- Bitcoin vs. Altcoins — A battle of volume and price.

- While Bitcoin dominates this space, altcoin indices have been volatile.

As the holiday season approaches, the cryptocurrency market is alive with the battle for supremacy between Bitcoin (BTC) and altcoins.

Historically, this period has been marked by unique market dynamics, with Bitcoin often perceived as a stable choice, while altcoins serve risk-taking traders seeking high returns.

The analysis reveals the complex interplay between these two sectors, providing insight into which sectors could be the winners of the holiday season.

Bitcoin: Steady performance despite market fluctuations

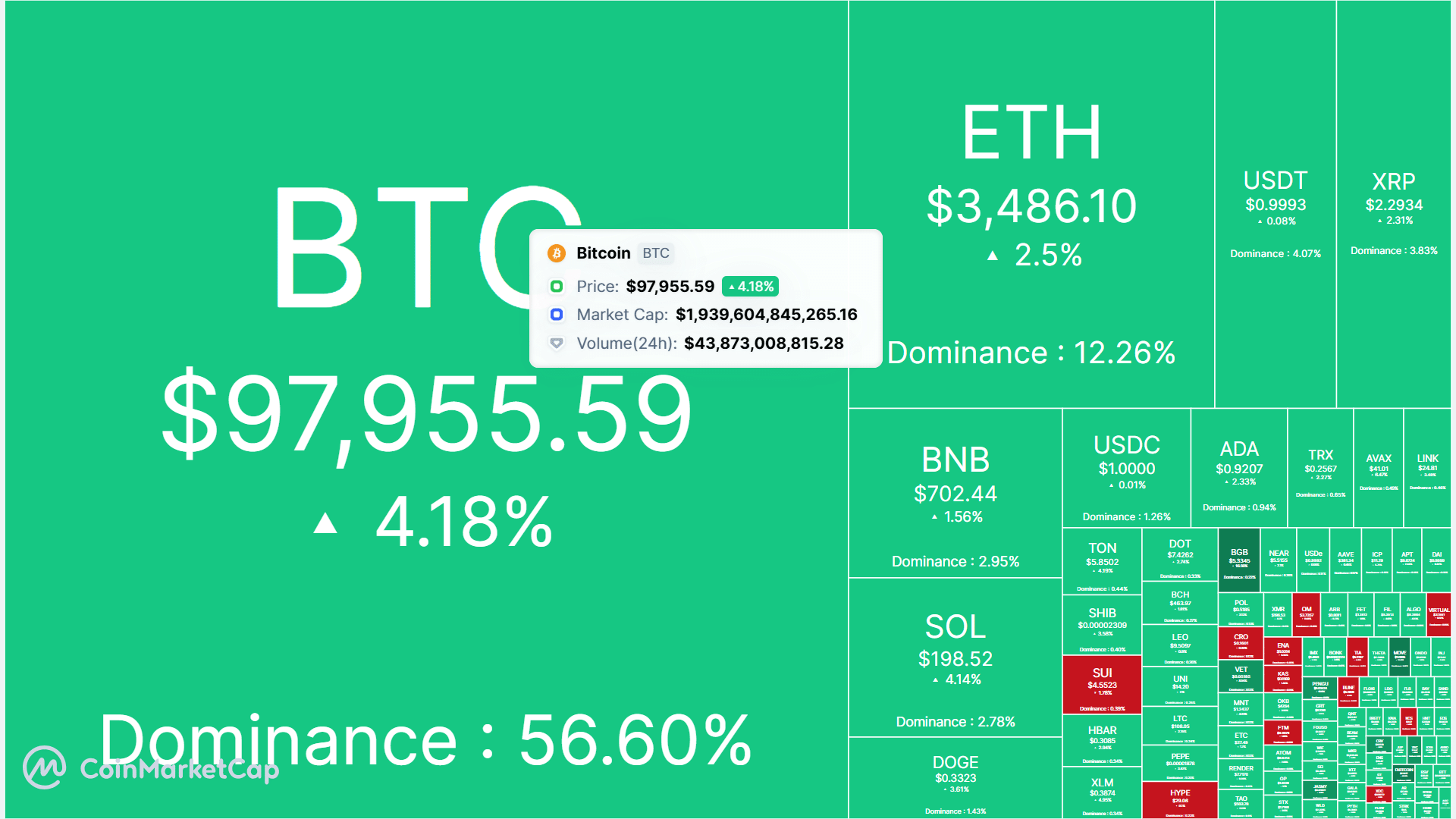

Bitcoin has shown resilience this holiday season, holding the price at $97,955 with a daily gain of 4.18%.

The market dominance chart shows Bitcoin’s stronghold at 56.60%, indicating a clear preference among investors for the leading cryptocurrency.

This dominance highlights Bitcoin’s ability to withstand market turbulence while providing stable returns.

Source: CoinMarketCap

The market heatmap further highlighted Bitcoin’s consistent performance, with trading volume exceeding $43.87 billion over the past 24 hours.

This flurry of activity reflected continued institutional interest and retail confidence in Bitcoin serving as a “safe haven” asset during times of extreme volatility.

Despite competition from altcoins, Bitcoin’s steady upward trend has solidified its position as a reliable asset for long-term holders seeking lower risk, especially during seasonally volatile periods.

