- BONK’s open interest hit its lowest level last month.

- Key technical indicators suggest a possible further decline in the value of BONK.

BONK, the dog-themed Solana-based meme coin, lost 29% in value last week as futures open interest fell to a 30-day low.

According to data from CoinMarketCap, BONK was trading at $0.0000233 at press time, making it the cryptocurrency asset with the most losses over the past seven days.

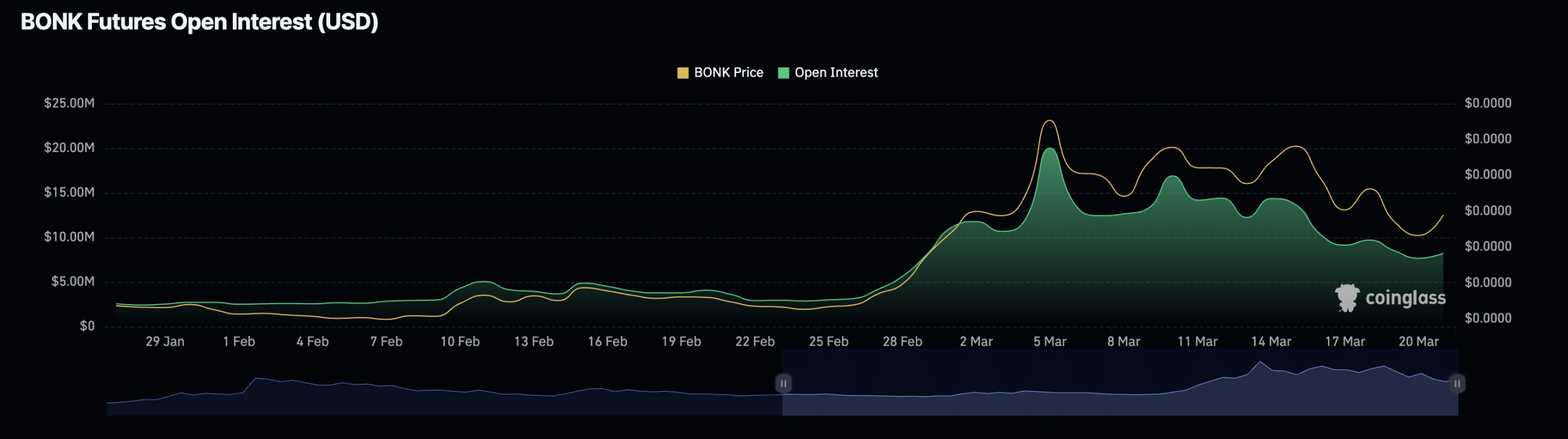

The decline in altcoin prices is due to the fact that futures open interest fell to the lowest level in a month. According to data from Coinglass, BONK’s open interest began falling on March 5 and has fallen 60% since then.

Source: Coinglass

A decrease in open interest for an asset indicates a decrease in trader interest or participation in the derivatives market for that asset. This is often the result of changes in investor sentiment and attempts to increase profit taking or reduce losses.

More trouble awaits BONK

Over the past week, the value of major meme assets has fallen as the hype around them has begun to die down. For BONK, the weighted sentiment turned negative on March 16 and has since recorded a value below zero.

Negatively weighted sentiment indicates a prevailing bearish outlook among market participants and often results in further declines in asset values.

