join us telegram A channel to stay up to date on breaking news coverage

Bitcoin prices have risen slightly over the past 24 hours, trading at $87,769 as of 2:40 a.m. EST, with trading volume down 7% to $66.1 billion.

This follows the Texas state government’s purchase of BlackRock’s iShares Bitcoin Trust (IBIT) spot BTC exchange-traded fund (ETF) for $5 million, at an average price of about $87,000 per bitcoin.

Lee Bratcher, president of the Texas Blockchain Council, highlighted the purchase in a post about X.

Texas is on the decline!

Texas became the first state to purchase Bitcoin, investing $10 million on November 20th at approximately $87,000!

Congratulations to the auditor @KHancock4TX And the Texas Treasury’s dedicated investment team has been watching this market… pic.twitter.com/wsMqI9HrPD— Lee ₿ratcher (@lee_bratcher) November 25, 2025

An additional $5 million has been set aside for additional direct purchases of Bitcoin.

Still in the US, Representative Warren Davidson says the US could fund its Bitcoin reserves by accepting taxes in Bitcoin. This is exactly what the bill he introduced, the Bitcoin for America Act, would enable.

Allowing Americans to pay their federal taxes in Bitcoin would benefit the United States as it would have an asset that would appreciate over time, unlike the U.S. dollar, which has plummeted due to inflation.

Congress must pass the Bitcoin for America Act to put America on a stronger financial footing! pic.twitter.com/ADvMEYGv66

— Rep. Warren Davidson (@Rep_Davidson) November 25, 2025

In another positive development for Bitcoin and cryptocurrencies, Bloomberg reported that cryptocurrency advocate Kevin Hassett is US President Donald Trump’s preferred candidate to succeed Jerome Powell as Federal Reserve Chairman.

Hassett’s odds of succeeding Powell have jumped to 58% on prediction market Kalshi.

Hasset, a former chairman of the Council of Economic Advisers, is known for advocating for lower interest rates and maintaining direct ties to the cryptocurrency industry. He declared that he owns about $1 million worth of Coinbase stock.

Kevin Hassett is currently the leading candidate for Federal Reserve chairman and recently supported a 50 basis point cut in December. The 10-year Treasury yield is already below 4%, reflecting growing market confidence. We believe the 10-year maturity could fall further to target 3% in the coming years.

— Steve Grasso (@grassosteve) November 25, 2025

Bitcoin price is heading towards recovery.

