- The price of BNB is currently trending within a descending triangle.

- Demand for altcoins must increase to break the upper line of this triangle.

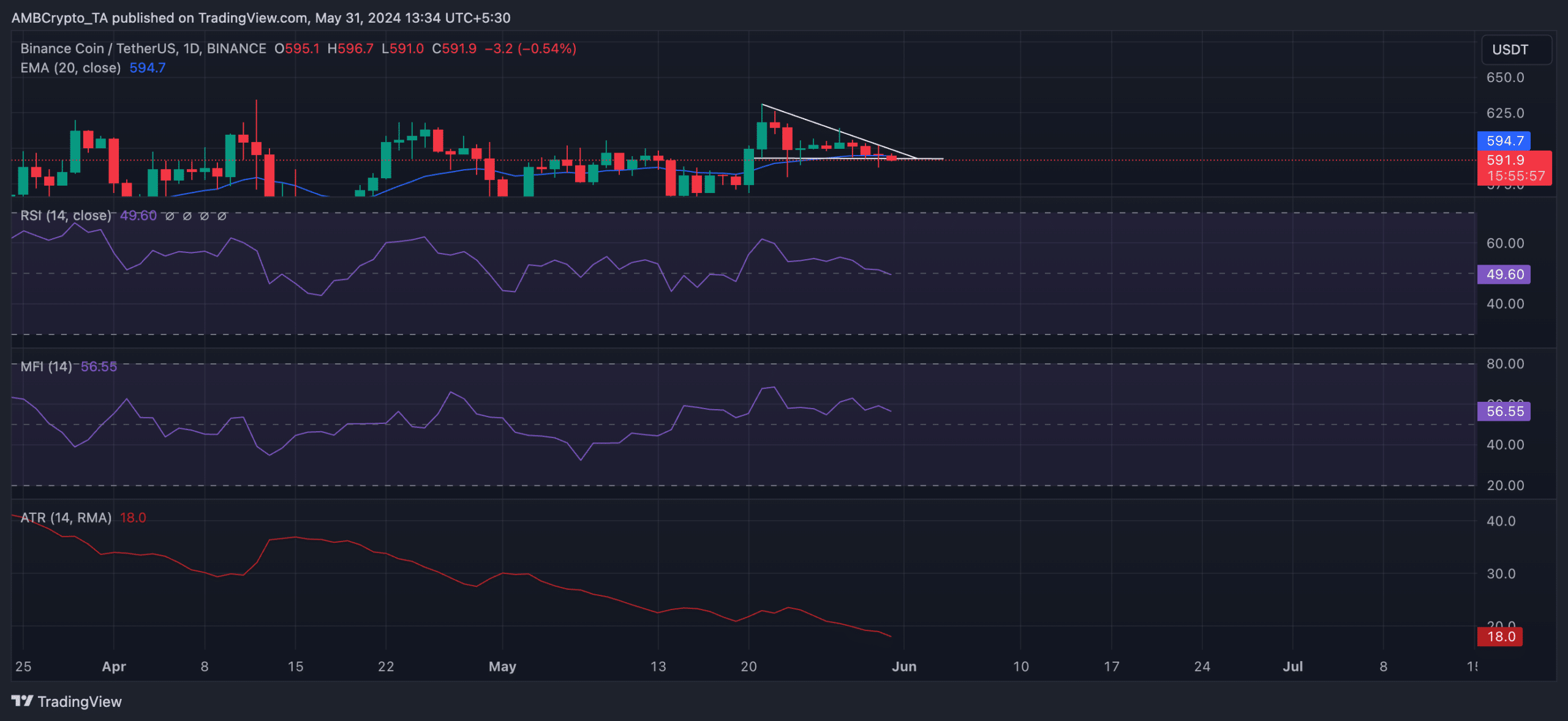

Binance Coin (BNB) has been trending downward since the price peaked at $612 on May 27 and formed a descending triangle. At the time of writing, the altcoin is trading at $593.11, recording a 3% price decline over the past three days.

BNB at the intersection

At the current price, Binance Coin is trading slightly below the bottom line of the descending triangle that forms support.

For a move towards the top of this triangle (resistance) to be realized, buying pressure would need to surge.

Looking at the key momentum indicators for BNB in the current market, it appears that neither buyers nor sellers are applying enough pressure to drive the trend in their direction.

