Main takeout

- Bitcoin and Altcoin plunge as economic uncertainty increases.

- The market response is subtle because strategic bitcoin protection areas do not include new government purchases.

Share this article

The fear of the dark economic downturn between the US and Canada caused a decline in the price of Bitcoin and selling Altcoin on Sunday night.

Fox News talks about the future of Sunday morning, and Trump said he didn’t like to predict “those things” in 2025. He emphasized that economic policy aimed to return wealth to the United States, but the transition could take time.

Trump’s tariffs on imports of countries such as Canada, Mexico and China have become a source of market volatility. Nevertheless, the US president defended the approach necessary to achieve economic goals.

Also on March 9, Mark Carney, the president of the bank of Canada, won the Liberal Party Leadership Election by replacing Justin Trudeau as a Canadian prime minister.

The new prime minister went out of Trump in his first speech, and Trump stated that he would not succeed in the trade war with Canada.

“America is not Canada. And Canada will never be part of the United States in the form or form, ”Carney said. Trump repeatedly mentioned Trudo as a “governor” in Canada, and suggested that Canada would be better as the 51st American country.

“Our government will continue to keep our tariffs until Americans give us respect,” he said. Canada imposed 25%of tariffs on US consumer goods as retaliation for Trump’s tariffs.

According to Coingecko data, Bitcoin has fallen to less than $ 81,000 with Carney’s victory. In the press time, the BTC has recovered slightly to more than $ 82,000, down 4% over the last 24 hours.

As Bitcoin decreased, market confusion deepened. Ether and XRP shed more than 6%and Dogecoin fell by more than 10%.

Other top coins, such as BNB, Solana, Cardano and TRON, also showed significant losses, injected, manufacturers and two -digit bubbles with rich two -digit bubbles.

