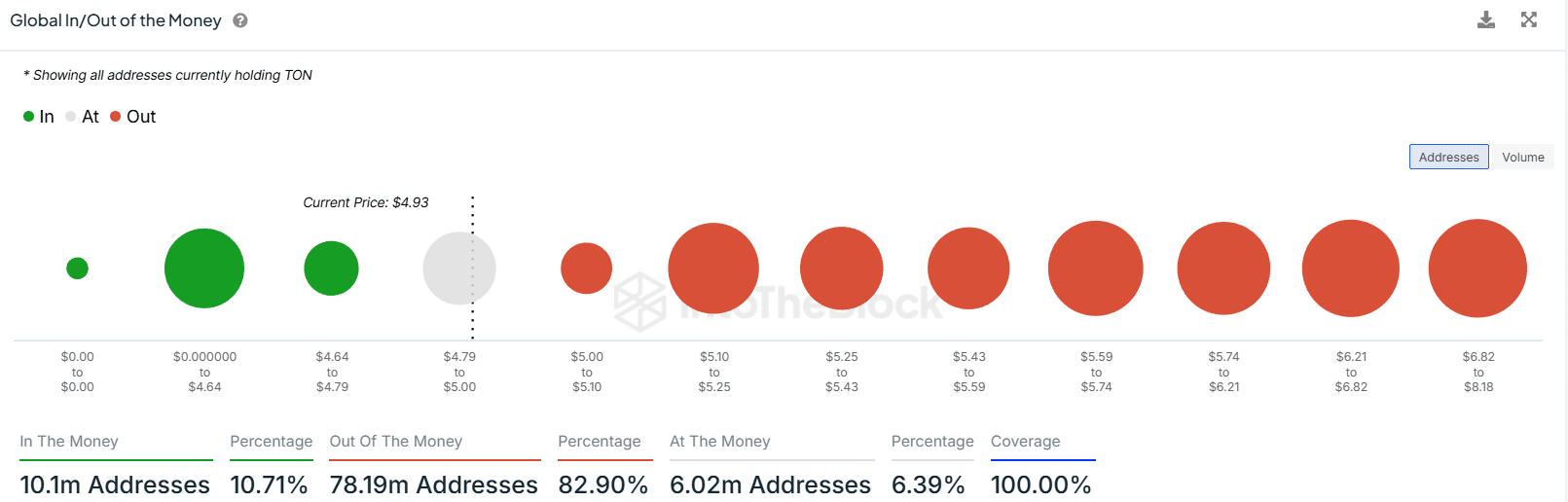

- At press time, only 10.71% of TON holders made a profit.

- Whales and large investors currently hold 91.52% of the total TON circulating supply.

Amid price corrections across the cryptocurrency industry, Telegram-linked Toncoin (TON) is showing strength and poised to see a notable uptick due to positive price action.

However, this rally in TON is likely to occur when market sentiment switches from a downtrend to an uptrend.

