- Bitcoin rainbow chart shows BTC signal accumulation.

- Forecast models and analysts predict a major rally for BTC in the coming months.

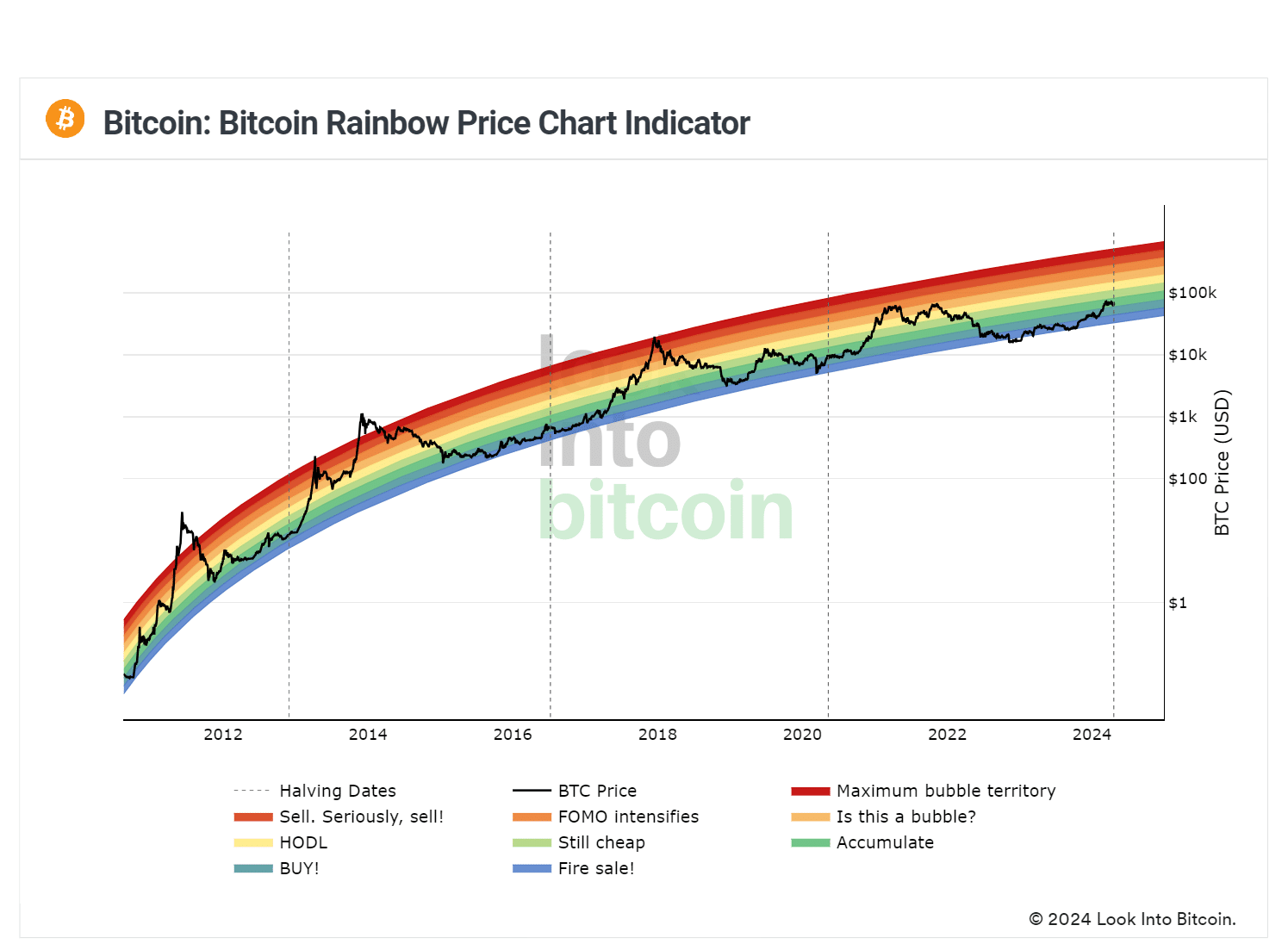

Bitcoin (BTC) Although it rebounded more than 68% in the first quarter of 2024, headwinds in the second quarter ate away some of its gains. With BTC down 7% in the second quarter and remaining stuck in the $60K-$71K price range, it is important to use the Bitcoin rainbow chart to gauge whether BTC is overvalued or undervalued.

