Bitwise Chief Investment Officer Matt Hougan offered a long-term view on Bitcoin halving based on historical data and spot ETF demand.

In an April 19 interview with CNBC, Hougan viewed this year’s Bitcoin (BTC) halving as a “news-buying” opportunity for investors interested in the world’s largest cryptocurrency asset class.

“If you look at halvings historically, the price movement within a week or two after a Bitcoin halving is relatively quiet. But looking ahead one year, the BTC price has rebounded significantly after each of the last three halvings and I think it will continue to do so.”

Matt Hougan, Bitwise CIO

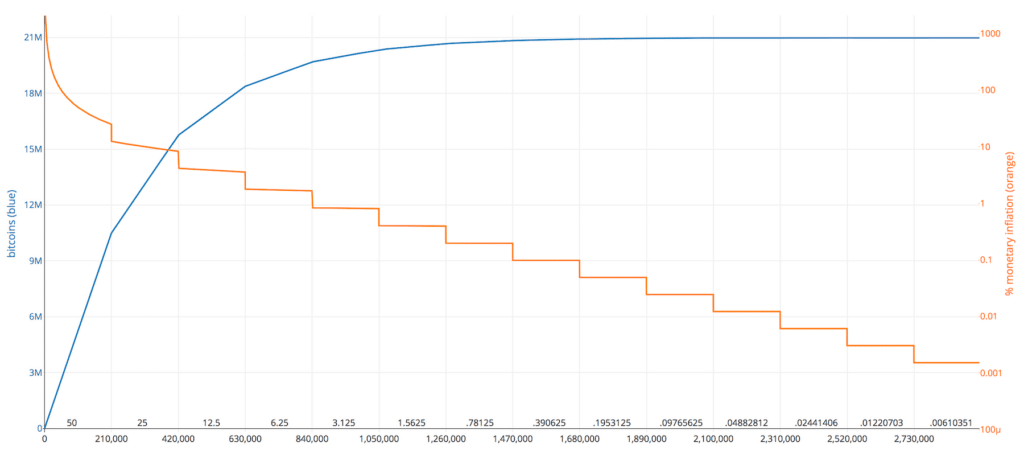

Halving is a pre-installed code change designed by the anonymous Bitcoin creator Satoshi Nakamoto to reduce BTC inflation and maintain supply shortages. Nakamoto built a system that reduces mining rewards by 50% every 210,000 blocks, or four years.

As block mining rewards are halved, the amount of new BTC in circulation is also halved. Many believe that this decrease in supply, coupled with increased demand through spot Bitcoin ETFs, will push prices higher through next year. BTC ETF issuer Hougan agrees with this sentiment.

“The new supply of Bitcoin entering the market is being cut in half. We are eliminating $11 billion in annual supply. The big picture is it has to be good value for money and we expect that to continue to be the case next year.”

Matt Hougan, Bitwise CIO

Bitcoin Halving to Solidify Demand for Spot BTC ETF

Coinpass CEO Jeff Hancock told crypto.news that Bitcoin has matured from a hobby and speculative market to a real-world asset attracting institutional interest. This is bound to make this cycle different, especially in an economy with high inflation and high interest rates, Hancock said.

“Historic market opportunities may emerge this Bitcoin cycle following the fourth halving. Bitcoin ETFs have already been successfully launched in the United States, there is currently an ETF pending in Hong Kong, an ETN on the London Stock Exchange, and Bitcoin prices are already at record highs before the halving. This has never happened before. In my opinion, the future of the Bitcoin market has unlimited potential.”

CoinPass CEO Jeff Hancock

In Hancock’s view, global demand for Bitcoin will remain strong beyond 2024 and tradfi will continue to proliferate the cryptocurrency ecosystem. Spot Bitcoin ETFs have already amassed over $60 billion in assets in less than six months.

The boss of a UK-registered cryptocurrency company added that the success of the spot BTC ETF could extend to its Ethereum (ETH) counterpart, despite staunch opposition from the US SEC.

“Institutional demand for Bitcoin will remain. An Ethereum ETF could follow in 2024, meaning institutional investors can now access staking rewards and decentralized finance through institutional tools.”

CoinPass CEO Jeff Hancock