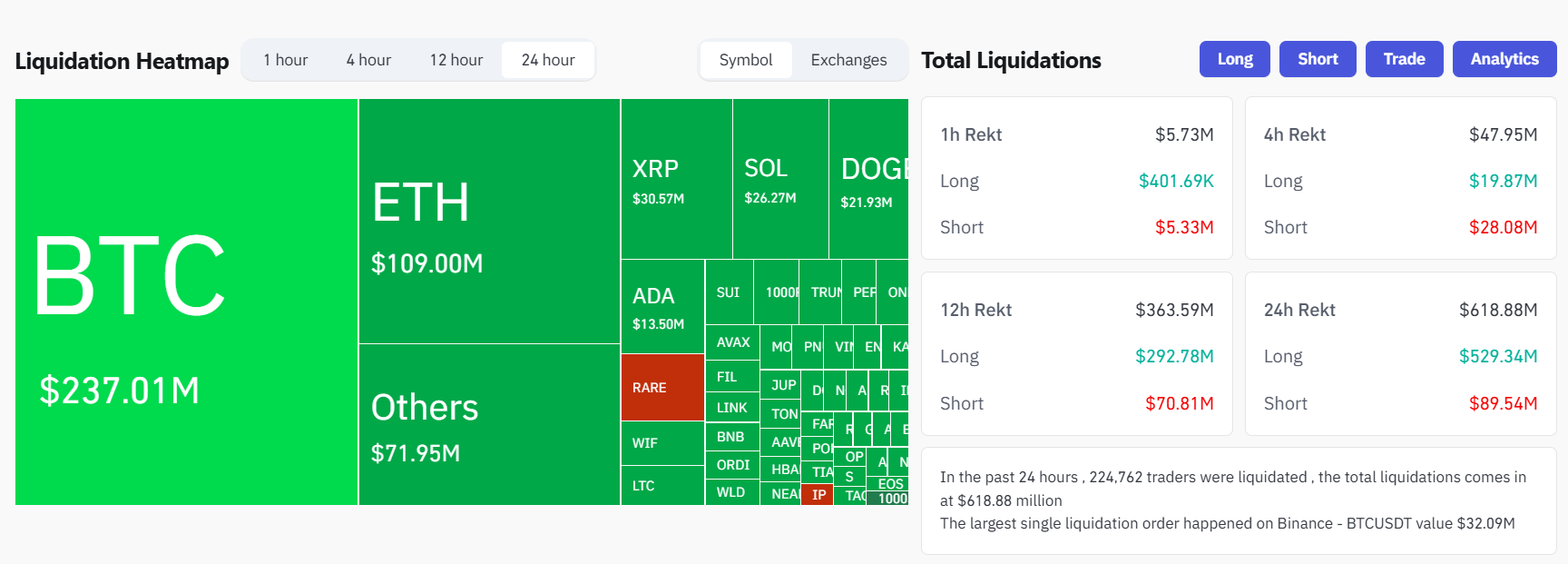

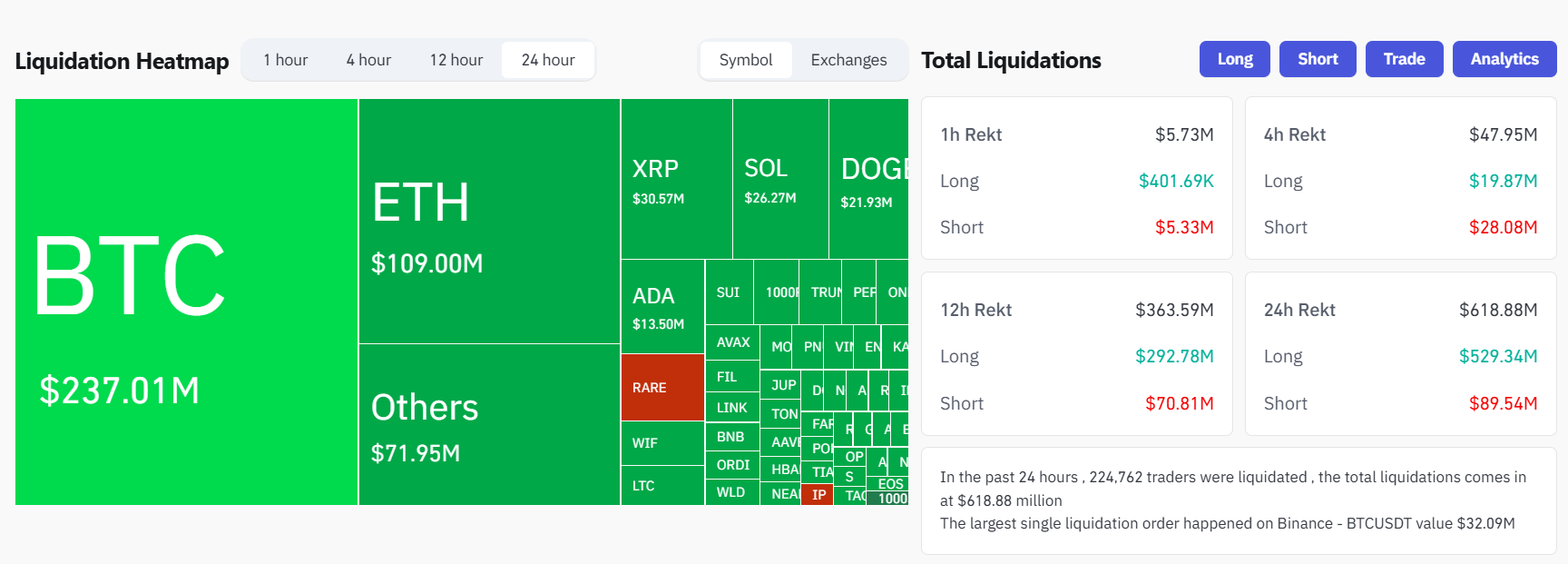

The total market capacity of the total encryption decreased by 6% in one day. According to the CoingLass data, the leverage liquidation has reached $ 600 million and about $ 550 million has been removed.

The GDPNOW model of the Atlanta Federal Reserve revised the first quarter of the 2025 forecasts, predicting 2.4%of GDP contraction. This downward revision raises concerns about potential economic downturn, with a wider consumer expenditure and trade deficit.

Market reaction to Trump’s Bitcoin Protection Zone: Mixed Bag

Market turbulence continued after Trump’s Thursday administrative order continued after the establishment of a strategic Bitcoin protection zone, and at first, the sales pressure was initially raised because the details of the details of the existing US director Bitcoin were limited.

US Treasury Secretary Scott Bessent is discussing additional BTC acquisitions on Friday, but the first step is to stop selling the seized Bitcoin.

It is also focusing on Bitcoin, but a wider strategy is to build a comprehensive encryption reserve.

Some analysts officially recognize the role of Bitcoin as a strategic asset, and positioned with traditional reserves such as gold, but this recognition has not turned into an immediate market trust.

Members of the encryption community also responded to the White House encryption summit held after the administrative order.

In this event, Sergey Nazarov, co -founder of Chainlink, expressed optimism that US officials are actively participating in the blockchain and encryption industry.

Nazarov said, “I and others in the room think that encryption, blockchain, and Web3 infrastructure are the repetition of the next financial system. “And I think the United States should continue its leadership position in the new financial system.”

Multicoin Capital Managing Partner Kyle Samani also watched the event positively and marked the “historical moment” of encryption.

In contrast, Coin Bureau CEO NIC PUCKRIN and Bitcoin Maximalist Justin Bechler expressed their disappointment of the impact of the summit and criticizing the approach.

Share this article