On a year-to-date (YTD) basis, BTC has added over $22,000, a gain of 50.3%. But second-quarter headwinds, including interest rate concerns and Middle East tensions, unnerved investors and partly explained last week’s decline.

Now that Bitcoin is back above $66,000, the biggest question is: Is it too expensive or is it currently worth it?

Bitcoin Rainbow Chart Signal “Accumulation”

Source: Source: A Look at Bitcoin

According to Bitcoin Rainbow chartBTC’s current price level was within an area called “accumulation.”

The Bitcoin Rainbow Chart provides a visual representation of the value of Bitcoin based on historical data. Specifically, it is a logarithmic scale with color bands indicating buy (blue, green) and sell (orange, yellow) areas.

In the last three halving cycles, BTC was massively undervalued immediately after the halvings. Current BTC price levels are slightly higher than last cycle, but within “accumulation” territory.

So, according to the Bitcoin rainbow chart, BTC is still undervalued and not overheating.

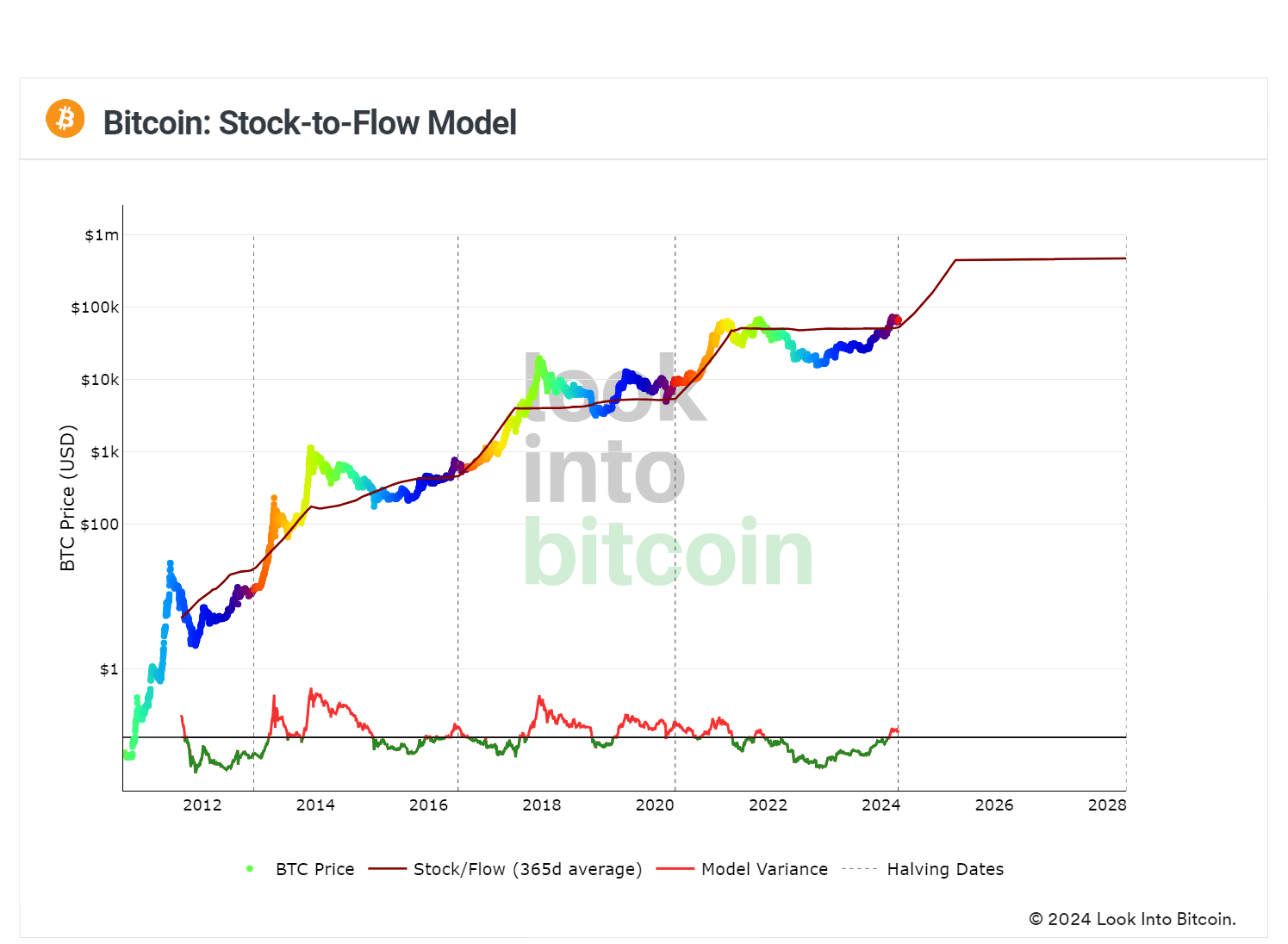

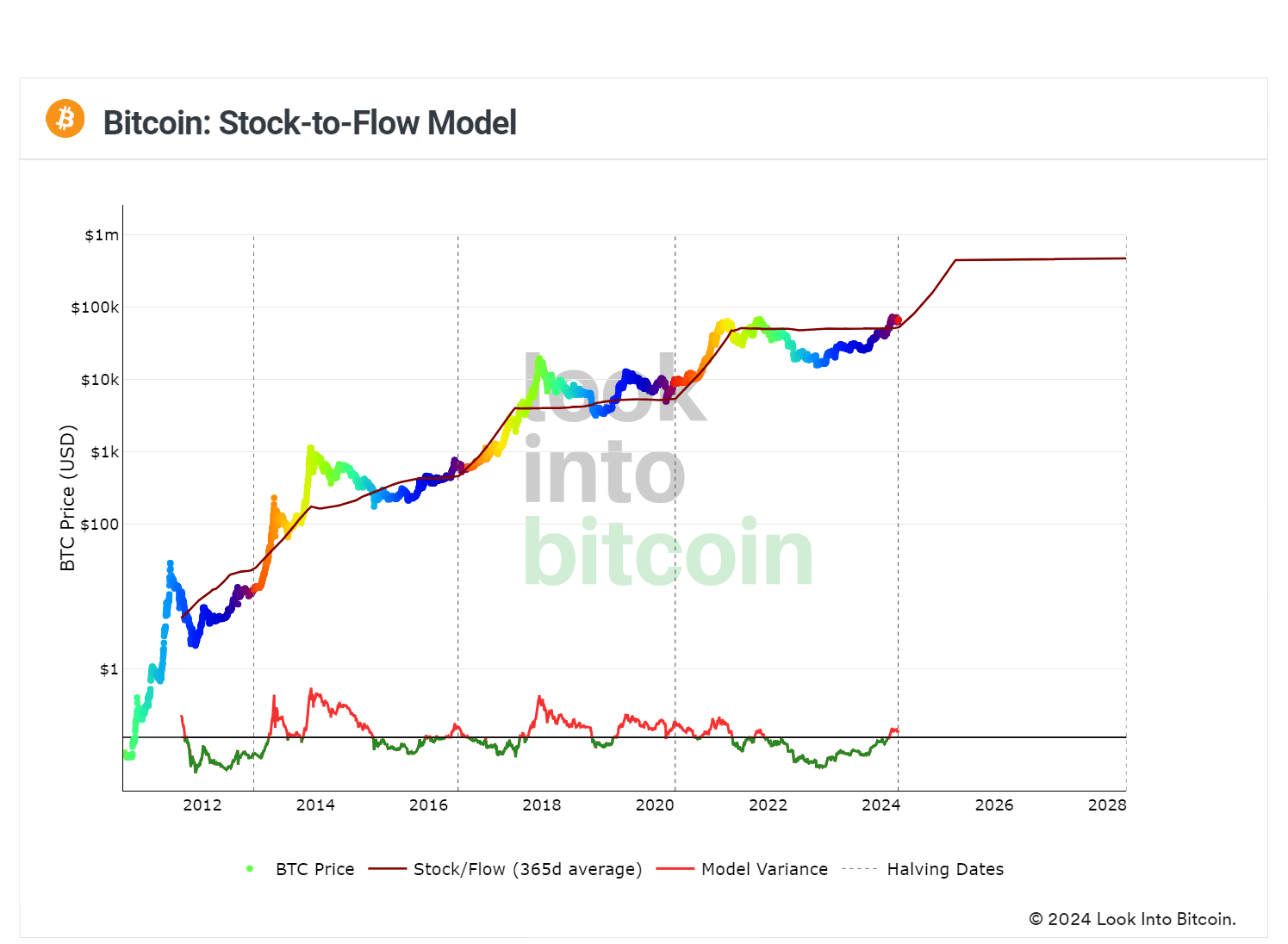

Additionally, the Stock-to-Flow (S/F) model indicates that the Bitcoin price is more likely to rise. This model evaluates the future price of BTC by dividing the circulating supply by the number of coins mined per year.

This model has been able to predict the BTC price by a fair margin in the past. BTC is predicted to surpass $100,000 in the third quarter of 2024 and $450,000 by the end of 2025.

Source: Explore Bitcoin

However, given the new US spot BTC ETF factors and macro pressures, cross-referencing S/F forecasts with nuanced expert analysis can also provide important insights.

Why analysts think BTC could reach $200,000 in 18-24 months

Interestingly, Standard Chartered predicts that Bitcoin could reach $200,000 in the next 18-24 months.

In recent years interviewGeoff Kendrick, head of digital asset research at Standard Chartered, saw spot BTC ETF maturity as a driving force.

“We expect between $50 billion and $100 billion of inflows starting from the beginning of this year until the ETF market in the U.S. market matures. So far we have $12 billion. “That could happen in 18 to 24 months,” he said.

Analyzing the correlation between the BTC ETF and gold, Kendrick pointed out that when ETF flows matured, the price of gold rose 4.3 times. According to Kendrick, if BTC ETF flow maturity follows gold’s path:

“That could get you into the $150,000 to $200,000 range.”

Likewise, in mid-March, Bernstein analysts revised their BTC price forecast from $90,000 to $150,000 by mid-2025, citing “higher-than-expected” flows from the spot BTC ETF.

