- Bitcoin’s dominance is an important indicator of where investors are putting their money.

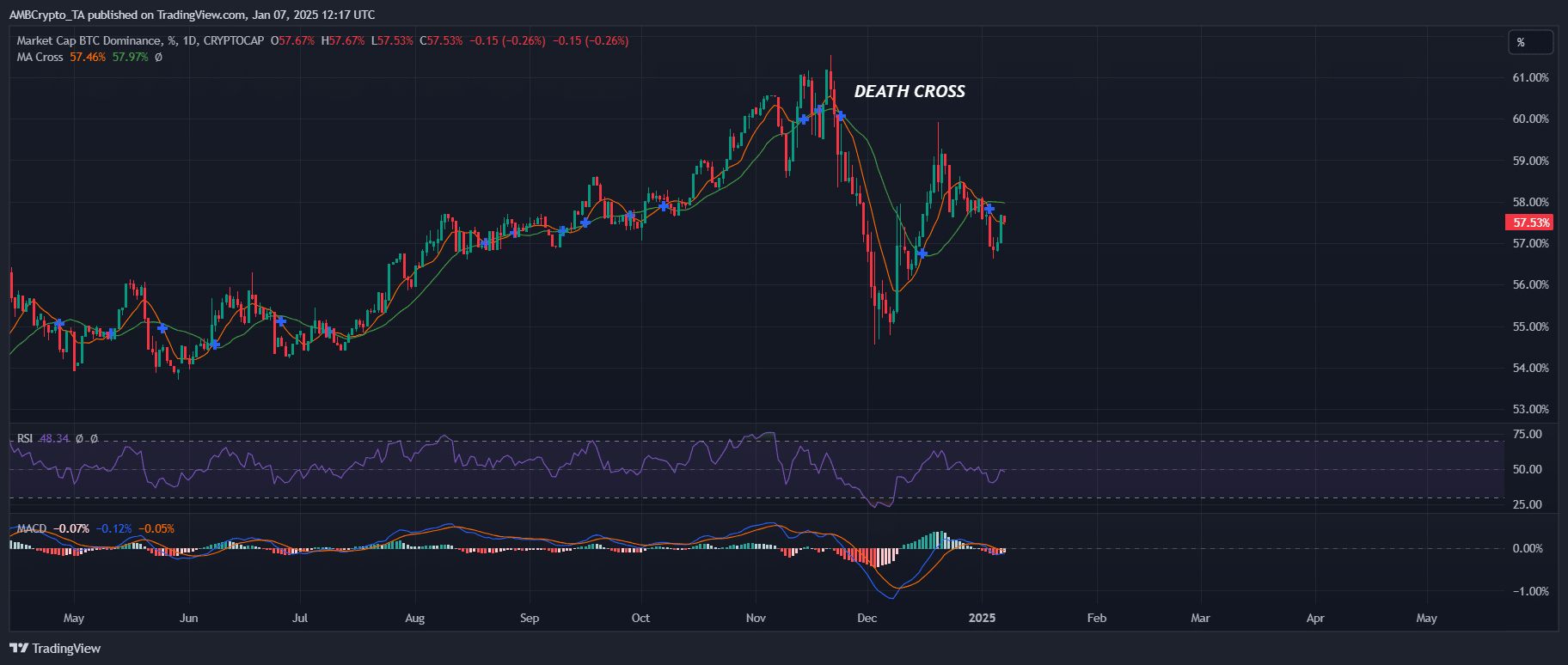

- The emergence of Deadcross after four years is not just a technical signal, but a clear warning.

Even though Bitcoin (BTC) closed the first week of 2025 at a high and regained $102,000 after a two-week market slump, Bitcoin’s dominance has declined slightly.

This could be a sign that altcoins are starting to gain traction as investors look to diversify.

So, does the chart show a repeat of the 2021 cycle?

Typically, a weakening of Bitcoin dominance is often a strong signal that altcoin season is about to begin. And now that hypothesis is becoming more and more important.

Over the past week, the market has turned green, with high-value altcoins posting double-digit gains. It’s still too early to make bold predictions, but the signs are there and it’s definitely a trend to watch.

why? Four years ago, Bitcoin started the first quarter with a dominance of 72%, but less than four months later it fell below 40%, as a dead cross appeared on Bitcoin’s dominance chart.

Accordingly, Ethereum (ETH) soared 467% from $737 in January to $4,183 in May. And get this: This is four times the 107% jump achieved by Bitcoin in the same period.

So does history repeat itself? The market seems to be hinting at this. In mid-November, a dead cross formed on the Bitcoin dominance chart for the first time in four years.

Source: TradingView

What are the results? BTC’s market share fell from 60% to 54% in just two weeks. During the same period, Ethereum surged 30% and closed above $4,000.

But a lot has changed in the past four years. Dead crosses often signal altcoin rallies, but they don’t automatically mean Ethereum is in charge.

The cryptocurrency landscape has evolved, and new competitors may gain traction.

So who can take the lead when Bitcoin dominance declines??

Interestingly, memecoin is enjoying strong popularity and dominating the market. Top Winners List Weekly surge rate exceeded 50%. In fact, three out of the top five tokens are meme-based tokens, proving that meme mania is on the rise.

However, this trend highlights that investors are seeking quick, short-term profits, especially as Bitcoin breaks the $100,000 barrier. What is clear is that Memecoin is following the lead.

What’s even more interesting is how meme-based tokens are currently outperforming traditional altcoins. Let’s take DOGE/BTC as an example. MACD is in an upward trend and is on the verge of a breakout.

Source: TradingView

Read Dogecoin (DOGE) price prediction for 2025-2026

Takeout? Investors should watch the memecoin market carefully as they seem to be more interested in ‘hype’ than long-term ‘value’.

The spotlight on memecoins could become brighter as Bitcoin’s dominance comes under increasing pressure from those seeking cheaper, less volatile alternatives.