The price of optimism plummeted to a 14-day low of $2.90 on January 8, down 30% from the all-time high of $4.18 recorded on December 27.

The sharp price drop was caused by the liquidation of $2.45 million worth of LONG Optimism (OP) futures contracts within a frenzied 24 hours. Derivatives market data trends provide key insight into how dramatic changes in Optimism futures trading could impact OP spot price action going forward.

Why did the price of Optimism fall?

The price of optimism hit an all-time high of $4.18 on December 27 as the Ethereum layer-2 scaling protocol hit a groundbreaking network usage milestone. However, as the year turned, the altcoin market rally slowed and OP holders began recording profits.

Surprisingly, the operating profit price fell below the $3 mark in the early morning of January 8, causing millions of dollars in losses in the derivatives market. This operating profit price drop is 30% lower than the all-time high of $4.18 recorded on December 27th.

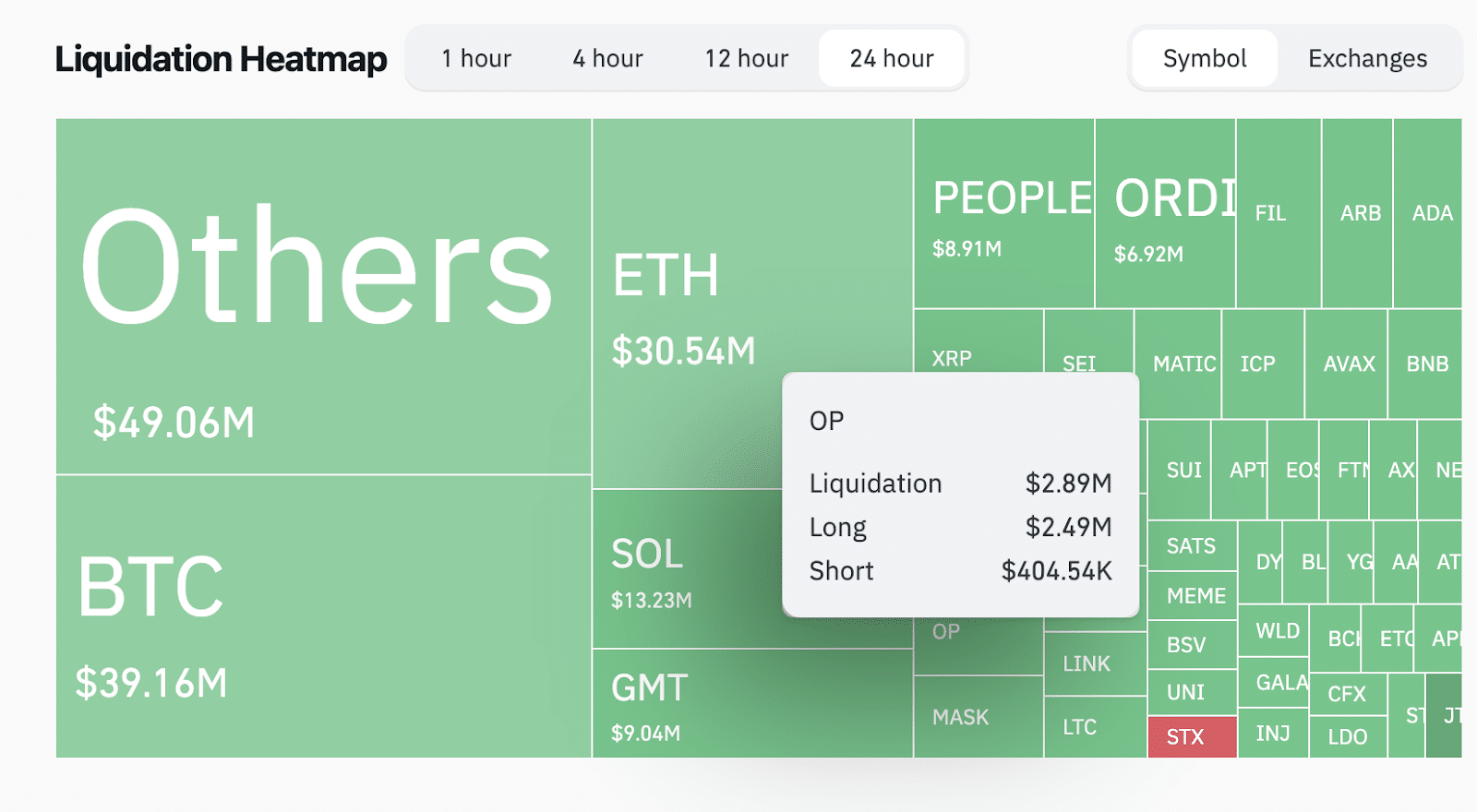

The recent downward price trend appears to have gone unnoticed by bullish futures traders. Monday’s price decline was heralded by widespread liquidation in derivatives markets. Coinglass’ Liquidation Heatmap chart shows that negative price action in OP on January 8 resulted in over $2.8 million worth of futures contracts being wiped out.

