- BONK forms a major technology pattern on the chart and suggests strength.

- Purchasing activities and strong feelings in the derivatives market contribute to Bonk’s potential.

Bonk (BONK) remains one of the most impressive tokens in the market over the past month. Last week alone, assets increased 44.63%, and there were 21.22%movements per month.

This movement suggests that as market sentiment changes to buyers, interest in notes is increasing and additional market profits.

Optimistic patterns can be added to the rally.

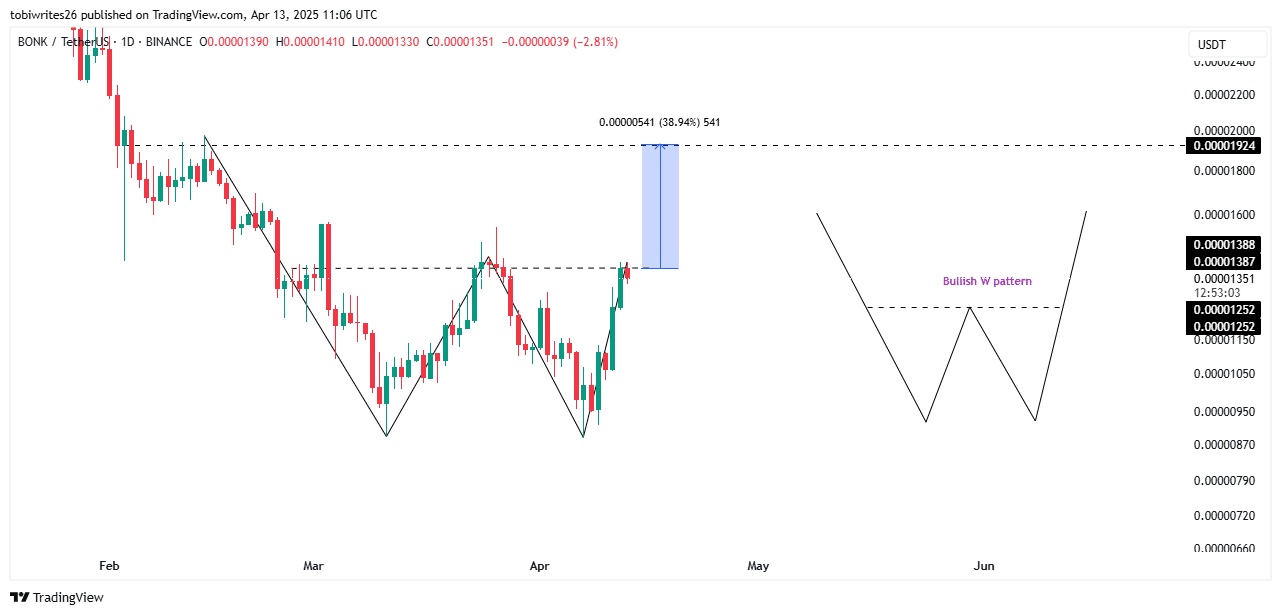

BONK has formed a strong pattern known as a “W” pattern and is known to serve as a catalyst for assets after a rest of the structure.

The interruption of this structure occurs when the asset begins in violation of the resistance line. In the case of bonk, the extended dotted line displays the level that must be violated.

Source: TradingView

If this violation occurs, the BONK can take a leap forward, accounting for about 38%on the chart and rising to $ 0.00001924.

This price goal suggests that there is a difference in fair value, which is the level of liquidity known in the chart, and the price can be recorded by trading the price to that point.

Market indicators and demands add to strong feelings.

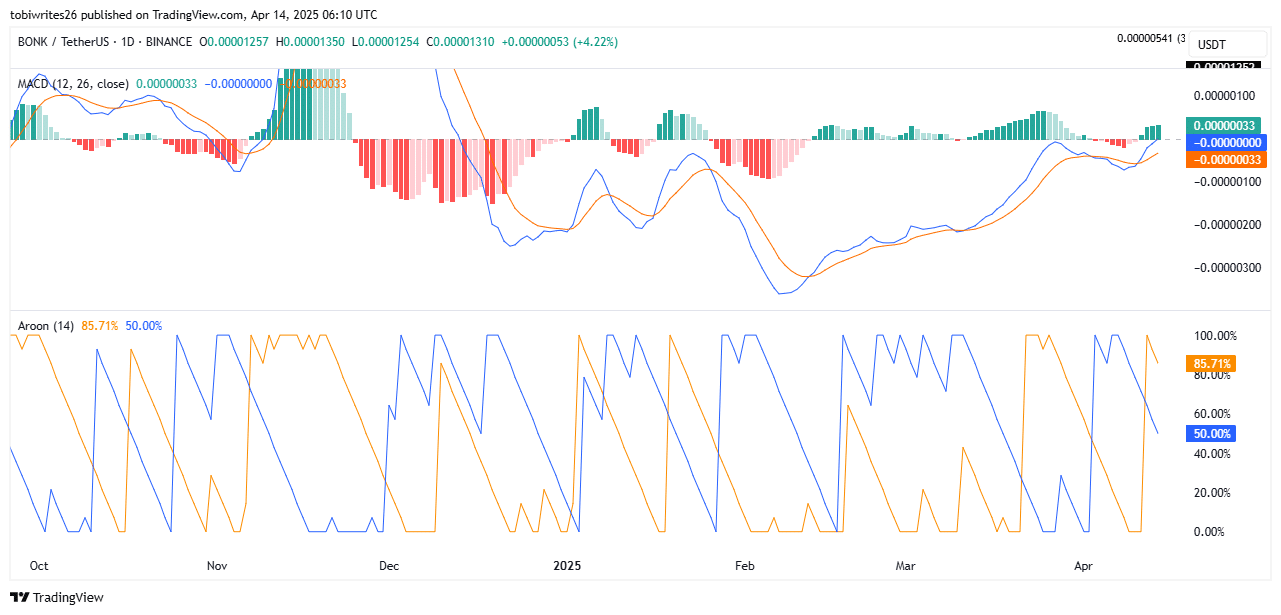

Technical indicators suggest that this resistance level is imminent. Movement average convergence and divergence (MACD) indicates that rally can soon be formed.

