- Daily trading volume on the Blur NFT marketplace has increased fivefold over the past month.

- Short-term traders have fallen into a trap as BLUR shows upward trend bars amid the recent overall market correction.

Daily trading volume on the Blur (BLUR) NFT marketplace increased more than fivefold in November. This was the largest spike ever, with volume exceeding $35 million.

This surge coincides with heightened activity suggesting growing interest in NFT platforms, which could potentially impact the BLUR token price.

In particular, volume spikes were inconsistent. Instead, it came in sudden bursts, indicating reactive trading behavior.

Source: Token Terminal

If the trend of increased NFT activity continues, the price of BLUR may react positively, reflecting the highest trading volume.

However, this may vary significantly depending on other conditions and continued interest in trading on the Blur platform. This means BLUR will become a key player in the NFT space, requiring close monitoring of future market reaction.

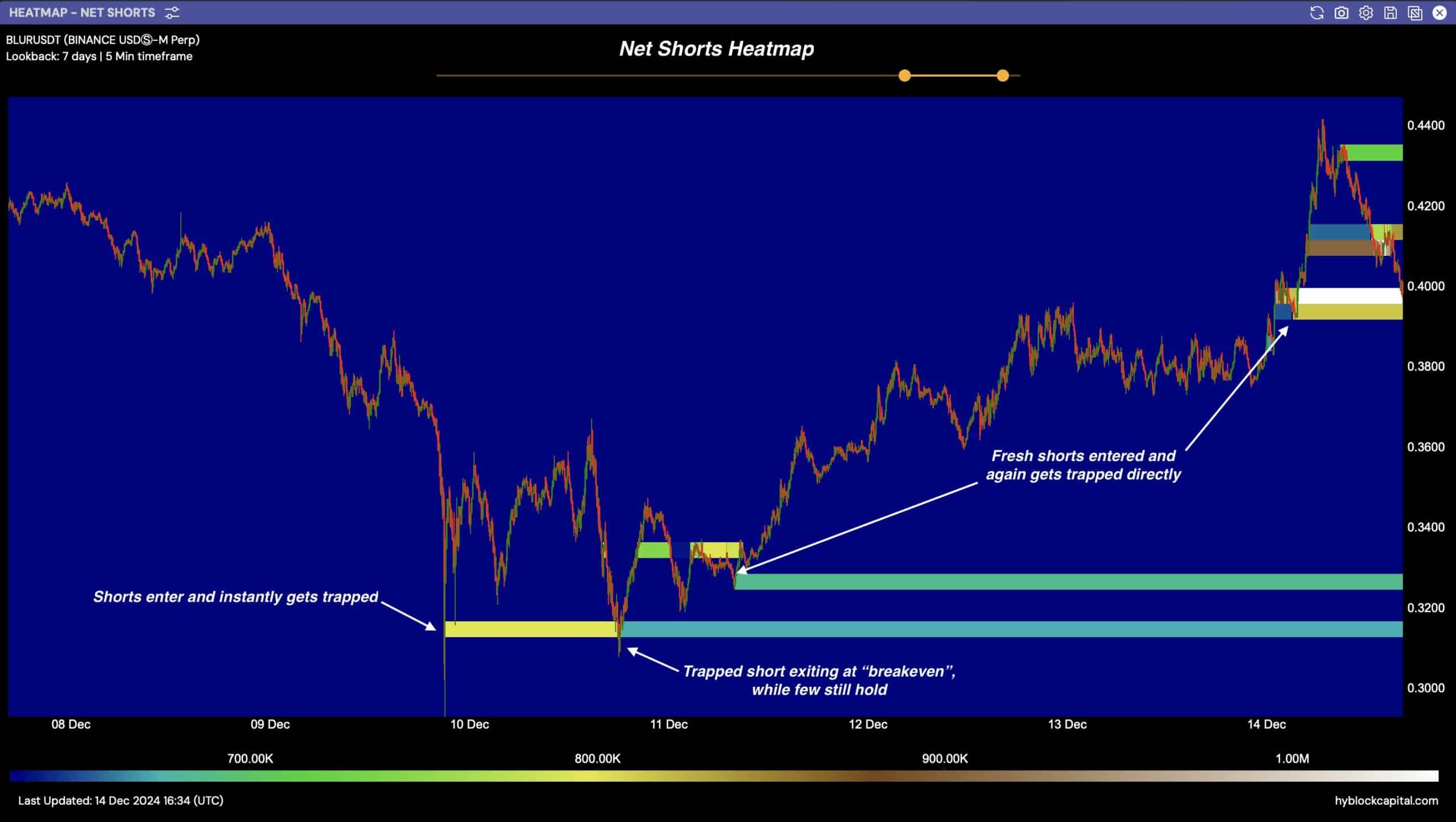

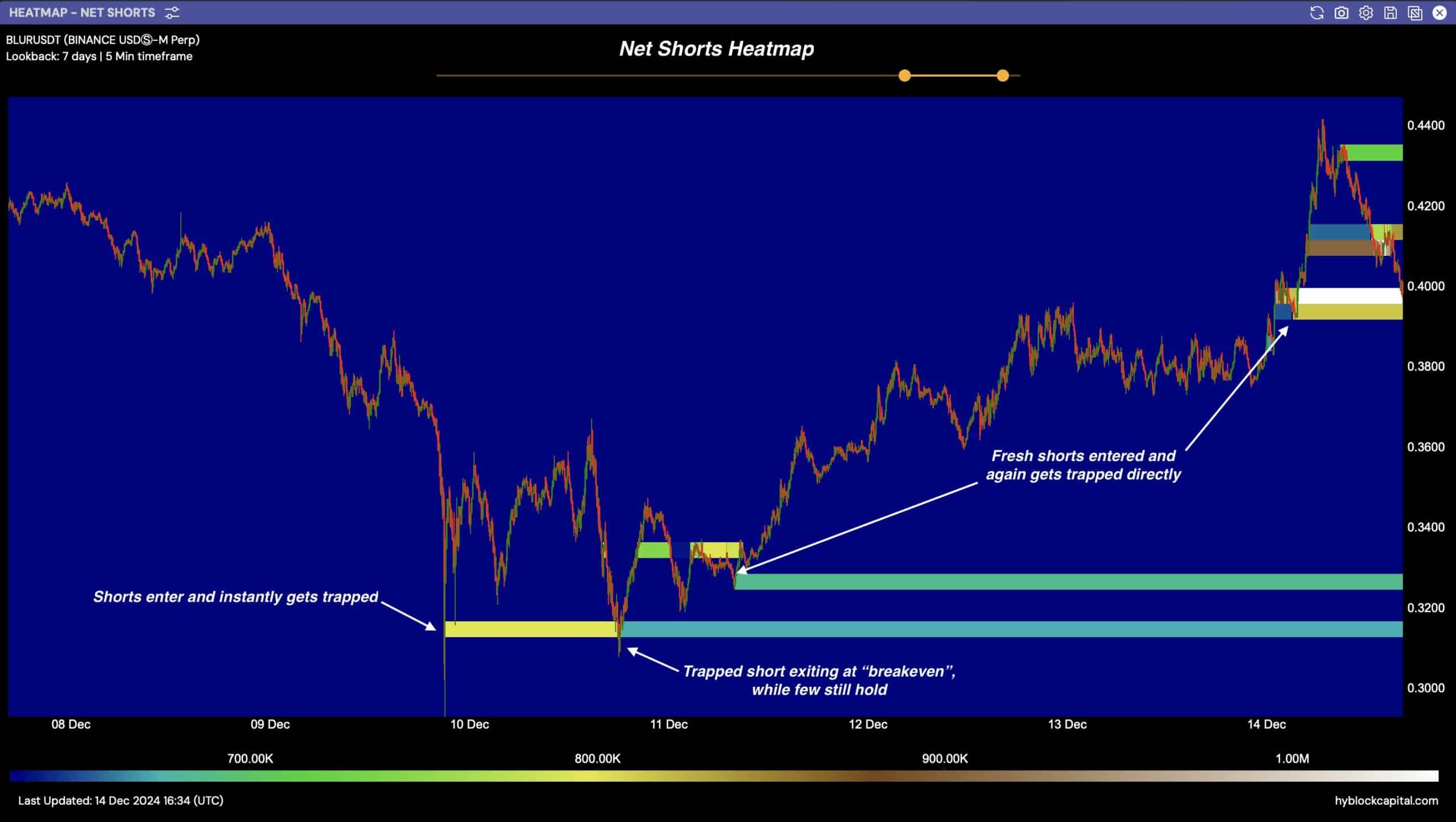

BLUR short sellers are trapped.

Last week, BLUR’s short selling activity resulted in an immediate price spike, and a quick bounce trapped shorts. This highlights the concentration of orders, indicating crowded short-term trading.

Afterwards, new shorts entered the market but were trapped as the price rose sharply, reaching a high near $0.44.

Trapped shorts indicate the volatility and risk of betting on a strong BLUR uptrend.

Source: Hiblock Capital

This activity indicates entry and exit points for short sellers. If the short selling trend continues, it suggests that short selling may continue and the price could rise further due to potential short selling pressure.

