- Ethereum underperformed Bitcoin, with the ETH/BTC pair hitting a four-year low.

- ETH is down 2.48% in the last 24 hours.

Over the past few months, Ethereum (ETH) has struggled to maintain upward momentum, while Bitcoin (BTC) has continued to hit new highs.

Therefore, Ethereum has continued to struggle with Bitcoin as BTC.Dominance pushes Bitcoin to recent lows.

In fact, at the time of writing, ETH/BTC is trading at $0.031, a four-year low. The decline raises concerns about Ethereum’s future prospects and whether it can reverse its fortunes.

Ethereum continues to compete with Bitcoin.

Over the past year, Bitcoin has seen significant gains, rising 144.45%. This has increased from $40K to $101K at the time of writing, while BTC has reached an ATH of $109K over the same period.

Source: TradingView

In comparison, Ethereum rose more modestly to $3,219, up 30.27% over the same period. During this period, ETH remained approximately 33% below the ATH $4891 recorded in 2021.

The ETH/BTC ratio fell to 0.031, wiping out all the gains realized over the past four years. Historically, the pair peaked at 0.087 in 2021, which saw a significant surge in altcoins in the market.

However, after reaching this level, the altcoin experienced strong downward pressure.

Factors contributing to this decline

A variety of factors have caused Ethereum to underperform Bitcoin. In particular, KingCoin has experienced high preference from institutions and governments.

In this regard, many governments have considered setting up Bitcoin reserves to ensure that BTC has a higher preference and adoption rate compared to other cryptocurrency assets.

