- BNB held the $400 price range.

- The RSI showed that BNB is still in a strong downtrend.

Binance Coin (BNB) has recently shown a noticeable downward trend, with its price falling for the sixth consecutive day, mirroring the overall market downtrend.

This prolonged decline has resulted in BNB seeing its highest liquidations ever, indicating a significant level of market anxiety among BNB holders.

Binance Plunges Below Major Markets

The BNB decline began with an initial drop of more than 2% on July 31. With the decline, the price fell to around $576.

This marked the start of a six-day losing streak in which BNB lost more than 26% of its value.

The biggest single-day drop occurred on August 5, when the price fell 6.48% to around $464.

Source: TradingView

This string of losses has caused BNB’s Relative Strength Index (RSI) to drop below 30. However, recent data has shown some recovery, with BNB up over 3% at the time of writing, pushing the price into the $478 range.

Accordingly, the RSI has moved slightly higher, moving just above 30. Despite this minor bounce, the data shows that the bearish trend of BNB is still strong.

Binance Coin Sees Record Liquidations

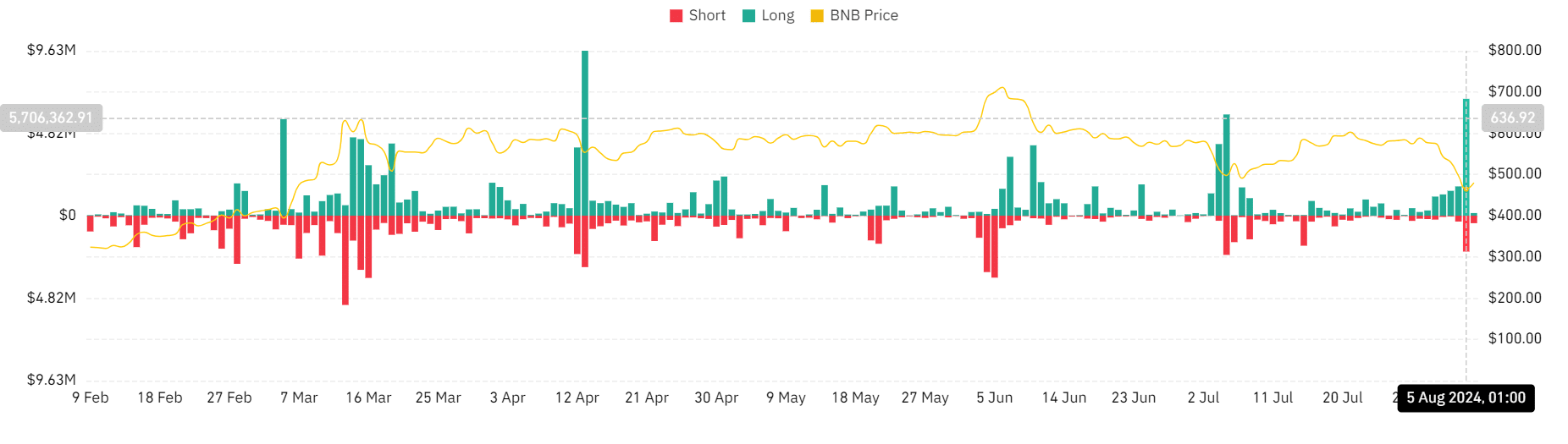

According to data from Coinglass, the recent BNB price drop has led to a significant surge in liquidations among traders. During this period, the total BNB liquidation volume has increased by nearly $9 million.

This marked the highest liquidation volume since April.

Source: Coinglass

A closer look at the data shows that long positions were hit particularly hard, accounting for more than $6.8 million of total liquidations, suggesting that many traders were expecting prices to rise or stabilize.

In contrast, short-term liquidations, which occur when traders bet against the market, amounted to about $2.1 million.

BNB falls into negative sentiment

As of the time of writing, BNB’s funding rate is -0.0170%, clearly showing a predominantly bearish market sentiment.

Read Binance Coin (BNB) Price Prediction 2024-25

This negative funding rate meant that sellers controlled the market dynamics, so the cost of holding a long position exceeded the cost of holding a short position, essentially rewarding traders for holding short positions.

Although the BNB price has recovered slightly recently, the persistently negative funding rate shows that this bounce was not enough to change the overall trader sentiment from bearish to bullish.