Main takeout

- Bitcoin decreased 1.3% after US inflation data exceeded expectations.

- Federal Reserve Banks can maintain limited policy stance as inflation problems increase.

Share this article

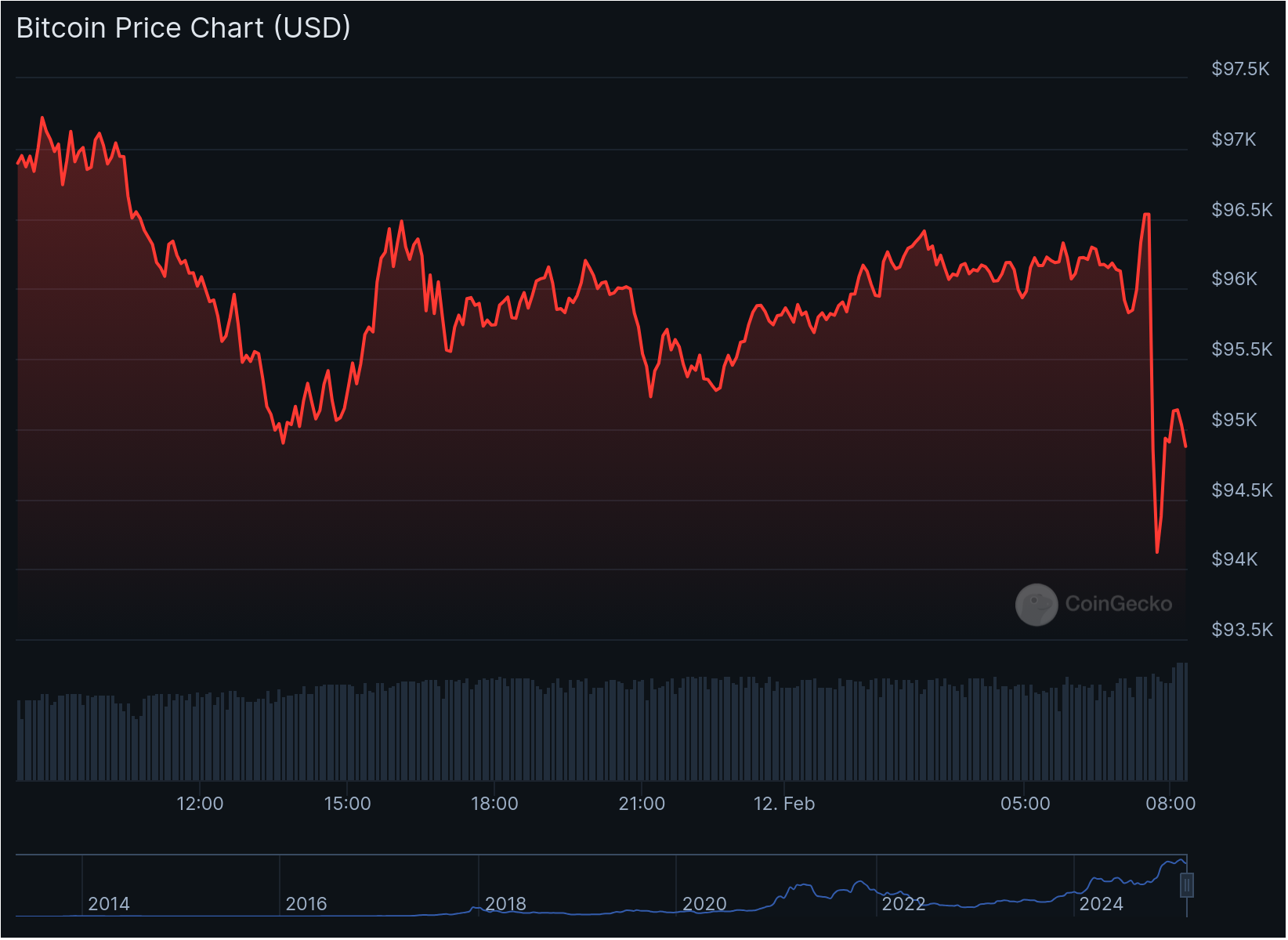

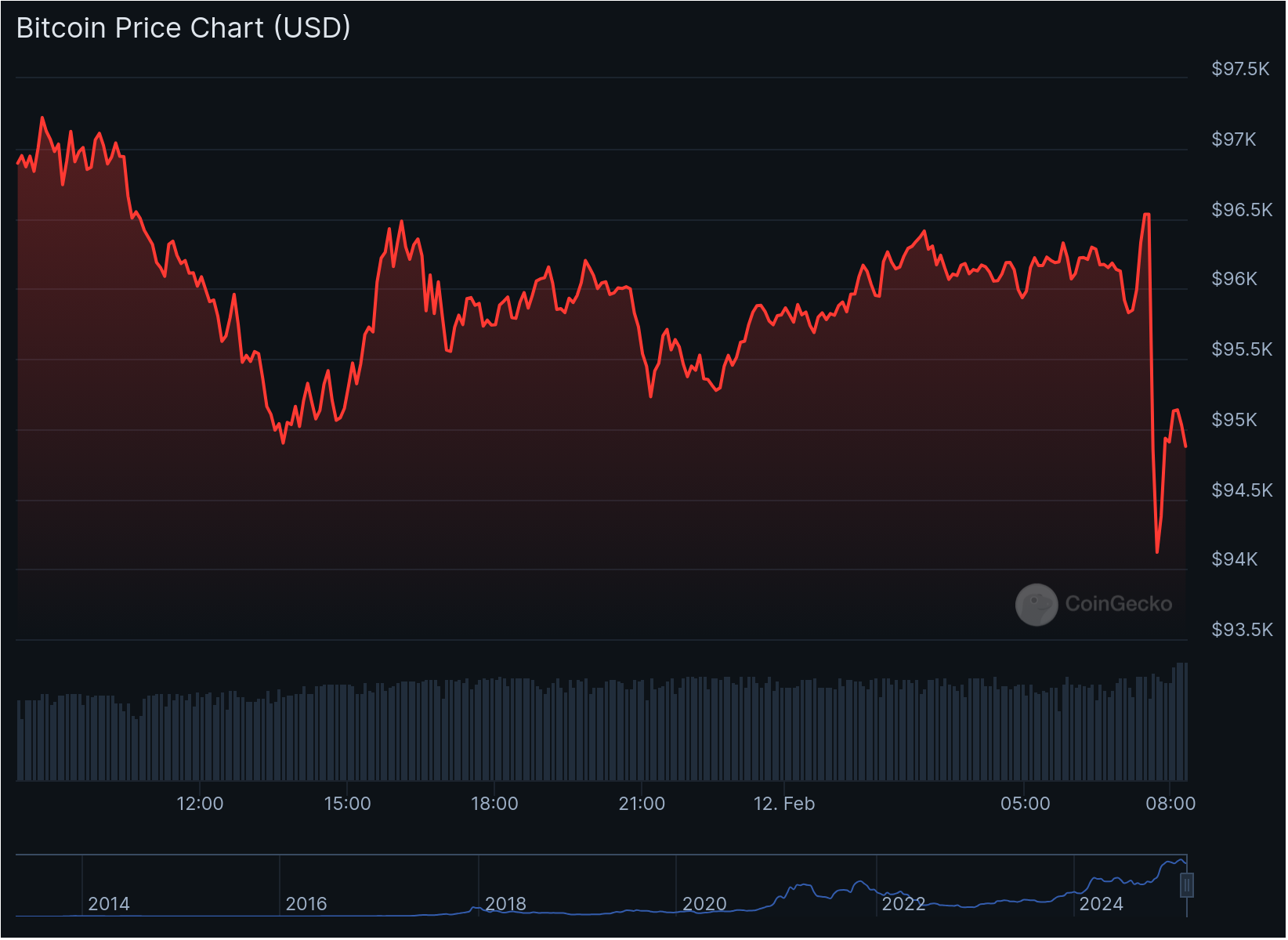

BITCOIN fell to $ 94,081 after US inflation data in January, and the consumer price index increased by 3.0% year -on -year forecasts.

Core inflation, excluding food and energy prices, increased 3.3%, surpassing 3.1%. The higher figures than expected triggered sales in the encryption market, and Altcoins also decreased.

Inflation reports emphasized the measured approach to monetary policy according to the testimony of Jerome Powell’s Federal Reserve.

POWELL said, “The current policy position is much less limited and the economy remains stronger than before.

POWELL reaffirmed the Fed’s 2% inflation goal and insisted that it was “not in a hurry” to reduce interest rates.

During the hearing, Senator Elizabeth Warren demanded interest rate cuts at the March meeting, citing concerns about potential economic damage caused by monetary strengthening.

The headline CPI reading value increases from 2.9%in December, suggesting that the Federal Reserve Bank can maintain a longer limited policy position than previously expected.

Bitcoin, which is often considered as a hedge to inflation, has struggled to maintain the story in recent months.

The encryption market is very sensitive to US economic data and federal reserve banking policies.

As the inflation is still hot, the Fear & Greed Index has recently recovered and returned to the “horror” area today.

Share this article