- Traditional finance is preparing to change as the US government turns into a professional crypto policy.

- Bank of America CEO proposed potential stability if there is legal clarity.

Over the past year, the adoption of encryption throughout the state, government and traditional finance has soared. Together with the US professional crypto government, various traditional financial companies are preparing to participate in the encryption race.

The latest company that announces this movement is Bank of America, and the CEO has announced plans to launch Stablecoin.

Bank of America will release Stablecoin

According to the Bank of America CEO Brian Moynihan, banks are preparing to start stability if there is a provision that allows this.

Moynihan said he was interested in joining the rapidly growing encryption space during his speech at the Washington Economic Club. But he mentioned that the company is waiting for legal and regulatory clarity.

He mentioned it

“If it is legal, it will be a stable state.”

Moynihan also mentioned that the $ 1 Starble Lixin, issued by a bank, will have a variety of uses and applications for daily activities.

The bank aims to use the same framework as used when you first started the mobile banking app, which has succeeded in more than 40 million users.

But Moynihan mentioned that the exact role that Stablecoin can pay is still unclear. This means that the bank has not yet decided how to use Stablecoin in existing financial settings.

Despite this lack of clarity, the announcement with more than $ 3.3 trillion in assets of Bank of America is an important development in the encryption industry. If a bank adopts Stablecoins, other banks can follow, leading to the bank revolution.

This revolution can also create more space for adoption and growth.

Professional encryption policy and stablecoins regulations

As Moynihan revealed his plans for the entrance of the bank, the ball was entirely left to lawmakers. Legal clarity is required for banks to enter the space.

The US Congress considered various bills, including genius law and stable law. This regulation will establish encryption assets to the same dollar, such as USDT and USDC.

But the bill is approved and there is still a long way to go before the president signs.

The meaning of the encryption market

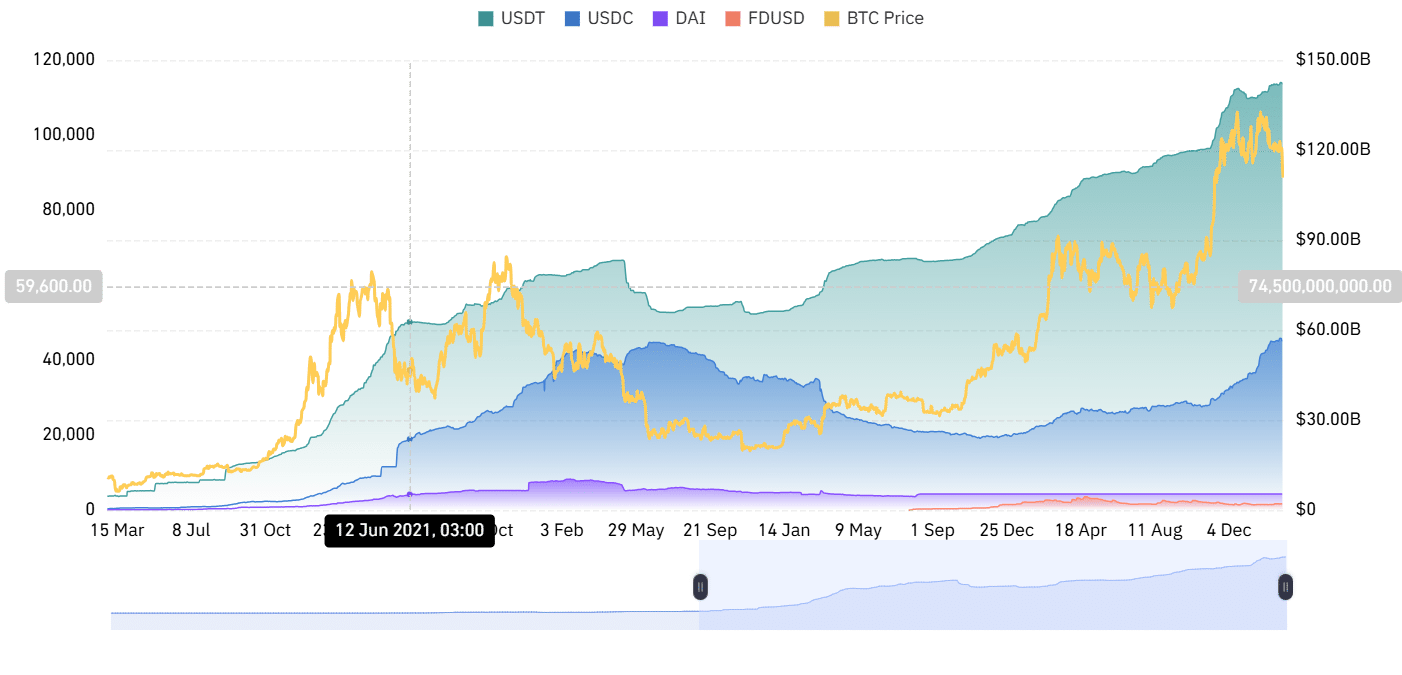

Source: COINGLASS

Bank of America’s possible admission will have a big impact on the encryption market. First, the STABLECOIN market, which has experienced steady growth over the past few years, will increase to $ 237 billion.

This growth has reached a market cap of $ 142.1 billion, with a USDT, and USDC reaches $ 52.9 billion.

As the market cap of Stablecoin increases, the entrance of another big player will further improve market growth.

And this growth will also lead to wider growth in the cryptocurrency market because SMATABLECOINS has become the center of encryption transactions.