- Whale accumulation and support forming a bounce indicate potential bullish momentum for PENGU.

- Despite low social indicators, rising public interest and consolidation signaled an imminent breakout.

Whale made headlines in the last 24 hours by depositing 401 million Pudgy Penguins (PENGU) tokens, worth $9.5 million, into its wallet.

The move comes after Whale withdrew $15.87 million from Binance to PENGU, purchasing 581.96 million tokens and selling $71.96 million for $1.93 million.

Currently, the whale holds 110 million PENGU tokens worth $2.62 million distributed across two wallets. At the time of reporting, PENGU is It was trading at $0.02435, up 1.92% over the last 24 hours.

Questions are being raised as to whether these developments signify a phase of accumulation for PENGU.

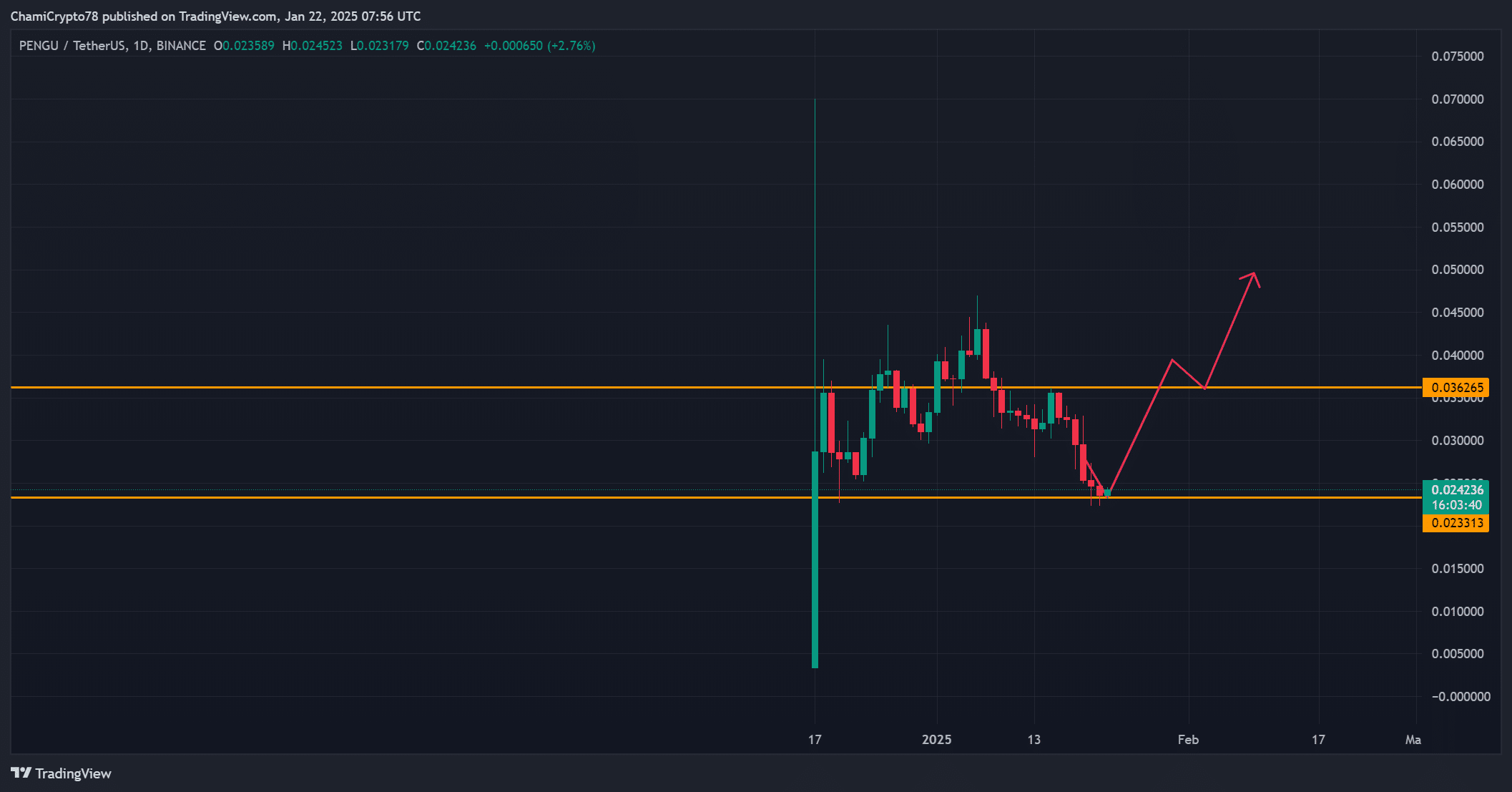

PENGU chart overview shows potential breakout

PENGU maintained a steady recovery, successfully rebounding from the important support level at $0.0233. The daily chart suggests that the next major resistance lies at $0.0362. If buying momentum strengthens, this level could be tested.

Moreover, the price trajectory shows that a breakout towards $0.05 is likely if this trend continues. Whale activity coincides with this rebound, suggesting confidence among large investors.

The upcoming session may define whether PENGU will capitalize on this rebound or face new challenges.

