- Chainlink shows potential for a 40% upside, but breaking $13 resistance is key for the move.

- While there is a surge in large-scale transactions, on-chain indicators point to continued accumulation of LINK over the past month.

Chainlink (LINK) was trading in $11.09 At press time, it is down 6.16% in the last 24 hours. The token’s circulating supply is 630 million LINK, with a market capitalization of approximately $6.95 billion.

Trading volume over the last 24 hours reached $594.2 million, indicating active trading despite recent price declines.

The current price movement comes after a downtrend and a period of consolidation in the $11-$12 range. Analysts are watching the $13 resistance level closely as it has repeatedly served as a key barrier. A move above this level could indicate a bullish trend change.

Potential Breakout and Major Resistance

Crypto analyst Michaël van de Poppe said: maintain Bullish outlook for Chainlink. He expects a breakout in the next two weeks if LINK can overcome $13 resistance. He explains this level as follows:

“It is the key to triggering further upward movement.”

Source: X

If LINK successfully breaks above $13, the price could potentially rebound to the $18 level, which would represent a profit of approximately 40% from the breakout point. The Relative Strength Index (RSI) currently suggests that there is room for upside in neutral territory.

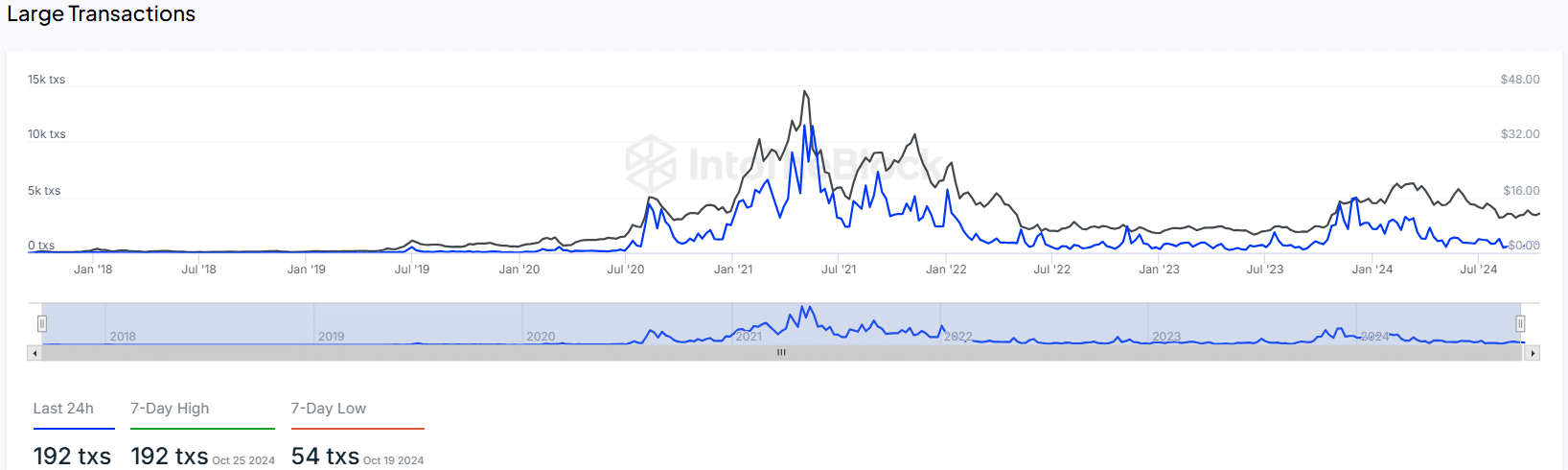

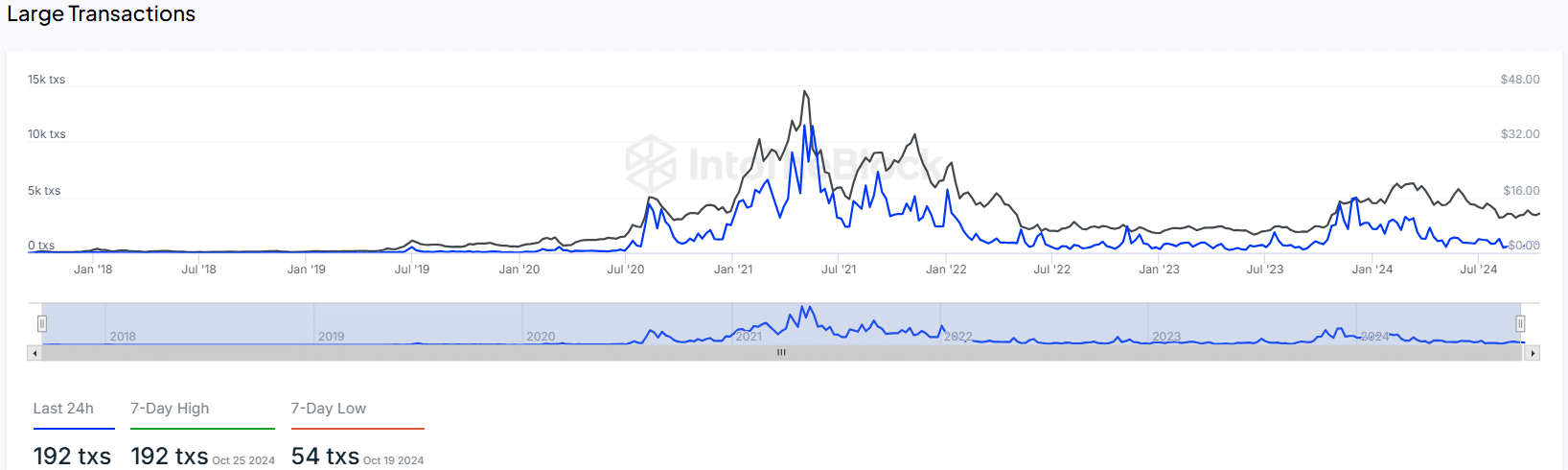

On-chain indicator: surge in large transactions

In the last 24 hours, 192 large transactions were recorded on the Chainlink network, matching the 7-day high reached on October 25. This is an increase from the seven-day low of 54 transactions on October 19.

Source: IntoTheBlock

A surge in large transactions suggests growing interest or significant capital movement among major holders.