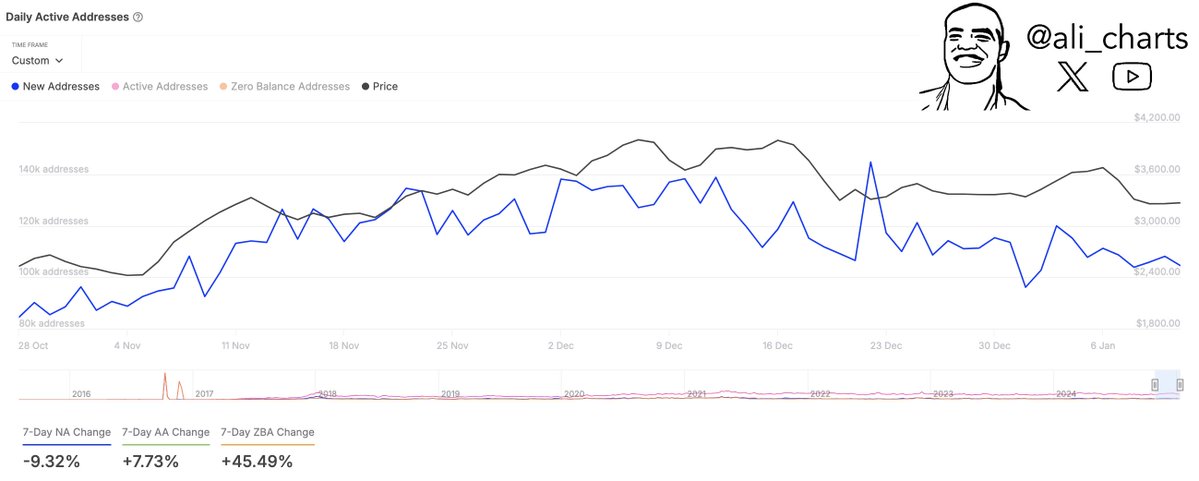

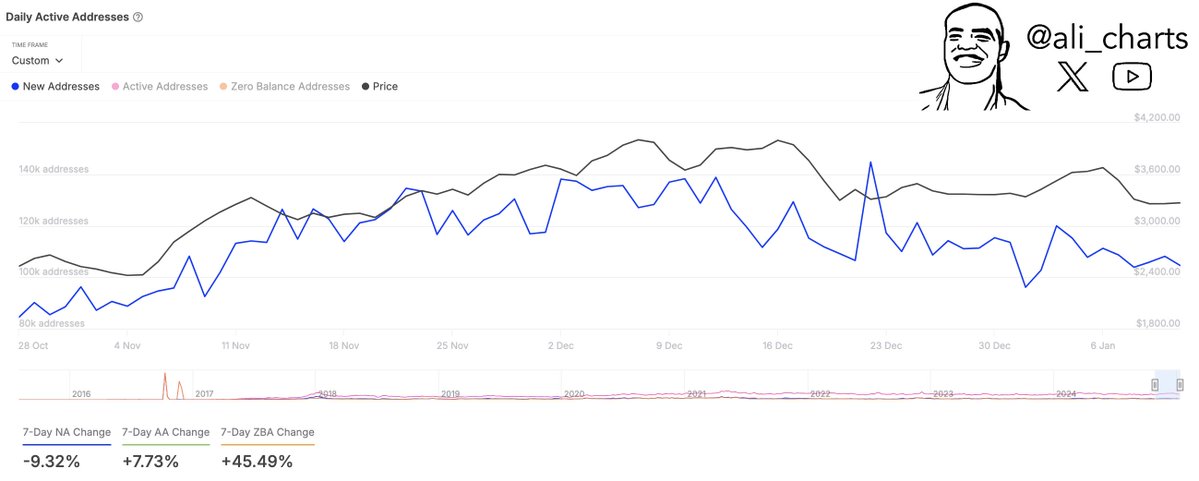

Source: X

Ethereum, on the other hand, experienced a decline in adoption, with new addresses falling by 9.32%.

