join us telegram A channel to stay up to date on breaking news coverage

Bitcoin prices are still limited below $92,000 as investors hold steady ahead of what U.S. Securities and Exchange Commission (SEC) Chairman Paul Atkins says will be a big week for the cryptocurrency market.

Atkins’ comments come days before the U.S. Senate Banking Committee takes its markup on the Digital Asset Market Clarity Act (CLARITY).

BTC has fallen slightly over the past 24 hours, trading at $91,997 as of 12:49 AM EST, with volume up 40% to $42.4 billion, indicating increased trader activity despite the slight decline.

Senate holds market structure markup on Thursday

According to Atkins, “Passing a bipartisan market structure bill will help us future-proof our country against rogue regulators.”

This week is a big one for cryptocurrency. Congress is committed to upgrading financial markets for the 21st century.

I fully support Congress clarifying the division of jurisdiction between the SEC and the SEC. @CFTC. pic.twitter.com/NtDWRW85kL— Paul Atkins (@SECPaulSAtkins) January 12, 2026

House lawmakers passed the bill last July, and it has been under consideration in the Senate for months, supposedly delayed by the 43-day government shutdown in October and November.

Banks and several cryptocurrency companies have raised concerns about provisions in the draft bill regarding stablecoin compensation, and many Democrats are reportedly pushing for stronger ethics safeguards and clearer guidelines for decentralized finance.

In an interview with Fox Business’ Stuart Varney, Atkins did not rule out the possibility that U.S. authorities would seize Venezuela’s reported Bitcoin holdings after the U.S. military ousted and arrested President Maduro.

The SEC chairman said it “remains to be seen” what action the United States would take if it had the opportunity to seize the reported 600,000 BTC.

Now: 🇺🇸 🇻🇪 SEC Chairman Paul Atkins said it is still unclear whether the United States will pursue seizure of Venezuela’s $60 billion in Bitcoin holdings. pic.twitter.com/hyD1pYbZMG

— CryptoGoos (@cryptogoos) January 12, 2026

Cryptocurrency markets trade cautiously amid political and economic tensions

However, the cryptocurrency market is still trading cautiously and with a moderate level of risk as traders take part in the Justice Department’s criminal investigation into Federal Reserve Chairman Jerome Powell.

As the S&P 500 and Dow Jones Industrial Average hit record highs on Monday, hitting 52-week highs of 6,986 and 49,633, respectively, the cryptocurrency market fell less than 1 percentage point to a market capitalization of $3.21 trillion.

middle heightened political tensionsGold and silver also hit record highs, with gold exceeding $4,600 per ounce and silver exceeding $85 per ounce, driven by demand for safe assets.

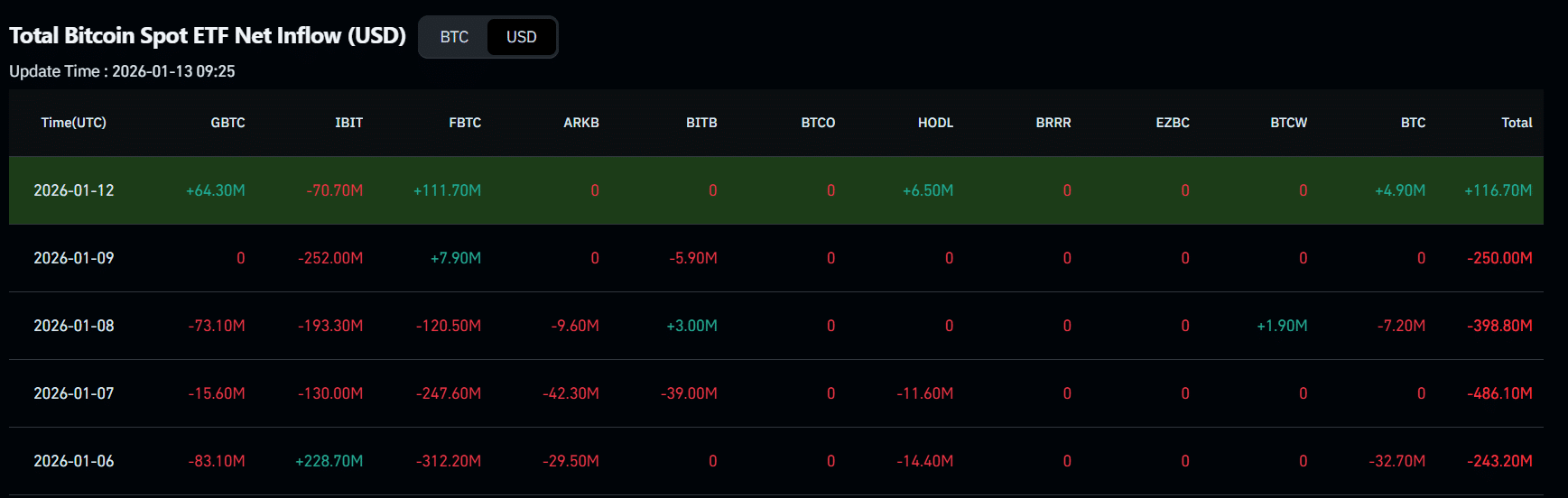

one side, coin glass According to , the U.S. spot BTC ETF recorded net inflows of $116.7 million, a positive figure after four consecutive days of net outflows.

