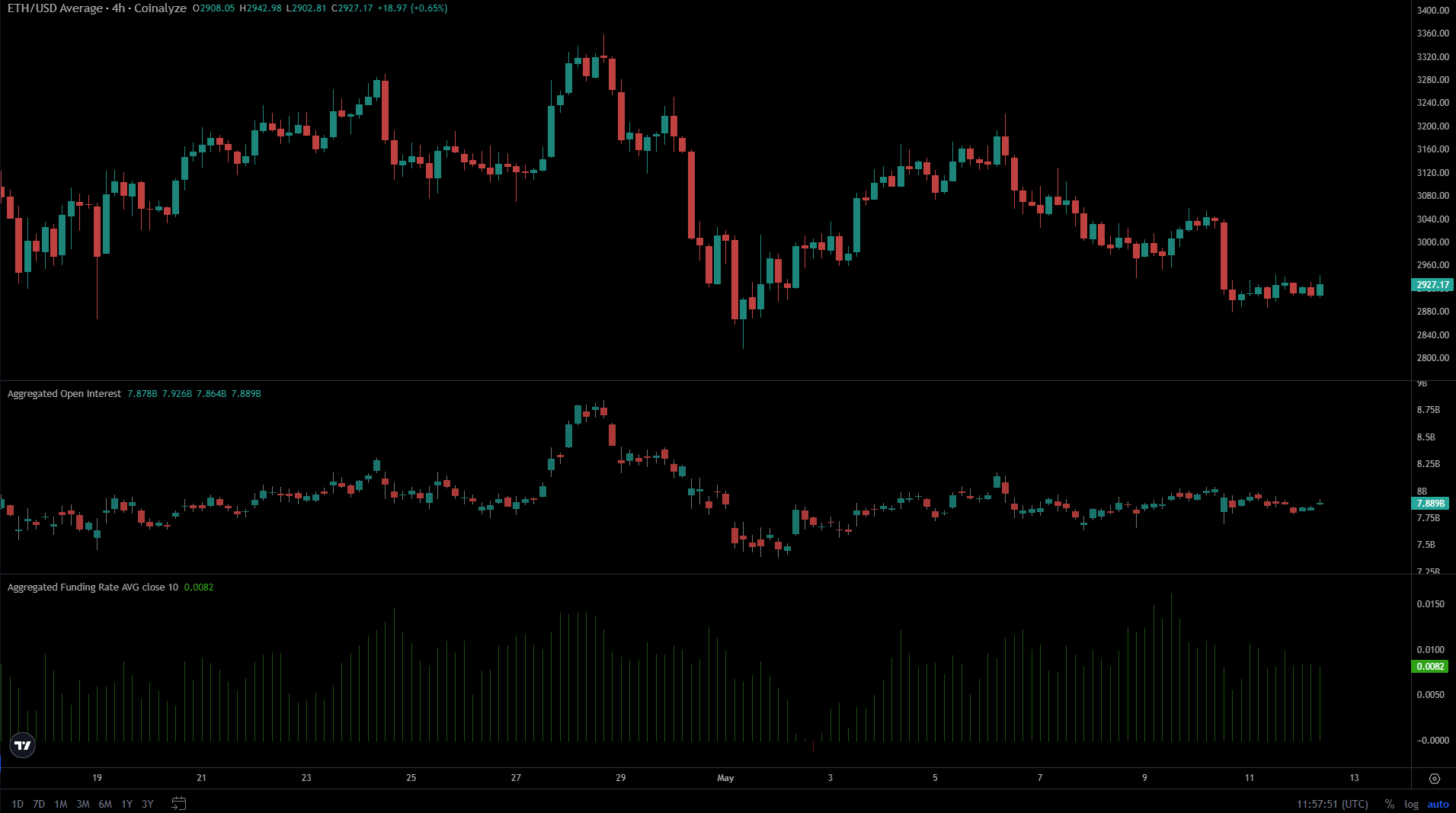

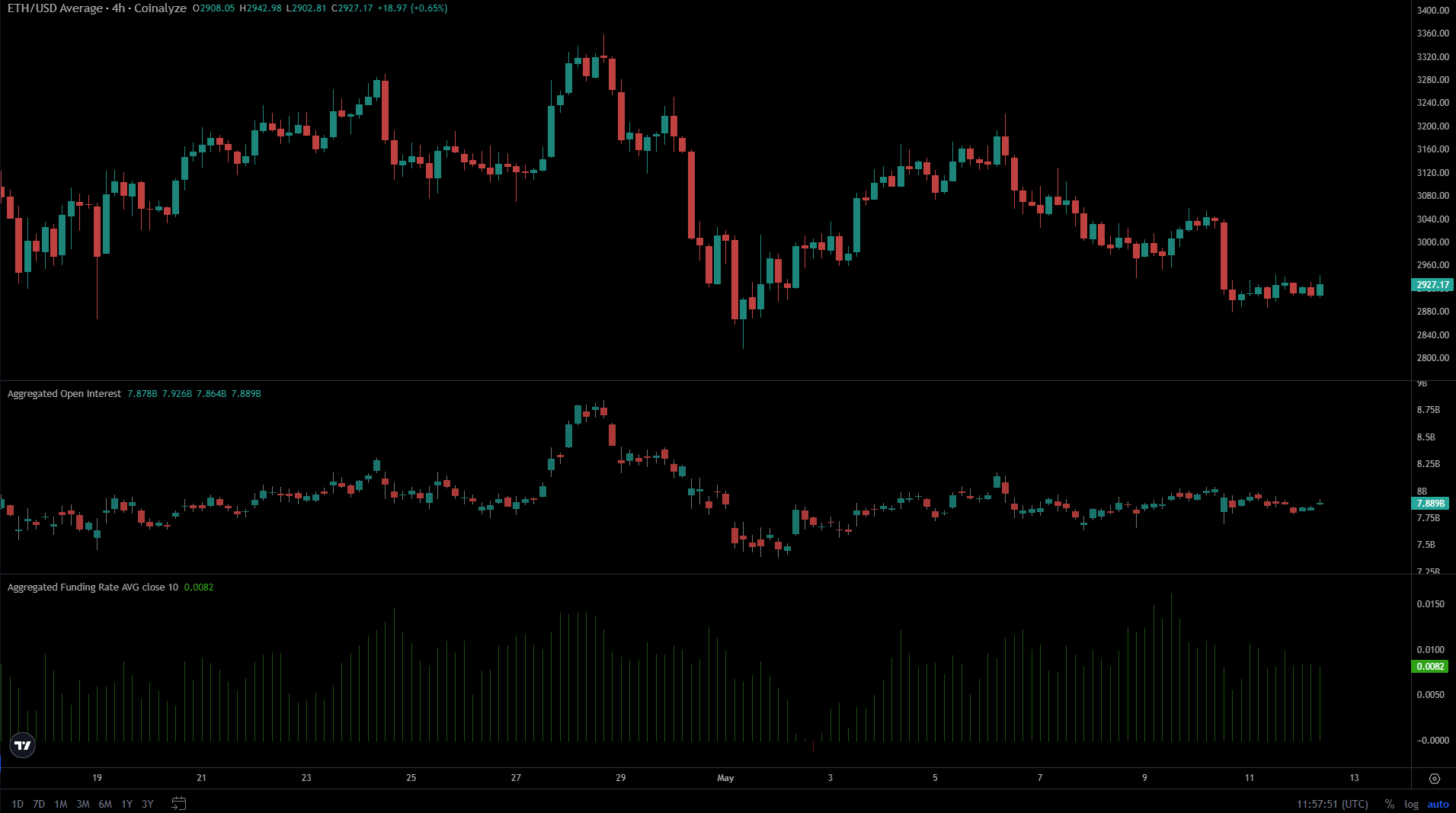

Source: Coin Analysis

Ethereum also saw its funding rate fall into negative territory in early May, but has since recovered. Last week’s downward trend saw the funding ratio hover around the baseline +0.01 level.

A slight rebound from $2980 to $3040 on May 9 resulted in higher open interest and funding rates.

This was not repeated for Bitcoin despite a similar price rally, suggesting that speculators were more eager to buy ETH than BTC.

What is the next pocket of liquidity that could attract prices?

