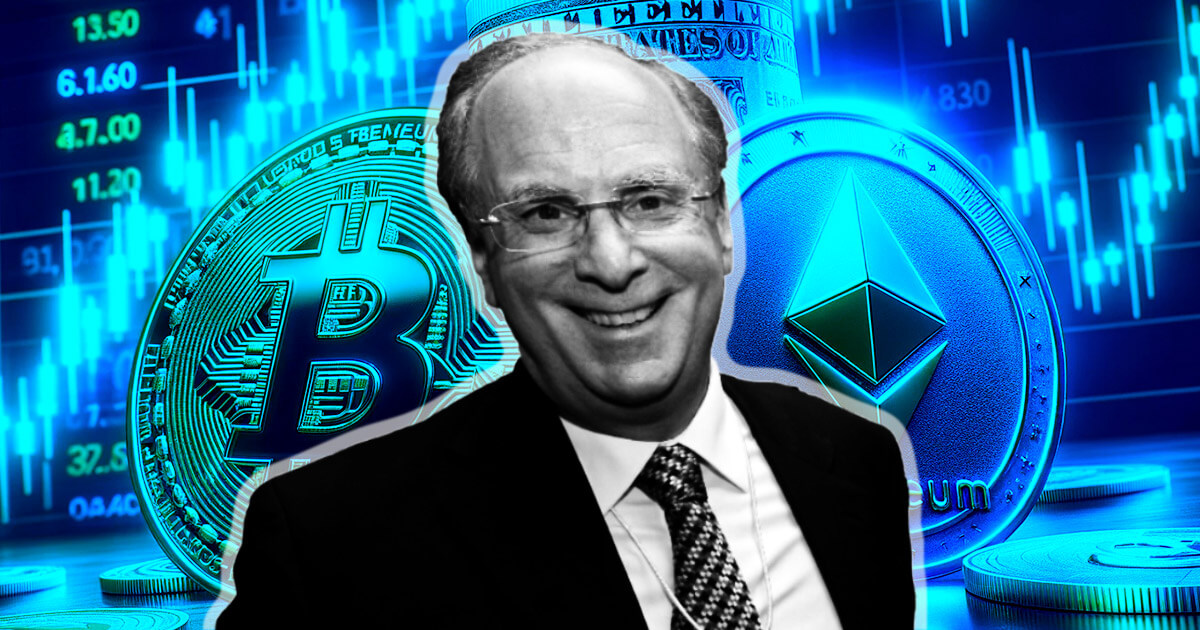

BlackRock’s spot Bitcoin ETF launch was highlighted in an interview with CEO Larry Fink on CNBC. Fink, who previously expressed skepticism about Bitcoin, now sees it as a viable asset class, if not a potential currency. This change in position is consistent with BlackRock’s broader strategy to embrace technological advancements in the financial sector, primarily through ETFs and the eventual tokenization of financial assets.

In a CNBC interview following the first day of trading for BlackRock’s Bitcoin ETF, Fink said that the perception of Bitcoin has changed significantly. Fink has advanced to view Bitcoin as an asset class similar to digital gold, suitable for holding wealth but not as a currency.

Fink’s discussion with the CNBC host delved into the implications of Bitcoin’s value, its comparison to gold, and its potential price trajectory. He emphasized that Bitcoin, like gold, is a haven asset that gains value amid geopolitical and economic uncertainty.

However, unlike gold, Bitcoin has a nearly fixed supply limit, strengthening its appeal as a store of value. When probed for predictions like Cathie Wood’s, which predicts Bitcoin will reach more than $600,000, Fink refrained from speculating on a specific valuation and instead focused on the asset’s wealth preservation potential.

The conversation also touched on the broader implications of BlackRock’s ETF initiative. Fink sees ETFs as the first step in a technological revolution in financial markets, with tokenization of financial assets being the next step.

He believes this vision is consistent with BlackRock’s successful history of integrating ETFs into a variety of asset classes and demonstrating a consistent strategy of leveraging technology to transform the financial landscape.

Fink’s comments on the inflows into the Bitcoin ETF on the first day were positive, and BlackRock received significant market attention. He emphasized the competitive advantages of ETFs over traditional trusts, noting the lower fees associated with ETFs. These aspects, combined with the tax implications of transferring assets from a trust like Grayscale to another low-fee ETF, present both challenges and opportunities in the evolving cryptocurrency market.

Finally, discussing the future of cryptocurrency ETFs, Fink expressed optimism about the possibility of other cryptocurrencies, such as Ethereum, being included in ETF products.

He emphasized the importance of tokenization in increasing transparency in financial transactions and reducing corruption, suggesting a future where financial assets and identities are tokenized to create a safer and more efficient financial system. He concluded:

“These are just stepping stones towards tokenization, and I really believe this is where we’re going. It eliminates all the corruption by having a tokenized system.”