Since August 9, the price of BitTorrent (TAO) has experienced a steady daily decline. This downward trend is in sharp contrast to the performance of altcoins from August 5 to 8, when the price was rising.

Holders had hoped TAO would continue its upward trend and retest last week’s highs. However, it appears the same investors are responsible for the recent decline.

Project development alone is not enough to promote Bittensor accumulation.

At the time of writing, TAO is trading at $278.93, down 15% over the past 4 days. According to the daily chart, the Money Flow Index (MFI) and On Balance Volume (OBV) have remained roughly flat since the decline began.

The MFI fluctuates between 0 and 100, and measures the buying and selling pressure around a cryptocurrency using price and volume. When it rises, it means that buying pressure is increasing. However, when it falls, it suggests that selling is increasing.

However, since the indicator has stopped, it means that TAO investors are not actively buying or selling tokens, but are waiting to see. Like MFI, OBV measures buying and selling pressure. However, this indicator only considers trading volume and has a similar interpretation to the former.

Learn more: How to Invest in Artificial Intelligence (AI) Cryptocurrencies?

As seen above, the OBV on the Bittensor chart remains stable, indicating that investors may no longer expect a price increase. This sentiment contrasts with last week when TAO surged after Grayscale added to the investment.

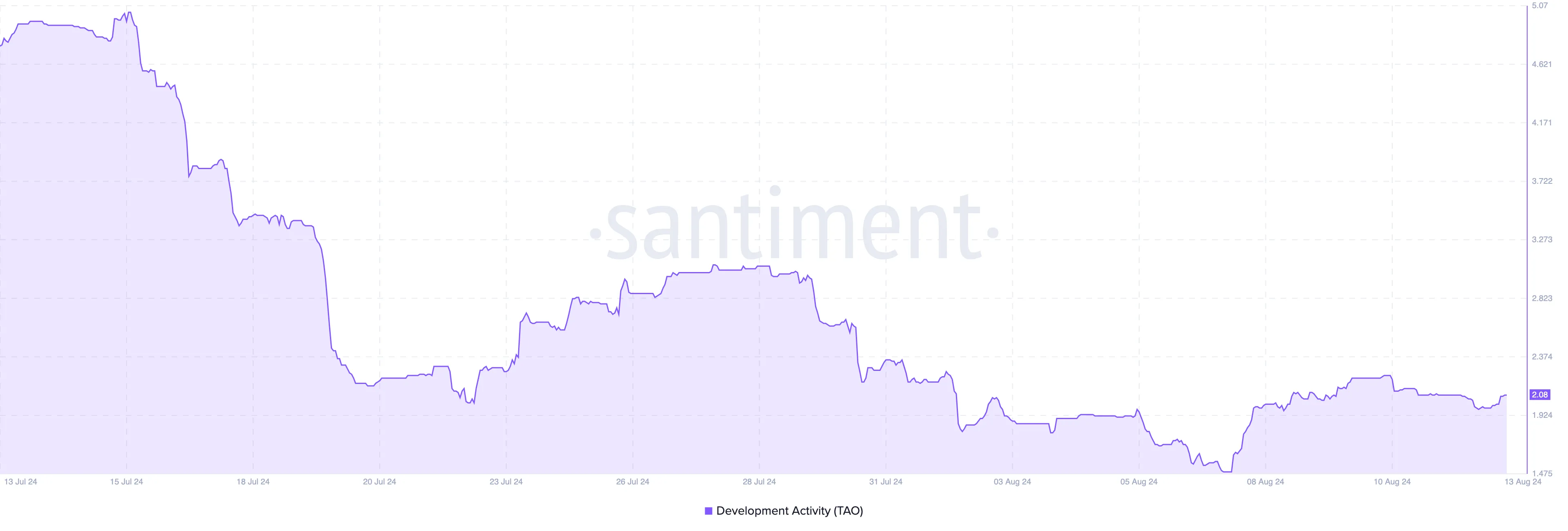

Meanwhile, on-chain data shows that Bittensor’s development activity has been improving, suggesting that work is being done privately to add new features and fix issues on the blockchain.

TAO Price Prediction: Bullishness Falters as Price Eyes $241

Looking back at the chart, we can see that the bulls tried to push TAO higher but hit a roadblock. This is clearly evident in the signals shown by the Relative Strength Index (RSI).

The RSI, which measures momentum, crossed the neutral line of 50.00 on August 8, signaling a potential price rally for TAO. However, this is no longer the case as the RSI has since declined. This indicates that the bullish momentum has weakened and is not strong enough to sustain a sustained price rally.

The exponential moving average (EMA) also adds more context to this position. The EMA measures the direction of the trend over a given period of time. As of this writing, the 20-day (blue) and 50-day (yellow) are above the TAO price, suggesting a bearish trend.

A longer EMA rising above a shorter EMA, called a death cross, reflects price weakness and suggests that the token may continue to decline. The opposite would be a golden cross.

Read more: 9 Best AI Cryptocurrencies of 2024

In the image above, the price of TAO can drop to $241.19, which has a 0.236 Fibonacci correction indicator. For context, the Fibonacci indicator shows price levels that can act as support or resistance.

However, if investors start buying TAO again, the price prediction could change. In that case, TAO could rise to $288.91 or approach $327.48.

disclaimer

In accordance with the Trust Project guidelines, this price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto strives to provide accurate and unbiased reporting, but market conditions are subject to change without prior notice. Always conduct your own research and consult with a professional before making any financial decisions. Please be advised that our Terms of Use, Privacy Policy and Disclaimer have been updated.