Open interest in Bitcoin futures has risen to over $23 billion. These positions have low leverage, which reduces the likelihood of a major price crash due to liquidation.

Open interest in Bitcoin futures has risen more than 20% to highs not seen since the 2021 bull market.

Why the sudden interest in Bitcoin futures?

CME Group and Binance dominate Bitcoin futures open interest with $6.39 billion and $5.75 billion, respectively. Bybit and OKX recorded $3.89 billion and $2.19 billion, respectively.

Read more: Where to Trade Bitcoin Futures: A Comprehensive Guide

Investor interest in Bitcoin futures has surged since early 2024. CoinShares confirmed in a January report that $1.9 billion has flowed into Bitcoin products in 2023. Exchange-traded futures products offer tradable shares of Bitcoin futures.

The Bitcoin Futures ETF received approval from the U.S. Securities and Exchange Commission in 2021. For a while, Bitcoin futures ETFs were the only way for institutions to obtain regulation on the asset.

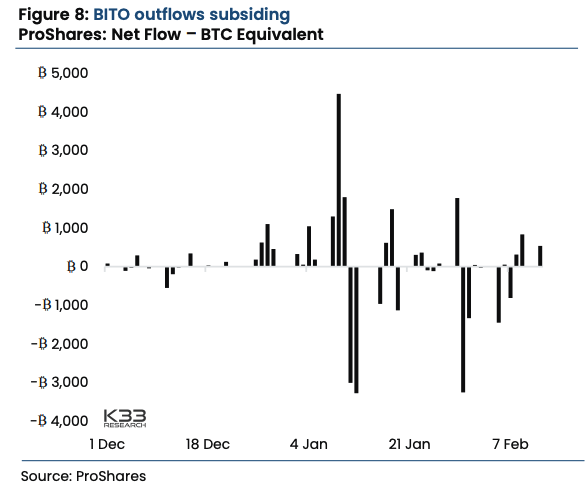

The largest Bitcoin futures ETF, ProShares Bitcoin Strategy ETF (BITO), surpassed $2 billion in assets under management in the first week of January. However, the fund saw major outflows towards the end of the month. Since then the outgoing flow has subsided.

Reduce liquidation risk with low leverage

However, according to data from CoinGlass, a surge in open interest in Bitcoin futures is unlikely to cause a price collapse. Leverage levels have increased slightly in recent weeks, from 0.18 to 0.2, but are still far from the levels seen in August last year.

Experienced traders use leverage to amplify profits from long or short positions. A long position predicts a higher future price of the futures contract asset, while a short position predicts a lower price.

Read More: How to Trade Bitcoin Futures and Options Like a Pro

Cryptocurrency futures trading platforms notify traders when they need to add more money to maintain their positions. This usually occurs when an investor’s margin falls below the exchange’s threshold for the price of a particular asset.

If the trader fails to add more funds to cover his position, the exchange liquidates the trader’s margin. Therefore, if margin trading clients use higher leverage and are unable to maintain their positions, the exchange may reduce the price of the asset through liquidation.

If your leverage ratio is around 0.2, this is less likely to happen. It also highlights how BTC’s recent rise to $50,000 and the recent approval of regulated investment vehicles such as ETFs that track assets directly negate the need for excessive risk. BlackRock, the second largest spot Bitcoin ETF provider, recently acquired 100,000 BTC as demand for ETF shares grows.

BeInCrypto reached out to CME Group, the largest cryptocurrency derivatives platform, for comment but did not hear back at press time.

disclaimer

In compliance with Trust Project guidelines, BeInCrypto is committed to unbiased and transparent reporting. These news articles aim to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to check the facts and consult with experts. Our Terms of Use, Privacy Policy and Disclaimer have been updated.