Share this article

![]()

Bitcoin (BTC) broke a two-week decline by surpassing $70,000 today. However, trader Rekt Capital emphasizes that this has already happened recently and that a daily close above the resistance would need to occur to confirm this breakout.

Bitcoin broke a two-week decline today.

But we’ve seen uptrends over these downturns before.

This is why we need a daily close later today to confirm this breakout.$BTC #Cryptocurrency #Bitcoin pic.twitter.com/0jjg7TeebA

— Rekt Capital (@rektcapital) June 3, 2024

merchant shared In This consists of rejections from progressively lower prices to form lower highs. A daily close above $68,000 is essential for BTC to start regaining momentum.

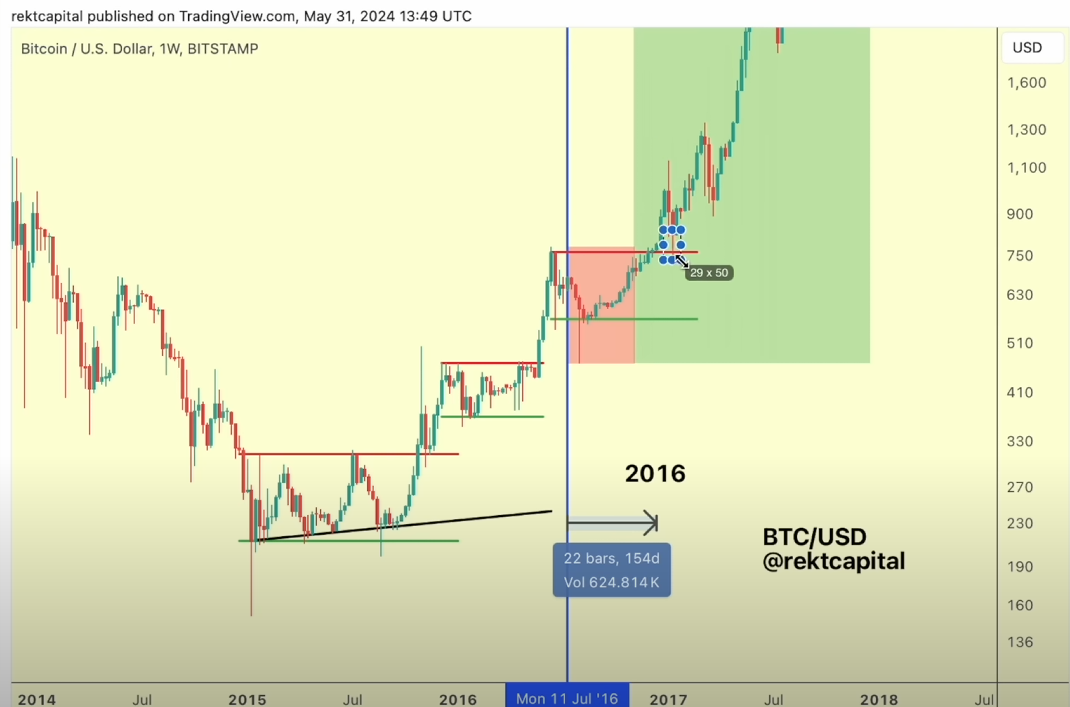

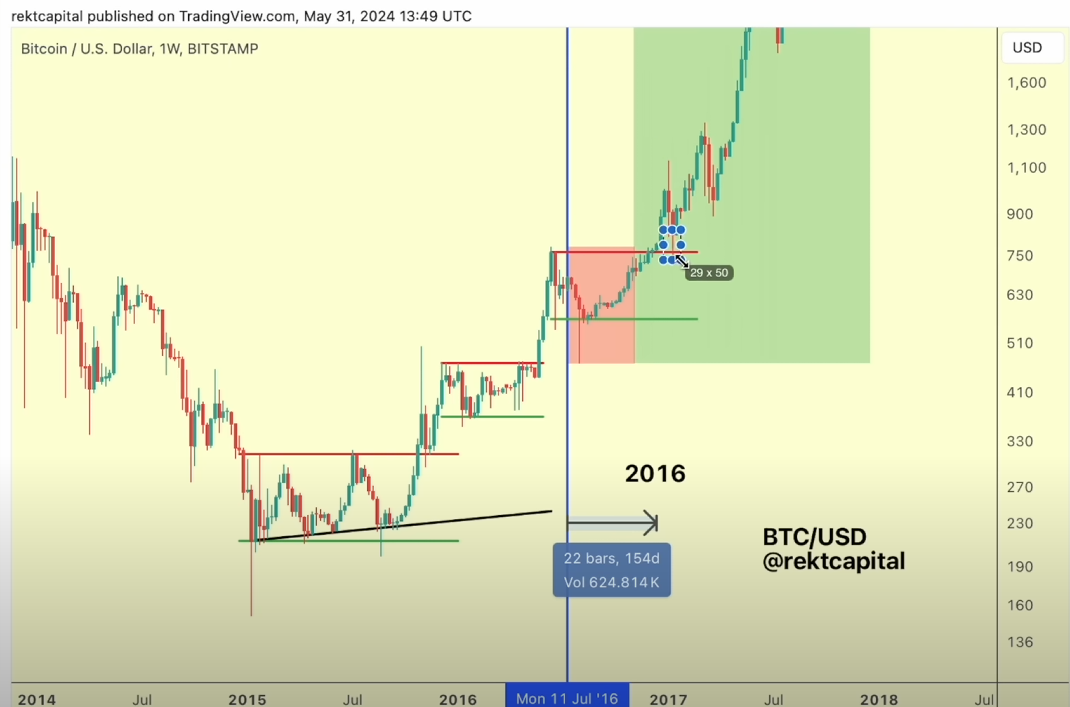

Rekt Capital also frequently highlights that Bitcoin has two phases remaining in its current bull cycle: the re-accumulation phase and the parabolic upward movement phase. in video In a report released on June 2, traders compare the current cycle to the 2016 halving cycle. This is because both cycles recorded multiple cumulative periods.

In particular, the current redeposit period may take 150 to 160 days from April 15 to end. “We see a lot of cross-sectional similarities between 2016 and 2024. The extent of reaccumulation here (in 2016) is very similar to what we saw in 2024, and the post-halving danger zone is very similar to what we saw.” added. Rect Capital.

As a result, if history repeats itself, Bitcoin could consolidate between $68,000 and $71,500 by September before the upward parabolic movement phase begins. This suggests history that BTC will not begin a strong bullish move in the near term, even if today’s daily close is above resistance.

Share this article

![]()

![]()