A liquidation event occurs when a speculative trader closes due to lack of margin coverage due to unfavorable price movements. Coinglass’ liquidation data heatmap shows a real-time snapshot of major loss directions.

The green bar above shows that LONG traders have a disproportionately higher daily loss rate than bearish traders. In particular, at noon ET on January 8, Optimism bulls accounted for 86% and $2.49 million in OP LONG positions were eliminated.

Optimism Open Interest Decrease for 12 Days

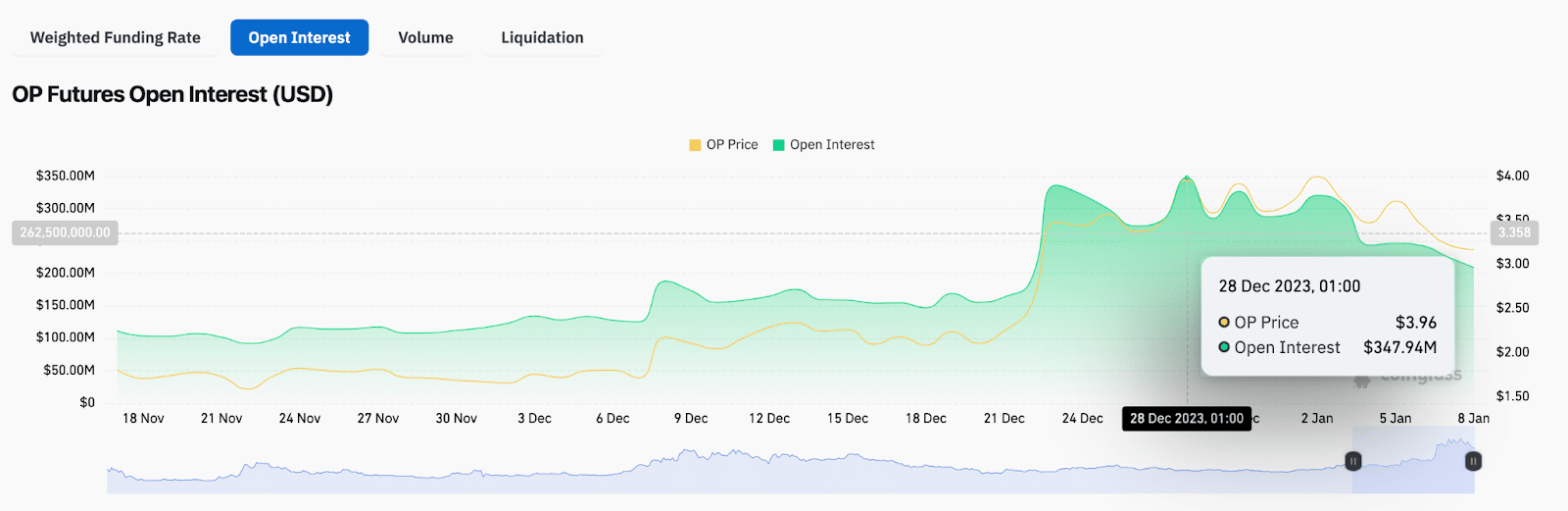

The surge in bullish open interest relative to spot prices over the past 12 days is another important market indicator that highlights growing bearish pressure on operating margins. Since December 27, Optimism open interest (OI) has plummeted 10% faster than price, signaling a wave of voluntary liquidations as market momentum turns bearish.

As shown below, Optimism open interest decreased by 40% between December 27 and January 8, from $347.9 million to $290 million. In comparison, the OP spot price decreased only 30% from $4.11 to a local low of $2.90.