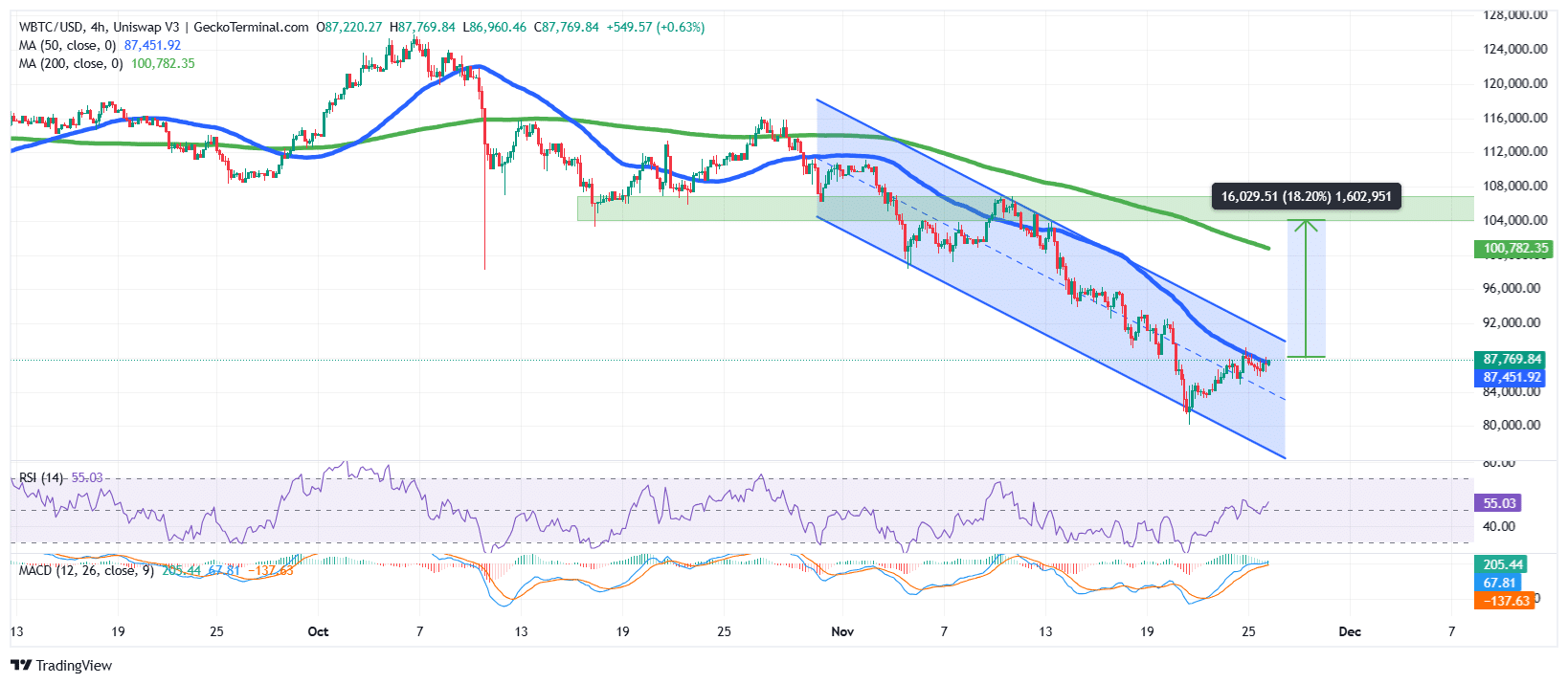

After hitting an all-time high (ATH) above $126,000 last October. BTC price It is continuing to decline thanks to a dead cross formed around $116,000.

Bitcoin price has since traded within a well-defined descending channel pattern towards a support area around $82,000.

This support on the lower border of the descending channel allowed the bulls to recover above the level of the channel’s midline.

Due to a slight recovery, BTC price is now above the 50-day SMA of $87,451 on the 4-hour chart.

Meanwhile, if BTC breaks out of the downward channel, the 200-day SMA still acts as the next resistance level at $100,782.

The relative strength index (RSI) has also turned positive and is currently hovering around the 50 midline, currently at 55, which may suggest that the Bitcoin price is showing signs of recovery.

Additionally, Moving Average Convergence Divergence (MACD) indicates a shift to positive momentum, with the blue MACD line crossing above the orange signal line.

BTC price bullish targets $104K resistance.

According to BTC/USD chart analysis on the 4-hour chart, Bitcoin price is attempting to recover from the downtrend.

If the price surges above the upper border of the descending channel, the next possible target is resistance at $104,053, an 18% surge from current levels.

Conversely, if the bearish movement continues within the downward channel, BTC price could fall back to the $80,000 region.

Ali Martinez, an influential analyst at X with over 163,000 followers, further supports this story. He said that on the 1-hour chart, BTC is forming a bearish flag and could fall towards the $79,000 area.

If this is a downward trend, Bitcoin $BTC It could head to $79,000. pic.twitter.com/FGFjWSmpcg

— Ali (@ali_charts) November 25, 2025

Related news:

Best Wallet – Diversify your cryptocurrency portfolio

- Easy to use and highly functional cryptocurrency wallet

- Get early access to the upcoming token ICO

- Multi-chain, multi-wallet, non-custodial

- Now available on App Store and Google Play

- Stake to win native token $BEST

- 250,000+ monthly active users

join us telegram A channel to stay up to date on breaking news coverage