On-chain data shows an increasing trend of Bitcoin moving to exchanges, which is a classic bearish sign, but another signal remains bullish.

Although Bitcoin exchange inflows increased, USDT deposits also increased.

According to data from on-chain analytics firm st tly, Recently, BTC has been flowing into exchanges. The relevant metric here is “exchange supply,” which tracks the percentage of the total circulating supply of a cryptocurrency that is currently in wallets on all centralized exchanges.

A rising value of this metric means investors are net depositing assets into the platform, while a falling value means outflows are occurring.

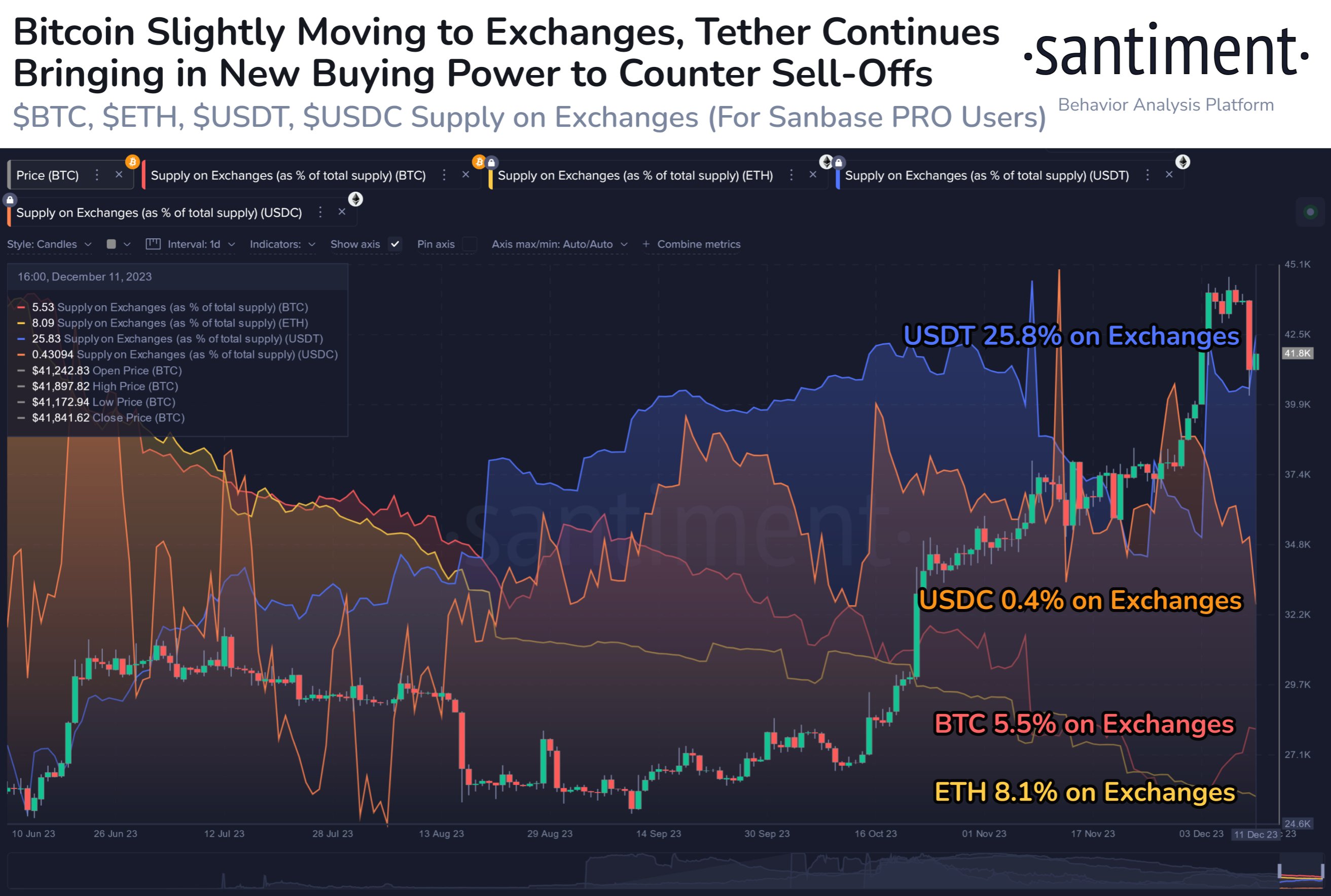

The impact one of these trends could have on the market depends on the type of cryptocurrency in question. Santiment shared the chart below that shows how exchange supplies have changed recently for four assets: Bitcoin, Ethereum (ETH), Tether (USDT), and USD Coin (USDC).

The trends in the exchange supplies of the different top cryptocurrencies | Source: Santiment on X

As you can see in the graph above, both Bitcoin and Ethereum exchange supply had previously been declining, but BTC has recently broken out of this decline and recorded some net deposits.

These deposits first came after BTC rallied to $44,000 and then started trading sideways. Typically, one of the main reasons holders deposit their coins on an exchange is to sell them, so recent inflows could be a sign that a sale is underway.

The recent plunge in assets has also led to a slightly steeper trend in exchange supply growth, suggesting that inflows are actually adding to selling pressure.

Looking at the chart, we can see that Bitcoin supply on exchanges has not yet reversed its trend, a potential indicator that the selling has not fully exhausted itself yet.

Meanwhile, Ethereum continues to see supply leaving these central entities, suggesting that cryptocurrency investors are still likely to engage in net accumulation.

However, what could prove positive for BTC is the fact that Tether supply on exchanges has increased since the crash. Investors typically use stablecoins like USDT and USDC whenever they want to escape the volatility associated with coins like BTC and ETH, but these investors usually only do this as a temporary measure.

If holders plan to exit the cryptocurrency sector altogether, they do so through fiat instead. So choosing stablecoins instead means that they are likely to stay in the market and eventually return to the more volatile side.

Large swaps from stables to Bitcoin and other assets can provide a natural price boost, so exchange inflows can be a bullish signal for these volatile assets.

The most bullish combination is when BTC bounces and USDT exchange supply remains the same. These trends suggest that new capital is entering the sector.

In the current case, Tether exchange supply has increased at the expense of the BTC price, which has only resulted in capital circulation. Nonetheless, the fact that not all capital has fled the sector may still be an optimistic sign for a rally return.

BTC price

Bitcoin plummeted to $40,000 yesterday, but has already shown a rapid recovery as it is currently trading at around $41,700.

Looks like BTC has made some recovery from its lows | Source: BTCUSD on TradingView

Featured image from Shutterstock.com, chart from TradingView.com, Santiment.net

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.