- Open Interest in Bittensor (TAO) is at an all-time high and positive sentiment is also on the rise.

- In the past 30 days, TAO is up more than 130%.

Bittensor (TAO) performed well. Bitcoin (BTC) The broader cryptocurrency market is up 13% in the last 24 hours. In fact, TAO has been the best performing altcoin, with its value rising by more than 130% over the past 30 days.

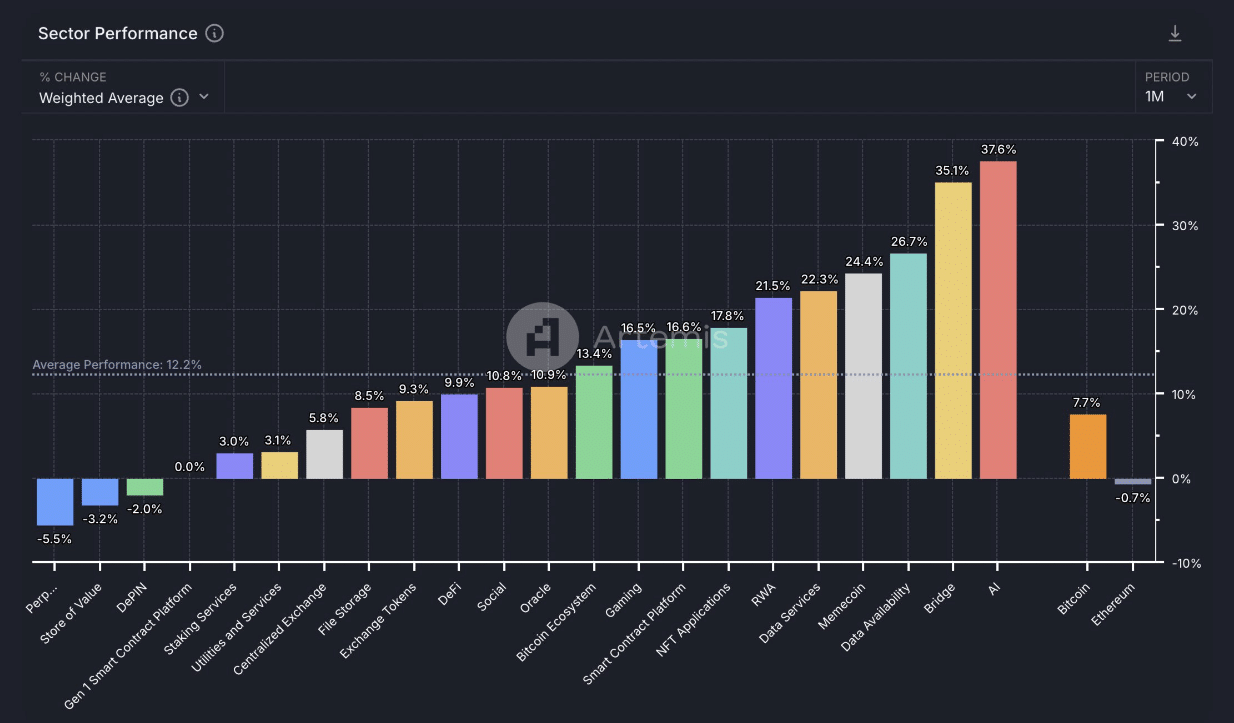

According to Artemis, the artificial intelligence (AI) cryptocurrency sector is leading the market with a weighted average gain of 37% over the past month.

(Source: X)

In just one month, the total market capitalization of AI and big data cryptocurrencies increased from $26 billion to $35 billion. CoinMarketCap. This growth has fueled gains for TAO, the second-largest AI cryptocurrency with a market capitalization of $4 billion.

Open interest has reached an all-time high.

