The analytical company, GlassNode, realized that Bitcoin’s trend could suggest that the loss could begin to get fatigue.

Bitcoin realized that losses were signs of saturation.

In X’s new post, GlassNode talked about how Bitcoin surrender looks during the latest price cuts. The chain indicators of the relevance here are “realized losses,” and as the name suggests, we measure the total losses that investors in Bitcoin networks ‘realize’ as a whole.

Metric works by moving or selling from the blockchain through the transaction record of each coin and checking what price was traded before. If the previous selling price is more than the current spot price of all coins, sales contribute to the loss of losses.

The amount of losses realized in sales is the same as the difference between the two prices. The losses realized are summarized to calculate this value for all transactions that occur in the network and to find the total situation.

Like the realized loss, there are also indicators known as the benefits realized. This metrics, of course, track the opposite types of sales (that is, where the last transmission value is lower than the latest spot price).

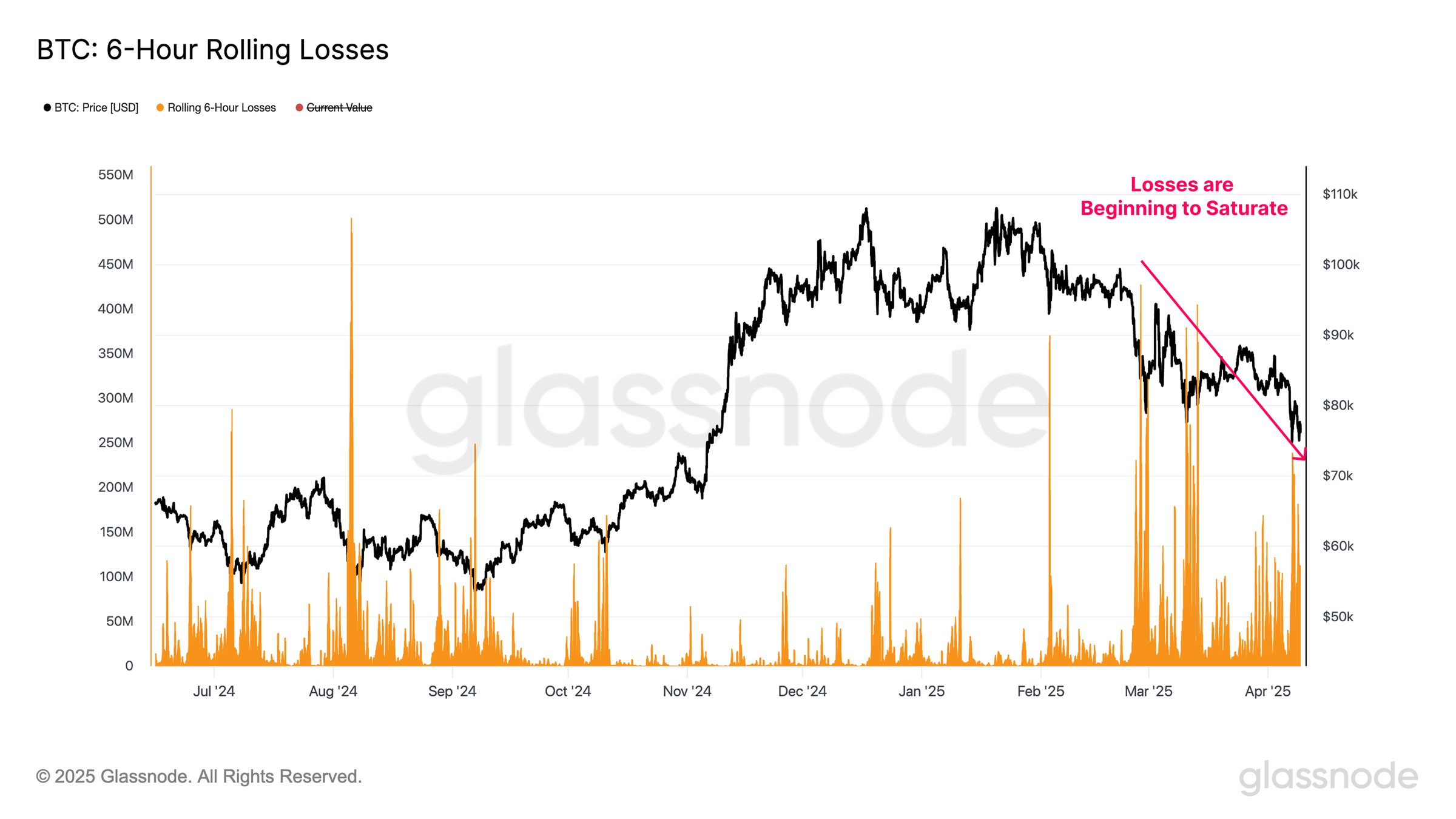

Bitcoin’s chart now shows the trend of rolling value for six hours last year.

Looks like the value of the metric has observed large spikes in recent days | Source: Glassnode on X

As shown in the graph above, Bitcoin observed several large spikes during the weak price behavior in February and March, and investors suggest that panic sold underwater coins.