Source: TradingView

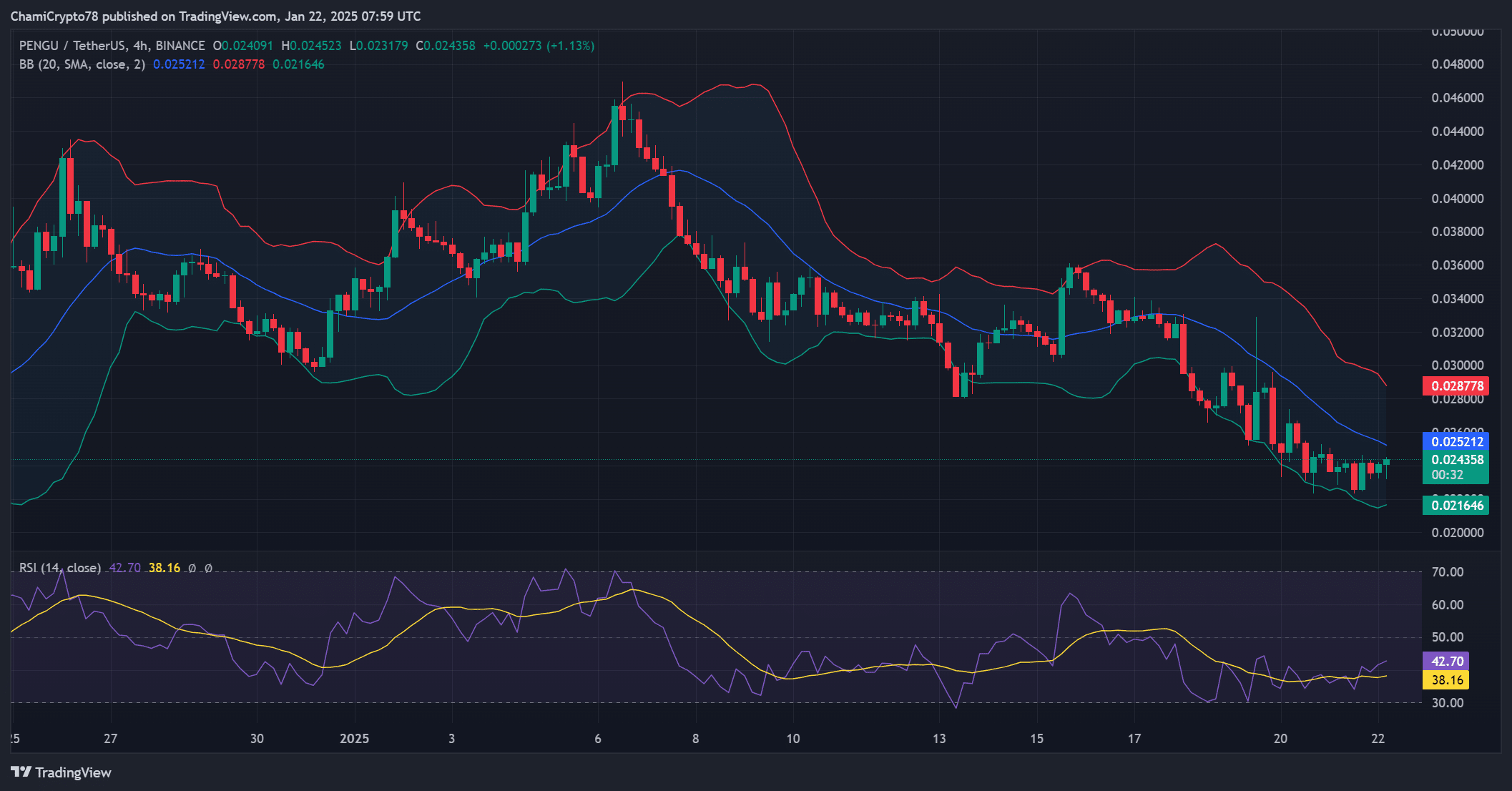

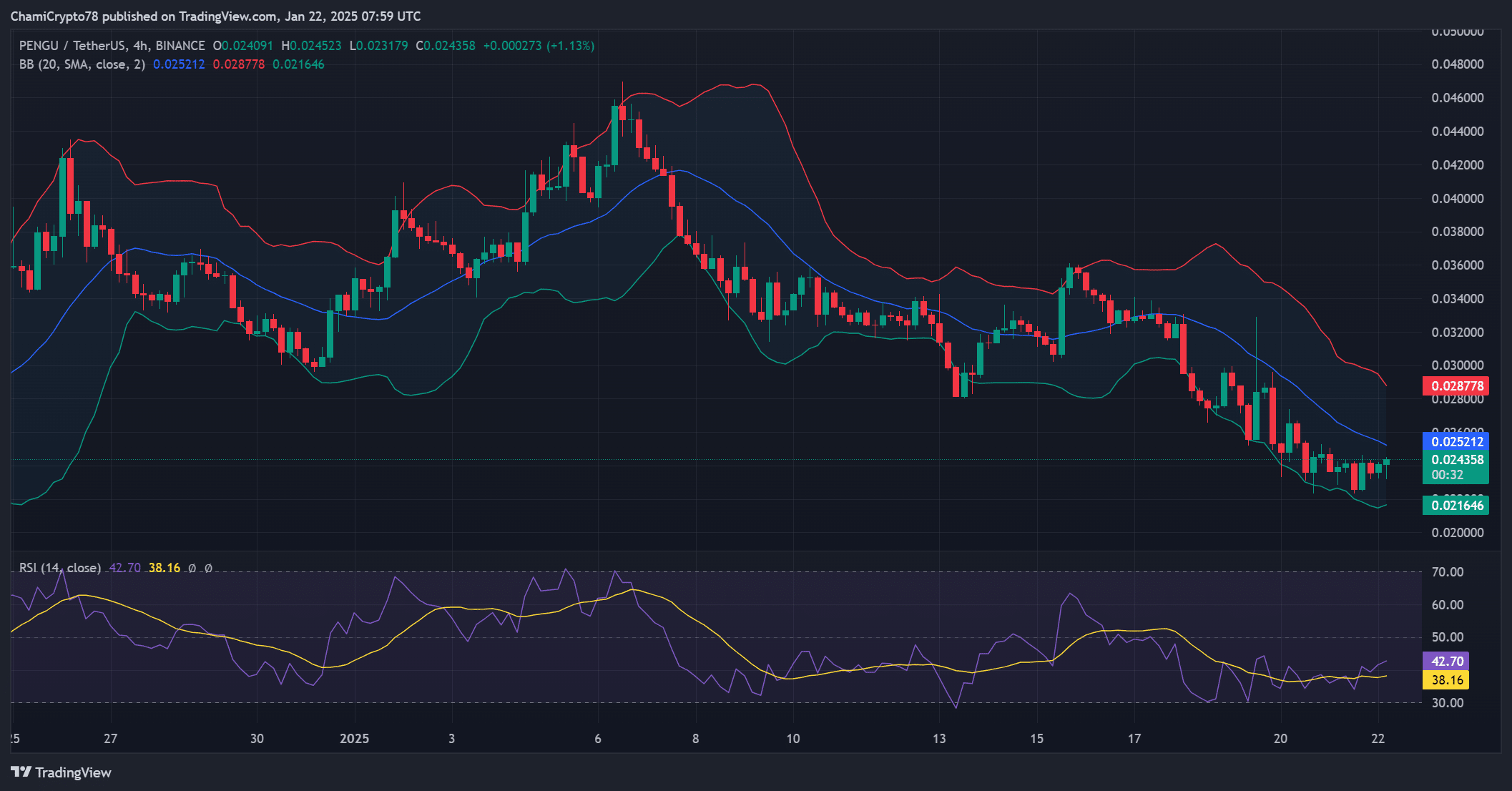

The 4-hour relative strength index (RSI) is currently at 42.7, indicating neutrality. This does not mean that the price is overbought or oversold and there is still room for upside.

Additionally, the Bollinger Bands (BB) are tightening, suggesting that volatility is decreasing and a breakout is likely soon. The price is positioned in the middle of the band, reinforcing the possibility of further consolidation.

