join us telegram A channel to stay up to date on breaking news coverage

The price of Bitcoin has surged 10% in the past 24 hours, trading at $62,465 as of 5:40 a.m. ET, with volume surging 98%.

Amid growing interest in the BTC token, BTC over-the-counter (OTC) supply levels have plummeted to depletion levels, according to a report from on-chain market intelligence firm Glassnode.

#Bitcoin Given the supply constraints on the OTC desk, the odds of reaching $61,000 are high.

OTC desk supply is at its lowest level in six years, which will spur buying. $BTC In a public exchange.

The agency is here for real people! pic.twitter.com/eV4hsZOKSW

— Mikybull 🐂Crypto (@MikybullCrypto) February 28, 2024

Such a turnout could force institutions to buy Bitcoin on public exchanges, and the resulting demand pressure would likely send Bitcoin prices further north. The depletion of OTC BTC tokens is due to institutional demand inspired by interest in spot BTC exchange-traded fund (ETF) investment products.

#Bitcoin Net inflows reached $670 million.

Mostly this is done through Blackrock’s ETFs and interests.

The price is at $62,600 and is showing an incredibly strong move ahead of the halving.

What should you look for?

If a correction occurs, aim for $46K or $53K in the long term. pic.twitter.com/4l8W1ukBy7

— Michael van de Poppe (@CryptoMichNL) February 29, 2024

Bloomberg Intelligence ETF expert Eric Balchunas recently said that the attractiveness of the BTC ETF has surpassed that of gold, adding that the Bitcoin ETF’s assets under management (AUM) are likely to surpass that of the Gold ETF. In less than two years.

Gold’s pain is Bitcoin ETF’s gain in store-of-value smackdown. How gold being in the gutter is like the cherry on top for Bitcoin fans who just witnessed the launch of the largest ETF of all time. This is news. Bitcoin ETFs will likely surpass gold ETFs within two years. pic.twitter.com/rXJra1dyhF

— Eric Balchunas (@EricBalchunas) February 26, 2024

The bullish sentiment seen in the Bitcoin price has left analysts impressed with its trajectory, saying “Bitcoin (price) has not seen a correction of more than 5% in over a month.” @DaanCrypto also recognizes that Bitcoin is having its second-best February in history.

#Bitcoin We’re heading into our second-best February on record.

The best year tracked was 2013, with a +62% increase. But at the time it was trading for ~$30, so it was a lot less impressive. pic.twitter.com/m6Rga3rwL6

— Daan Cryptocurrency Trading (@DaanCrypto) February 29, 2024

rich dad poor dad Author Robert Kiyosaki said Bitcoin is working to destroy the dollar and restore the integrity of money. With the BTC ETF making headlines in US markets, CNBC’s Mad Money host Jim Cramer said an ETH ETF could be launching soon.

Considering the success of the Bitcoin ETF, it is pretty clear that the Ethereum ETF will soon blossom.

— Jim Cramer (@jimcramer) February 28, 2024

Morgan Stanley Wants Its Bitcoin ETF Cake

Meanwhile, Morgan Stanley, one of the world’s most important financial consulting firms with assets under management (AUM) of up to $1.3 trillion, predicts that cryptocurrencies will disrupt the global financial system in 2024.

With this in mind, CoinDesk reports that the company is conducting due diligence on whether to add a spot Bitcoin ETF product to its brokerage platform. The firm is a leader in alternative investments and private markets, with more than $150 billion in assets under management.

JUST IN: Morgan Stanley is currently considering an offering. #Bitcoin We provide ETFs to customers of large brokerage platforms. pic.twitter.com/TUQwKGkaWw

— Bitcoin Magazine (@BitcoinMagazine) February 28, 2024

Based on the report, the company began adding Bitcoin ETF language to its filings with the U.S. Securities and Exchange Commission (SEC) for its investment arm. To quote an excerpt from Wednesday’s filing for the Morgan Stanley Europe Opportunity Fund: “The fund may gain investment exposure to Bitcoin indirectly by investing in Bitcoin ETFs.”

Several Morgan Stanley funds were among the largest holders of Grayscale GBTC.

