Several factors worsened bearish market sentiment on Monday, sending the Bitcoin price below the $43,000 level.

The world’s largest cryptocurrency by market capitalization was down more than 0.5% over the past 24 hours to $42,676 as of 12 PM ET, according to The Block’s pricing page.

Price action resulted in the liquidation of more than $75 million worth of long cryptocurrency positions, according to Coinglass data. Over the past 24 hours, liquidated Bitcoin leveraged positions have surged to nearly $30 million, of which more than $18 million were long positions.

On Monday, the price of Bitcoin fell below $43,000. Image: The Block’s pricing page.

Genesis Files for Selling Grayscale Assets

The price action comes as bankrupt cryptocurrency lender Genesis Global Capital filed a new motion on Saturday with the U.S. Bankruptcy Court for the Southern District of New York seeking approval to sell approximately $1.6 billion in trust assets.

According to the documentsAssets held by Genesis, a subsidiary of Digital Currency Group, include shares of Grayscale. Bitcoin  BTC

BTC

-0.56%

The Trust is valued at approximately $1.4 billion, Grayscale Ethereum Trust shares are valued at approximately $165 million, and Grayscale Ethereum Classic Trust shares are valued at approximately $38 million.

The company also filed a separate motion to shorten the related deadline so that the sale application can be heard at the Bankruptcy Court’s next hearing on February 8.

Federal Reserve signals interest rate cut delay

The BTC price action comes as the broader market digests a signal from the US Federal Reserve that the potential interest rate cut cycle will be delayed until May 2024 or later.

On Sunday, Federal Reserve Chairman Jerome Powell ruled out an early rate cut in 2024 in an interview with CBS’ 60 Minutes.

Powell said a March rate cut was “unlikely” as Wall Street expected.

“We said we wanted to have more confidence that inflation would get down to 2%,” Powell said in an interview. “I don’t think the committee will reach that level of confidence in time for the March meeting.” “In 7 weeks.”

Bitcoin call options are centered at $50,000.

However, indicators from the derivatives market continue to indicate continued bullish sentiment towards BTC in the medium term. Bitcoin Active options data ahead of the next month-end expiration date of February 23 shows that the largest cluster of outstanding contracts are call options with a strike price of $50,000.

According to Deribit data, there are more than 3,899 call options with a strike price of $50,000 outstanding, with a notional value of more than $166 million.

Bitcoin put call spreads expiring at the end of February show the calls concentrated at $50,000. Image: Deribit.

In options trading, a call option gives the holder the right, but not the obligation, to purchase the underlying asset at a specific price before or at the expiration date.

The fact that there are a lot of call options at $50,000 suggests that a significant number of traders expect the price of Bitcoin to rise above $50,000 by the end of the February expiration date.

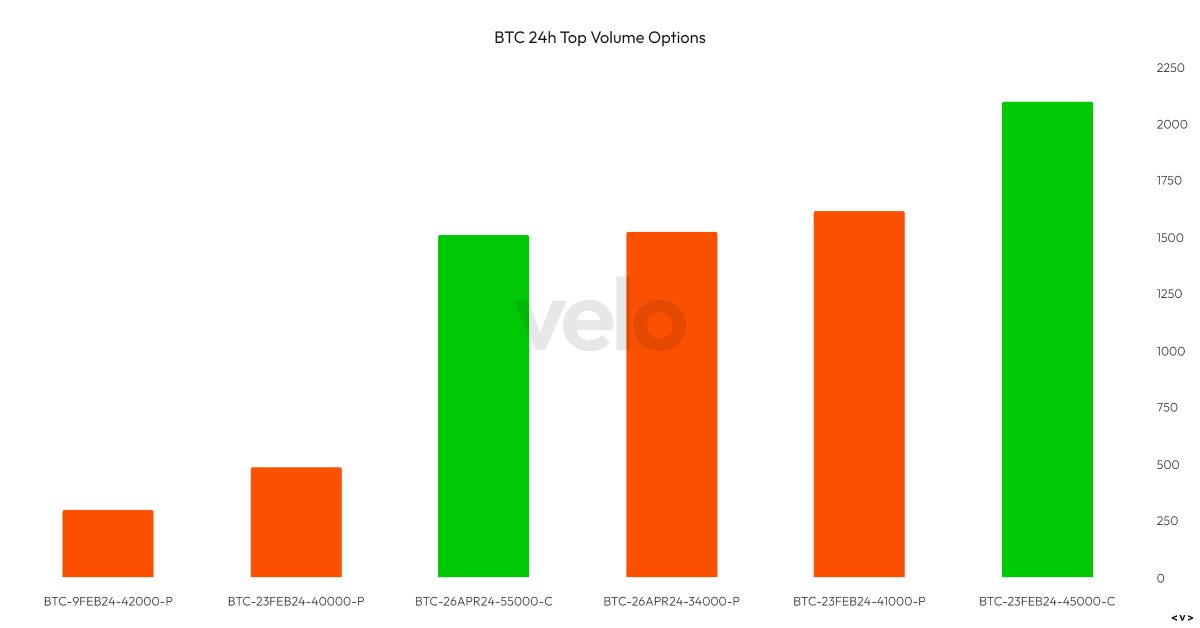

According to Velo Data, derivatives trading distortions over the past 24 hours have centered on options to buy Bitcoin at lower strike prices. The largest group of outstanding contracts are for $45,000 call options expiring on February 23, according to data charts from several exchanges.

Bitcoin active options volume. Image: Velo data.

Disclaimer: The Block is an independent media outlet delivering news, research and data. As of November 2023, Foresight Ventures is a majority investor in The Block. Foresight Ventures invests in other companies in the cryptocurrency space. Cryptocurrency exchange Bitget is an anchor LP of Foresight Ventures. The Block continues to operate independently to provide objective, impactful and timely information about the cryptocurrency industry. Below are our current financial disclosures.

© 2023 The Block. All rights reserved. This article is provided for informational purposes only. It is not provided or intended to be used as legal, tax, investment, financial or other advice.