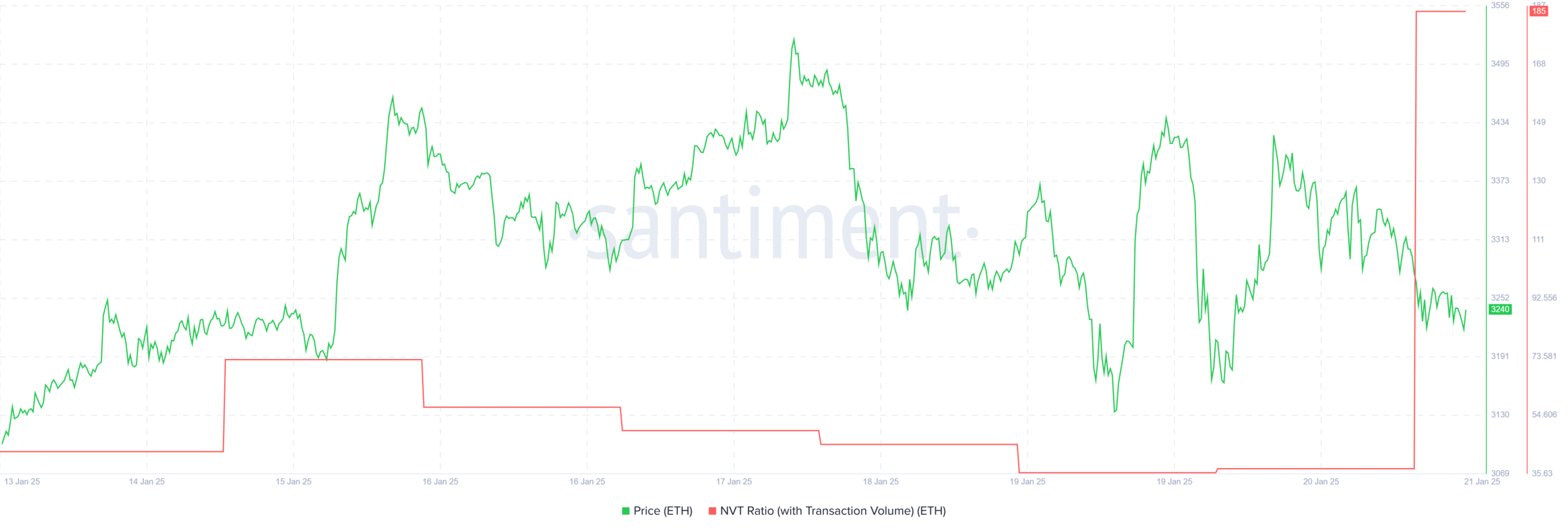

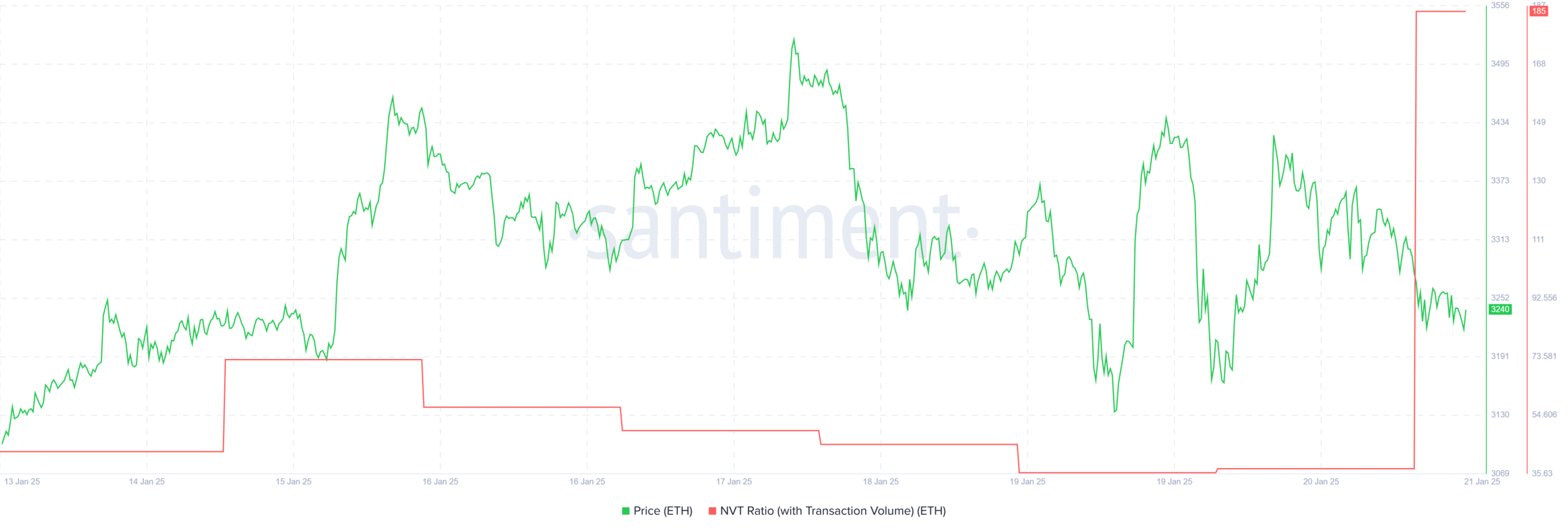

Source: Santiment

This decline in addresses is further evidenced by the NVT ratio soaring to 185.5, a sign of reduced trading activity. Therefore, transactions on the Ethereum network continued to decline.

This decline in network activity raises concerns about overvaluation, magnifying ETH’s lackluster performance.

What lies ahead?

As market favor declines, ETH could see more losses and its underperformance against Bitcoin could continue.

