- INJ bulls held on to support at $21.65 as analysts predicted a possible 12-fold rise to $380.

- Futures open interest showed an upward trend and volume increased 9.54%, indicating strong market confidence.

Injective (INJ) was trading at the following prices: $27.77 At press time, it was down 0.46% over the past 24 hours and down 1.66% over the past week.

The 24-hour trading volume is $221.5 million, the market capitalization is $2.73 billion, and the circulating volume is 98 million INJ.

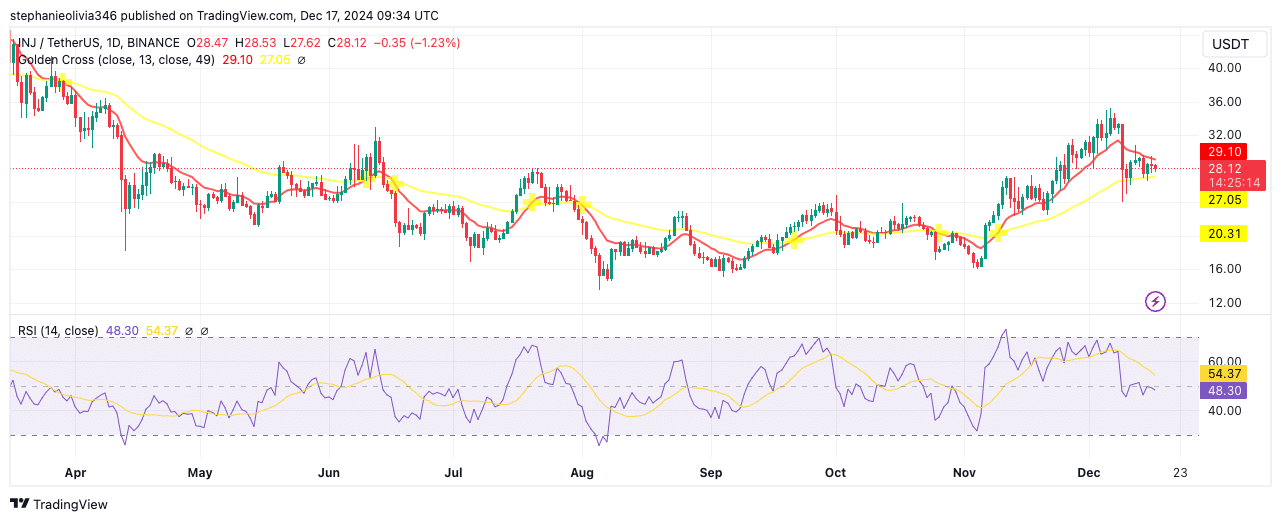

The chart shows INJ breaking out of a long-term downtrend after forming a round bottom pattern. This structure led to a strong rally, with buyers continuing to defend the $21.65 support level.

Source: X

Holding this key support is essential to maintain a bullish continuation pattern. analyst point to log If the trend continues, the target price is $380, which is 12 times higher than the current level.

Technical indicators suggest mixed momentum.

INJ’s technical signals show mixed momentum. In November, the 13-day moving average (MA) crossed the 49-day moving average and formed a golden cross, signaling a bullish trend.

However, the price is currently at $29.06, falling below the 13-day MA while remaining above the 49-day MA. If the price fails to stay above the 49-day MA, the next major support will be near $20.31.

Source: TradingView

The relative strength index (RSI) remained below 50 at 47.63, showing neutral to bearish momentum. A downward slope in RSI reflects weakening buying interest.

For buyers to regain control, the price would need to recover above the $29.06 resistance and a near-term rise to $32 is likely.

On-chain data shows decline in INJ activity

Source of data Into the Block Injective shows a decline in network participation. There were 654 addresses for the week of December 16, including 123 new addresses and 422 active addresses.

Over the past seven days, new addresses have decreased by 21.66% and active addresses have decreased by 11.34%.

Source: IntoTheBlock

A slight increase of 1.87% in zero balance addresses suggests that some users may have moved funds or closed positions. Although overall user activity has decreased, the fundamentals of the network remain supported by existing users.

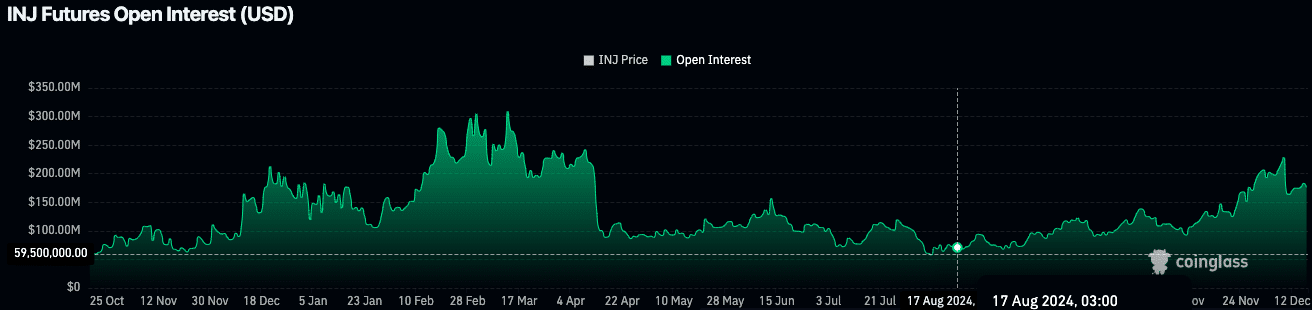

Futures data shows steady market interest

According to coin glassOpen interest (OI) in INJ futures was $174.37 million, reflecting a decline of 0.80%. This indicates light profit taking or a short-term decline in activity.

However, OI has been on the rise since October, suggesting steady participation from traders.

Source: Coinglass

Volume increased 9.54% to $271.95 million, demonstrating continued interest in the futures market.

Increasing trading volume along with steady open interest indicates continued investor confidence in INJ.

Read Injective (INJ) price forecast for 2024-2025

With technical patterns still in play, interest in futures rising, and volume high, INJ’s setup is still poised for further upside.