Bitcoin Price Outlook As BTC ETF Narrative Drives Market

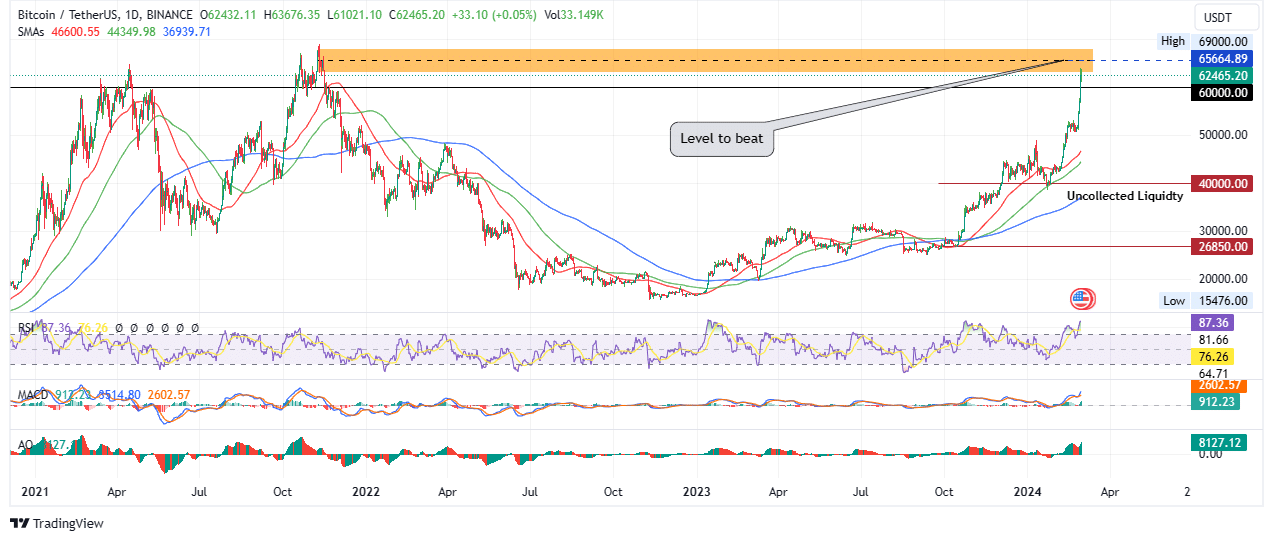

Bitcoin price is trading within a supply zone between $62,905 and $68,212. To confirm the continuation of the uptrend, the price must turn the $65,664 resistance into a support level. This move paves the way for the supply barrier to turn into a bullish breaker, effectively giving the king of cryptocurrencies a jumping-off point for a return to all-time highs above $69,000. Currently, BTC is just 9% off its all-time high.

The Relative Strength Index (RSI) at 87 shows that BTC is already massively overbought. However, given that this momentum indicator is still heading north, buying pressure continues to increase. This, combined with the strong uptrend in the BTC market as seen in the Awesome Oscillator (AO) and the moving average convergence divergence histogram bars in positive territory, highlights the bullish assumption.

TradingView: BTC/USDT 1-day chart

On the other hand, if the supply zone remains at a resistance level, the Bitcoin price may decline. This could push the BTC price back to the $50,000 milestone.

But as Bitcoin pumps, a new project called Green Bitcoin is gaining the attention of more and more investors.

A promising alternative to Bitcoin

GBTC is the ticker of the Green Bitcoin ecosystem, serving as an environmentally friendly alternative to Bitcoin. It combines the legacy of Bitcoin with the eco-friendly features characteristic of the Ethereum network.

Green Bitcoin now tops the list of best cryptocurrency presales! https://t.co/Ng4Su8wA0W

— GreenBitcoin (@GreenBTCtoken) February 27, 2024

This project introduces a prediction game where users can earn $GBTC rewards through the innovative Gamified Green Stake mechanism. This is called ‘Gamified Green Stake’ and allows users to earn passive income through staking rewards.

Some analysts have ranked Green Bitcoin as one of the best penny cryptocurrency investments, while cryptocurrency analyst and YouTuber Jacob Bury rates it as one of the best cryptocurrency altcoins to buy before the Bitcoin halving in 2024.

Funds raised so far have soared past $1.249 million, on track to reach a goal of $1.475 million.

Investors who want to purchase GBTC can do so on the official website. The token is currently selling for $0.5362, a price that will remain within 5 days before increasing.

Visit GBTC here to purchase.

Also read:

Green Bitcoin – Gamified Green Staking

- Coinsult’s contract audit

- Early Access Presale Now Live – greenbitcoin.xyz

- Profit Forecast – Cointelegraph Feature

- Staking Rewards and Token Bonuses

- Over $1 million raised

join us telegram A channel to stay up to date on breaking news coverage