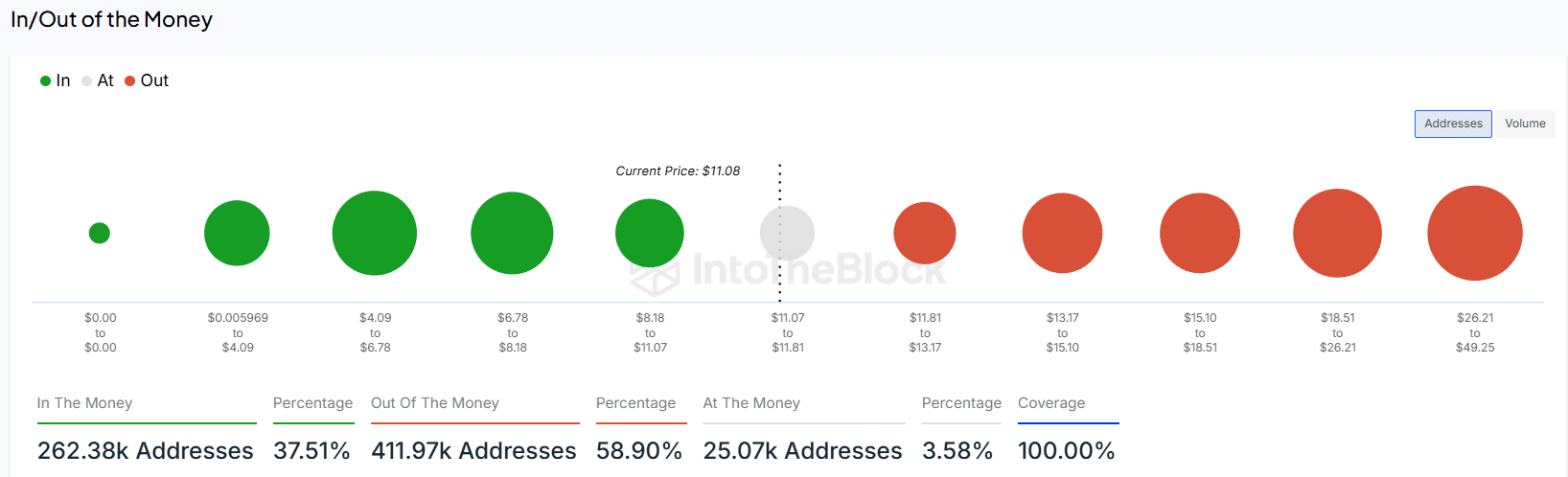

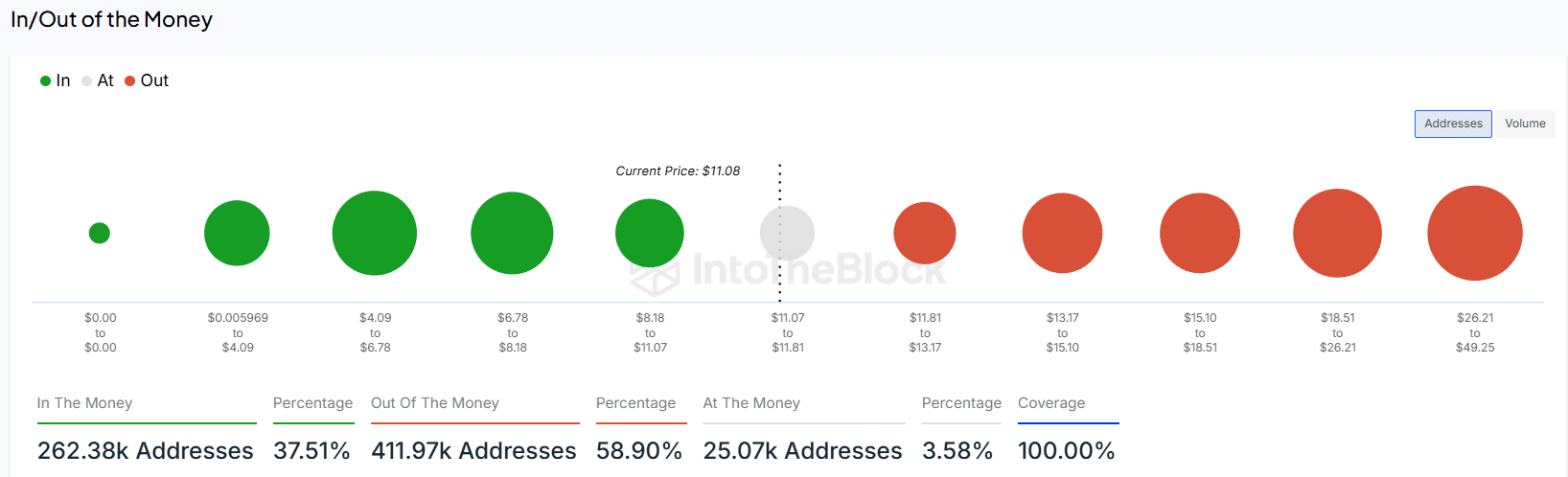

Additionally, In/Out of the Money analysis shows that 37.51% (262.38k) of addresses are “in-the-money” by purchasing LINK for less than $11.08. Meanwhile, 58.90% (411.97k) of the addresses are “out-of-the-money,” meaning they were purchased at a higher price.

Source: IntoTheBlock

Stronger resistance may occur as the price approaches the $11.81-$13.17 range.