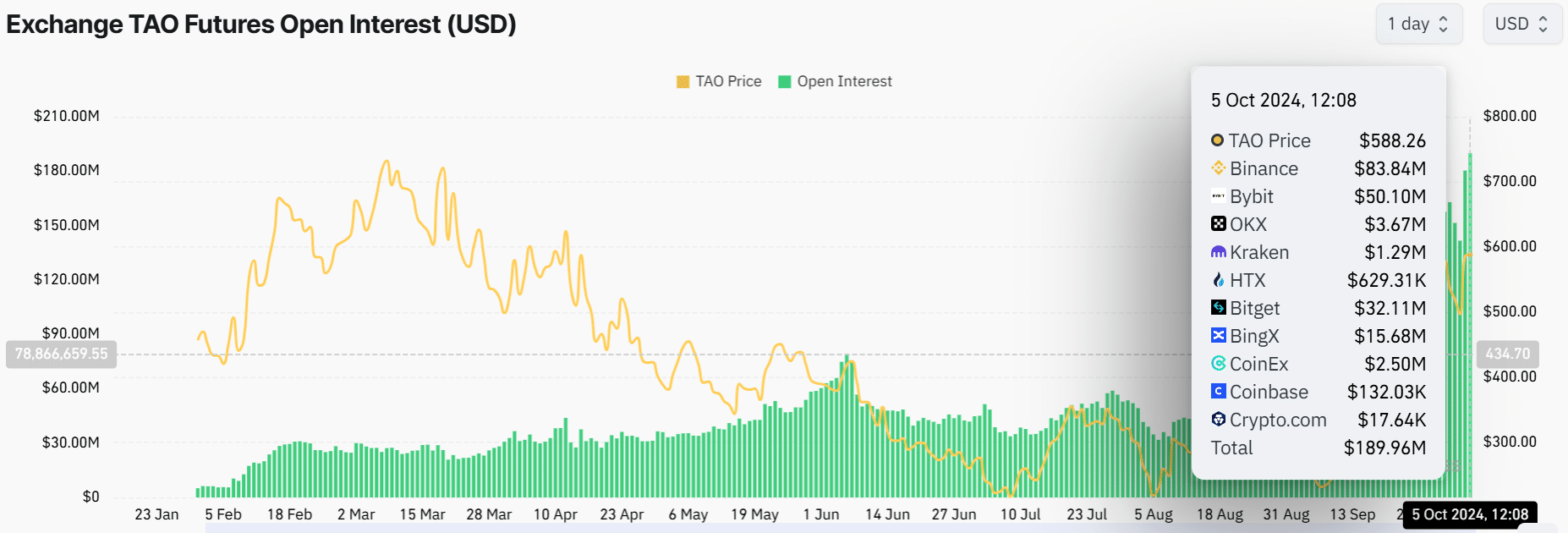

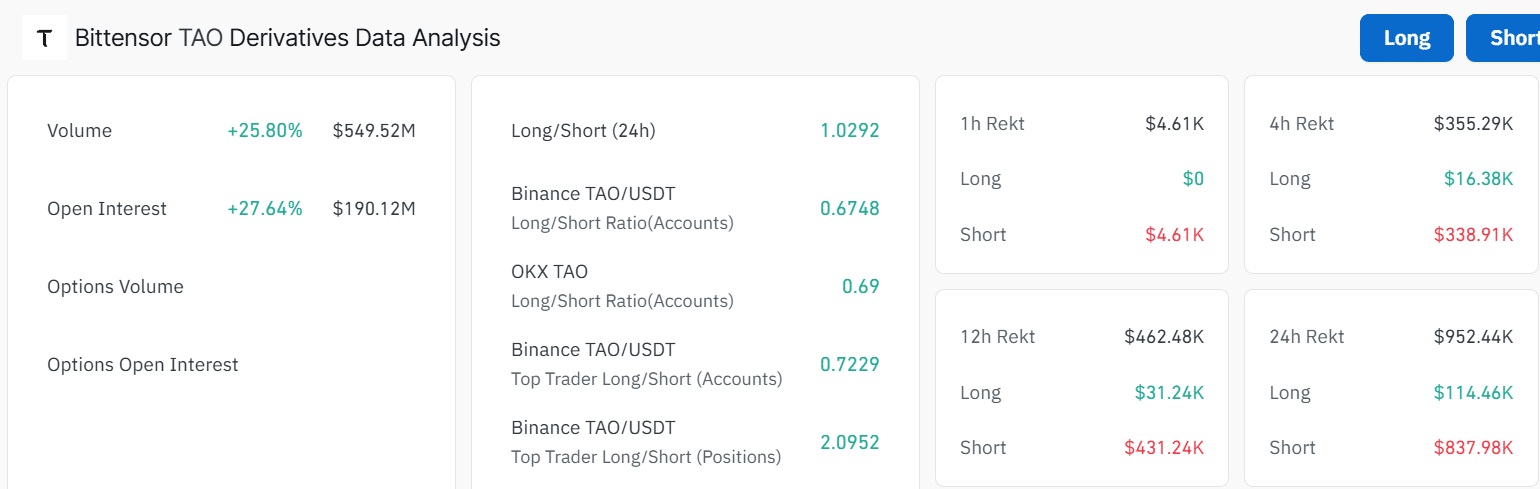

According to Coinglass, Bittensor’s open interest soared to an all-time high of $189 million. This figure has more than tripled from $50 million on September 5.

(Source: Coinglass)

An increase in open interest indicates that more traders are opening and maintaining positions in TAO.

When open interest rises along with the price, it indicates that more funds are flowing into TAO. This confirms the continued upward trend and the potential for the token’s profits to expand on their own.