The FUD for recent tariffs triggered a continuous decrease in assets, and as expected, the holders showed a large surrender.

Interestingly, however, the size of the 6 -hour loss was significantly lower than the previous spike. This can mean that the surrender is reaching a saturated point, and according to GlassNode, it can be an initial signal that the seller is exhausted. If so, BTC may be close to a kind of floor.

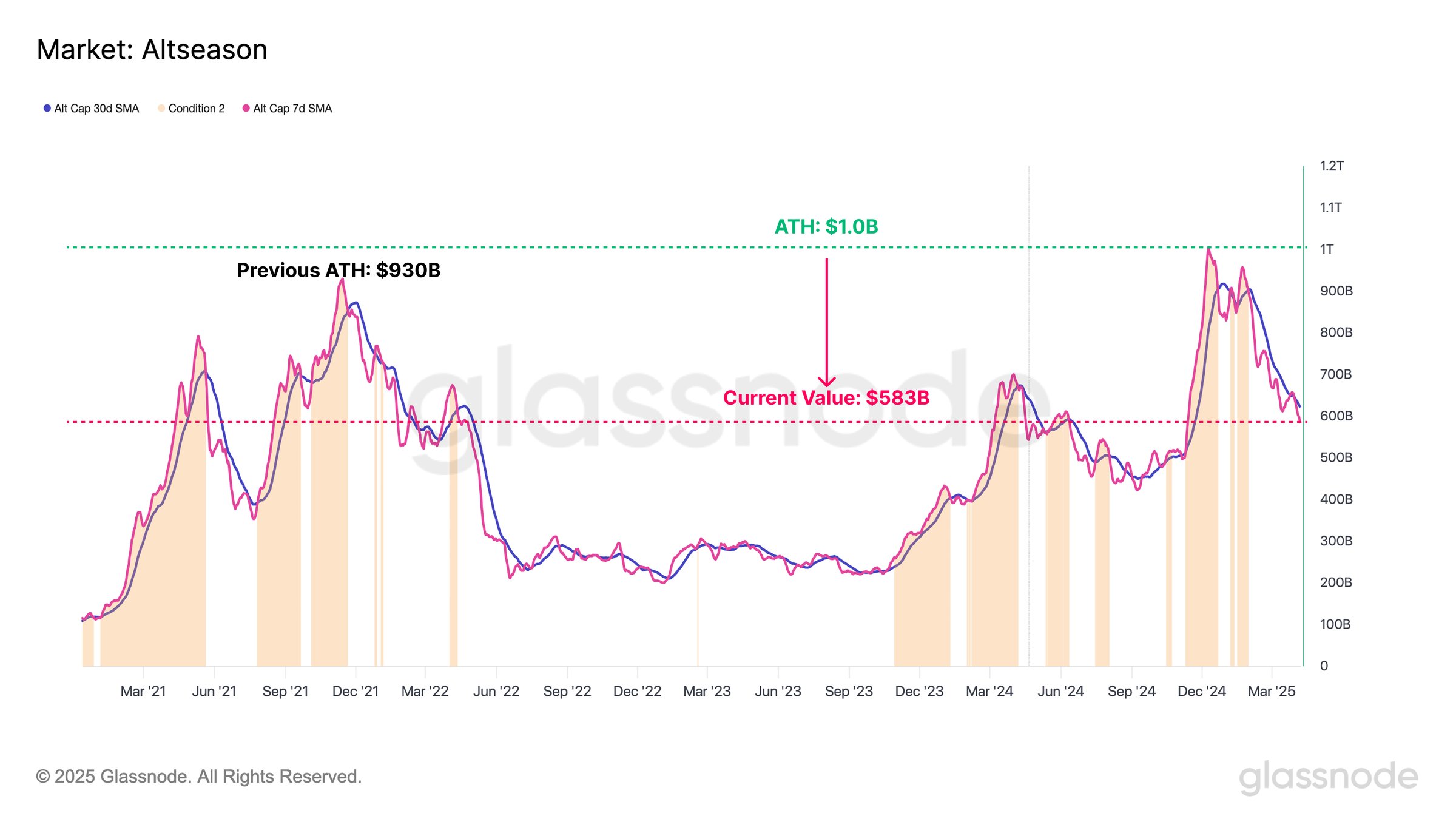

In the same thread, the whole chain analysis company also discussed the recent trajectory of Altcoins’ market cap (ie, cryptocurrency except Bitcoin, Ether Leeum and Stablecoins).

The trend in the combined market cap of the altcoins over the last few years | Source: Glassnode on X

In this chart, Altcoin’s market capitalization reached a record $ 1 trillion in 20024, but today’s indicators have been reduced to $ 550 billion. GlassNode said, “Assets for dangerous curves have increased sensitivity to liquidity shock, resulting in devaluation of serious areas.

BTC price

Bitcoin has attempted to recover when the price has returned to $ 81,900 for the last few days.

The price of the coin seems to have been rising recently | Source: BTCUSDT on TradingView

DALL-E, GlassNode.com’s main image, TradingView.com chart

Editorial process Bitcoinist focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.