Bitcoin has surged back above the $70,000 level over the past day despite the asset’s net taker volume being negative.

Bitcoin net taker volume has recently seen a large negative spike.

As CryptoQuant Netherlands Community Manager Maartunn explains: post X has recently seen a much larger surge in sales than ever before in Bitcoin Net Taker Volume.

“Net Taker Volume” is a metric that tracks the difference between Bitcoin taker buy volume and taker sell volume in perpetual swaps. How can the sales quantity and purchase quantity be different? CryptoQuant explains in its data guide:

This concept is often confusing because every transaction requires both a buyer and a seller of a specific underlying asset. However, depending on whether the orderer is a buyer or a seller (whether the transaction is at a bid or ask price), buy volume and seller volume can be distinguished.

If the value of this indicator is positive, it means that the current taker buying volume is overwhelming the taker selling volume. This trend suggests that the majority shares this feeling of optimism.

On the other hand, negative indicators suggest that more sellers are willing to sell their coins at lower prices, which is a sign that a bearish mentality is dominant.

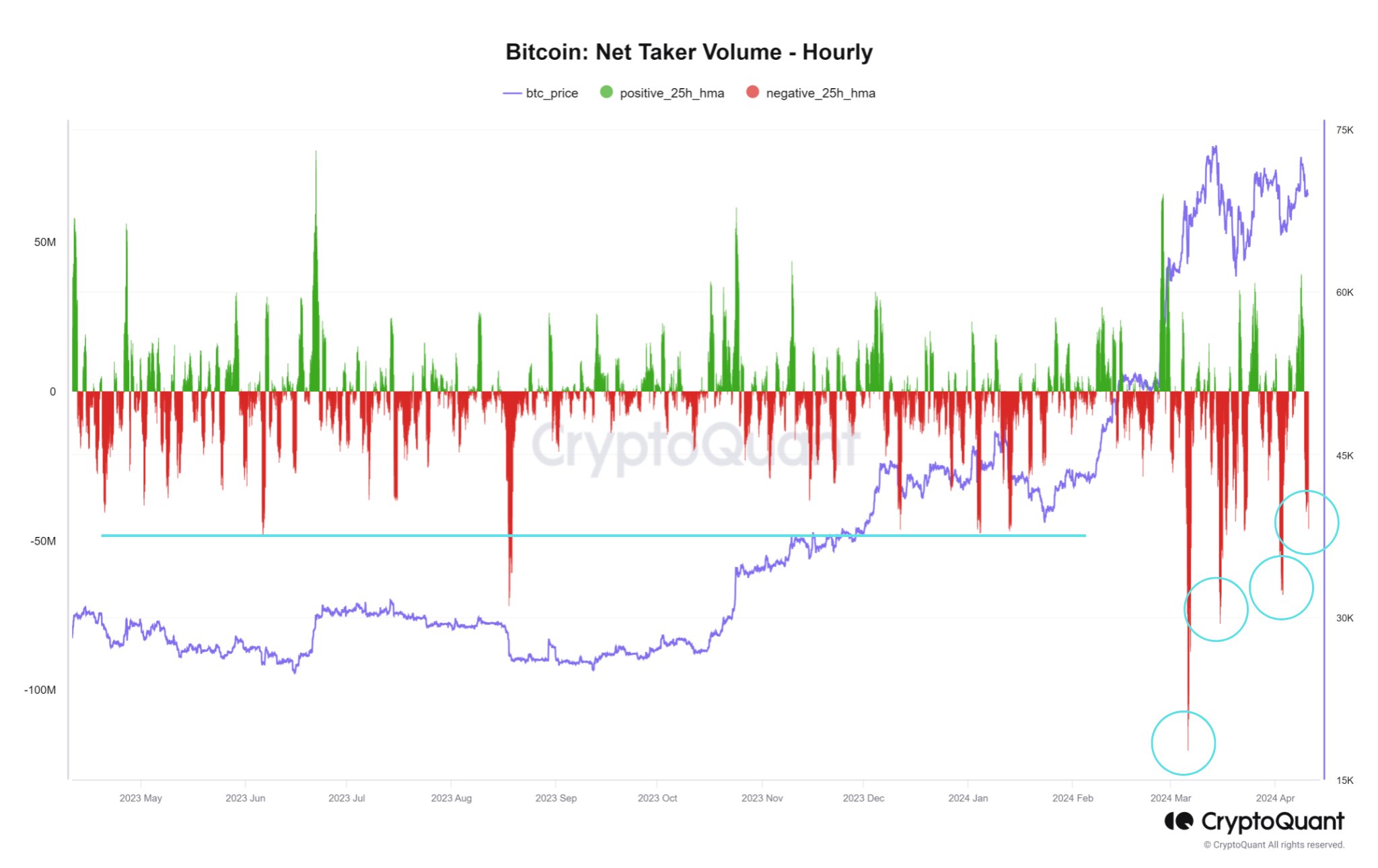

Now here is a chart showing Bitcoin net taker volume trends over the past year:

The value of the metric seems to have been quite red in recent days | Source: @JA_Maartun on X

As you can see in the graph above, Bitcoin net taker volume has recently seen a sharp negative spike, meaning taker selling volume has been higher than taker buying volume.

As the analyst highlights in the chart, Net Taker Volume has been seeing a big red spike for some time. “Bitcoin is taking a huge hit due to surge selling of Net Taker Volume, which is much higher than before,” says Maartunn.

Interestingly, despite this bearish sentiment in the market, Bitcoin price has held up relatively well. Obviously, while these negative net taker volume spikes persisted, the coin’s bullish momentum was lost, but it’s still impressive to see BTC holding strong against the continued downtrend.

The pattern we can see on the chart is that recent net taker volume has continued to show red spikes, but the magnitude has gradually declined.

So, if this trend continues, it is possible that the bearish mentality will eventually run out and buying pressure will take over Bitcoin. It remains to be seen how the indicators will develop soon.

BTC price

Bitcoin fell below $68,000 yesterday, but the asset has already rebounded today and is currently trading around $70,800.

Looks like the price of the coin has made some recovery over the past 24 hours | Source: BTCUSD on TradingView

Featured image by Jievani Weerasinghe on Unsplash.com, CryptoQuant.com, charts from TradingView.com

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.