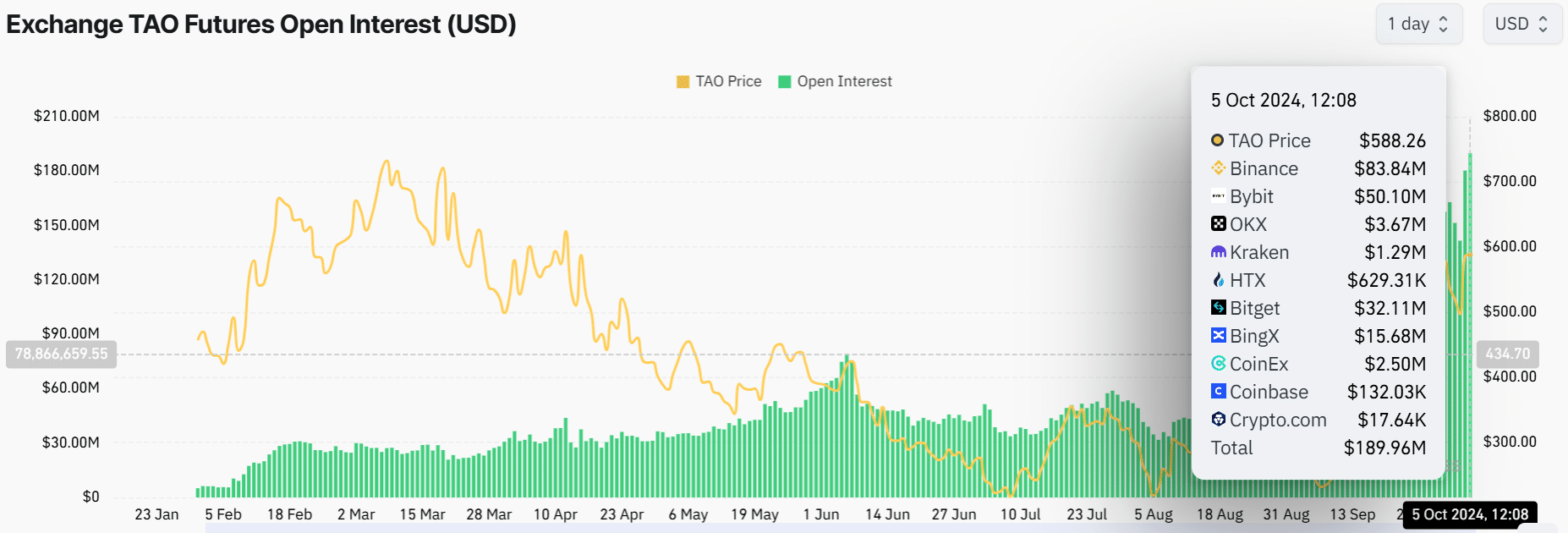

In addition to open interest, TAO’s derivatives data suggested positive sentiment towards the token. As of press time, the long/short ratio is 1, showing balanced market sentiment.

Additionally, over $800,000 in short positions was liquidated in 24 hours, meaning the market does not favor short traders.

(Source: Coinglass)

Technical Analysis of TAO

TAO was trading at $590 at press time. The token formed a bullish V-shaped recovery on the 4-hour chart. This is a sign that the bullish momentum may continue.

At the price at press time, TAO appeared to be trading at an important resistance level. The green volume histogram bar shows that the buying momentum is strong and could push the token above this resistance level.