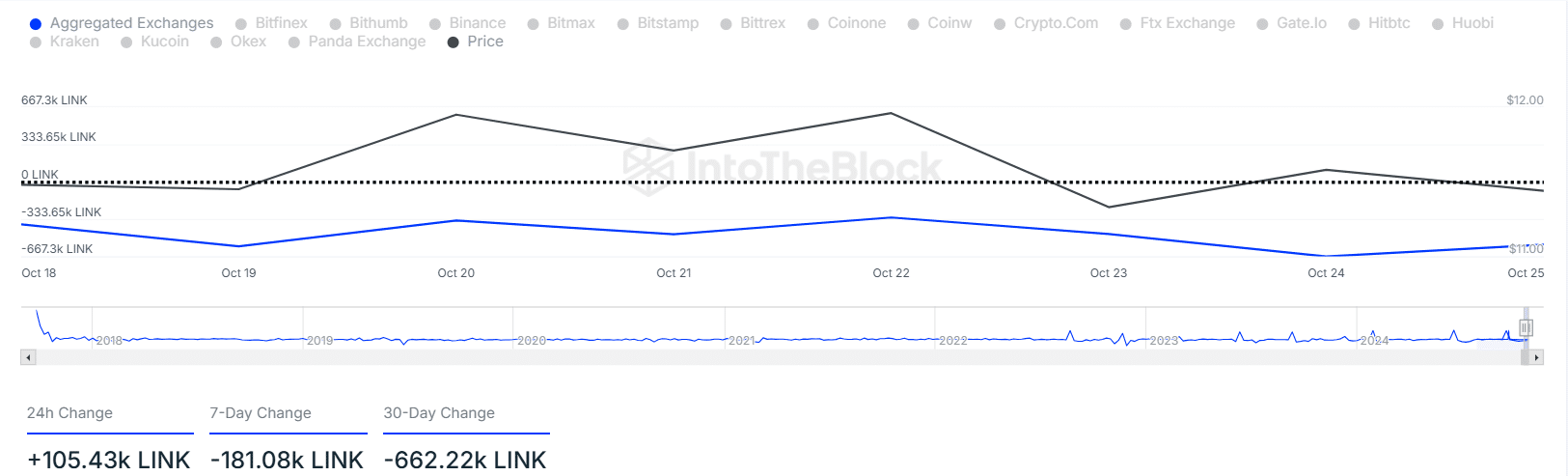

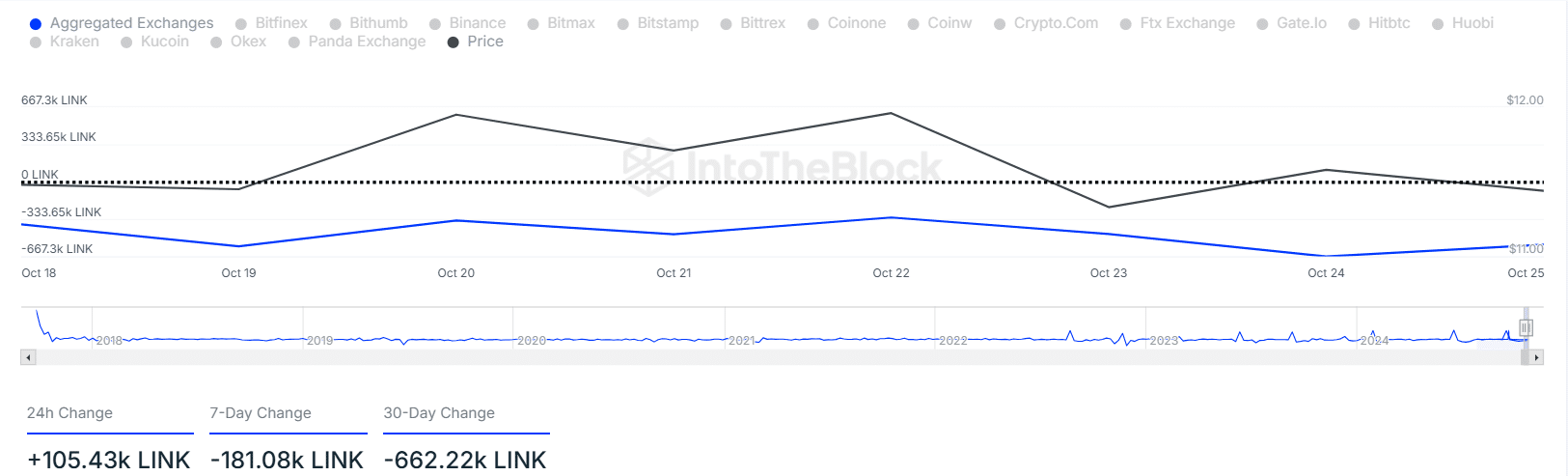

Exchange inflows and outflows

IntoTheBlock data for the last 24 hours reveal Exchange net inflows of +105.43k LINK indicate potential short-term selling pressure. However, the net outflow of -181.08k LINK over the past week suggests wider accumulation by holders.

Looking at the 30-day change, there is a net outflow of -662.22k LINK, indicating a continued long-term accumulation trend.

Source: IntoTheBlock

Is your portfolio green? Check out the LINK Profit Calculator

This pattern of inflows and outflows indicates that short-term selling is possible within a broader context of long-term accumulation.

While the recent increase in foreign exchange inflows may be a temporary reaction, larger outflows over the past month reflect confidence in LINK’s long-term prospects.