Source: TradingView

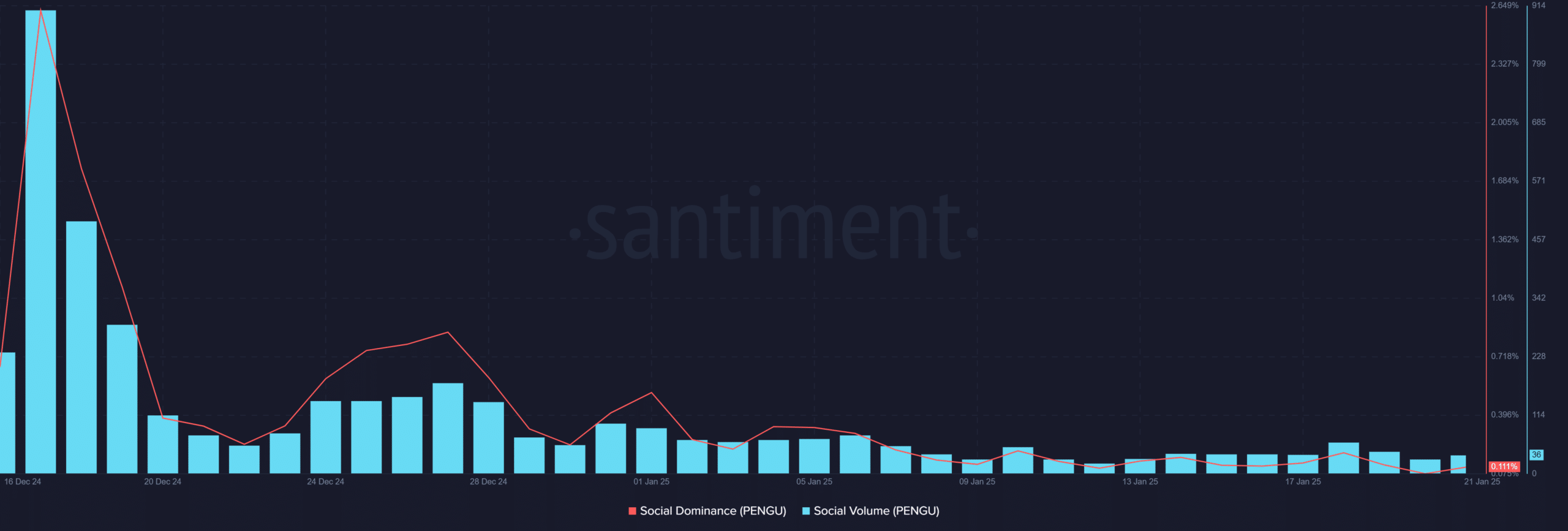

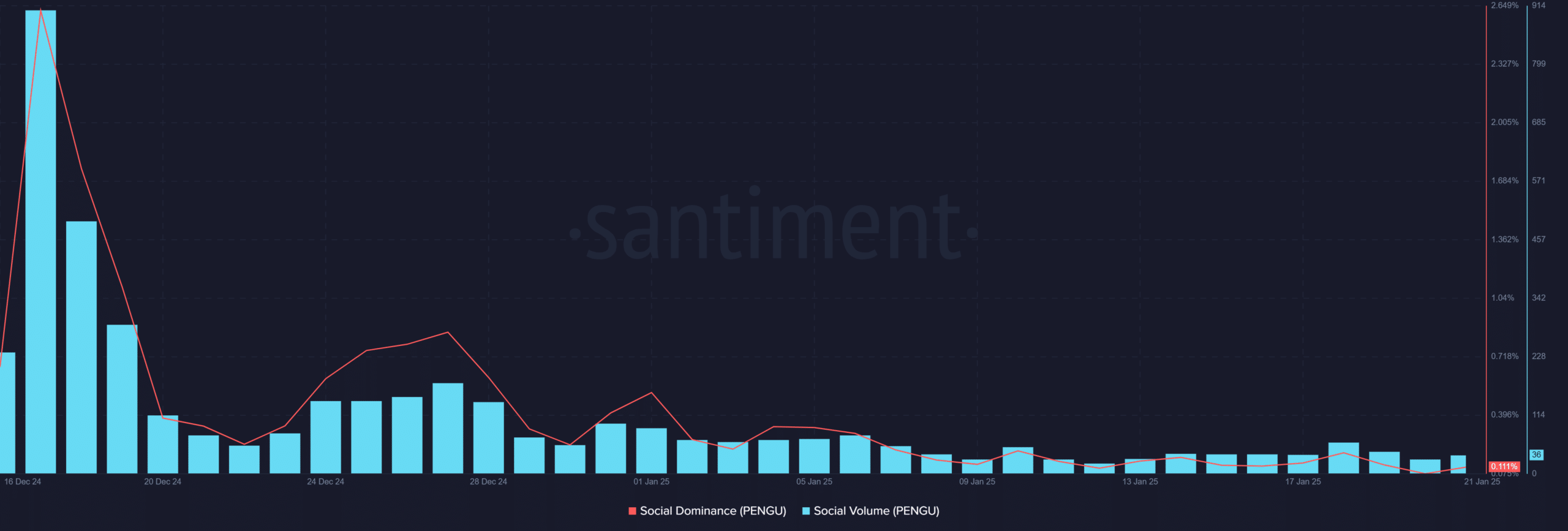

PENGU social volumes remain surprisingly low.

Despite this whale activity, PENGU’s social dominance and size are significantly low. Our latest data shows social dominance at just 0.11%, with just 36 social mentions in the last analysis window.

However, this subdued social engagement does not necessarily reflect market sentiment.

This may indicate that larger investors are acting strategically, separate from the retail hype. So while social indicators are lackluster, technical and market sentiment tell a different story.