Altcoin Seasonal Index: Momentum Shift

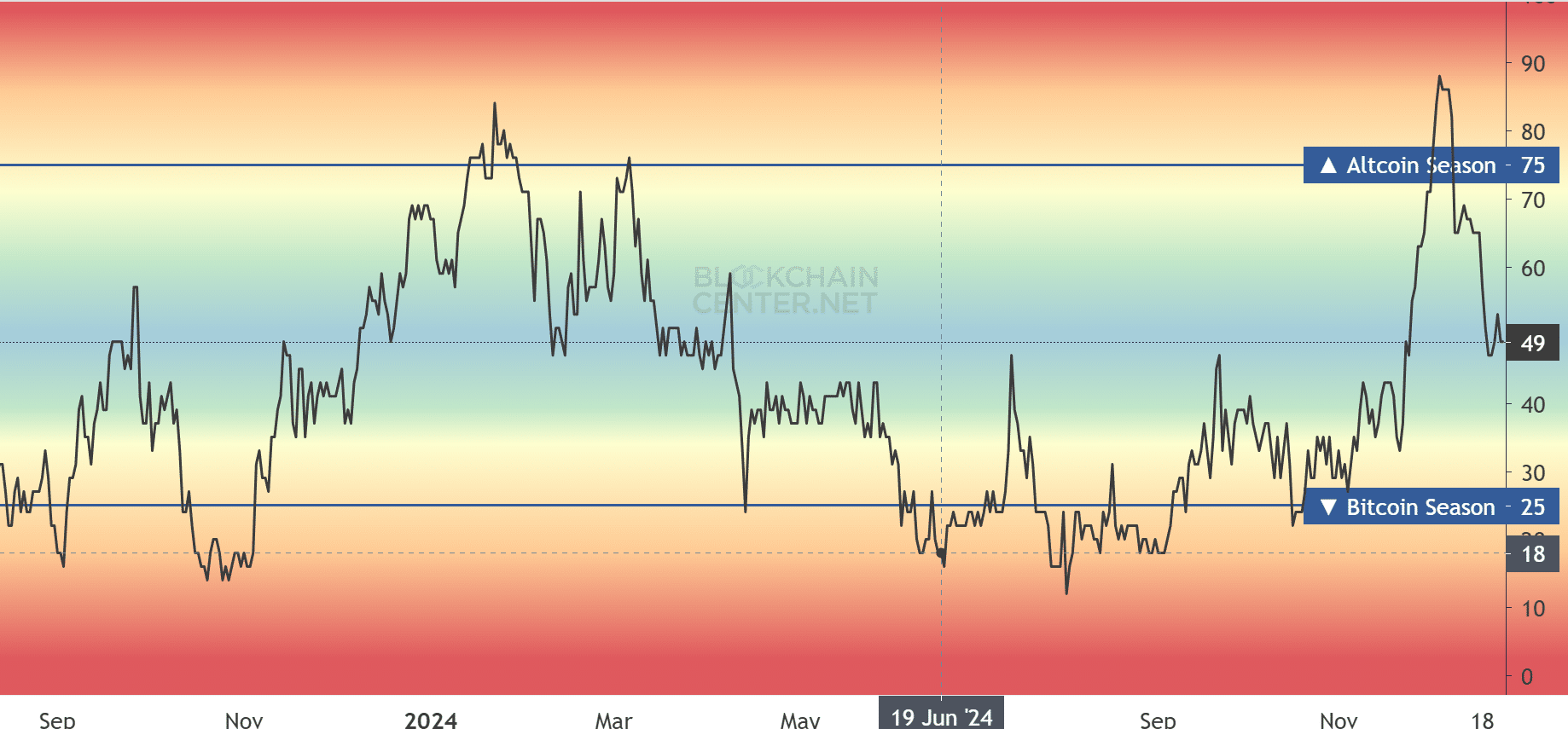

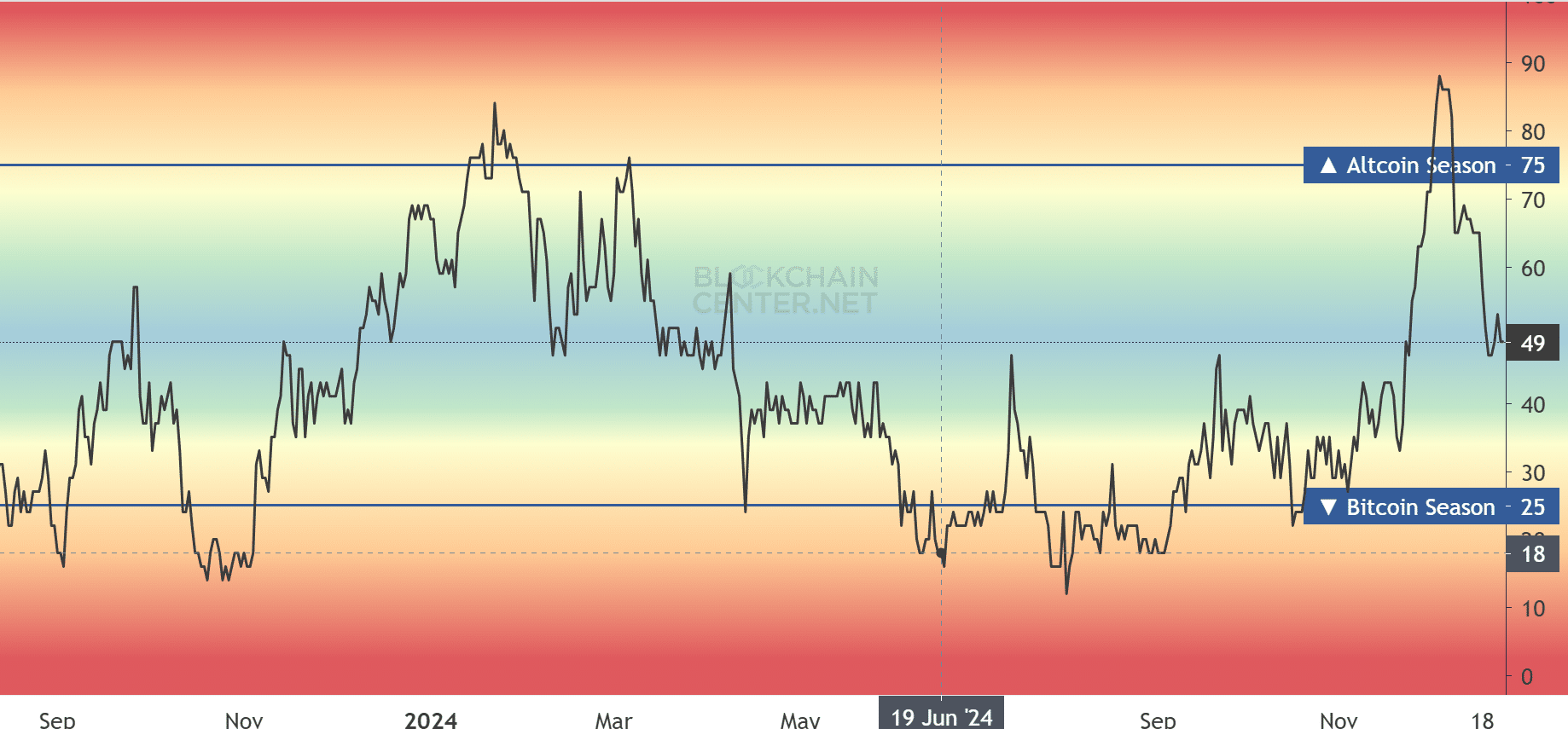

The Altcoin Season Index provided a comprehensive overview of the broader market dynamics. At press time, the index was at 49, indicating a neutral stance between Bitcoin and altcoins.

This follows a sharp decline from the previous high of 75, which signaled a dominant altcoin rally. This decline suggests a shift in market sentiment as Bitcoin gains popularity again.

Source: Blockchain Center

The mixed performance of the altcoin sector is accompanied by a decline in indices.

Notable assets such as Ethereum (ETH) (up 2.5%) and Solana (SOL) (up 4.14%) posted gains, but the broader altcoin market remains fragmented.