BNB’s relative strength index (RSI) was 49.50 and its money flow index (MFI) was 56.60. A comprehensive reading of the values of these indicators shows that price movements are balanced between profits and losses, with neither the downtrend nor the uptrend having a clear dominance.

This consolidation is confirmed by BNB’s Average True Range (ATR), which has lost 23% in value since May 23rd.

This indicator measures market volatility by calculating the average range between the highest and lowest prices over a specified period.

Source: BNB/USDT, TradingView

A decline in this way means that asset price volatility is decreasing and the market is entering a consolidation phase.

BNB bulls have a chance

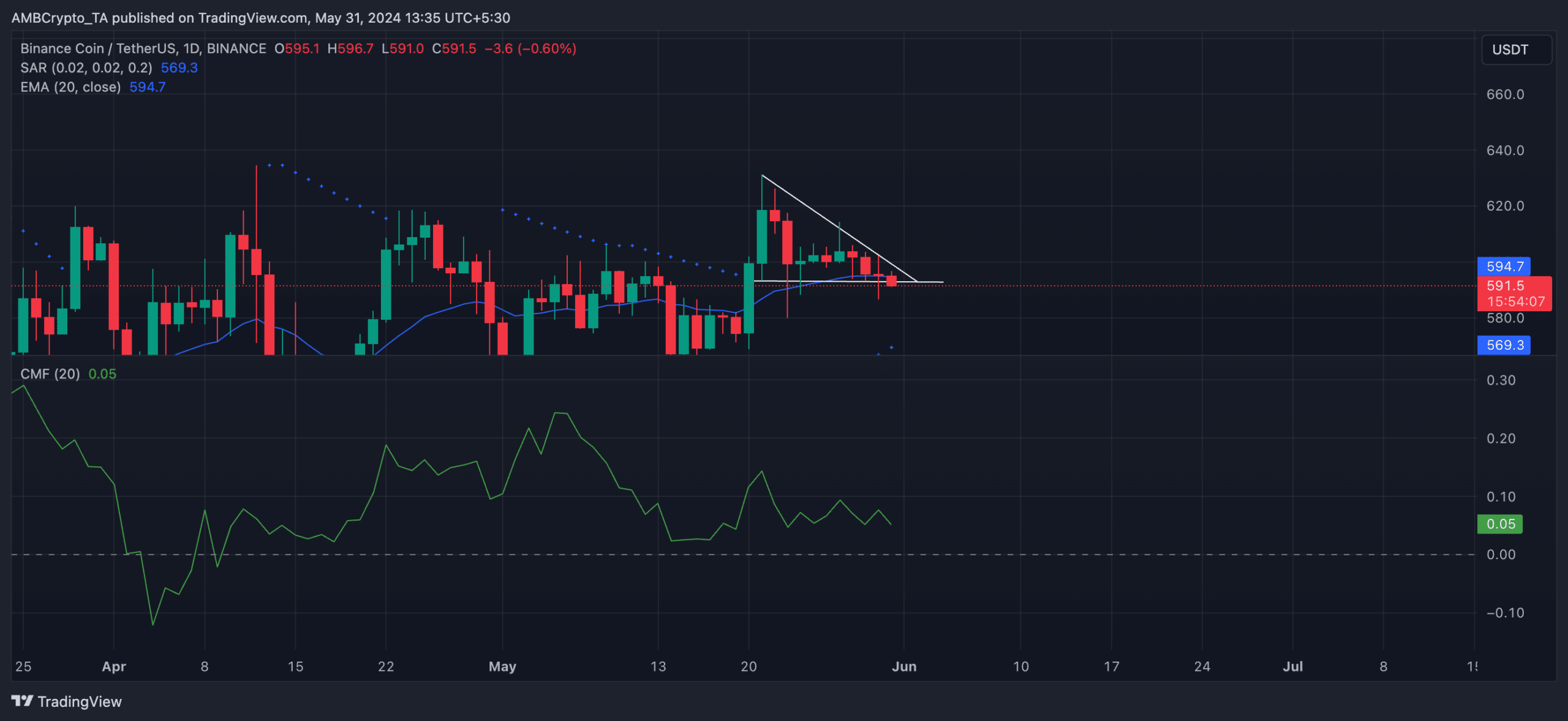

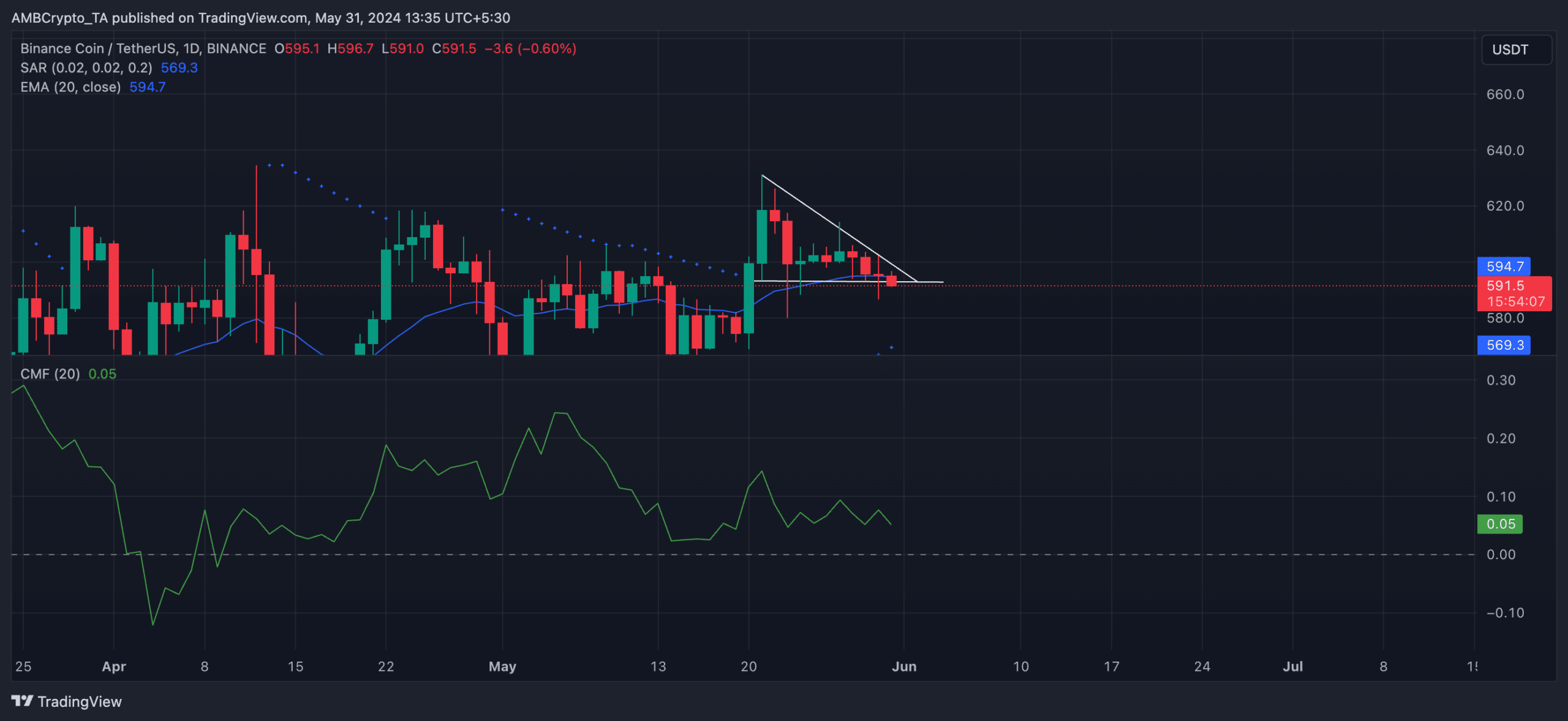

Although there appears to be a balance between supply and demand in the BNB market, AMBCrypto’s assessment reveals several indicators confirming a bullish bias towards altcoins.

For example, BNB’s Chaikin Money Flow (CMF) was above the zero line at press time. This indicator measures how money flows in and out of the BNB market. At 0.05, BNB’s CMF suggests there is still demand for the altcoin.

BNB’s Parabolic SAR readings confirmed this trend. At the time of writing, the points that make up this indicator are below the BNB price, suggesting a possible near-term price surge.

Read Binance (BNB) Price Prediction for 2023-2024

Lastly, BNB is trading slightly above its 20-day exponential moving average at its current price. This means that the current price is, by some margin, higher than the average price over the last 20 days.

Source: BNB/USDT, TradingView

This bullish signal suggests that traders may be slowly accumulating altcoins.