- BNB’s $1 billion burn could lead to potential bullish momentum towards $606 resistance.

- Higher trading volume and open interest revealed strong market interest and optimism.

The BNB Foundation recently completed its 29th quarterly burn, removing over 1.77 million BNB (worth approximately $1.07 billion) from circulation. This continuous burn strategy is intended to reduce supply and improve value for holders. In fact, previous burns have often triggered market reactions.

For example, the 28th burn slightly increased the price by 0.5% to $596 and increased trading volume by 22%. I also saw the 27th burn last April. Binance Coin (BNB) It rose 5% after burning 1.94 million BNB worth $1.17 billion.

Therefore, each burn increases the scarcity of BNB, setting the stage for potentially significant market movements.

Can BNB break through major resistance?

At press time, BNB was trading at $584.70 after recording a less than 1% increase in value in 24 hours. On the daily chart, BNB appears to be approaching an important resistance level near $606. This is a point that has been difficult to surpass in the past.

However, the price was forming an ascending triangle pattern, which is generally a bullish indicator.

A break above this $606 level could spark more buying interest and lead to a new uptrend. Conversely, if resistance remains firm, Binance Coin may register a downtrend and test the lower support level in the $560 range. So this level is the main battlefield for tokens.

Source: TradingView

A sign of market interest?

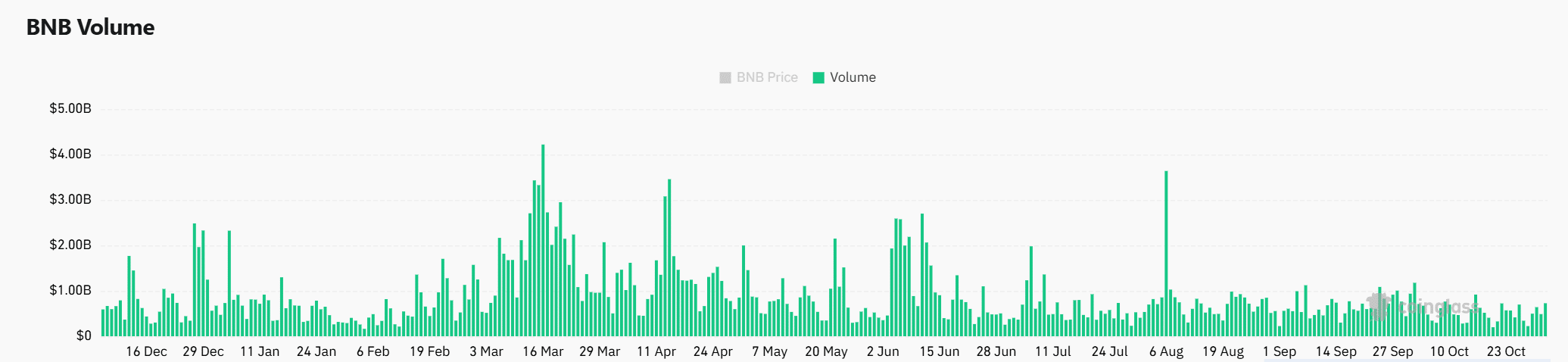

In addition to the burn, trading activity also surged.