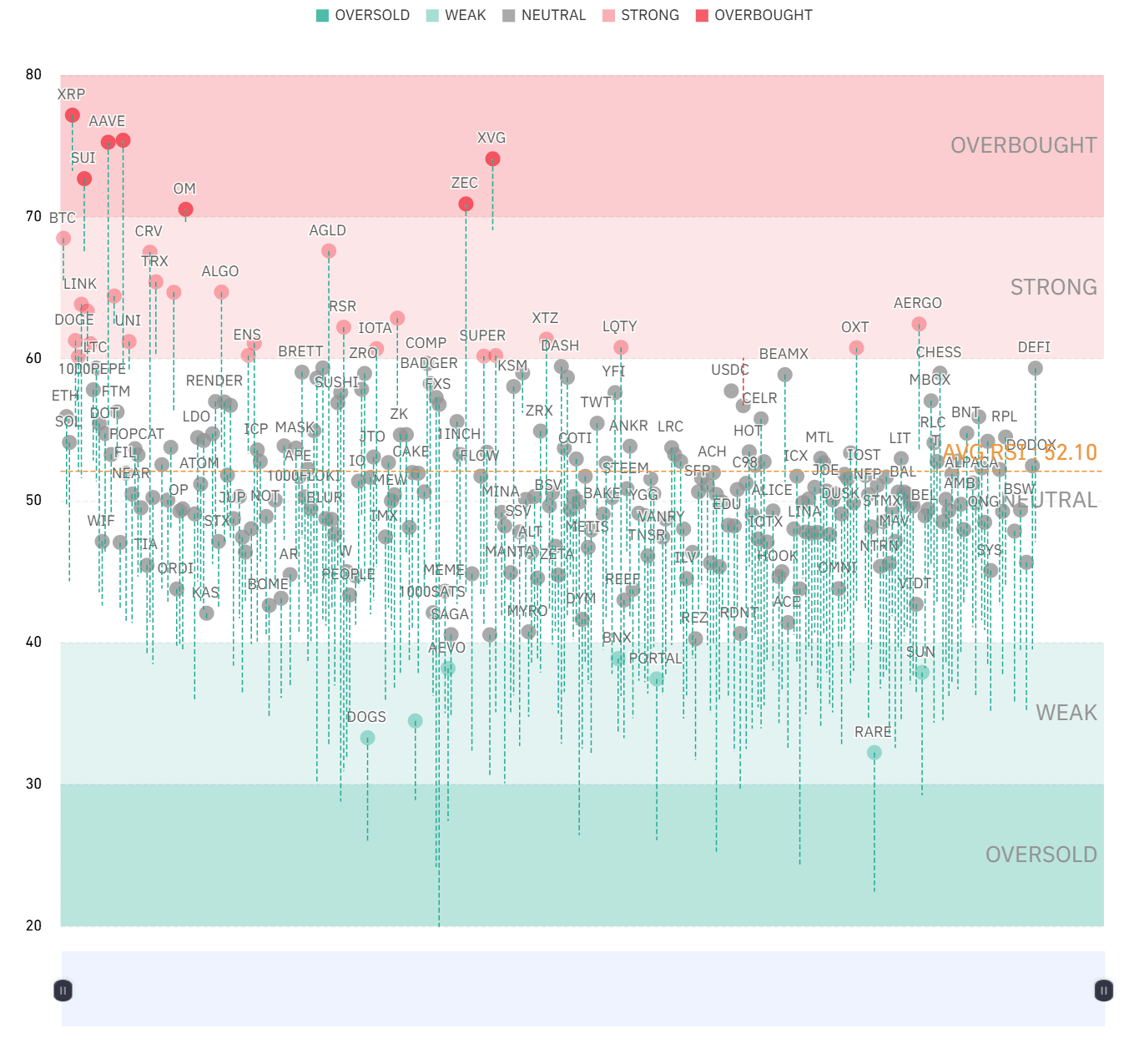

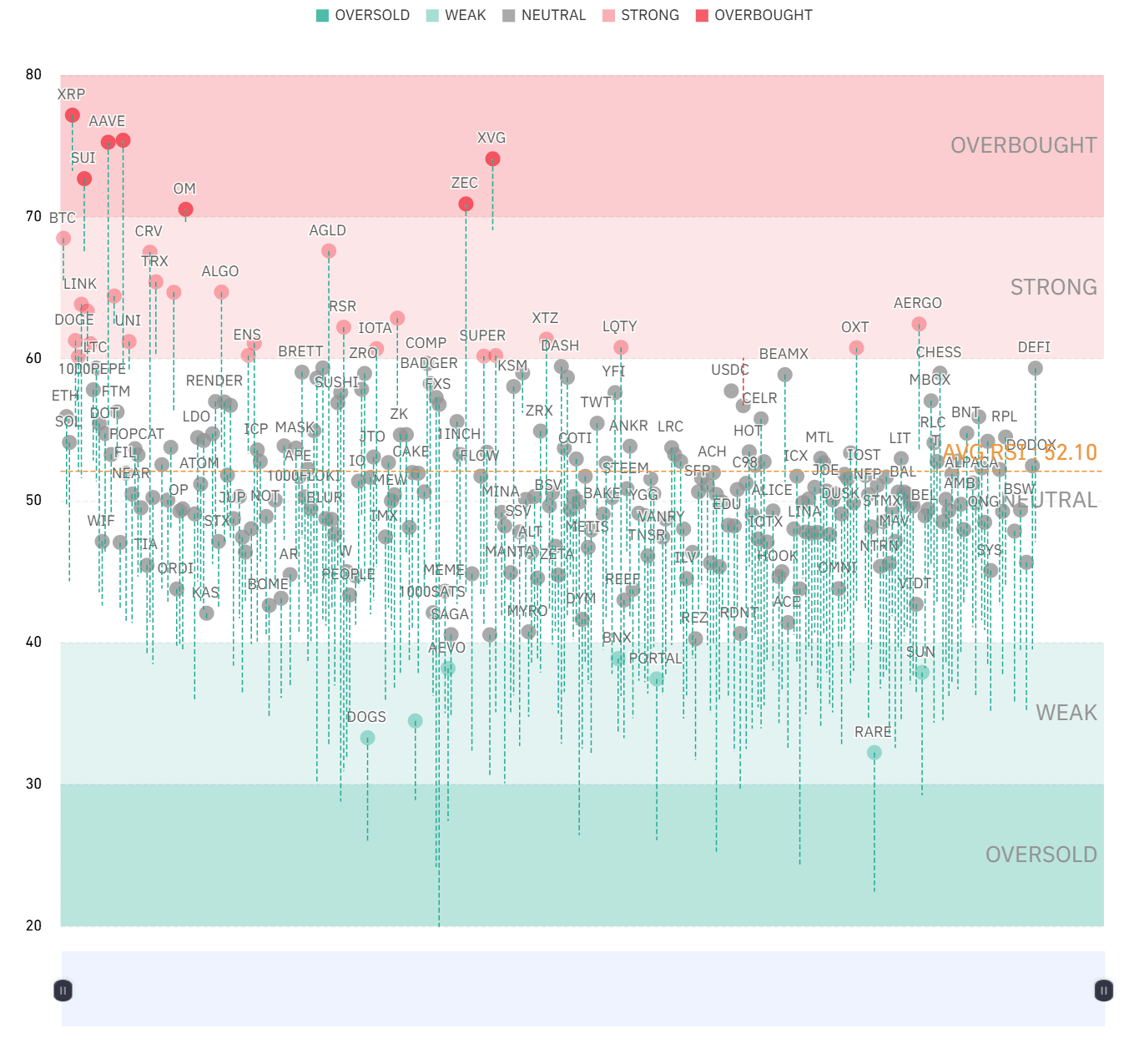

Oversold/overbought charts provide additional insight into differences in performance.

XRP and Aave (AAVE) are in overbought territory, hinting at a possible correction, while oversold assets have highlighted buying opportunities for speculative traders.

Overbought vs. Oversold: A Divergence Story

AMBCrypto’s analysis of oversold/overbought charts revealed a stark contrast between Bitcoin and altcoins.

While Bitcoin remained in neutral territory, indicating balanced sentiment, many altcoins were scattered in overbought and oversold areas.

Assets such as Zcash (ZEC) and XRP appear overbought, suggesting limited upside and potential profit-taking.

Meanwhile, oversold altcoins presented an opportunity for investors looking for undervalued assets during the holiday period.