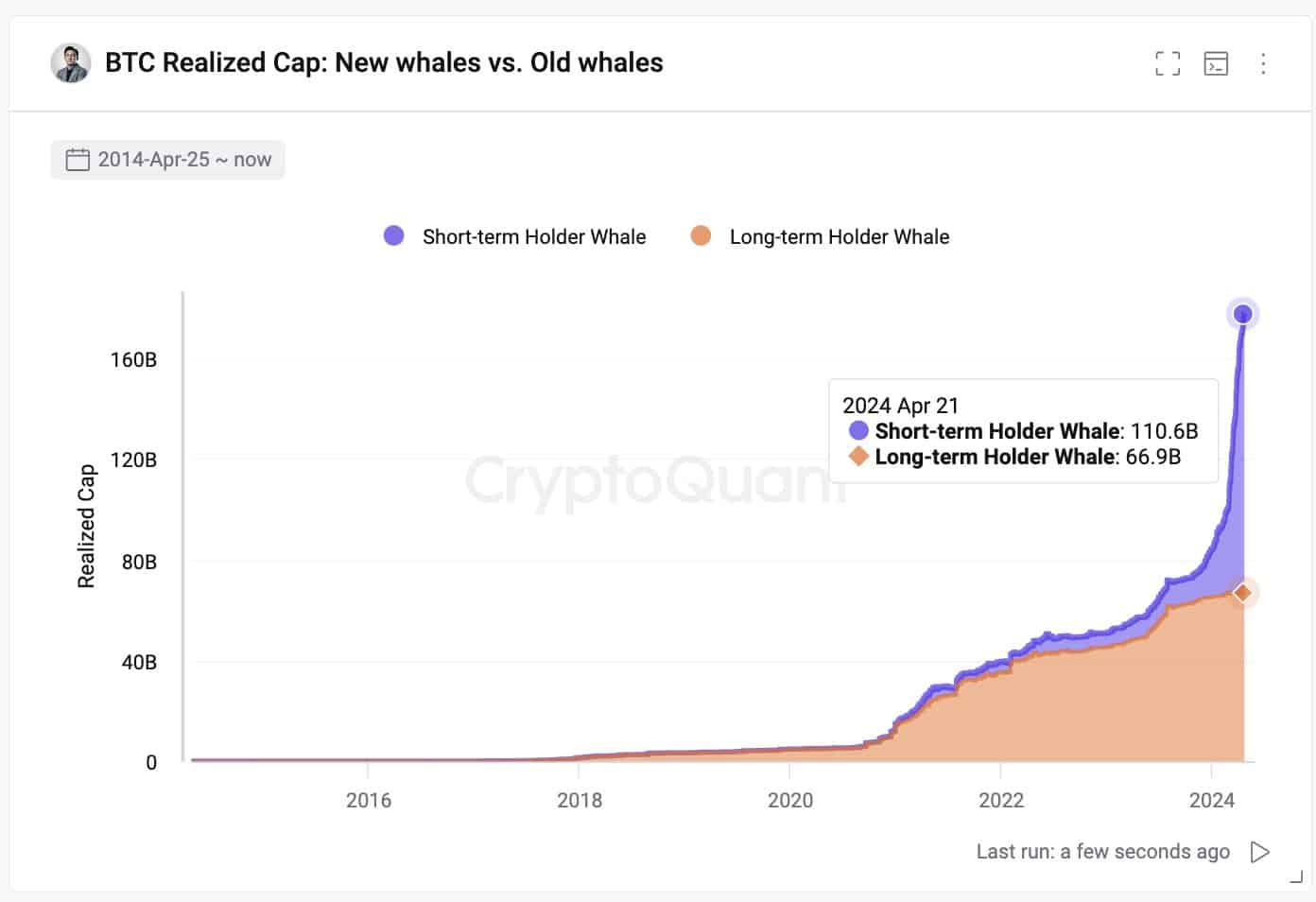

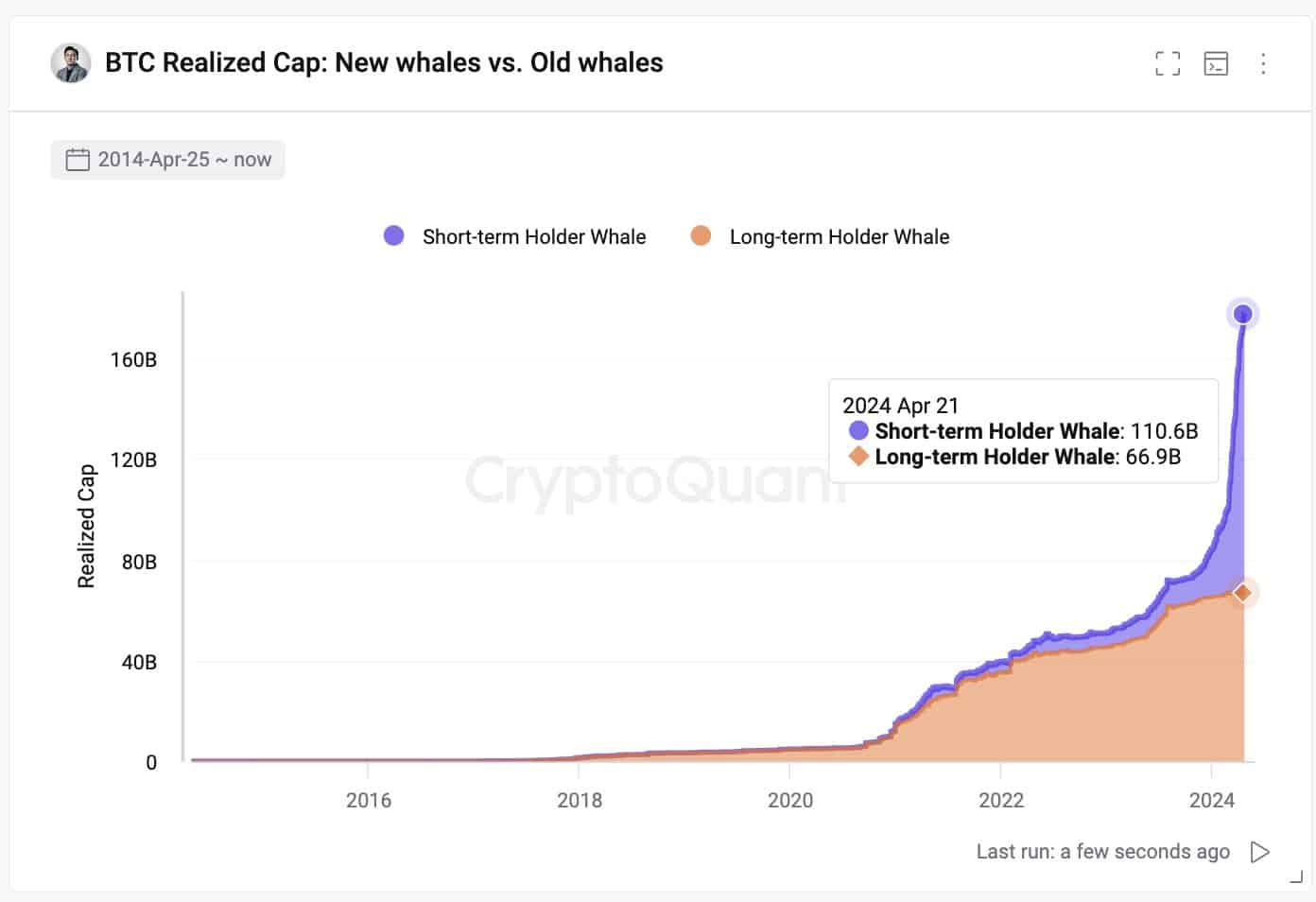

According to Youngju KiThe “new whale,” the founder of CryptoQuant, has now doubled his BTC accumulation.

“New whales’ initial investment in #Bitcoin is nearly double the old whales’ cumulative total.”

Source:

However, massive whale demand is not the only good news for BTC’s future price. The macro outline is also sorted.

BitMEX founder and Maelstrom CIO Arthur Hayes predicted a favorable summer for BTC, citing “treasury market” issues. The CIO said this in a recent blog titled “Left Curve.” famous;

“Rarely has the market done what it got this far (Bitcoin went from zero in 2009 to $70,000 in 2024) and got there (Bitcoin at $1,000,000). However, the macro settings that created the surge in fiat liquidity that fueled Bitcoin’s rise will likely become more pronounced as sovereign debt bubbles begin to burst.”

CIO correctly predicted last week’s massive sell-off, citing the US tax season and Bitcoin halving.

Tensions in the Middle East also played a role in last week’s decline, but Hayes’ predictions suggest that the macro picture for Bitcoin will look good starting from the summer.

read Bitcoin (BTC) price prediction 2024-2025

That said, Bitcoin price prediction models, including the Bitcoin Rainbow chart and analysts, all point to further upside for BTC in the coming months.

If these predictions are confirmed, the current BTC price will be at a huge discount.