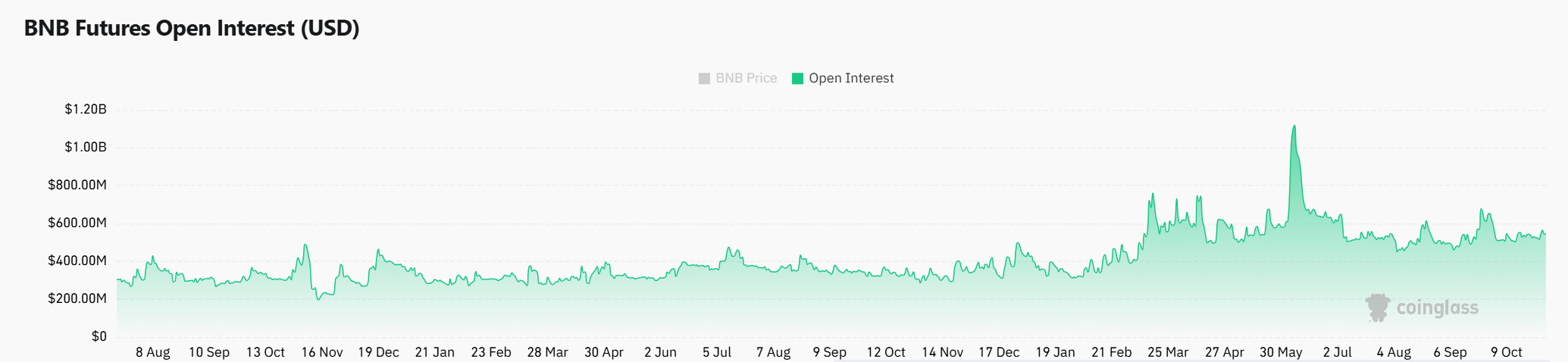

Derivatives trading volume increased 21.97% to $697.49 million, and open interest trading volume increased 2.3% to $543.6 million. A surge in volume and open interest signals growing interest as traders prepare for a decisive move.

Source: Coinglass

Higher trading volume often means more market activity, and a simultaneous increase in open interest usually indicates strong confidence among traders.

Therefore, this heightened activity could suggest an imminent breakout. Whether it goes up or down will depend on BNB’s ability to hit the $606 level.

Source: Coinglass

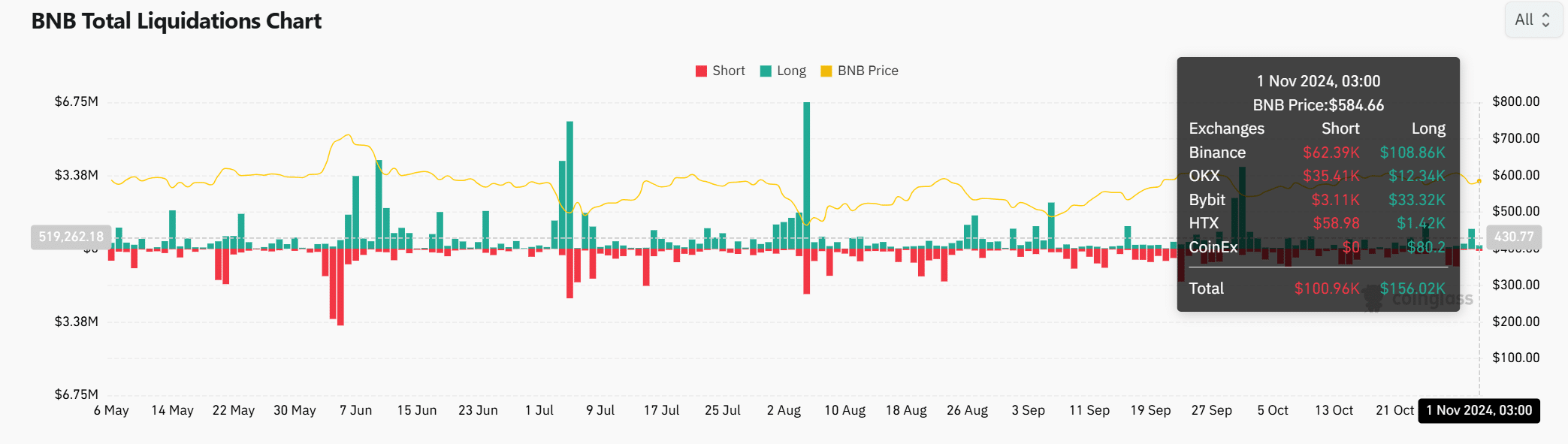

BNB Liquidation – Short Selling Warning?

Lastly, according to the latest dataset, long liquidations are at $156.02,000 while shorts are at $100.96,000, suggesting a slightly optimistic mood.

As Binance Coin inches closer to resistance, short positions are decreasing, indicating caution among bears. A breakout of BNB could result in more short-term liquidations, potentially fueling further upside.

Source: Coinglass

read Binance Coin (BNB) Price Prediction 2024~2025

Will this burn be a catalyst for BNB demand?

With Binance Coin nearing significant resistance and increasing trading volume, the 29th burn could be a turning point. The previous burn sparked bullish momentum and a break above $606 could open the door for a new rally.

However, failure to clear this level could result in consolidation or a slight decline.