Could BTC price also surge?

Bitcoin Price Analysis: Traders Eye Breakthrough

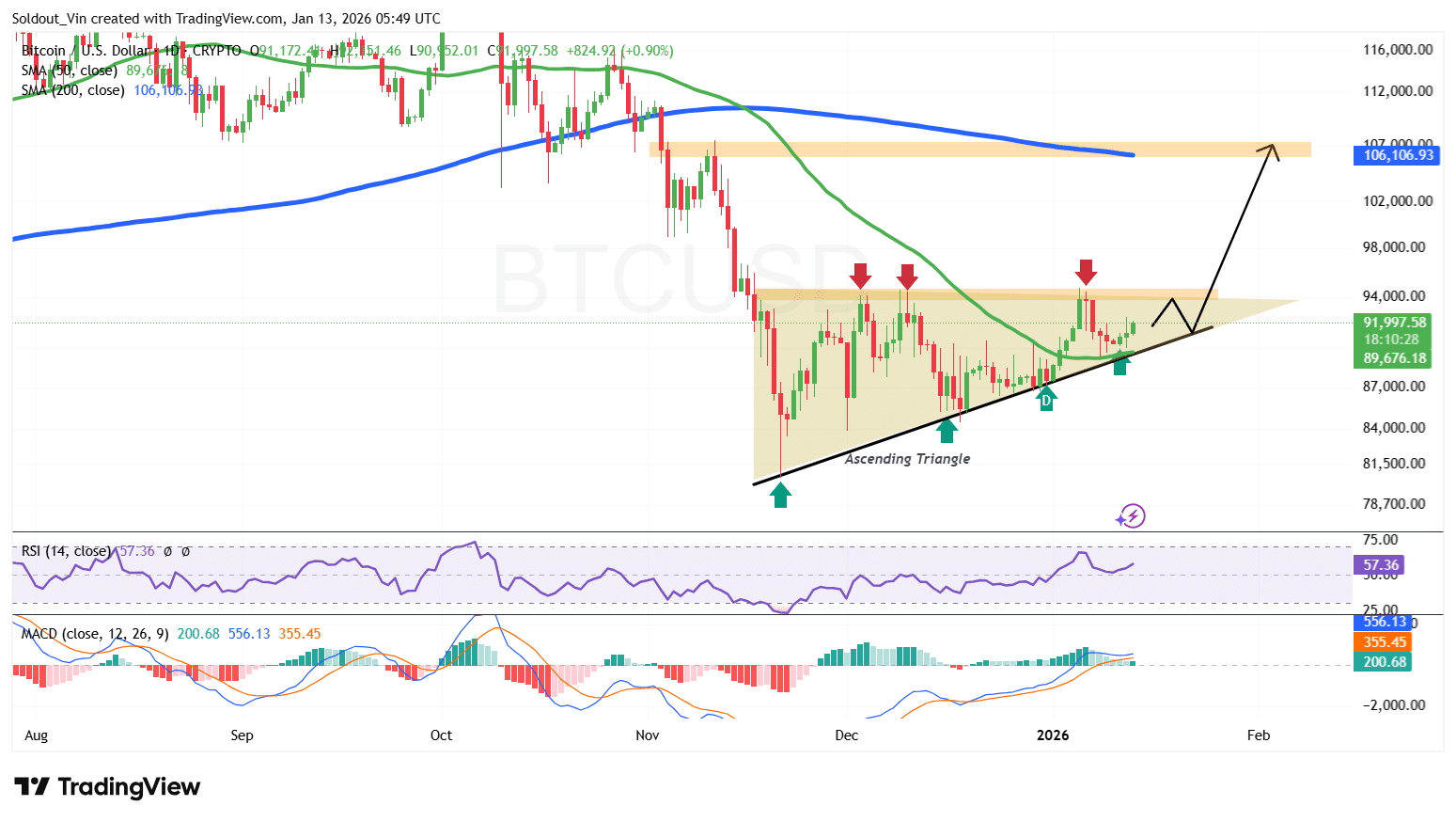

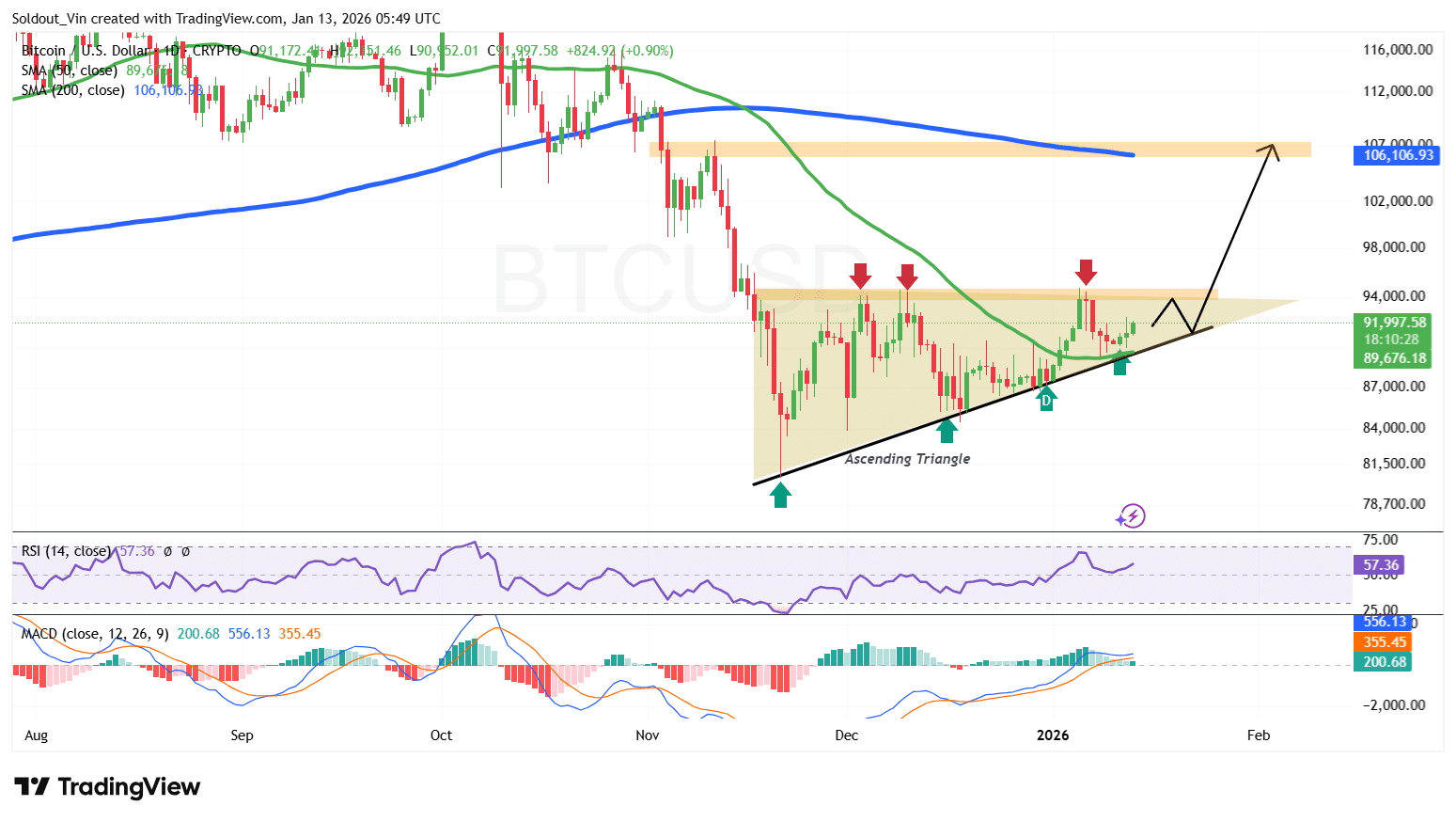

Bitcoin investors remain cautious amidst the ascending triangle pattern that in most cases signals a bullish rally following a breakout.

that BTC price It is trading below persistent resistance level around $94,000 and rising support level, with supply zones at $80,500, $85,300, and $87,200, with support currently at $89,600.

In the near term, Bitcoin price has moved above the 50-day simple moving average (SMA) on the daily chart, adding to the bullish outlook and potential for a breakout.

Meanwhile, key indicators support the optimistic outlook. A relative strength index (RSI) hitting 57 and rising is a sign that investors are entering the market, which could lead to higher prices.

Bitcoin’s Moving Average Convergence Divergence (MACD) has also turned positive, with the blue MACD line crossing over the orange signal line, confirming that sentiment has turned positive.

If the rally restarts and momentum continues to build, Bitcoin price could surge towards the psychological resistance of $94,000. If this level is violated, the next target would be the previous demand area at $106,106, which is within the 200-day SMA.

Conversely, if bears act against BTC at this level, key support around $89,000 will remain in place.

Related news:

Best Wallet – Diversify your cryptocurrency portfolio

- Easy to use and highly functional cryptocurrency wallet

- Get early access to the upcoming token ICO

- Multi-chain, multi-wallet, non-custodial

- Now available on App Store and Google Play

- Stake to win native token $BEST

- 250,000+ monthly active users

join us telegram A channel to stay up to date on breaking news coverage