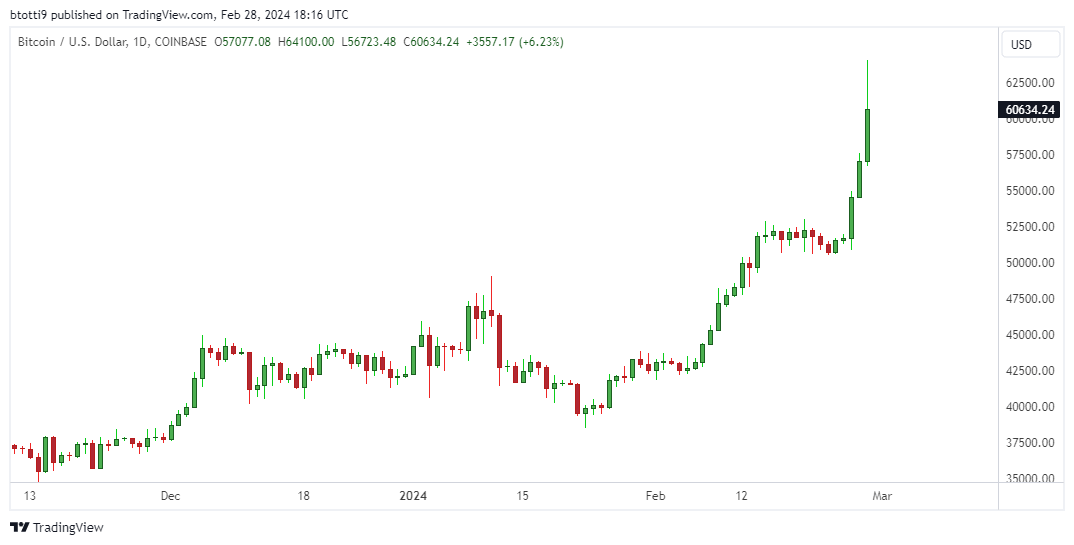

- The price of Bitcoin recorded a double-digit surge, reaching a high of $64,100 on Coinbase.

- However, BTC plummeted as Coinbase users reported account balance issues.

- Coinbase CEO Brian Armstrong noted that the exchange has seen a surge in traffic.

The price of Bitcoin surpassed $64,000 on Wednesday, February 28, marking its highest level since October 2021. The value of the top cryptocurrency rose more than 12% in 24 hours, hitting a record high of $64,100 on Coinbase.

However, as $100 million in liquidated BTC entered the market within an hour, the price fell sharply, reaching a low of $58,000. In the last 24 hours, total liquidations in the cryptocurrency market reached more than $630 million. According to Coinglass data, short selling volume was more than $355 million and long trading volume was more than $280 million.

The $6,000 drop occurred as users reported problems with their Coinbase accounts, showing their balances as $0. Coinbase support acknowledged the issue, stating that they are investigating the issue.

We are aware that some users may see zero balances across their Coinbase accounts and may receive errors when making purchases or sales. Our team is investigating this issue and will provide an update soon. Your assets are safe.

This case can be tracked at https://t.co/a3pl4WiDhZ.— Coinbase Support (@CoinbaseSupport) February 28, 2024

Coinbase Founder and CEO Brian Armstrong recognize Traffic surge that exchanges are seeing.

We are dealing with huge traffic surges. We apologize if any problems occur. The team is working to resolve the issue.

— Brian Armstrong 🛡️ (@brian_armstrong) February 28, 2024

What’s next for Bitcoin?

Up nearly 50% over the past 30 days, BTC is within 5% of its all-time high of $69,000, hitting multi-year highs. At today’s high, Bitcoin was twice as high as it was in October 2023, when it surpassed the $30,000 level.

The momentum driving the rally this week coincides with massive inflows into spot Bitcoin ETFs. The SEC’s approval of a spot ETF in January helped push BTC above $50,000, and record trading volume seen this week added momentum.

This week alone, BlackRock’s IBIT recorded a whopping $1.3 billion in trading volume. Today, spot ETFs are up to $2.6 billion with only half a day of trading data. Bloomberg ETF analyst Eric Balchunas shared this with X.

JEEZ: We’re only halfway through the trading day and the New Nine Bitcoin ETF has already broken its daily trading volume record with $2.6 billion. There are four BTC ETFs in the top 20. $ goes It ranks 4th overall, so it will probably trade more today than it did in the first two weeks combined. This is officially a craze. pic.twitter.com/Wqez1rKrCg

— Eric Balchunas (@EricBalchunas) February 28, 2024

The market expects the Bitcoin price to fall ahead of the halving. Bitcoin is currently hovering around $60,000.