- Bearish sentiment towards the token has increased.

- $0.93 was the next important support level for MATIC.

Polygon (MATIC) Over the past few days, it has crossed an important resistance area, suggesting another upward rally. But things changed quickly on April 1, when MATIC’s value plummeted. MATIC Will the downtrend control the start of the second quarter?

Polygon investors are shocked

Renowned cryptocurrency analyst World of Charts recently posted the following: Twitter We highlight the fact that MATIC has crossed the resistance level. This happened when the price rose to $1.

If MATIC had tested that level, the token price could have reached $1.01. However, this did not translate into reality as token price adjustments were witnessed.

According to CoinMarketCap, MATIC is down more than 3% in the last 24 hours alone. At the time of writing, it is trading at $0.9659 with a market capitalization of over $9.5 billion, making it the 17th largest cryptocurrency.

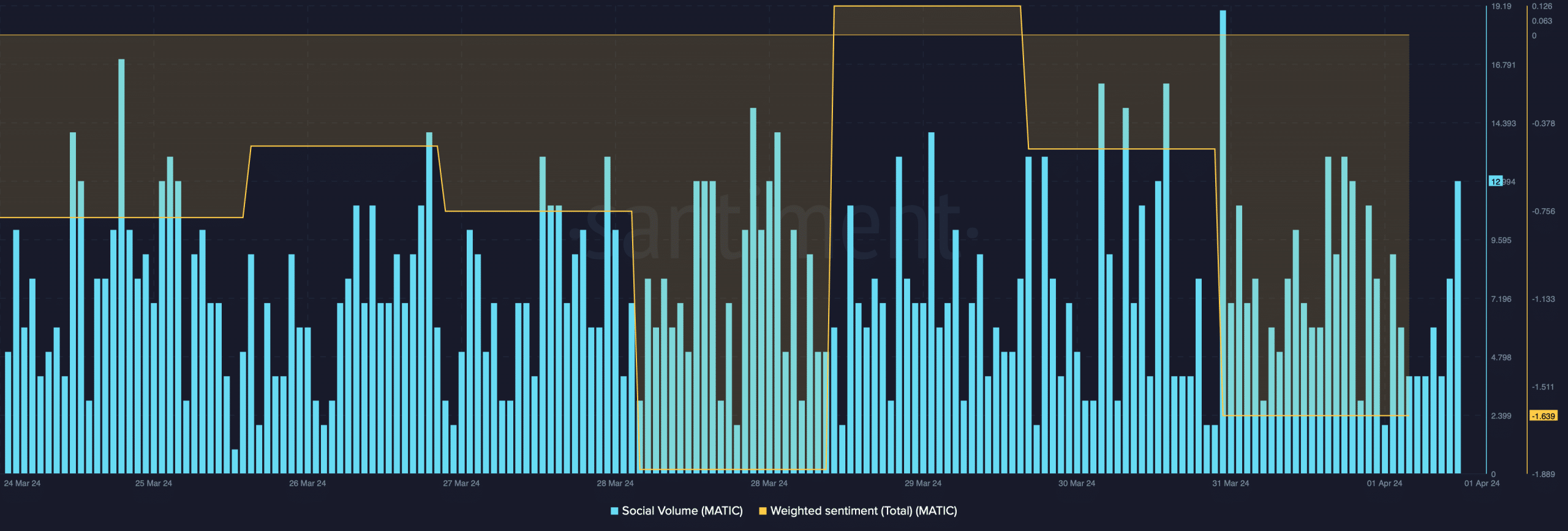

Falling prices also had an impact on social indicators. Polygon’s social volume has increased, reflecting the cryptocurrency space is talking about the token.

There has also been a significant increase in surrounding bearish sentiment, which is evident in the significant decline in weighted sentiment.

Source: Santiment

AMBCrypto then checked data from Hyblock Capital to determine the cause of this downward trend. Our analysis shows that there was a surge in liquidations when the price of MATIC reached $1.

High liquidation means high selling pressure, which usually causes prices to fall. The worst part is that MATIC failed to test the support level near $0.97 and fell there. This indicates that the token price may fall further.

Source: Hiblock Csapital

Will Polygon’s downward trend continue?

