Bitcoin Realized Cap has hit a new all-time high (ATH) following the recent rebound in the cryptocurrency price, according to on-chain data.

Bitcoin Realized Cap just hit a new high.

CryptoQuant founder and CEO Joo Ki-young explained: post At X, Bitcoin realization limit sets a new record. “Realization limit” is simply an indicator of the total amount invested by an investor in cryptocurrency.

This capitalization model differs from typical market caps, which calculate the total value of an asset by equating the price of each coin in circulation to its current spot value.

Instead, Realized Cap sets the value of each coin equal to the spot price at the time of the last move. The logic behind this is that the last transfer was probably when the coin last changed hands, so the price at that time will be the current cost basis.

Therefore, the sum of the cost basis over the entire supply corresponds to an estimate of the capital used by holders to purchase Bitcoin.

We now have a chart showing the trend of Bitcoin realization limits over the past few years.

The value of the metric seems to have been heading up for a while now | Source: CryptoQuant

As shown in the graph above, Bitcoin realization limits have naturally surged with the asset’s latest rally, with buying and selling occurring at increasingly higher prices.

The indicator has now broken its previous high and set a new record. This means that BTC now has more capital than ever before.

As for the purchase, as analyst James Van Straten points out in postThe Bitcoin investor community currently appears to be exhibiting aggressive accumulation behavior.

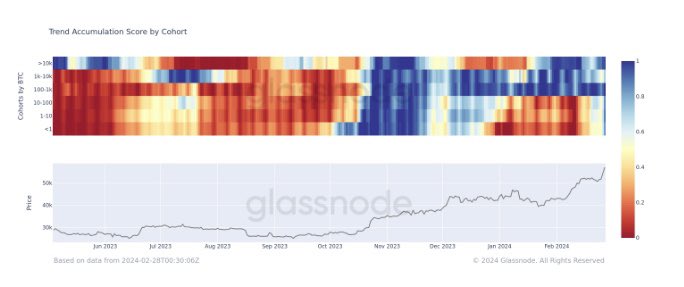

The data of the Accumulation Trend Score by cohort for the asset over the past year | Source: @jvs_btc on X

The chart shows data for Glassnode’s Accumulation Trend Score, which tracks accumulation behavior among groups of Bitcoin investors divided by wallet amount.

Looking at the graph, you can see that the entire market has just turned blue, meaning that the net balance change for all cohort addresses has become positive.

Straten points out that since November 2022, there have been a total of three instances of such aggressive accumulation in the sector. The first was during the lowest cycle in November 2022, and the second period began in October 2023 as ETF speculation occurred.

With such rapid accumulation occurring, it is no surprise that the cryptocurrency’s realization limit is on a sharp upward trajectory.

BTC price

As of this writing, Bitcoin is trading at around $62,900, up more than 22% since last week.

Looks like the coin has enjoyed a sharp rally recently | Source: BTCUSD on TradingView

Featured image of CryptoQuant.com charts from Shutterstock.com, Glassnode.com, TradingView.com