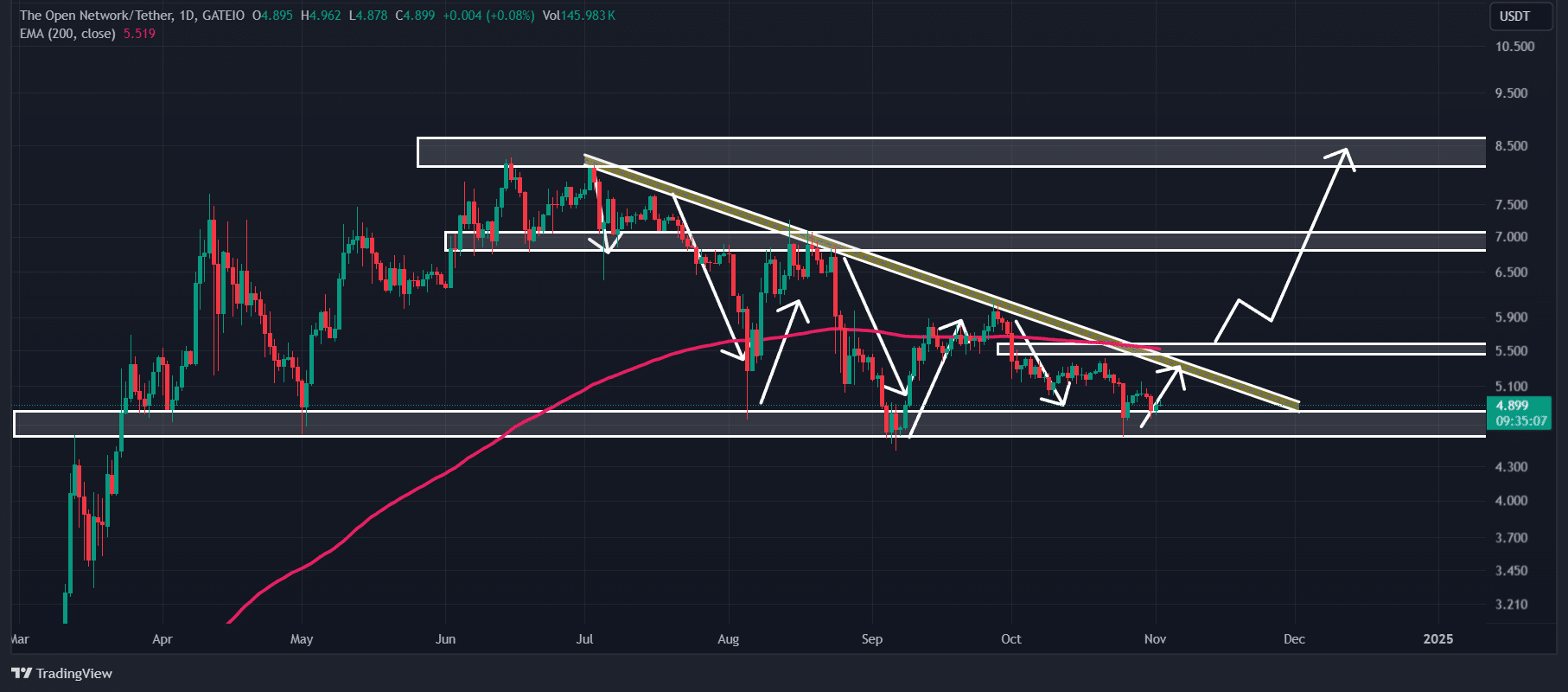

Toncoin technical analysis

According to technical analysis by AMBCrypto, TON appears bullish and is currently at a strong support level of $4.9. This is a level at which TON has historically experienced notable buying pressure and upside.

Now traders and investors are hoping for a similar move this time around.

Source: TradingView

In addition to the support level, the price of TON has reached a narrow zone within a downward price action pattern and is expected to break out of this pattern.

If sentiment changes and the price violates the downtrend line and closes the daily candle above the $5.6 level, it is likely to rise 40% and reach the $8.15 level in the next few days.

TON is currently trading below the 200 exponential moving average (EMA) on the daily time frame. The 200 EMA is a technical indicator used by traders and investors to determine whether an asset is in an upward or downward trend.

At press time, TON was trading near $4.91 and was unchanged over the past 24 hours. During the same period, trading volume decreased by 20%, reducing the participation of traders and investors.

Despite this optimistic outlook, one of the main concerns for retail investors regarding TON is the concentration of ownership among whales and large investors.

TON Whales and Investor Focus

According to on-chain analytics firm IntoTheBlock, approximately 87 whales and large investors currently hold 91.52% of the total TON circulating supply. Individual investors own about 8.48% of the shares, which is significantly lower than the shares held by whales or large investors.

Source: IntoTheBlock

The high concentration of whales and large investors increases the potential for price manipulation or fraud in these assets.

Is your portfolio green? Check out our Toncoin Profit Calculator

Despite significant holdings by whales and institutions, only 10.71% of current holders are making a profit, while 82.90% of TON holders are in out-of-the-money territory.

Also 6.4% is in the money. If the price rises due to low profitability, the possibility of a price sell-off also increases.