(Source: Trading View)

If TAO breaks this resistance level, the next target price will be $618. At the time of writing, Chaikin Money Flow (CMF) was positive at 0.21, indicating high buying volume. This supported the possibility of a breakout.

At the same time, the Moving Average Convergence Divergence (MACD) line inverted above the signal line. This is a sign of strong bullish momentum. The green MACD histogram bar further suggested that the uptrend may be under control.

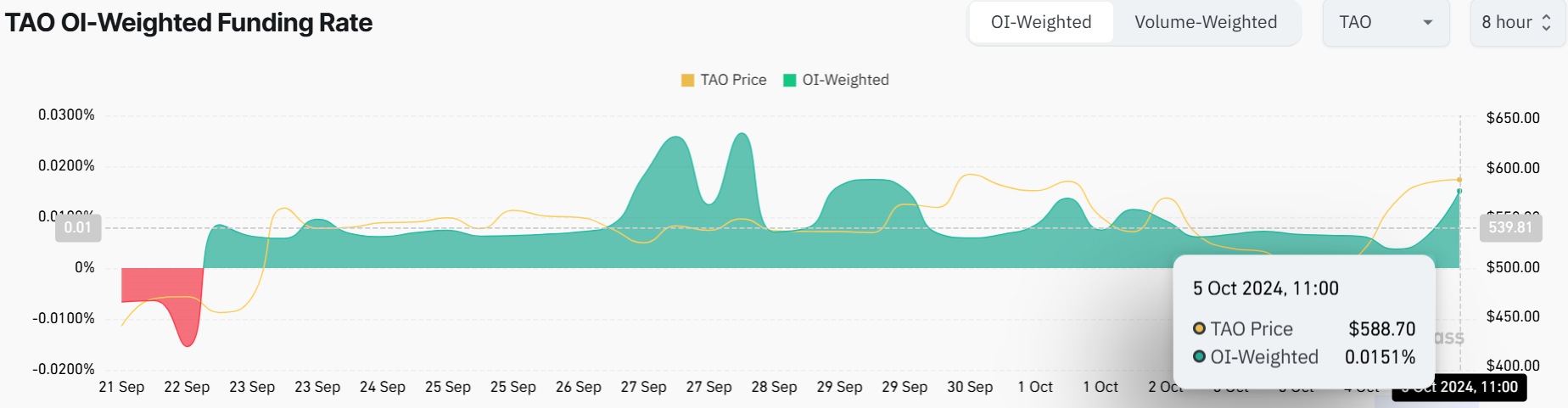

The positive sentiment towards TAO is further evidenced by positive funding rates since the end of September. This means that long traders are willing to pay a fee to short traders to maintain their positions.

(Source: Coinglass)