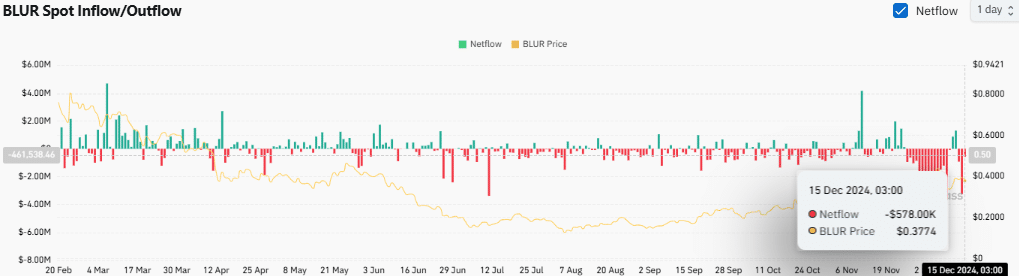

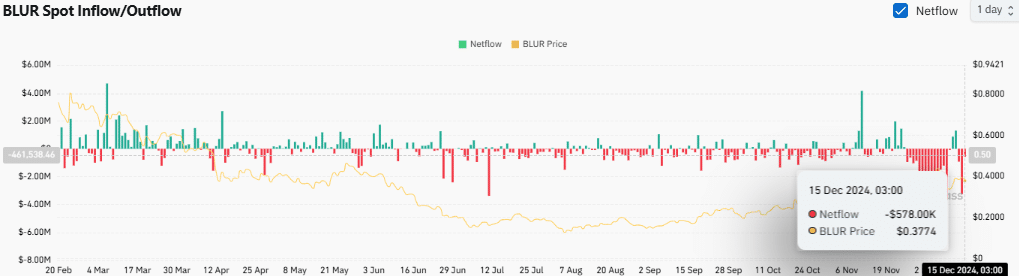

Forecast and spot inflow/outflow

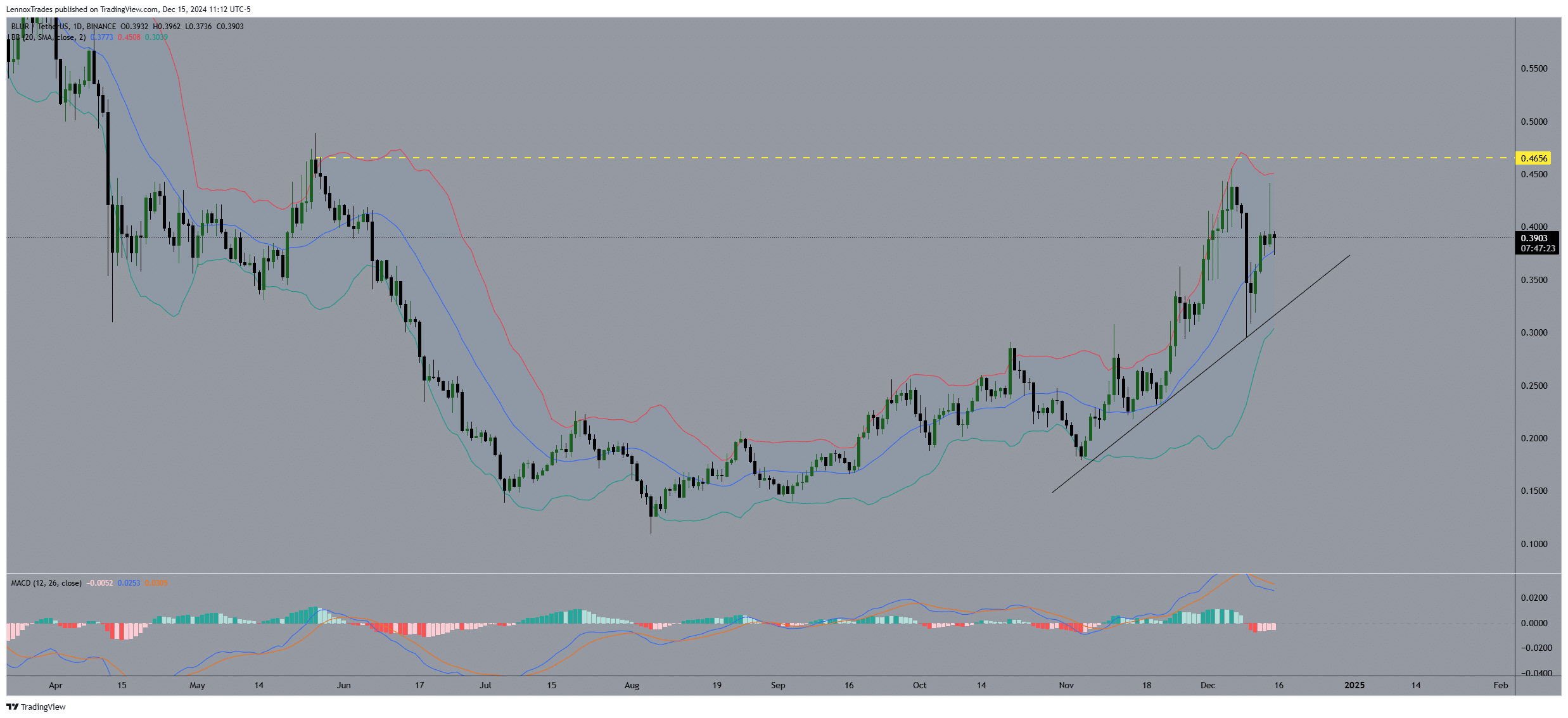

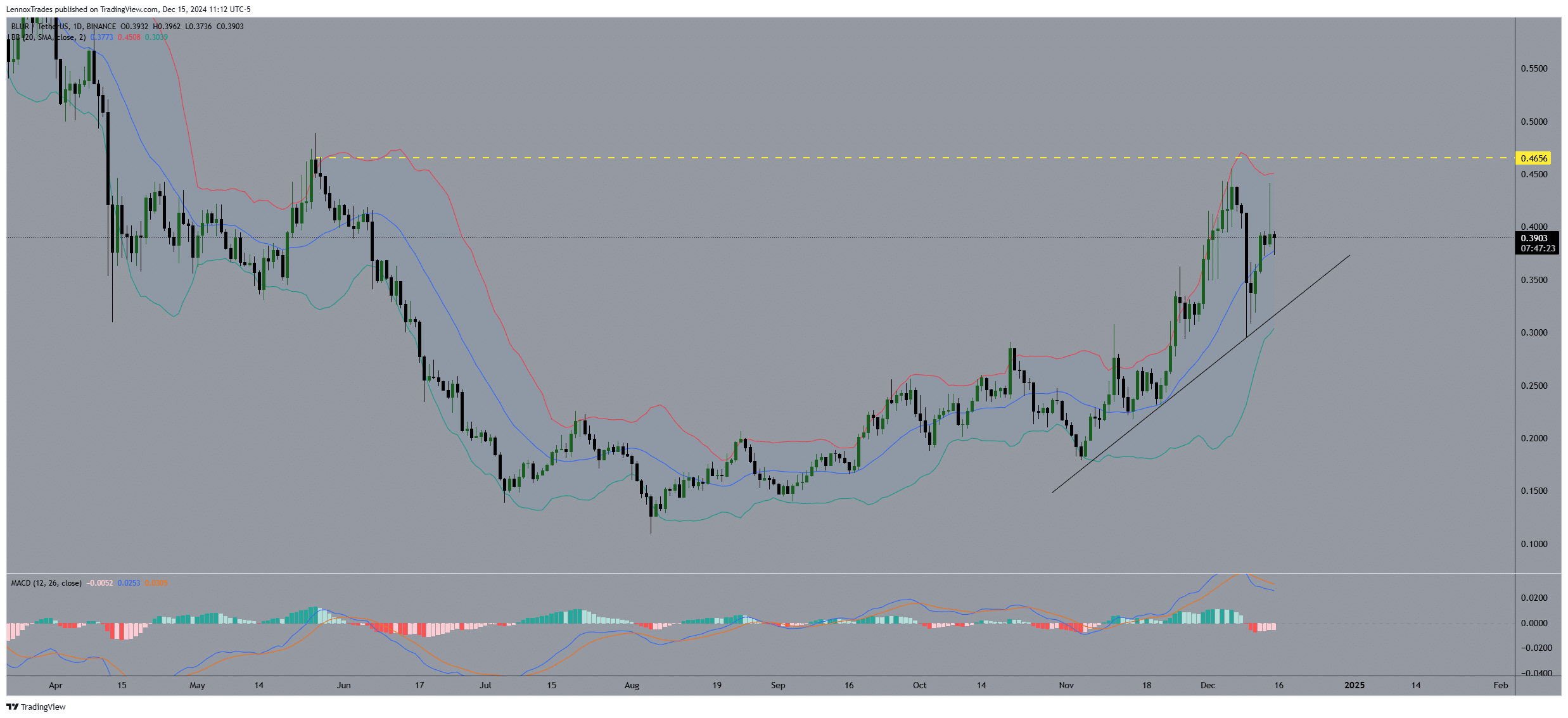

BLUR started at $0.25 per month in response to the ongoing resurgence of the NFT market and quickly rose near $0.45 by mid-December. This potentially attracted more traders.

This shows a sustained bullish trend above both the 50-day SMA and 200-day SMA, suggesting strong upward momentum.

Additionally, the MACD remains positive throughout this period as it is below the price, confirming the bullish sentiment. The sharp rise in MACD strengthened the bullish trend.

Source: Trading View

The rapid outflow of funds exceeding $6 million coincided with a surge in BLUR price, suggesting either high buying interest or withdrawal from the exchange.

Source: Coinglass

Netflow remains relatively stable, followed by rapid outflows, resulting in high year-to-year volatility.

The pattern suggested that inflows and outflows were important. If this trend continues, BLUR may experience further price volatility due to large-scale transfers in and out of exchanges.