- BONK is up 52% at press time since its April 19 low.

- The rebound may have been driven almost entirely by the futures market.

BONK showed an upward trend on lower time frames and its momentum was strong once again. A recent AMBCrypto report highlighted how the social sentiment behind memecoin has improved.

Trading volume also surged in the aftermath of the Bitcoin (BTC) halving. While this seemed like a positive development, there were still problematic elements that traders and investors should be wary of.

BONK’s internal structure maintained a bearish bias.

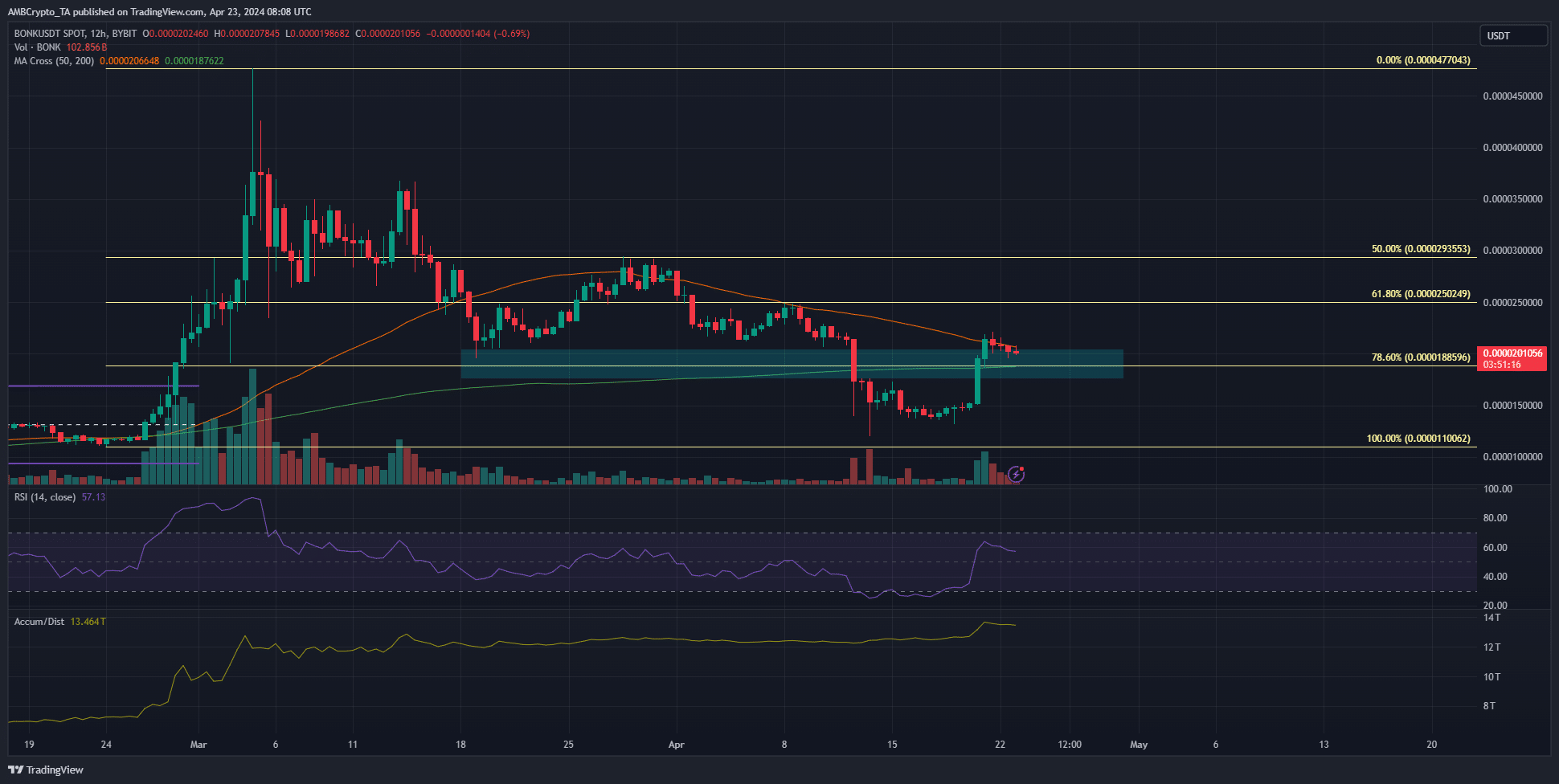

Source: BONK/USDT on TradingView

Higher term structures have remained bullish for BONK since the rally in late February. In recent weeks, BONK’s internal structure has remained weak even after the recent bounce brought the price back above the 78.6% retracement level of $0.00001885.

The simple moving average should act as support for memecoin with the demand area highlighted in turquoise. H12 RSI has moved back above the neutral 50 level to highlight the bullish momentum.