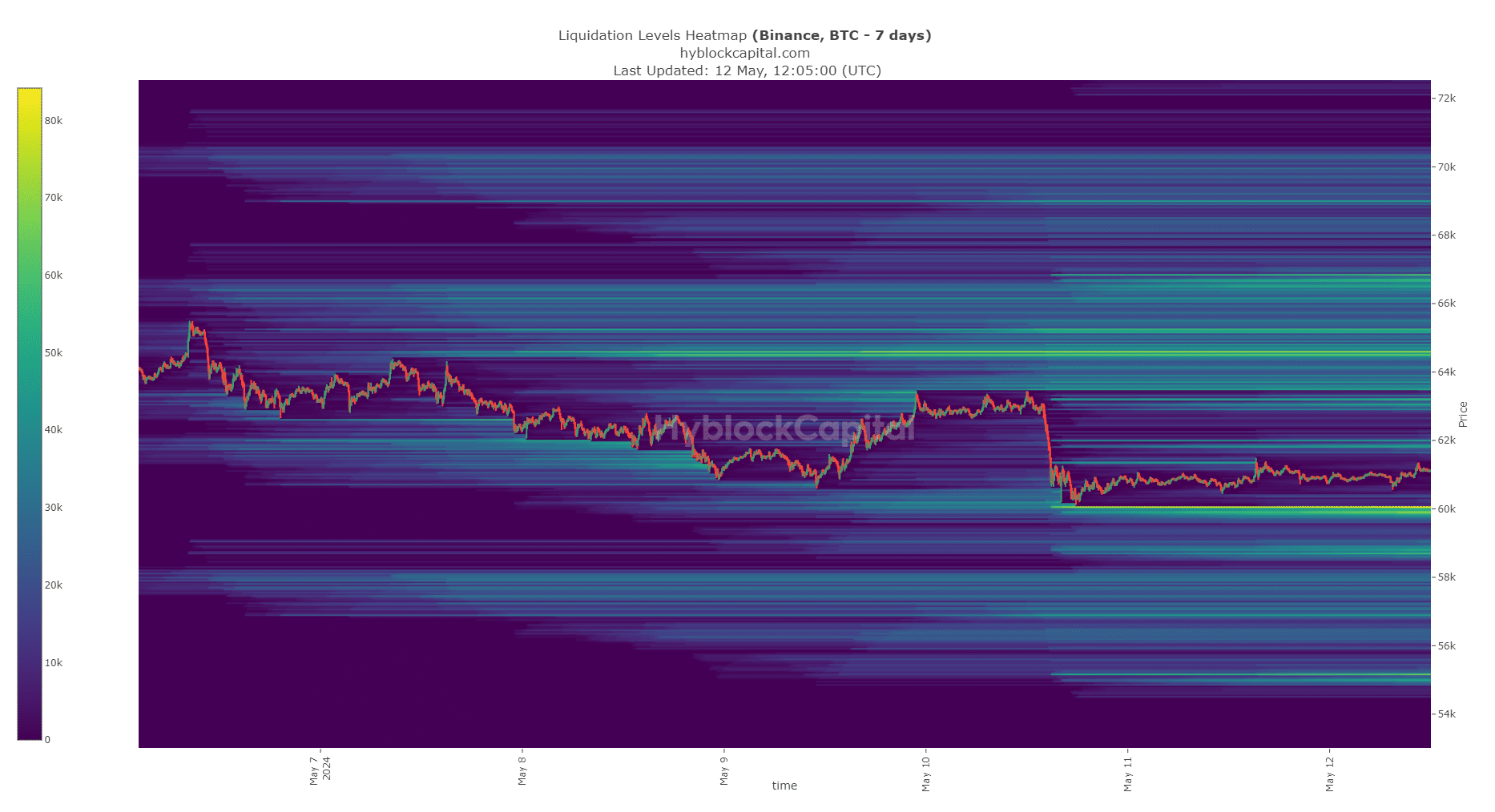

Source: CryptoQuant

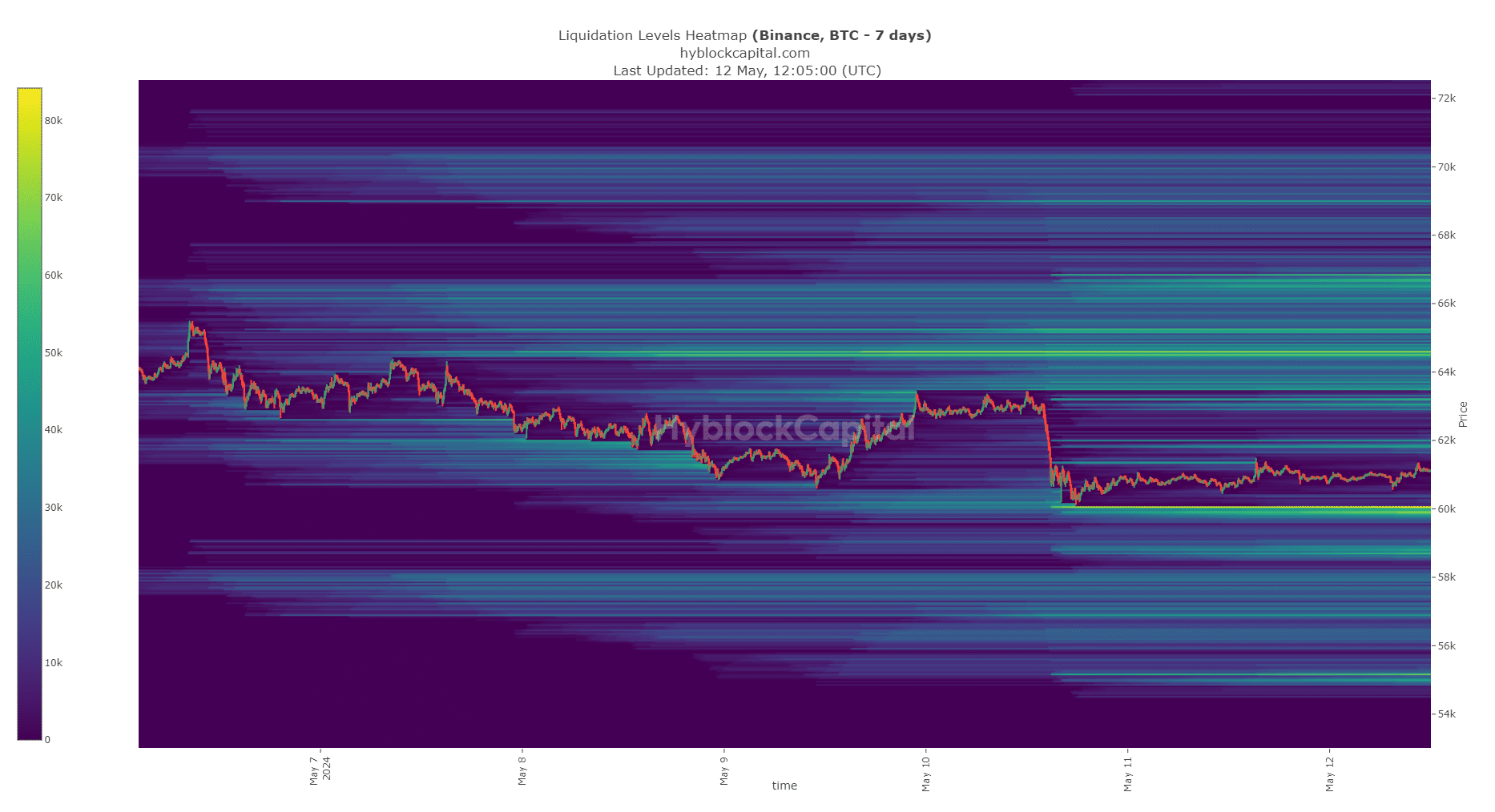

Bitcoin’s 7-day liquidation heatmap showed a bright liquidation cluster in the $60,000 region. To the north, $61,800 and $63,000 are the next bullish targets.

On May 5th, we saw the price surge above $64,000 to gather liquidity before a brutal short-term reversal.

Likewise, we could see a selloff on Monday to raise $60,000 of liquidity before a bounce higher. Therefore, BTC traders will want to buy dips into the $50.6k-$60k region.

However, traders should be prepared for a drop below $59.4,000 for BTC and set stop losses accordingly in case of a drop to $60,000.

