Share this article

![]()

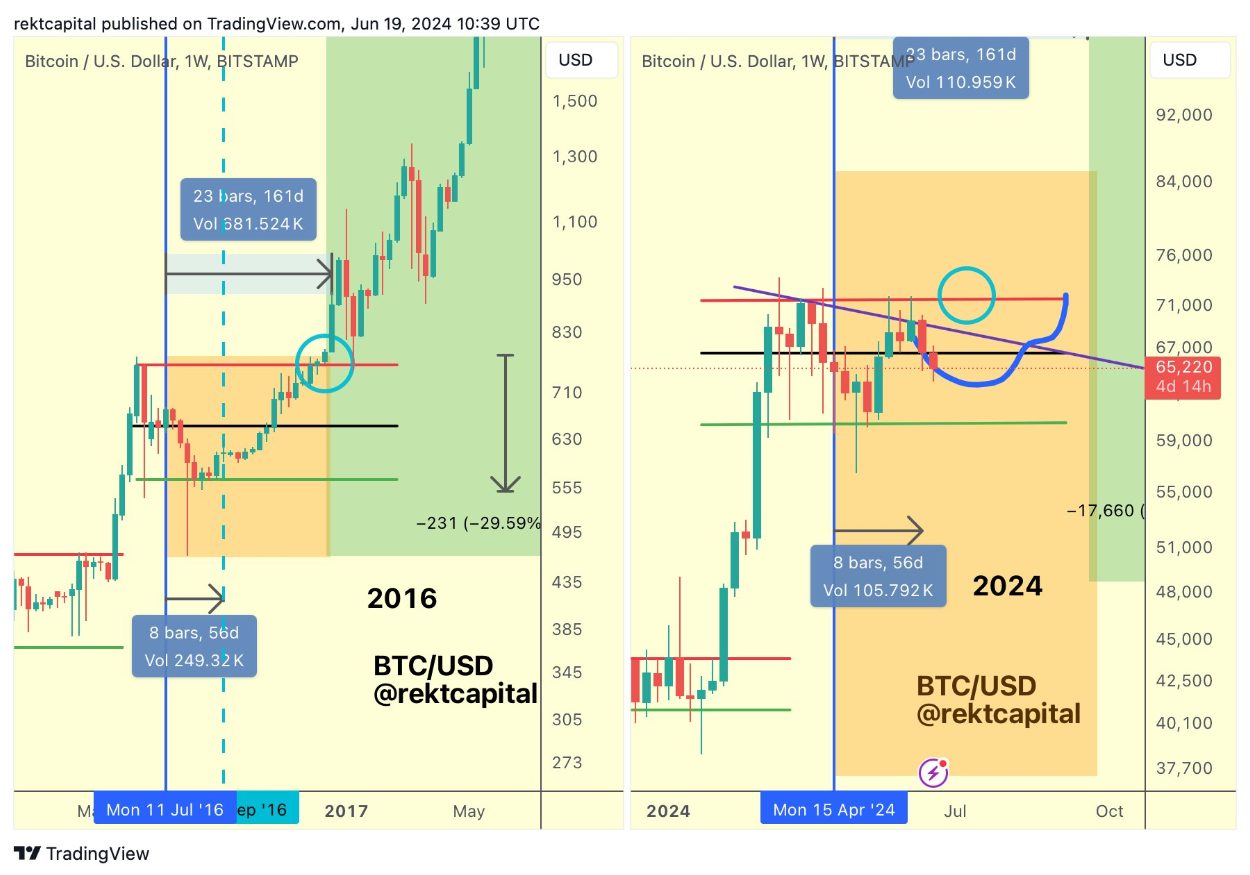

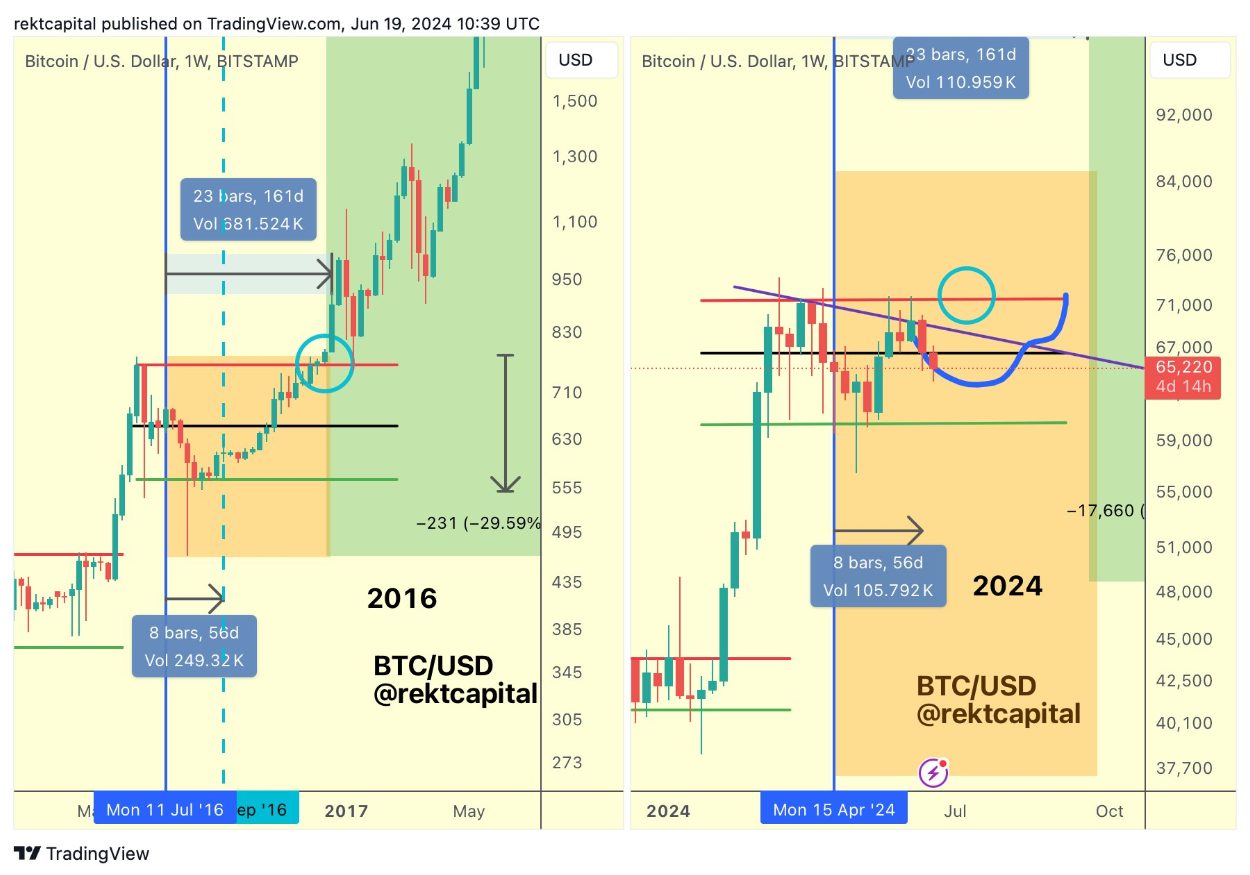

Bitcoin (BTC) has been under pressure due to the decline in June so far. according to To traders identified as Rekt Capital. However, a breakout of this trend could trigger a price reversal and send BTC back to the uptrend.

Bitcoin continued to trend downward throughout June (light blue).

However, once this downtrend line is broken, BTC will begin a price reversal.$BTC #Cryptocurrency #Bitcoin pic.twitter.com/SgkVRoMsfA

— Rekt Capital (@rektcapital) June 18, 2024

In particular, a price reversal is not the start of a parabolic upward movement. local inversion. This means that Bitcoin will still remain in a range between $60,600 and $71,500. constantly explaining This is an analysis by Rekt Capital.

Moreover, price action so far is similar to the 60-day period following previous halvings, which may calm investors desperate for a possible end to the current bull cycle.

Rekt Capital also identified a pattern that could see Bitcoin revert to $64,000 the following week and then slowly rise back to $71,000 by September.

Bitfinex analysts have recently confirmed that Bitcoin has been under pressure from a variety of investors such as whales, long-term holders, and miners. like reported According to Crypto Briefing, on-chain data involving three groups of BTC holders remains unfavorable to Bitcoin’s future.

BTC inflows to exchanges have increased as a percentage of total inflows, indicating increased whale activity and a trend that generally precedes price declines. Additionally, an inverse relationship between Bitcoin price and miner reserves was observed, with a notable decline in miner reserves coinciding with the peak of Bitcoin price around March 2024.

This indicates that miners were selling to take advantage of high prices and prepare for the halving event. With the miner’s reserves nearing a four-year low, it suggests selling pressure from this group is approaching a critical point, potentially impacting future market dynamics.

Share this article

![]()

![]()