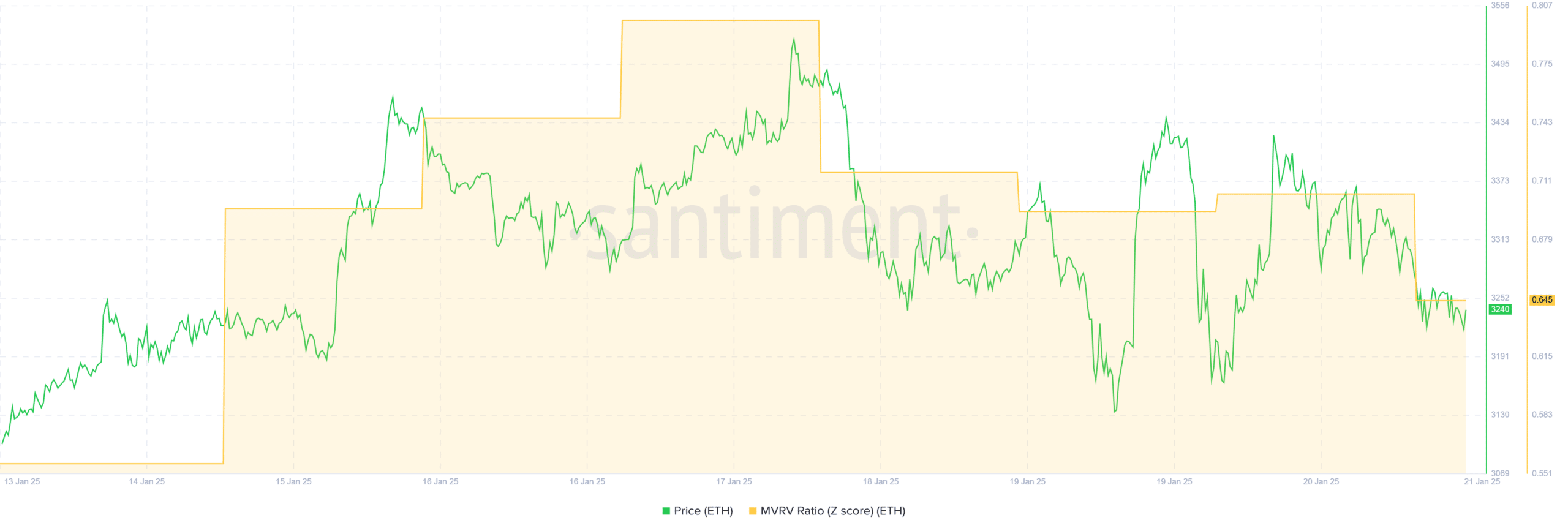

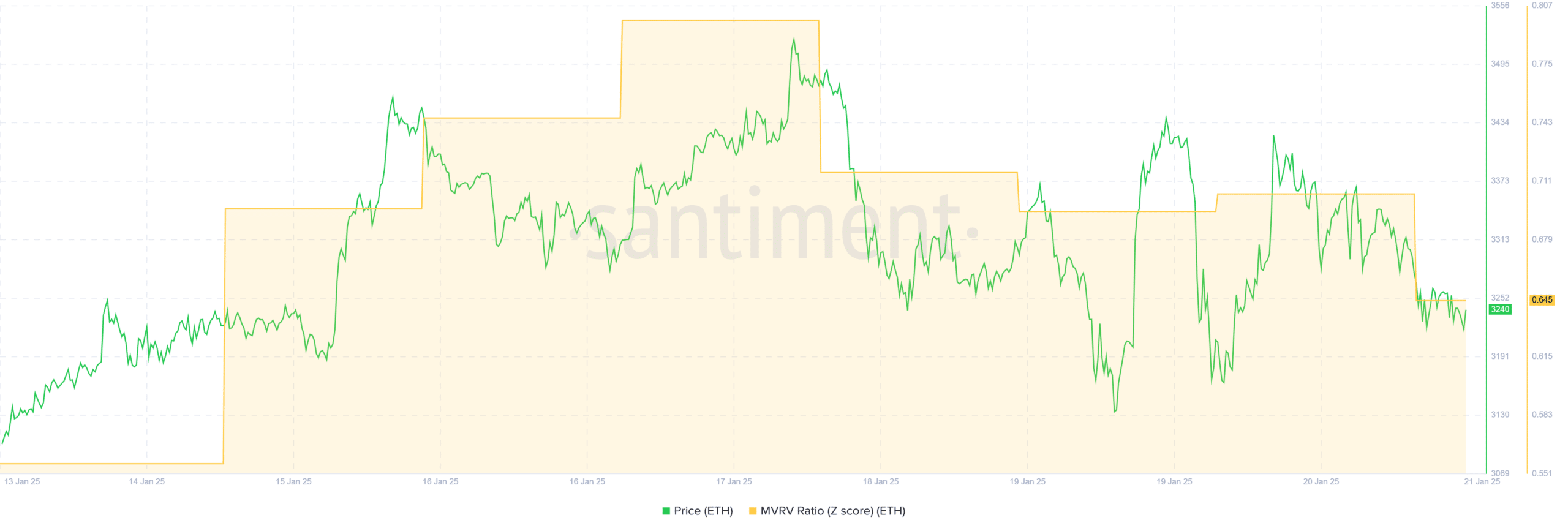

Source: Santiment

This potential decline is supported by the fact that the MVRV ratio has fallen to 0.64. This decline means investors are feeling bearish and have low confidence in a near-term price recovery.

Realistic or not, the market cap of ETH in BTC terms is:

Therefore, in the short term, Ethereum faces a strong downtrend that could push ETH down to $3,160. However, if buyers take this drop as a buying opportunity, ETH reclaims $3300 and attempts $4,000.

This will strengthen the ETH/BTC pair and push it to reclaim $0.04.