According to the on Chain Analysis Platform GlassNode, Bitcoin investors have about $ 1 trillion in unauthorized profits.

This important figure emphasizes the paper gains accumulated by long -term holders as Bitcoin continues to deal with record high.

The Bitcoin Investor’s base moves from a trader to a long -term assignment.

According to the GlassNode Data, the average profitable profit per investor is about 125%, which is lower than the 180%in March 2024, with the BTC price of $ 73,000.

However, despite these huge profits, investor behavior suggests that it is not in a hurry to sell the highest encryption. Beincrypto reported that the previous daily profits were relatively conquered and an average of $ 880 million.

This is in contrast to the previous price surge when profits from $ 2.8 billion to $ 3.2 billion, respectively, from $ 73,000 to $ 107,000, respectively.

In addition, the current market sentiment suggests that investors are waiting for more decisive price movement before investors adjust their upward or downward positions. This trend pointed out a firm guilty ruling among long -term holders, and accumulation continues to overcome pressure.

“This is what Hodling remains a dominant market behavior among investors, and accumulation and maturity have greatly surpassed the distribution pressure.”

Rezo, the Bitcoin analyst, pointed out that the current trend reflects the fundamental changes of the evolved profile of Bitcoin holders. According to him, typical BTC holders have shifted from short -term speculative traders to long -term institutional investors and assignments.

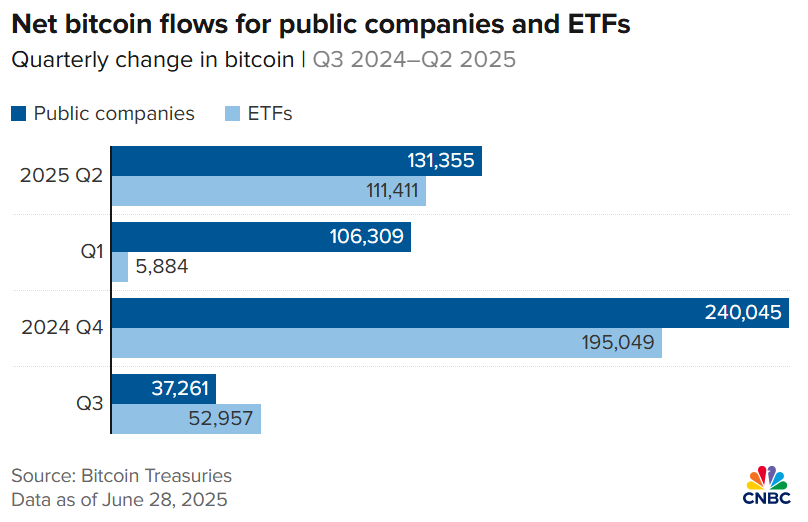

Rezo pointed out that the influence of public companies such as institution players and strategies (formerly Microstrategy), such as ETF, is increasing.

“Holderbase has changed from a trader looking for an exit from a quota who is looking for exposure. The fine straight flag sits in an unprecedented profit of billions of dollars.

In particular, public companies such as strategy increased Bitcoin Hold 18% in the second quarter, and ETF exposure to Bitcoin increased 8% over the same period.

Considering this, Rezo concluded that most short -term sellers fell from $ 70,000 to $ 100,000. He added that the remaining thing is that Bitcoin treats less as a speculative trade and treats it as a strategic long -term allocation.

disclaimer

By complying with the Trust Project guidelines, Beincrypto is dedicated to unbiased and transparent reports. This news article aims to provide accurate and timely information. However, readers should check the facts independently and consult with experts before making a decision based on this content. Our Terms and Conditions, Personal Information Protection Policy and Indemnity Clause have been updated.