To understand whether the downward trend will continue, AMBCrypto turned to CryptoQuant’s data. We found that MATIC’s exchange reserves are increasing. This means there is high pressure to sell tokens.

Other bearish indicators include daily active addresses and trading volume, which have also declined recently.

Source: CryptoQuant

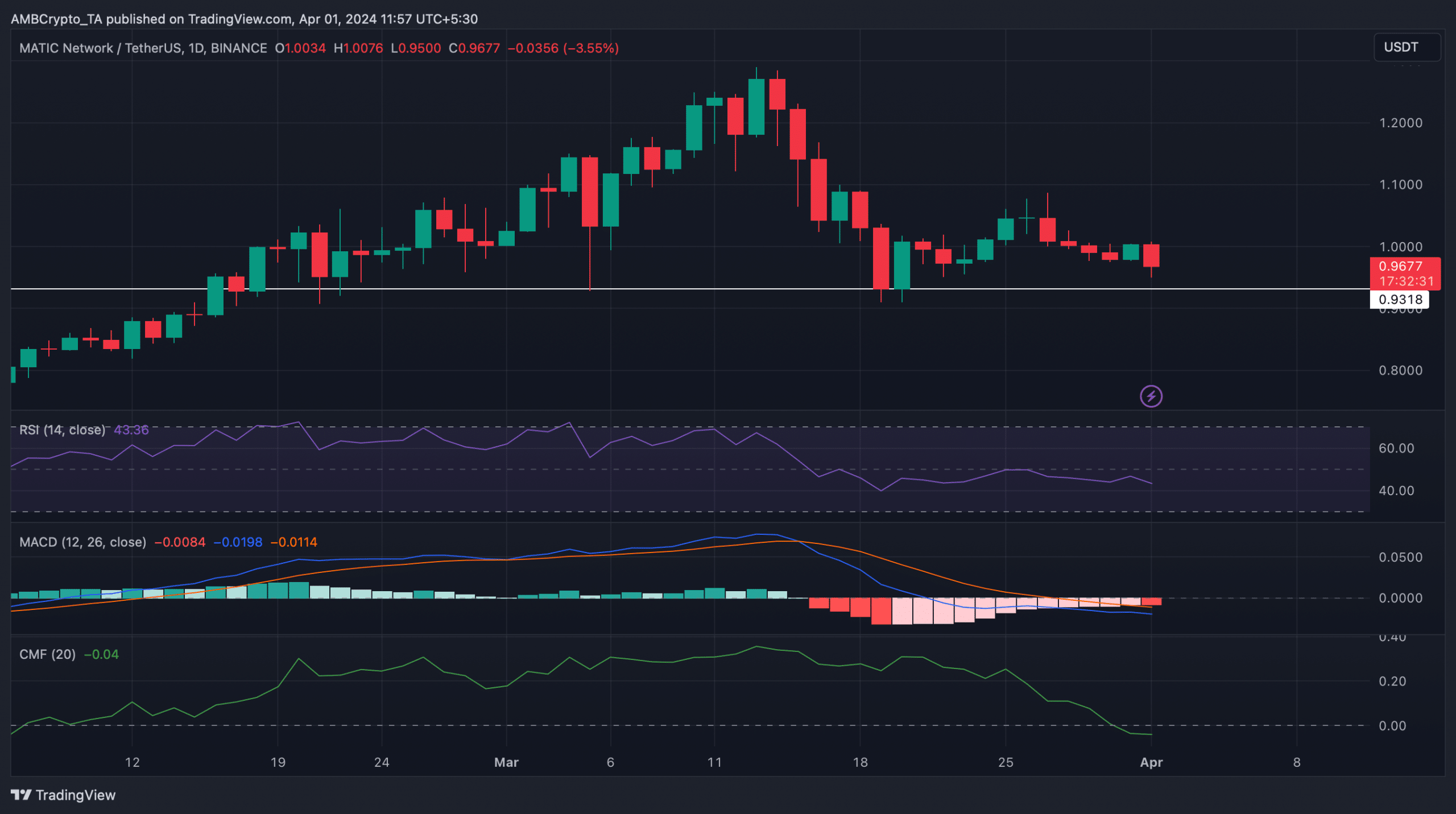

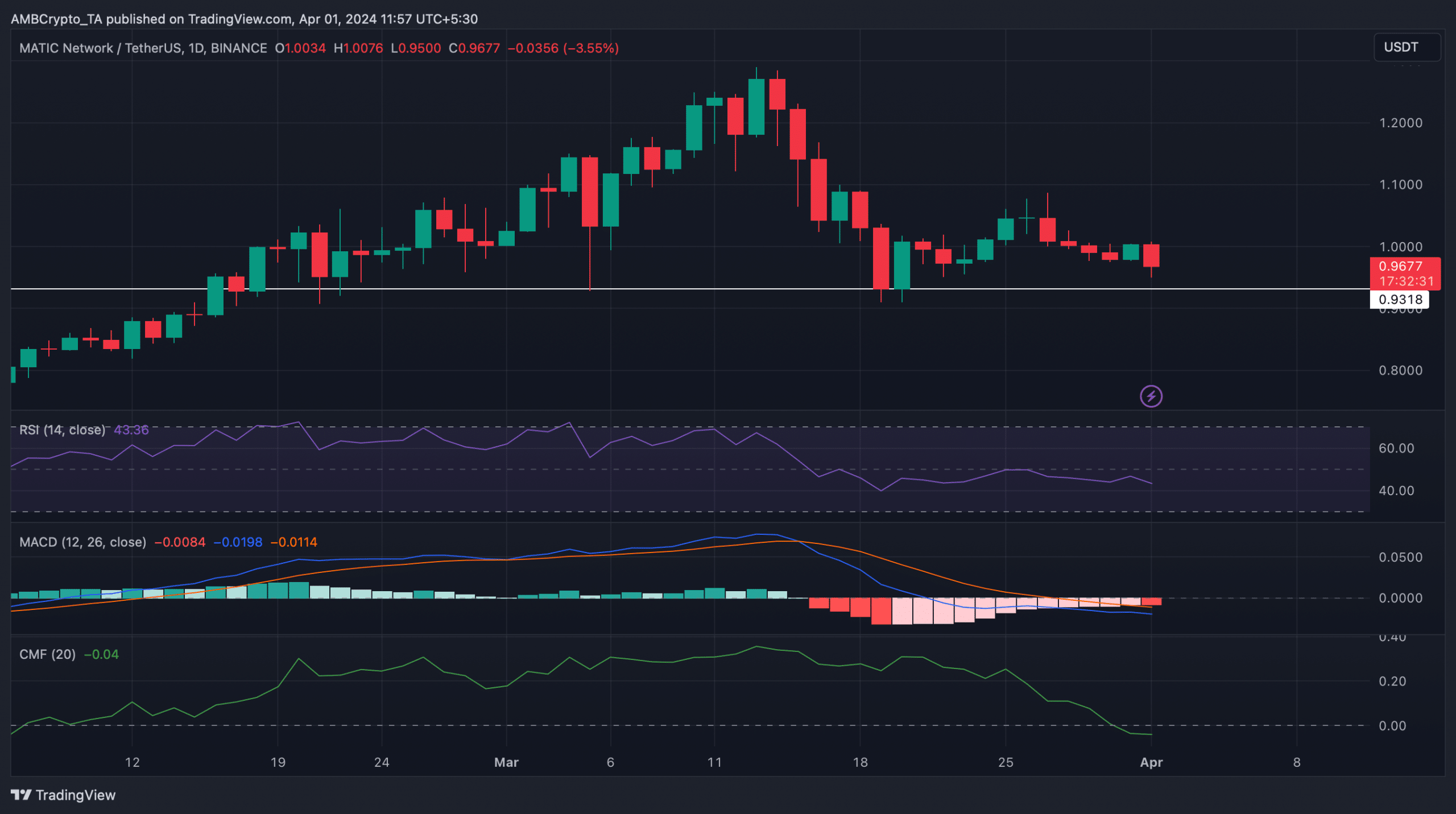

Technical indicator MACD showed a clear bearish edge in the market. The relative strength index (RSI) showed a sharp decline.

read Polygon(MATIC) Price Prediction 2024-25

In addition, Polygon’s Chaykin Money Flow (CMF) also showed a similar downward trend, suggesting that there is a high possibility of continued price decline.

If the downtrend continues, investors should watch out for the $0.93 resistance zone. This is because a plunge below that could be a concern.

Source: TradingView