- Bitfarms’ $60 million private placement with U.S. institutional investors will close around November 28.

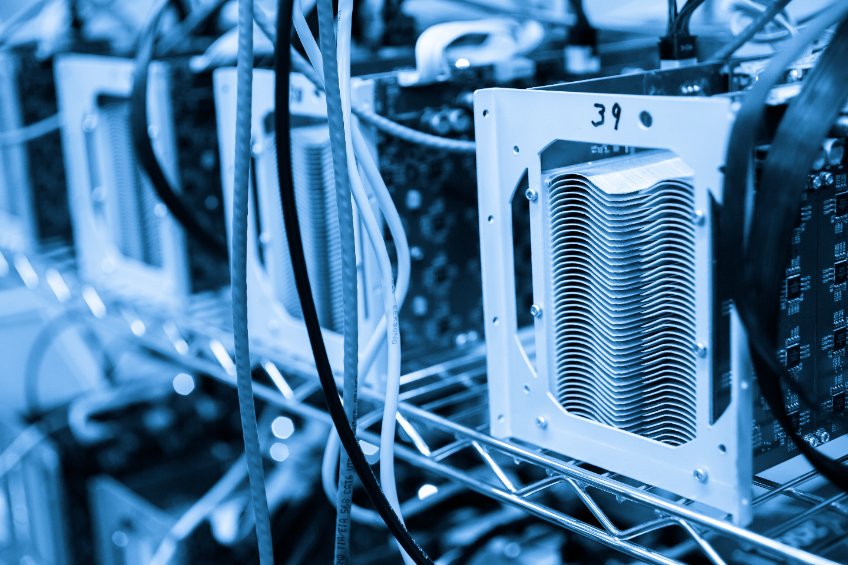

- The Canadian Bitcoin mining company will use the proceeds to purchase more miners and expand its infrastructure.

Bitcoin mining company Bitfarms is seeking C$60 million (about $44 million) in funding from U.S. institutional investors, the Canada-based company announced Friday.

Bitfarms plans to raise funds through a private placement, with gross proceeds of C$1.35 per share from 44.4 million common shares.

Investors will also have warrants to purchase a total of 22.2 million shares of common stock at an exercise price of C$1.61 ($1.17) per share. The warrants have a three-year exercisable period, Bitfarms said in a press release Friday.

Bitfarms will use the proceeds from the private placement to acquire additional miners, expand infrastructure, and improve the company’s working capital position. The company’s monthly mining production increased 7.3% in September.

According to today’s announcement, the private placement will close on or about November 28, 2023, the miner noted.

However, it will still “satisfy customary closing conditions” and require approval from the Toronto Stock Exchange. Meanwhile, New York-based investment bank HC Wainwright & Co. will serve as the exclusive agent for the private placement.