- The TAO can pop up to $ 240, but you can’t go higher.

- The CMF did not agree with other technical indicators, and the proposed bull has now gained an edge.

Bittensor (TAO) fell below $ 216 on April 6 and reached $ 167 on April 7. Since then, last month, we have returned almost 30%to test the core horizontal level of $ 216.

Source: TradingView Man/USDT

The first day of Bittensor showed that the decline has been in progress since the last week of January. At that time, it was when the level of $ 416 and the low level of the previous swing were broken.

In the next few weeks, the $ 434- $ 450 area has been changed from support to resistance. This was clear at the end of February.

OBV has steadily decreased, with Tao prices dropping from $ 470 to $ 180 over the last six weeks. Recently, the level of $ 216 has also been reversed from support to resistance.

Additional losses were expected and the price rose to $ 140- $ 150 in April.

Surprisingly, Bittensor 1 OBV has seen slight rise in the last few days, but the CMF has been higher as a large margin over the past week.

In the press time, some analysts were +0.05, which is used to indicate significant capital inflows.

Purchasing pressure has seen a noticeable increase in the CMF, but the market structure and momentum were weak.

The TAO was trading below the 20 -day moving average (blue), and the Bollinger band was increasing volatility and more losses after heading to a low price.

How the trader can deploy himself

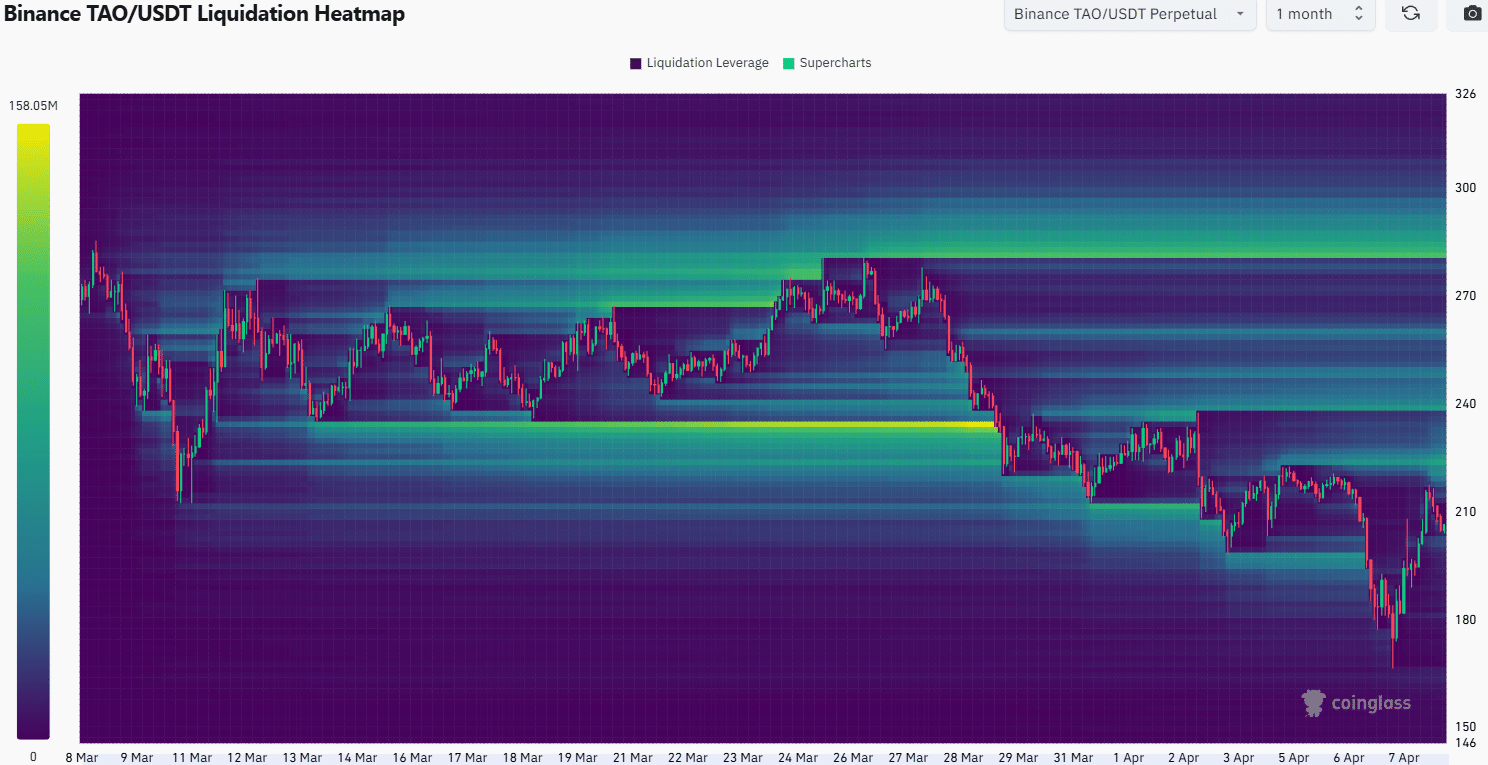

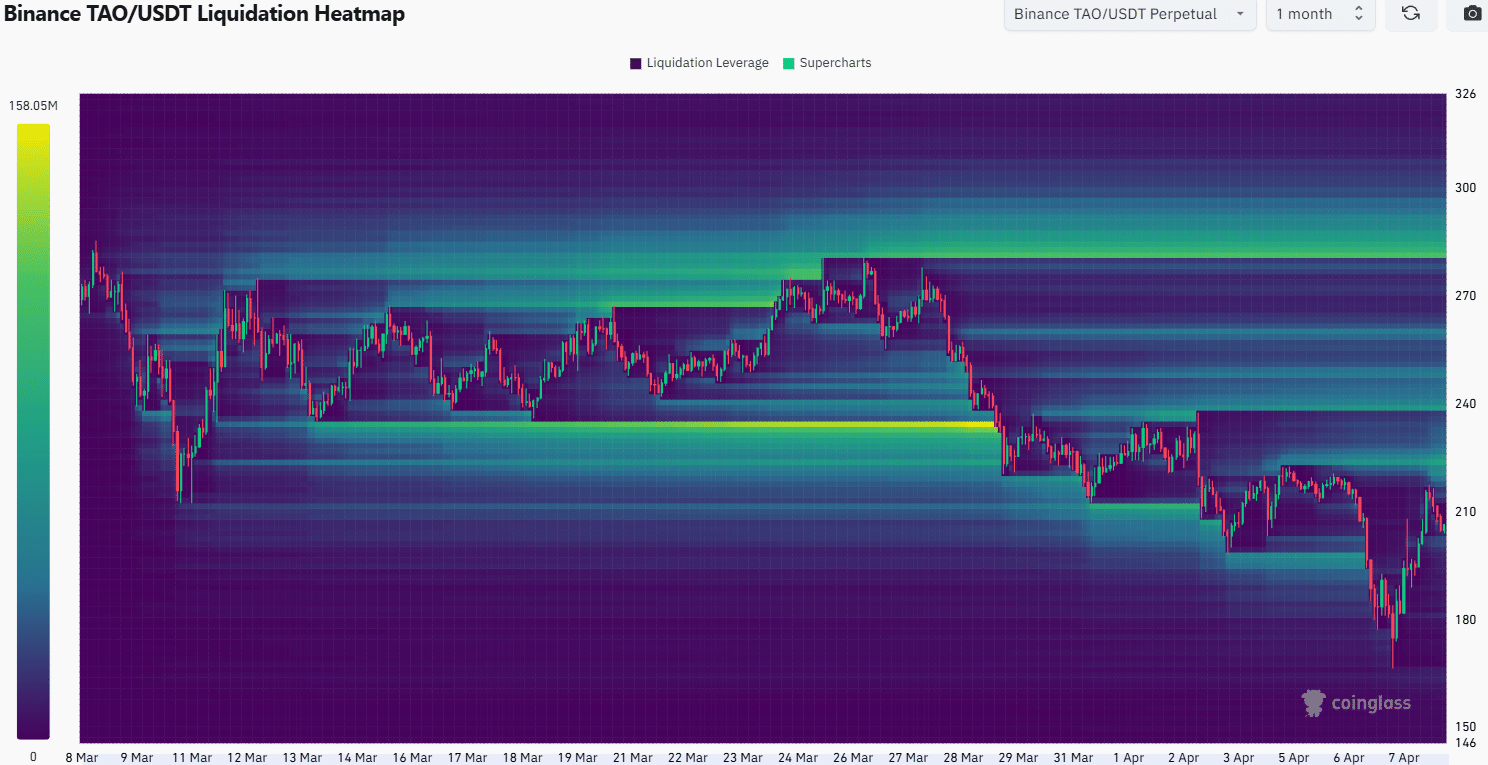

Source: COINGLASS

The one -month liquidation column map showed a liquidity collection for $ 240 and $ 220. Therefore, this level was a short -term price target because it is a remarkable self -area near the price.

Source: COINGLASS

The $ 220 willingness to expand the liquidation hit map for one week was much more rapid.

The liquidity cluster in the area was symbolic over last week, emphasizing the possibility that the TAO price would be higher to sweep the $ 220 area.

If this happens, the weak reversal will be a feasible possibility. It was harder to be sure whether the $ 220 could see the weak reversal or to go up to $ 240. The trader must prepare both possibilities.

Or if Momentum shift and Tao go up to more than $ 240, the trader should make a price bounce of 280- $ 300, so be more careful. In the short term, traders can keep their prejudice until $ 240 are supported.

Indemnity Clause: The information presented does not make up financial, investment, transactions, or other types of advice, and is entirely the artist’s opinion.