- BNB went back to $700 as take profits increased.

- Will it fall due to weak sentiment and muted whale interest?

Binance (BNB) It soared to nearly $800 in December before cooling off.

At press time, the altcoin had fallen to $700, indicating increased profit-taking after hitting an all-time high of $793.

But can altcoins defend $700 ahead of the Federal Reserve’s interest rate decision this week?

BNB Price Prediction: Will $700 Hold?

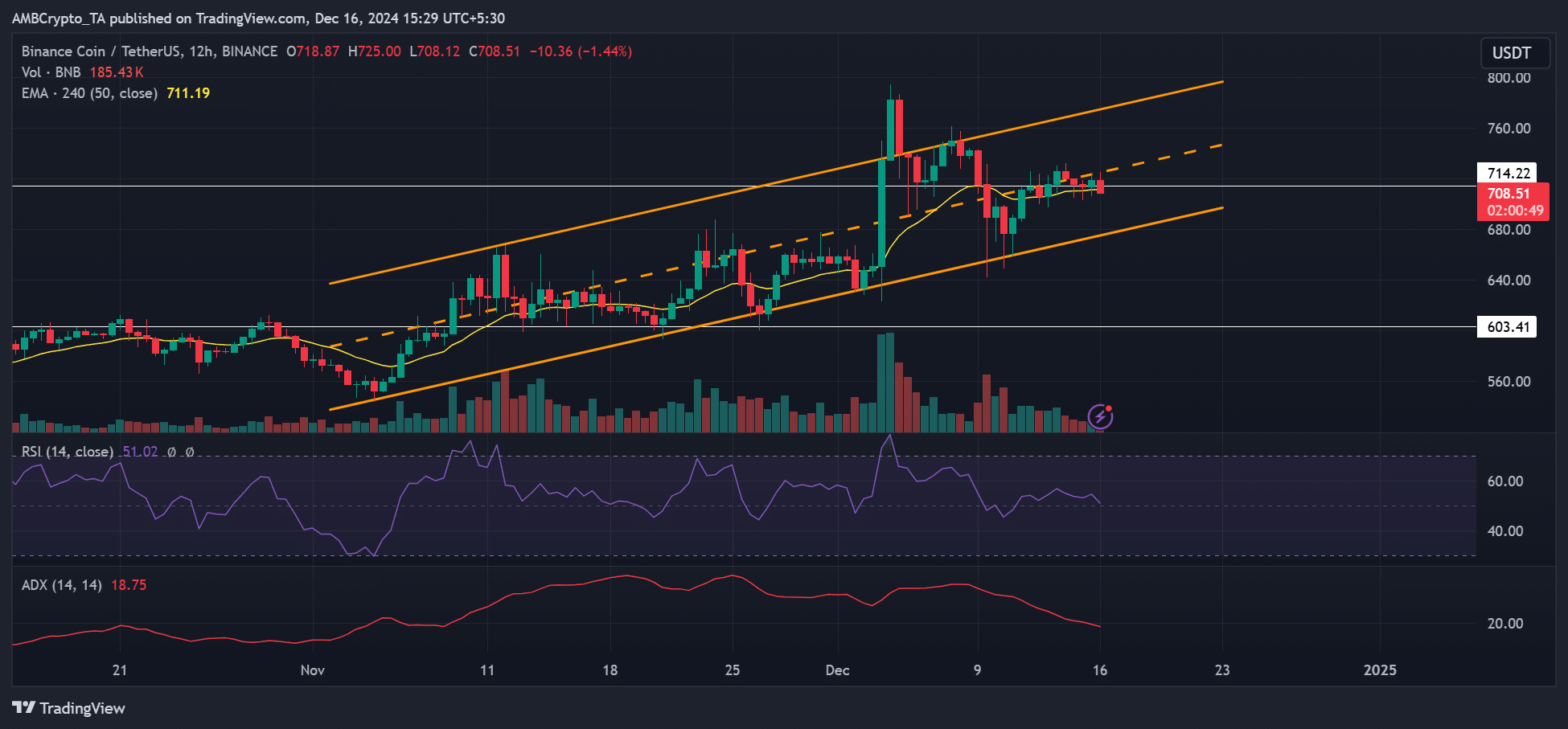

