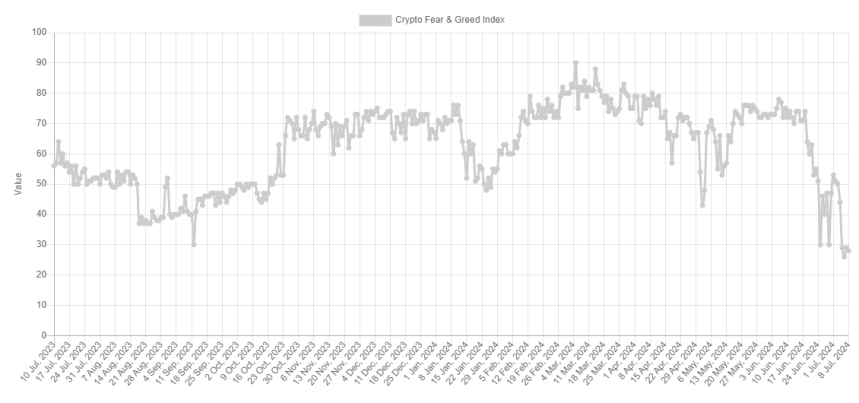

According to data, Bitcoin sentiment is getting close to entering extreme greed territory. Let’s take a look at what this could mean for the cryptocurrency price.

The Bitcoin Fear and Greed Index has been falling steadily recently.

The “Fear and Greed Index” is an indicator developed by Alternative that provides an average sentiment shared by traders in Bitcoin and the broader cryptocurrency markets.

This index determines this sentiment using five factors: volatility, volume, social media, market cap dominance, and Google trends. This indicator uses a numerical scale from 0 to 100 to indicate mentality.

Any indicator value above the 53 mark suggests the presence of greed among investors, while a value below 47 suggests that fear is dominant. The area between these two thresholds is correlated with neutral sentiment.

Now, let me tell you what the current Bitcoin fear and greed index is.

As you can see above, Bitcoin Fear & Greed currently has a value of 28, which means the average investor is showing fear. The level of fear is also quite remarkable, as this current value is quite deep into that area.

In fact, the latest level of this indicator is very close to a special area called “Extreme Fear”. Investors show extreme fear when the index falls below 25. There is a similar area on the greed side, known as “Extreme Greed”, which appears above 75.

In the first half of last month, the indicator was in or close to the latter territory, but the recent market decline has caused sentiment to drop sharply to the opposite end of the spectrum.

Historically, Bitcoin and other cryptocurrencies have tended to move against what the majority expects. The stronger the crowd’s expectations, the more likely such a move is.

Extreme sentiment is when traders are too biased in one direction. Therefore, major tops and bottoms of an asset are usually formed when the index is in these zones.

Because of this fact, some traders prefer to buy when investors are extremely fearful and sell when they are extremely greedy. This trading philosophy is commonly referred to as “contrarian investing.” A famous quote from Warren Buffett sums up the idea: “Be fearful when others are greedy, and greedy when others are fearful.”

As Bitcoin’s fear and greed index approaches extreme levels of fear, past experience suggests that the cryptocurrency may once again be presenting a profitable entry point.

Bitcoin Price

Bitcoin has yet to recover significantly from its recent crash, with the price still hovering around $56,700.