Similarly, accumulation/distribution indicators also favored buyers. It has been rising slowly over the past week. A move above the lower time frame swing high of $0.000025 would encourage bulls to shift their short-term bias to bullish once again.

Declining public interest pointed to a discouraging idea.

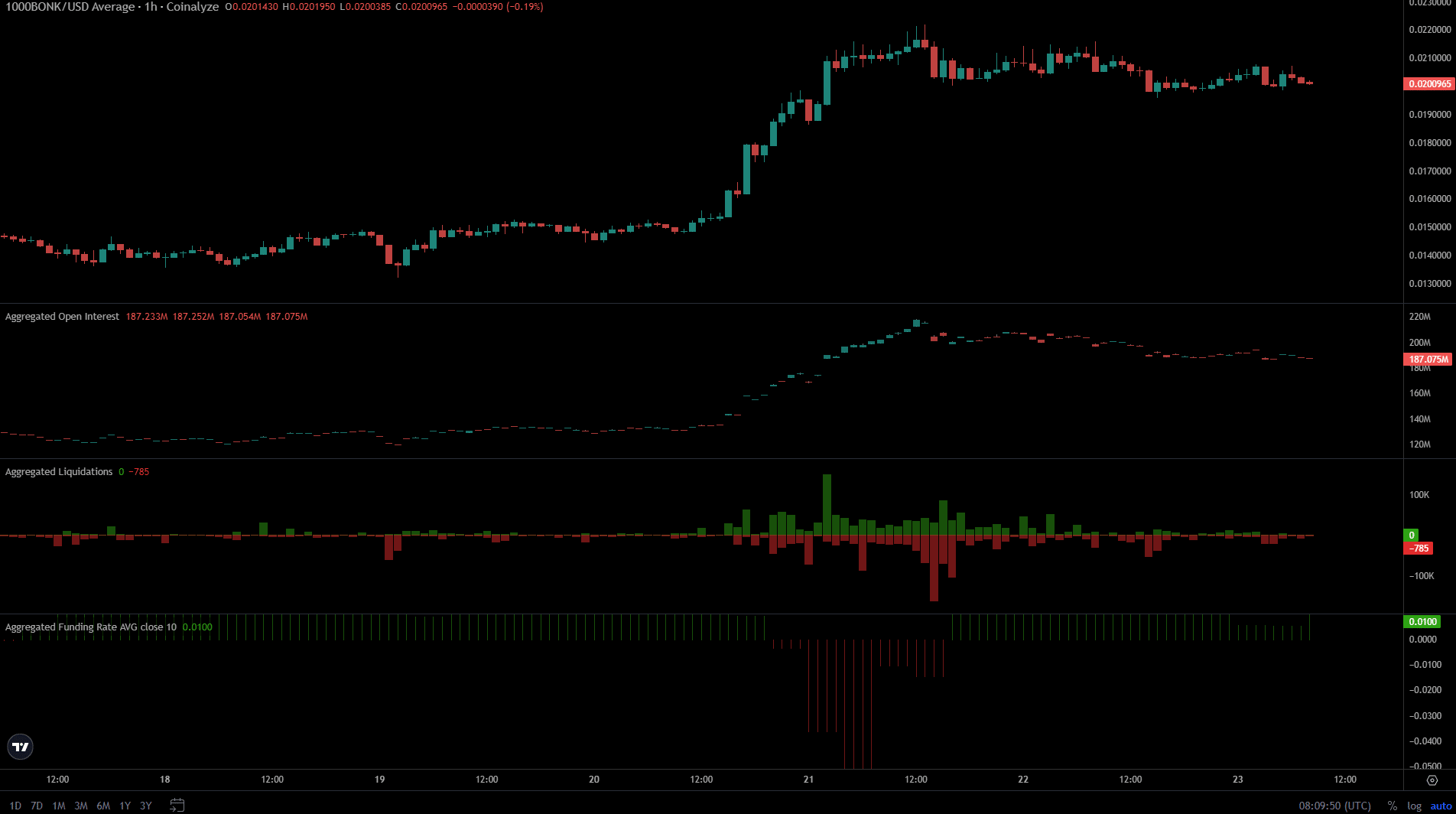

Source: Coin Analysis

BONK’s funding ratio fell deep into the red zone on April 21, but has been recovering since then. This means that although participants have not been bearish, open interest has still been weak over the past two days.

The inference was that speculators were operating on the sidelines and there was a lack of bullish confidence.

Realistic or not, the market capitalization of BONK in BTC terms is as follows:

Additionally, short positions liquidated during the rebound were noticeably high. Taken together, OI and clearing suggest that the recent price rebound is likely driven by futures markets rather than spot demand.

Therefore, a bullish recovery may be more difficult in the future.

Disclaimer: The information presented does not constitute financial, investment, trading or any other type of advice and is solely the opinion of the author.