Bitcoin’s move back below $63,000 has provided a clearer view of support and resistance levels leading up to next month’s halving.

Bitcoin (BTC) and cryptocurrency analyst Ali-Charts has identified three important prices that act as support levels for the world’s largest digital asset. $61,100, $56,685 and $51,530 would cushion Bitcoin against further declines, according to on-chain observers citing Glassnode data.

Conversely, after BTC hit a new all-time high on March 14, the following resistance levels were $66,990 and $72,88, according to CoinGecko. The cryptocurrency hit a high of $73,737 after weeks of massive inflows into its U.S. spot Bitcoin ETF offering.

Bitcoin falls 6%, spot BTC ETF records negative daily flow.

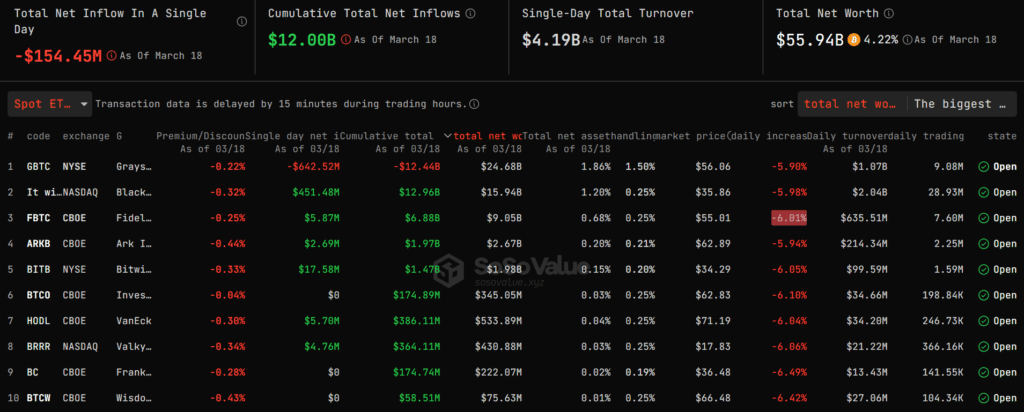

BTC’s 6% drop on March 19 followed its first daily net outflow since late last month. BlackRock’s BTC ETF attracted $451 million, but investors dumped $642 million worth of Grayscale’s GBTC, per Soso Value. March 18 was the biggest day of GBTC exodus to date, confirmed ETF expert Eric Balchunas.

Price fluctuations resulted in a net outflow of $154 million as eight other issuers each raised less than $20 million on the day. Franklin Templeton, Invesco Galaxy and WisdomTree funds had daily net inflows of $0.

While the figure is a departure from previously recorded continuous inflows, the spot BTC ETF has still accumulated 4.2% of Bitcoin’s available supply after three months of trading. The nine funds manage more than $20 billion in assets, led by BlackRock’s more than 203,000 BTC worth nearly $16 billion.

Veterans like Balchunas also predict that spot BTC ETF demand will expand as more institutional players allocate capital and support exposure to the asset class. Wall Street asset managers such as Bank of America’s Merrill Lynch and Wells Fargo have added spot Bitcoin ETFs to their products, reversing previous decisions not to allow such funds to clients.