- TAO recovered +80%in April, surpassing SOL and BTC.

- Analysts have linked the rise to the increase in demand for AI -centered bit ten the subnets.

Bittensor (TAO) It recovered more than 80% in April and increased 30% last week, surpassing the highest assets such as Bitcoin (BTC). Solana (SOL). But what is the catalyst for the explosive rise?

Tao Rally Driver

According to Mark Jeffrey, the increase in demand for the Bittensor subnet (community to build a new AI project in a chain) can be one of the driving factors. In his X (previous Twitter) post, he said.

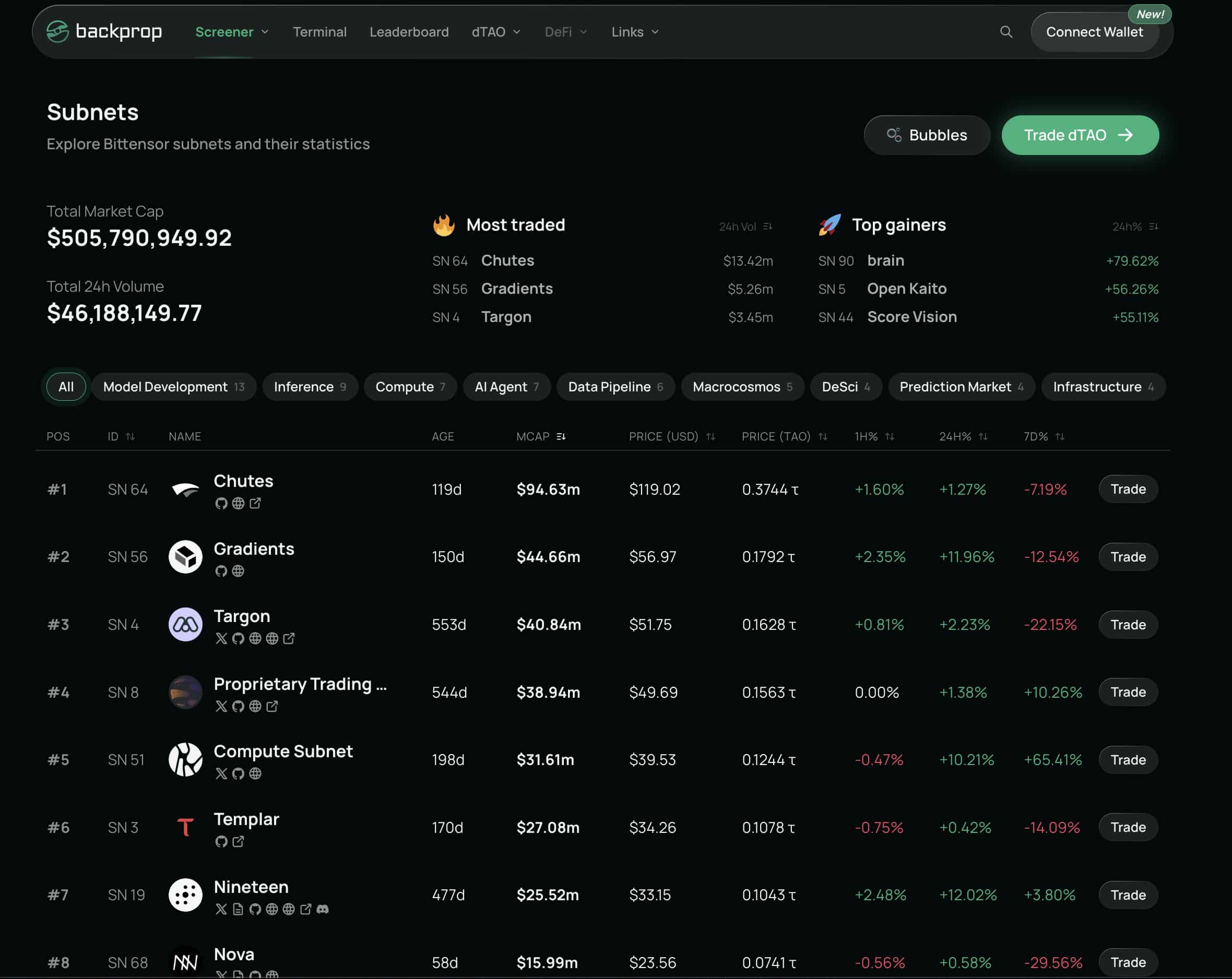

“The total market cap of $ TAO subnet has just exceeded $ 500 million. It’s 10 times before 9 weeks.”

source: reversal

For groups (subnets) that generate AI systems using bittensor, you need to lock the TAO. This produces fuel for the demand for basic tokens.

According to Jeffrey, the subnet has increased 10 times over the last 10 weeks, so growth has been able to improve TAO positively.

source: Ta Ostat

Ta Ostatsu, Subnet, was stagnant in January and then traction was later picked up. In January and April, subnets increased from 65 to 95 to 46%.

This is not surprising at all. In fact, recent Coingecko Reported One of AI’s best encryption stories. But according to other analysts Defi JeffThe subnet was still early and had enough growth potential.

“But we are still in the early stages. The 6% dedicated to $ tao is on the subnet and the hedge fund is as follows: Unexplained CAPITAL & CRYPTO Investors Yumagroup, DCG is doubling Bittensor Ecosystem. ”

In other words, TAO’s market reading was mixed at the time of writing. According to CoingLass, Binance has been tank in large quantities, with a drop of $ 220 million over the last seven days.

In addition, the $ 390K TAO was sent to Krake to sell per Exchange Netflow. But Binance users were optimistic and caught $ 1.92 million worth of TAO.

Source: COINGLASS

This means more sales pressure, rushing to promote profits after merchants surged 30% last week.

However, the SPOT CVD (cumulative volume delta) is flat and suggests that the demand for on -site market is stagnant. On the contrary, the open interest (OI) fee was 100%.

This meant that the last 30% rally became a leverage, and it could not be sustainable if the demand for spots was improved in the short term.

Source: Coinalyze