Source: Coinglass

These differences highlighted the speculative nature of altcoins, which often have amplified volatility compared to Bitcoin.

While this provides an opportunity for short-term profits, it also increases the risk of investing in altcoins during uncertain market conditions.

Bitcoin vs. Altcoins: Stability vs. Volatility

The market heatmap reflects Bitcoin’s stabilizing role, highlighting its share of trading activity and market capitalization.

While in some cases offering higher percentage profits, altcoins are prone to rapid price fluctuations due to low liquidity and speculative interest.

Bitcoin’s consistent trading volume and dominance indicate more stable sentiment than the fragmented and speculative nature of altcoins.

The neutral stance on the Altcoin Season Index suggests that while altcoins have enjoyed individual success, the broader market remains tilted towards Bitcoin as the preferred asset.

Holiday Winner

Analysis shows that Bitcoin will dominate this holiday season.

Its stability, rising dominance, and strong trading volume have made it the asset of choice for long-term investors and risk-averse traders.

However, the altcoin market offers pockets of opportunity for those looking to navigate volatility, with assets in oversold areas presenting potential entry points.

The final winner will depend on the investor’s goals. For those who prioritize stability and continued growth, Bitcoin remains the champion.

Selective altcoins can surprise those looking for higher risk and potentially higher reward. As the holiday season progresses, a closer look at these indicators will shed light on the evolving dynamics of Bitcoin and altcoins.