In the press time, the Blue MACD line is located at the neutral level of 0.00, showing a trend. The volume histogram indicates an exponential growth.

If the MACD line moves to a sheep area and the histogram continues to increase, the driving force between the merchants who actively purchases Bonk will increase.

Source: TradingView

The aroon indicators analyze market trends and intensity using Aroon Up (Orange) and Aroon Down (blue).

The strong sentiment is confirmed when the Aroon UP line remains on the Aroon Down line. The current reading value is 85.71%orange and 50.00%. These reading matches the general market story.

In the field market, the buyer actively acquired BONK. They purchased $ 2.6 million worth of assets and transferred them to their personal wallets for retention.

The transition from exchange to personal wallet indicates that the trust in the long -term potential of assets is increasing.

If the upcoming state continued, Bonk could see more price audits. This scenario increases the possibility of major upward exercises in the future transaction session.

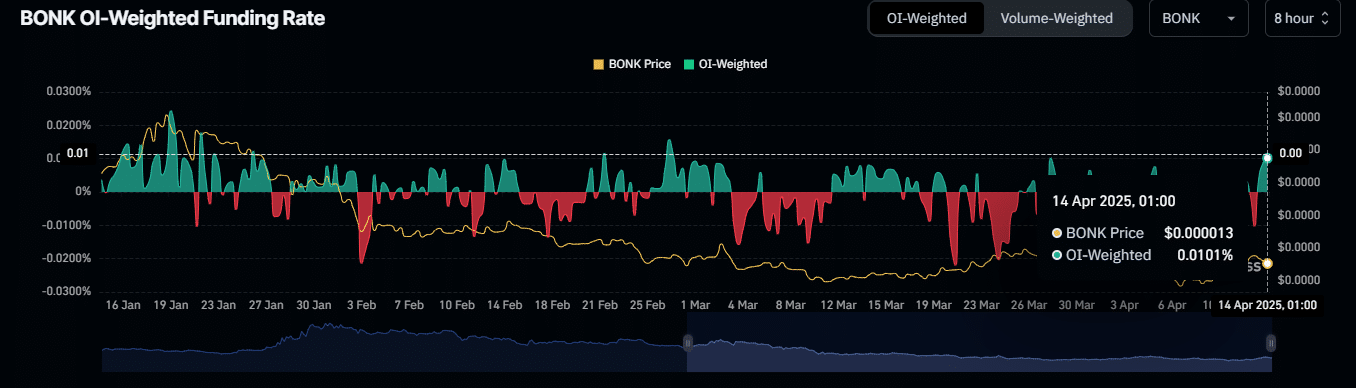

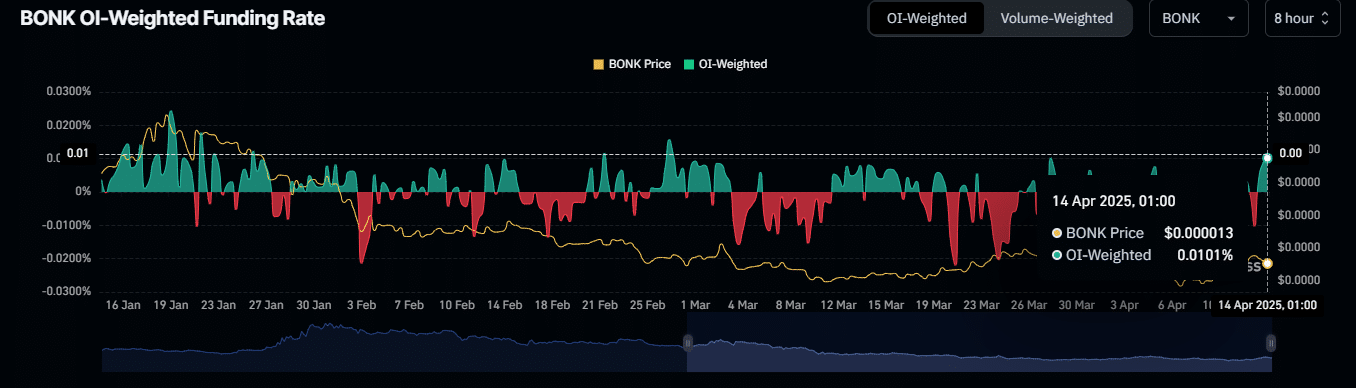

Source: COINGLASS

OI weighting funding ratio combines financing ratio and open interest to evaluate the potential market direction.

It indicates that the market prefers a long trader. At the time of writing, the rate of financing was 0.0101%.

This reading allows you to check high purchasing activities in the market and support resistance levels. If the resistance level is violated, it can lead to more rally, which can potentially lead to a new BONK’s highest point.

Overall, Bonk Rally appears to surpass the goal of the market and the assets are expected to rise.