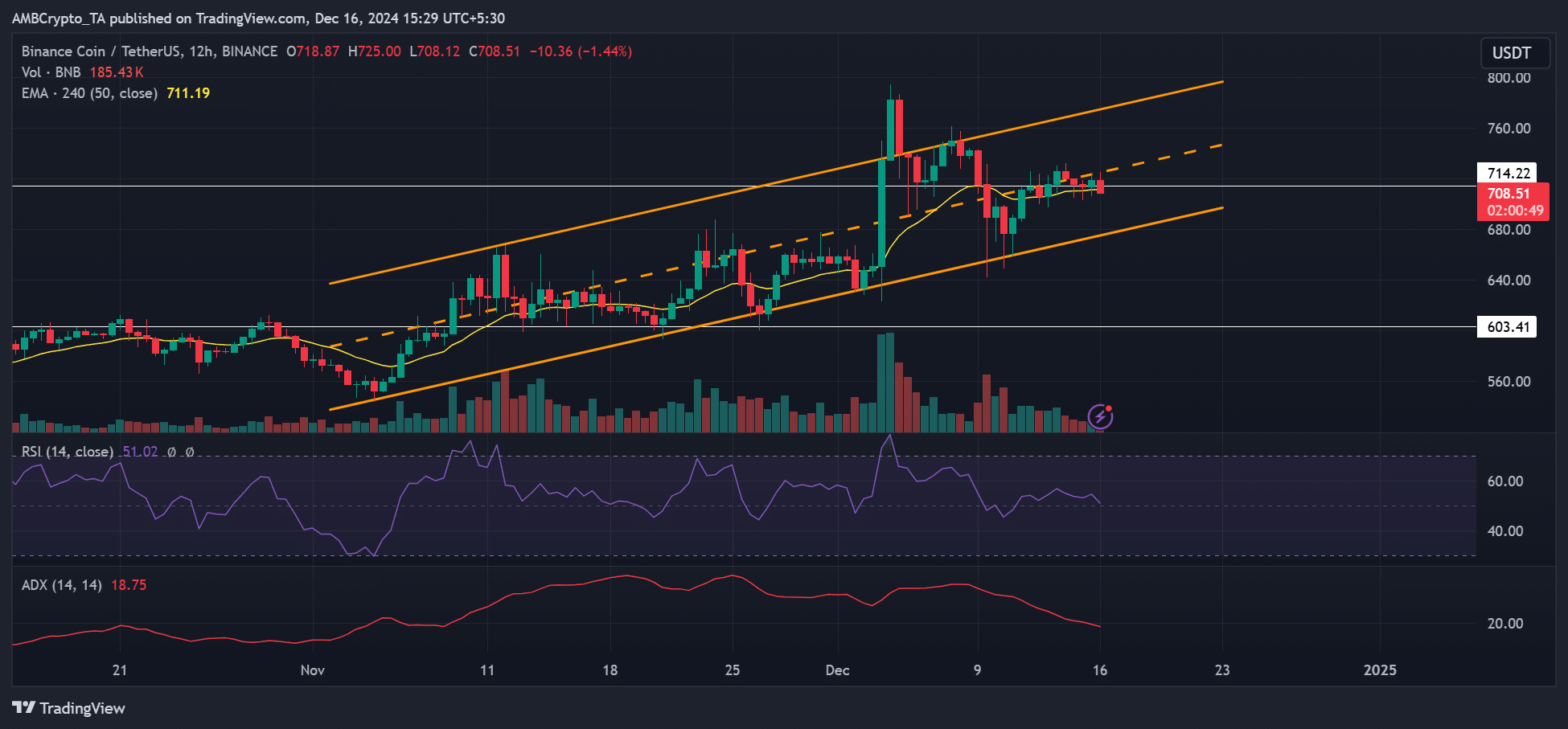

Source: BNB/USDT, TradingView

Since November, BNB’s price action has formed an upward channel. The last two price consolidations near the 4-hour 50EMA (exponential moving average, yellow) have resulted in a decline to the low range of the channel.

Over the past few days, the price of BNB has fluctuated above the moving average and mid-range.

If the moving average breaks as support, a fall below $700 is likely. Demand has also slowed, as evidenced by the tepid readings in RSI.