Open interest quantifies the total capital invested in active derivatives contracts for a specific crypto asset. Strategic investors view a decline in open interest for an asset as a bearish signal. This indicates that more capital is leaving the market than investors are raising new funds.

Current market dynamics show a 30% drop in OP prices since rejecting the market high on December 27th. But what’s even more concerning is that the capitalization of bullish futures contracts declined 10% faster.

A $2.4 million surge in OP LONG liquidations on January 8 represents a forced sell, forcing traders to exit long positions due to unfavorable price movements. Additionally, open interest falling faster than the bullish price means that not only will traders voluntarily liquidate their positions, but the liquidation effect will also accelerate.

This bearish correction potentially hints at further price declines that could result from margin calls and stop loss triggers.

OP Price Prediction: Can $3 Support Be Maintained?

Current market data trends suggest OP price will likely retest the $2.50 area. However, to fully capitalize on the growing negative momentum, bears must first break the psychological support level at $3.

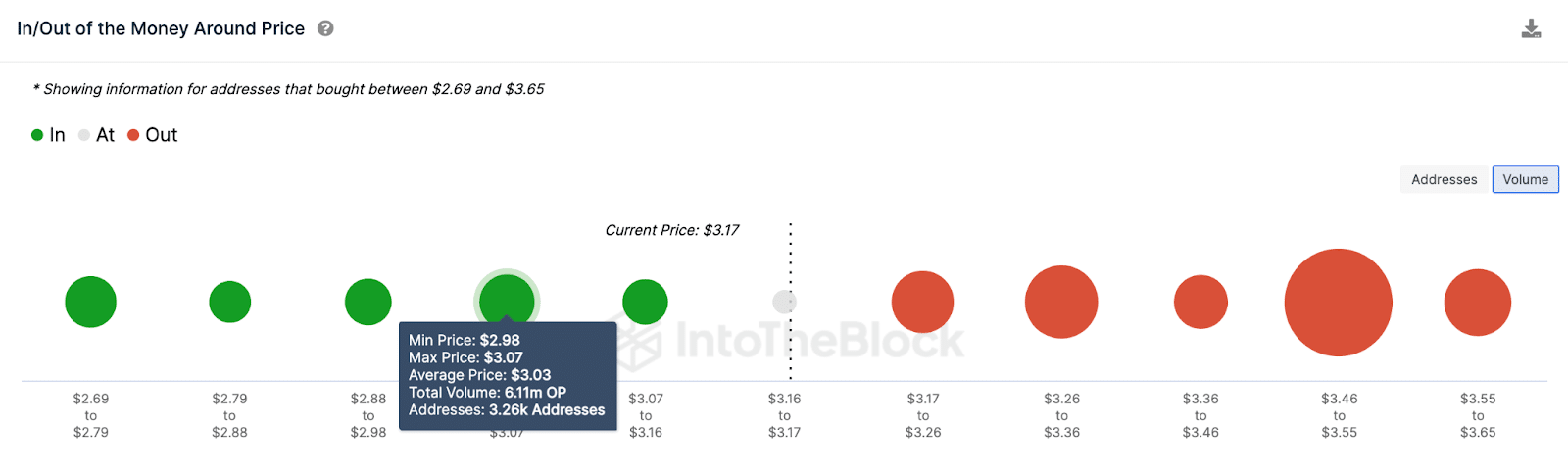

IntoTheBlock’s In/Out of the Money Around Price (IOMAP) data uses historical entry prices for current OP holders to illustrate key areas of support and resistance. This shows that bears could face significant resistance in the $3 region.

As you can see below, 3,260 addresses acquired 6.1 million OP tokens at an average price of $3.03. If these major investor groups make short-term purchases to defend their positions, operating profit prices may rebound.

However, a detour below $3 could result in another margin call and stop loss trigger. As expected, this bearish scenario will likely open the door to a retest of the $2.50 operating profit price.

On the positive side, the bulls can regain control of the market with the bullish price regaining $4. But in this case, 7,800 addresses earned 44.3 million OP at an average price of $3.50. If investors choose to take profits early, the operating profit price is reversed.

However, a positive spot Bitcoin ETF could create a bullish headwind for the altcoin market. In this scenario, OP bulls could gain enough momentum to break the $3.50 resistance sell wall.