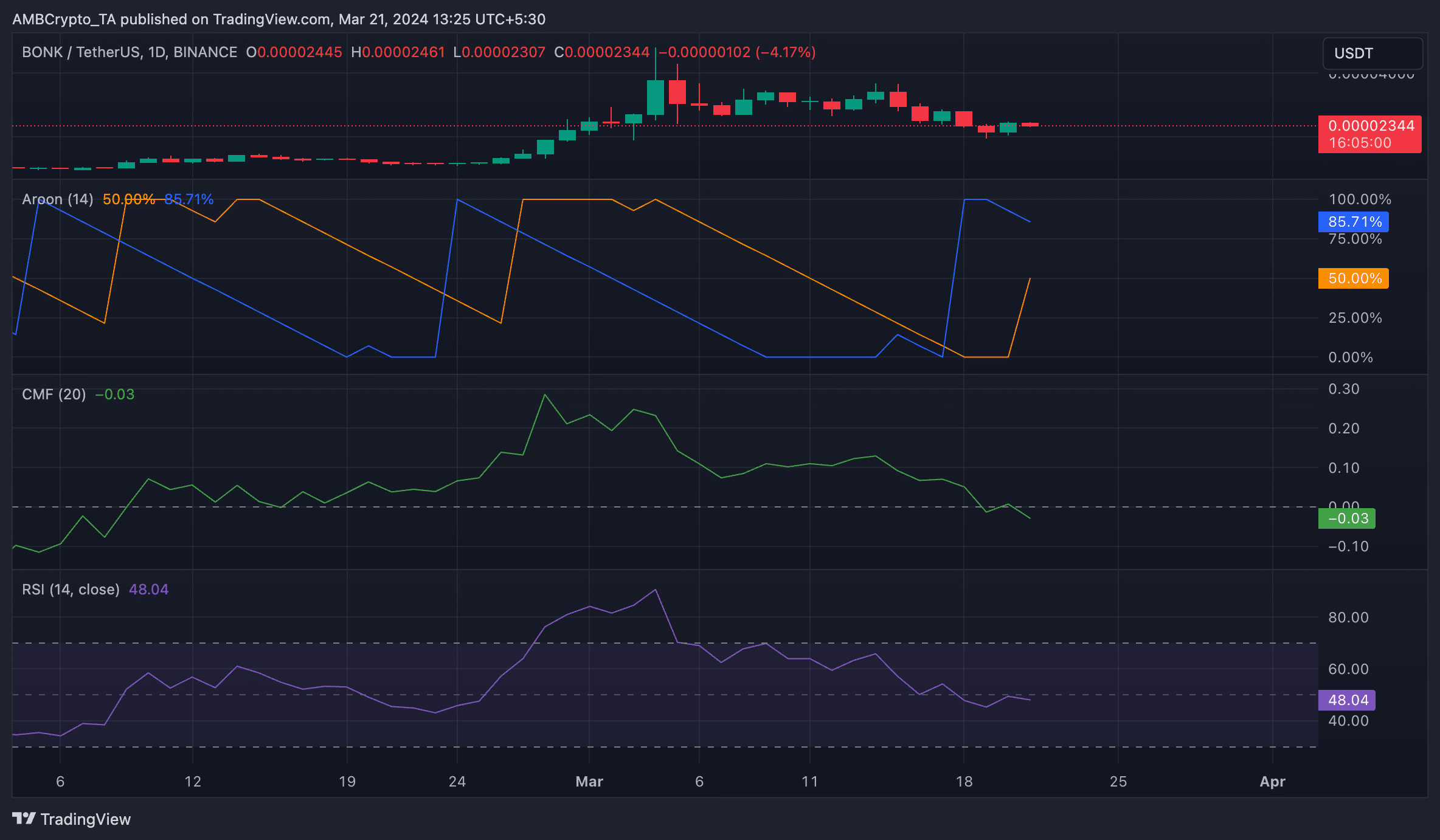

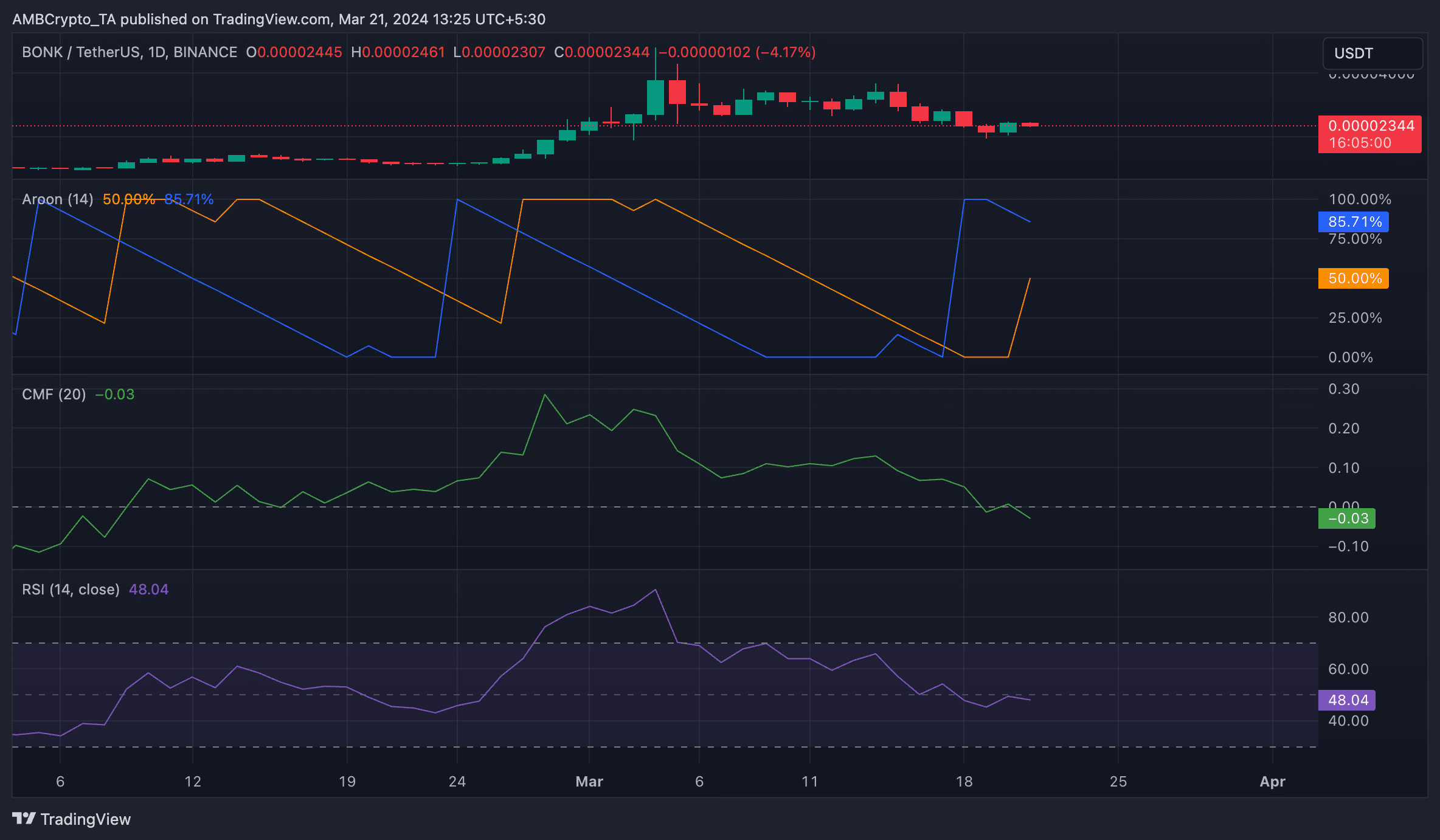

AMBCrypto assessed the price performance of BONK and the key technical indicators assessed confirmed the presence of a bearish sentiment. For example, Mimcoin’s Arun downline (blue) observed on the 24-hour chart was 85.71%.

This indicator is used to identify trend strength and potential trend reversal points in the price movements of crypto assets. The closer the Arun down line is to 100, the stronger the market’s downward trend and the more recent lows were reached.

Is your portfolio green? Check out our Bonk Profit Calculator

Additionally, BONK’s Chaikin Money Flow (CMF) was -0.03 at the time of reporting. A CMF value below 0 is a sign of a weak market. This means a reduction in liquidity inflows, which often leads to a continued decline in asset values.

Additionally, BONK’s Relative Strength Index (RSI) showed decreased demand for meme coins among spot market participants. At the time of writing, BONK’s RSI is 48.04, indicating that investors preferred selling their holdings rather than buying more.

Source: TradingView