At press time, price momentum has also weakened, as evidenced by the pullback in the Average Directional Index (ADX), which suggests BNB could fall below $700.

Whales Reduce BNB Exposure

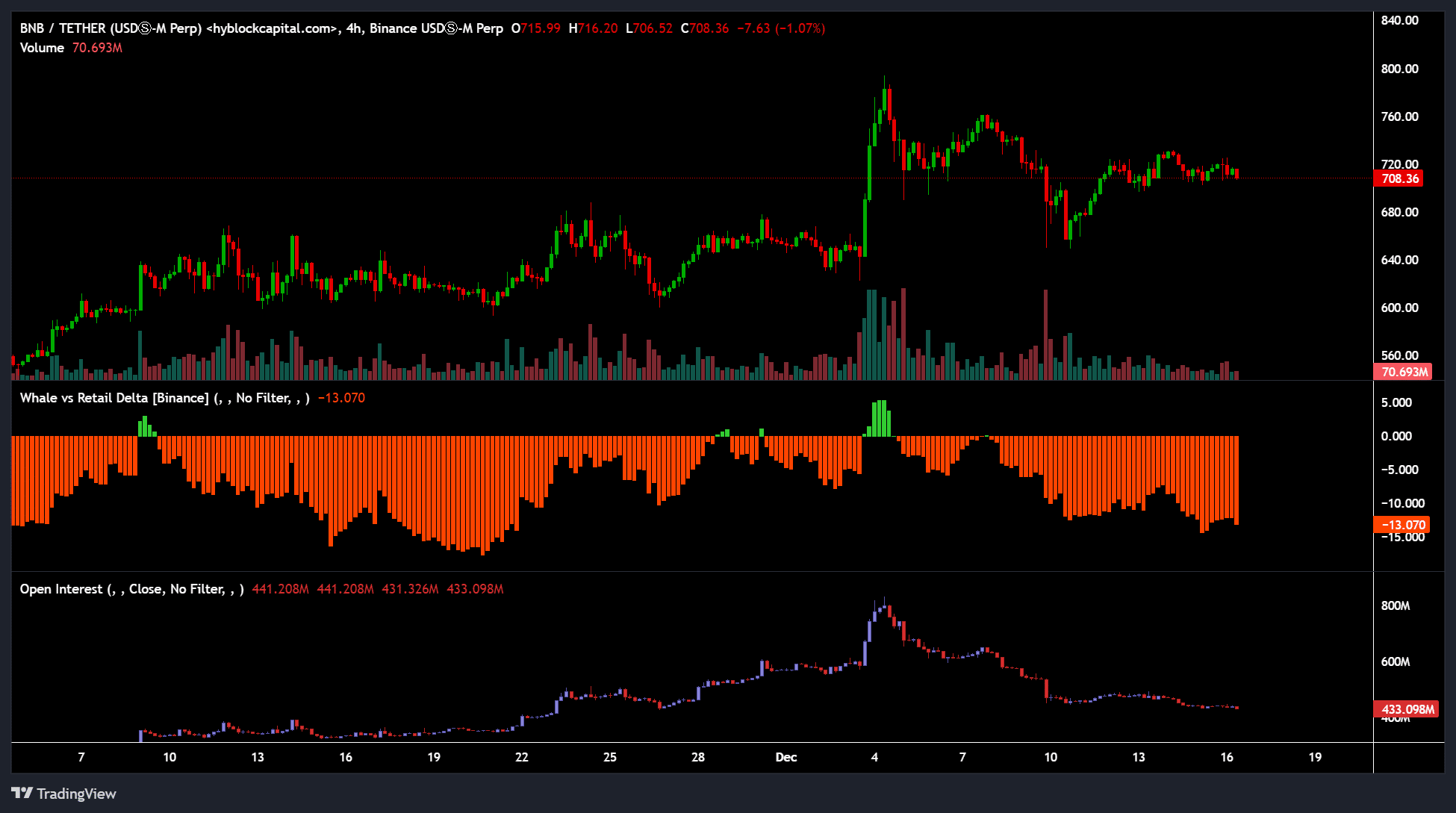

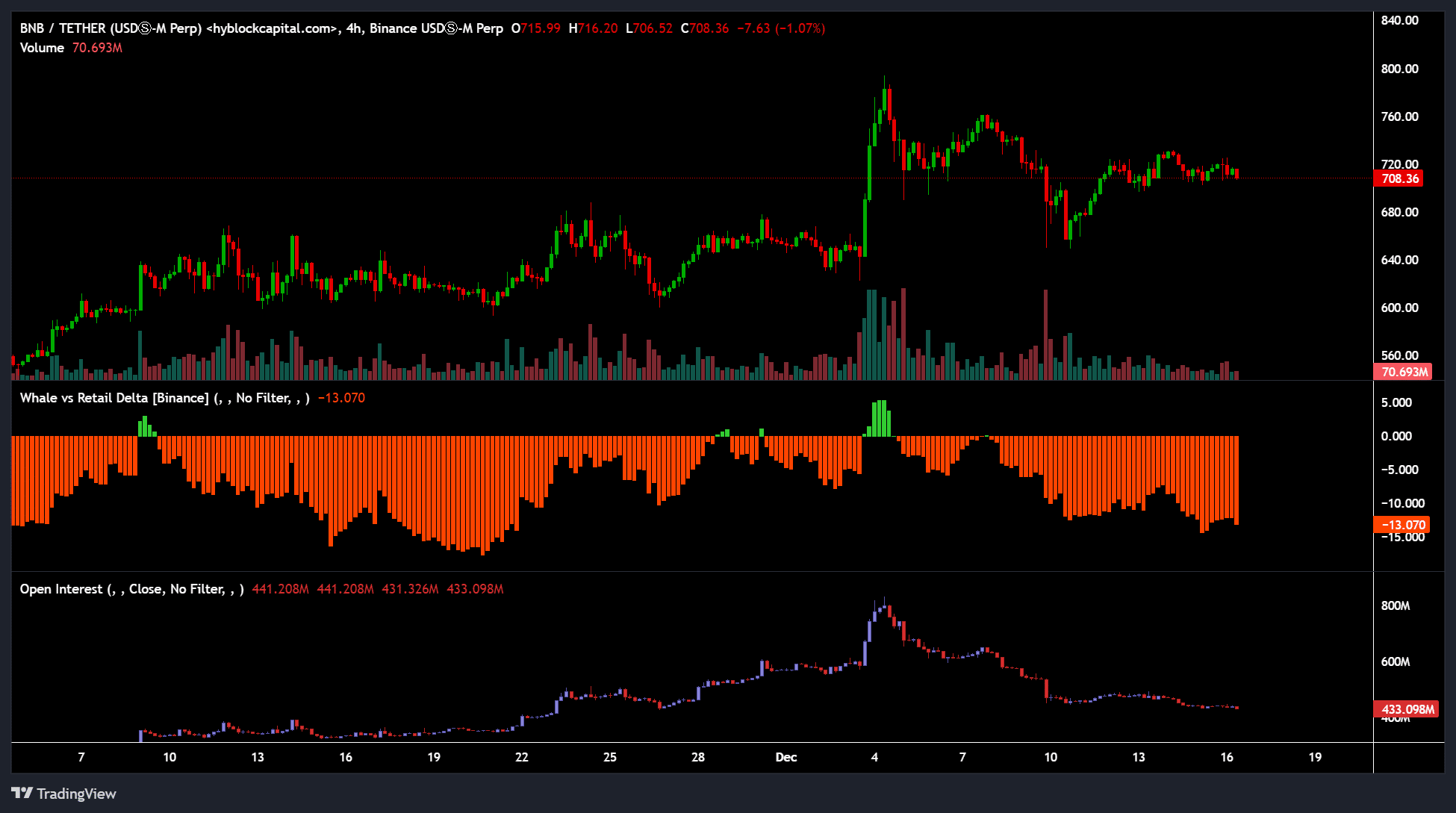

Source: Hiblock

Whales added small positions following the small green bar in the whale-to-sleeve delta during the ATH pump in early December.

However, they have been reducing their positions over the past few days and this has coincided with a retracement towards $700.

Excluding whales, the overall futures market had limited demand, with open interest (OI) down nearly 50% from $800 million to $433 million. This meant a short-term decline.