Source: CryptoQuant

Read Bitcoin (BTC) Price Prediction for 2024-25

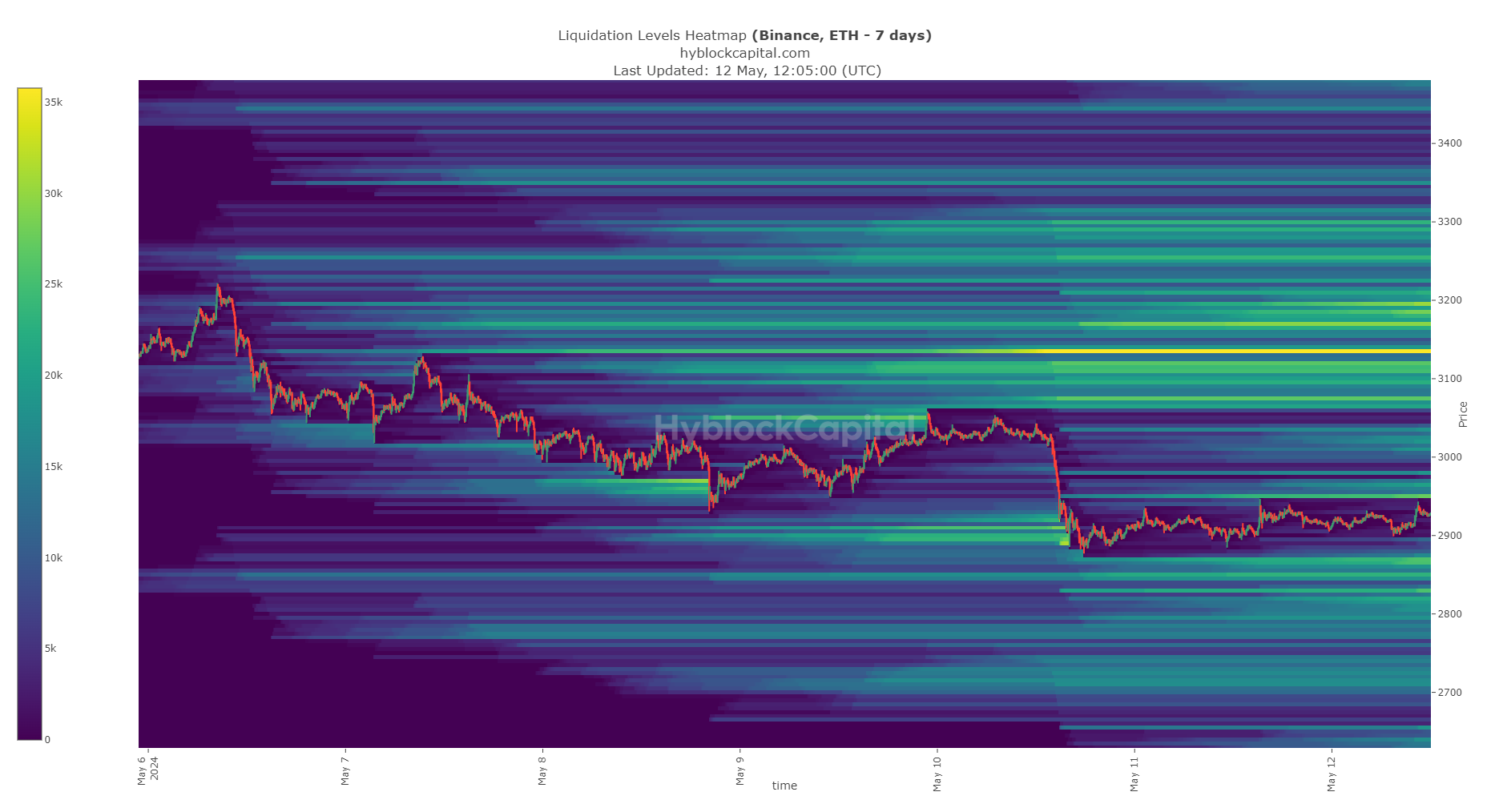

Ethereum, on the other hand, has a liquidity cluster near the north of $2950. This is close to the current market price of $2928. A decline towards the $2,860 region is likely to be a buying opportunity.

Liquidation levels in the $3.1k-$3.2k region present an attractive target. A drop below $2.8,000 would likely signal a strong near-term downtrend, in which case traders could cut their losses.