Source: Santiment

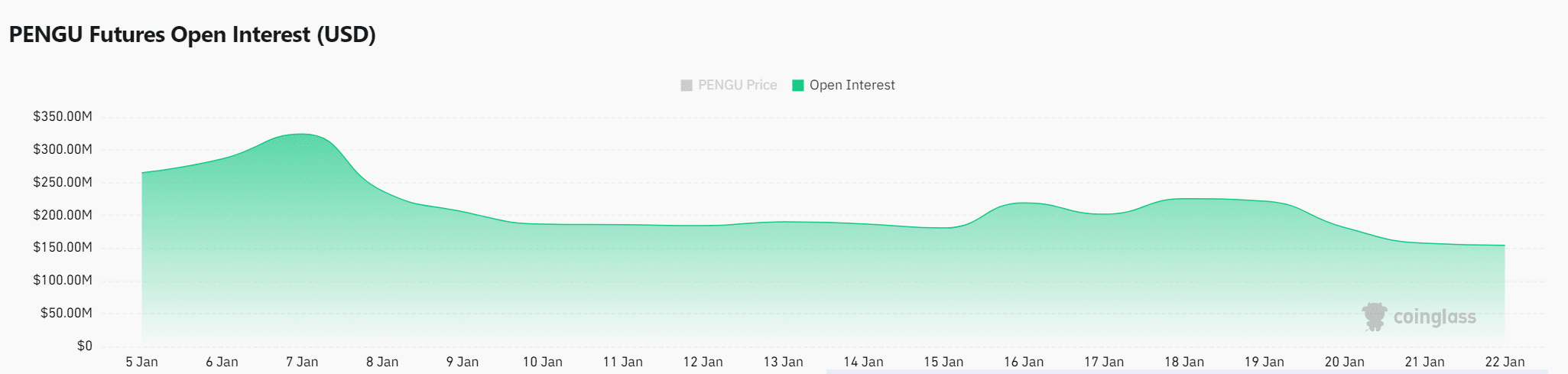

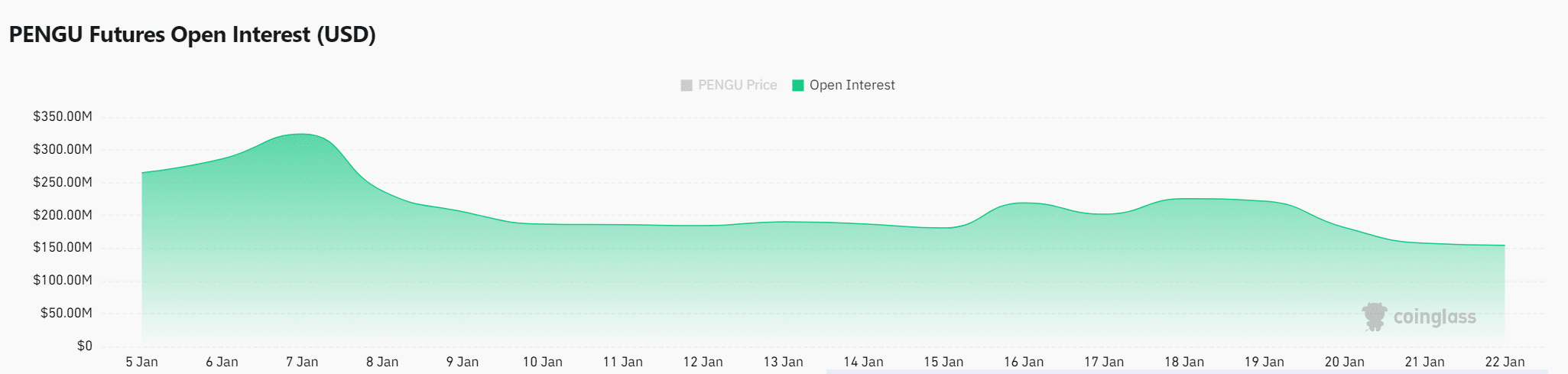

Market sentiment improved due to increased open interest

Open interest increased by 7.44% to a total of $160.41 million, indicating increasing participation from traders and investors. This rise reflects increased interest in PENGU due to whale activity and a technical rebound.

Additionally, an increase in open interest is often a signal of upcoming volatility, which could be beneficial to bulls if buying continues. So, despite the negative social indicators, the overall sentiment is shifting towards optimism.

Source: Coinglass

Read Pudgy Penguins (PENGU) price forecast for 2025-2026.

Whale activity, improving market sentiment, and technical recovery indicate that PENGU is poised for a significant upside. Social participation remains low, but current market conditions strongly favor accumulation.

PENGU is therefore well positioned to challenge resistance levels and potentially trigger a bullish rally in the future.