But could weak sentiment and demand push BNB below $700?

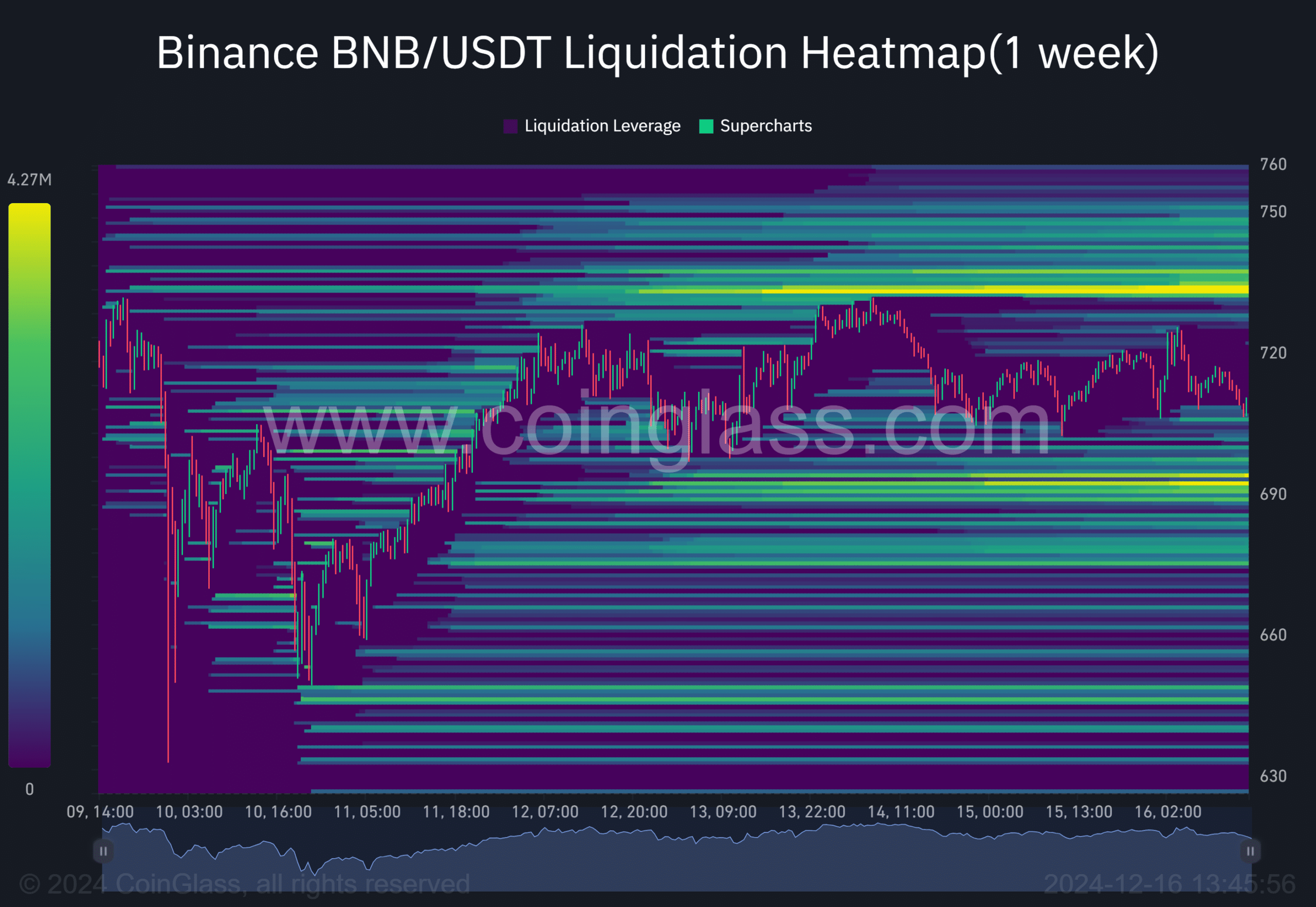

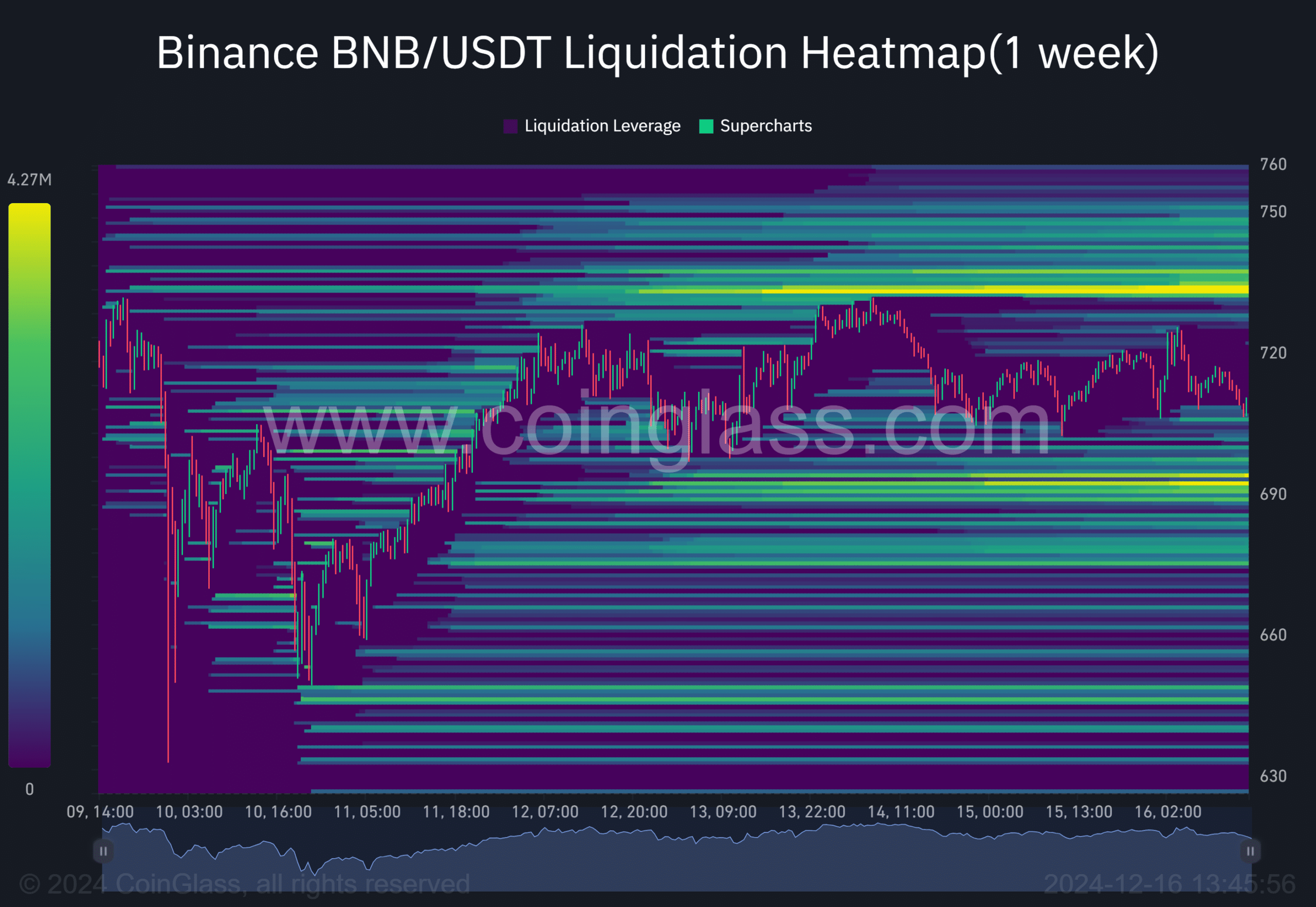

According to Coinglass’ weekly liquidation map, upside liquidity levels (short selling) are located at $734 and $750.

Source: Coinglass

read Binance (BNB) Price Predictionn 2024-2025

Conversely, leveraged buying was concentrated at $690. We can observe upside liquidity at $734 after market makers explored liquidity for leveraged buying, effectively pushing BNB below $700.

In conclusion, lukewarm BNB demand from whales and weak sentiment could lead to a decline below $700. However, if market sentiment improves, liquidity at $734 and $750 could become attractive.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.