- Solana has a strong bullish bias even when the price surges above key resistance levels.

- The Avalanche has seen its bullish momentum slowing down and could witness a slight decline.

Over the past two days, Solana (SOL) and Avalanche (AVAX) have shown slightly different trajectories on their price charts. The former continued to rally even as the rest of the cryptocurrency market made some gains, while the latter’s bullish momentum waned.

Bitcoin (BTC) has been a major driver of altcoin performance. Capital flows into ETFs have been huge, but that doesn’t mean the altcoin market has been forgotten. Here’s how traders can navigate incoming volatility.

The Avalanche could retest a key demand zone while Solana continues its upward trend.

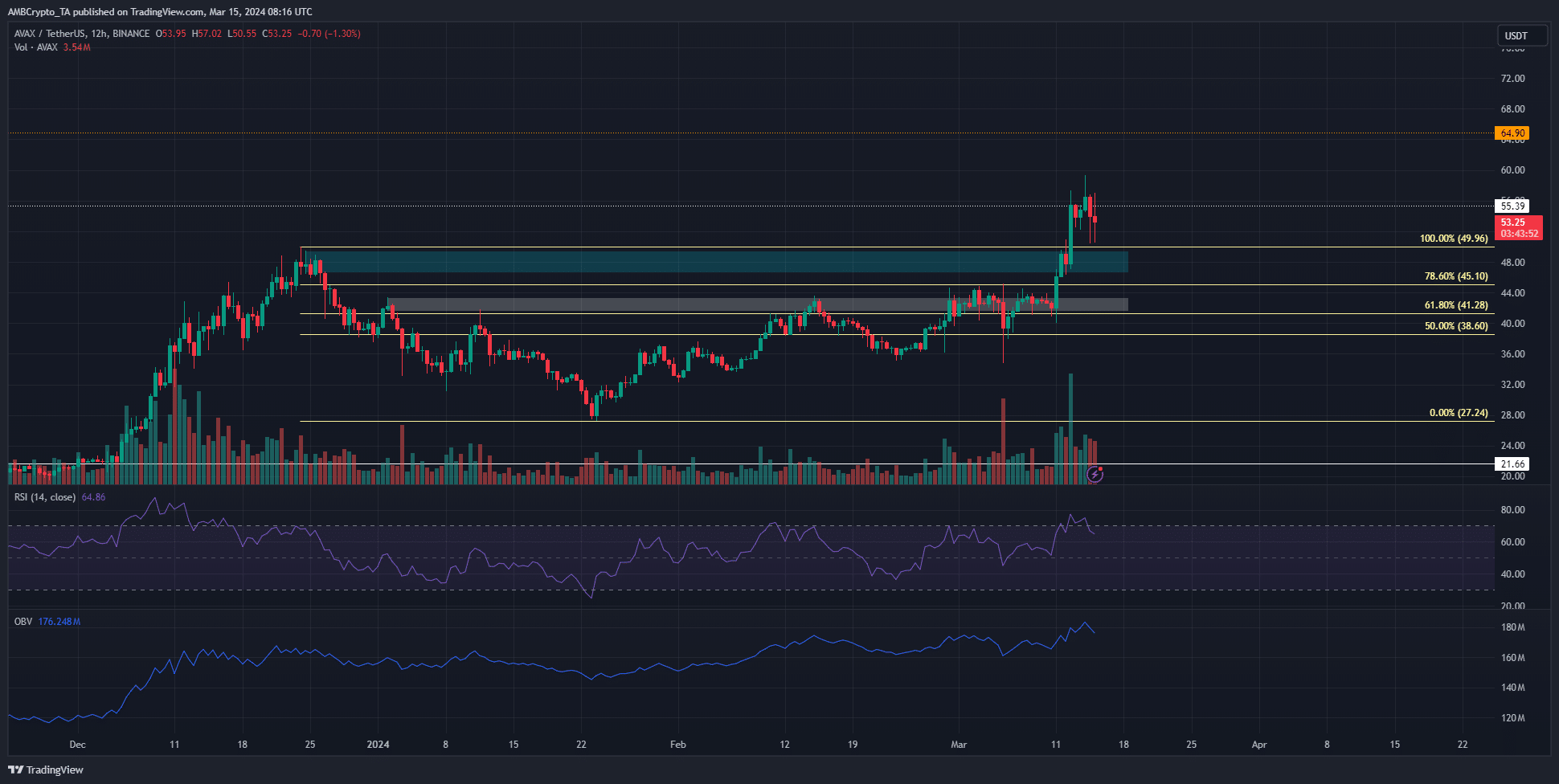

Source: AVAX/USDT on TradingView

The AVAX chart showed two previous bearish order blocks that converted into bullish block blocks in the past two weeks. This is highlighted with a white and cyan box.

The Fibonacci level shows that a bullish trend is established once the white box resistance at $43.35 is broken.

The $55.4 and $64.9 levels were higher period resistance levels that traders should watch out for. OBV and RSI have been bullish with an upward trend in recent weeks. A further rise is expected after the decline.

A retest of the $49 and $43 demand zones could occur and a retest would present a buying opportunity.

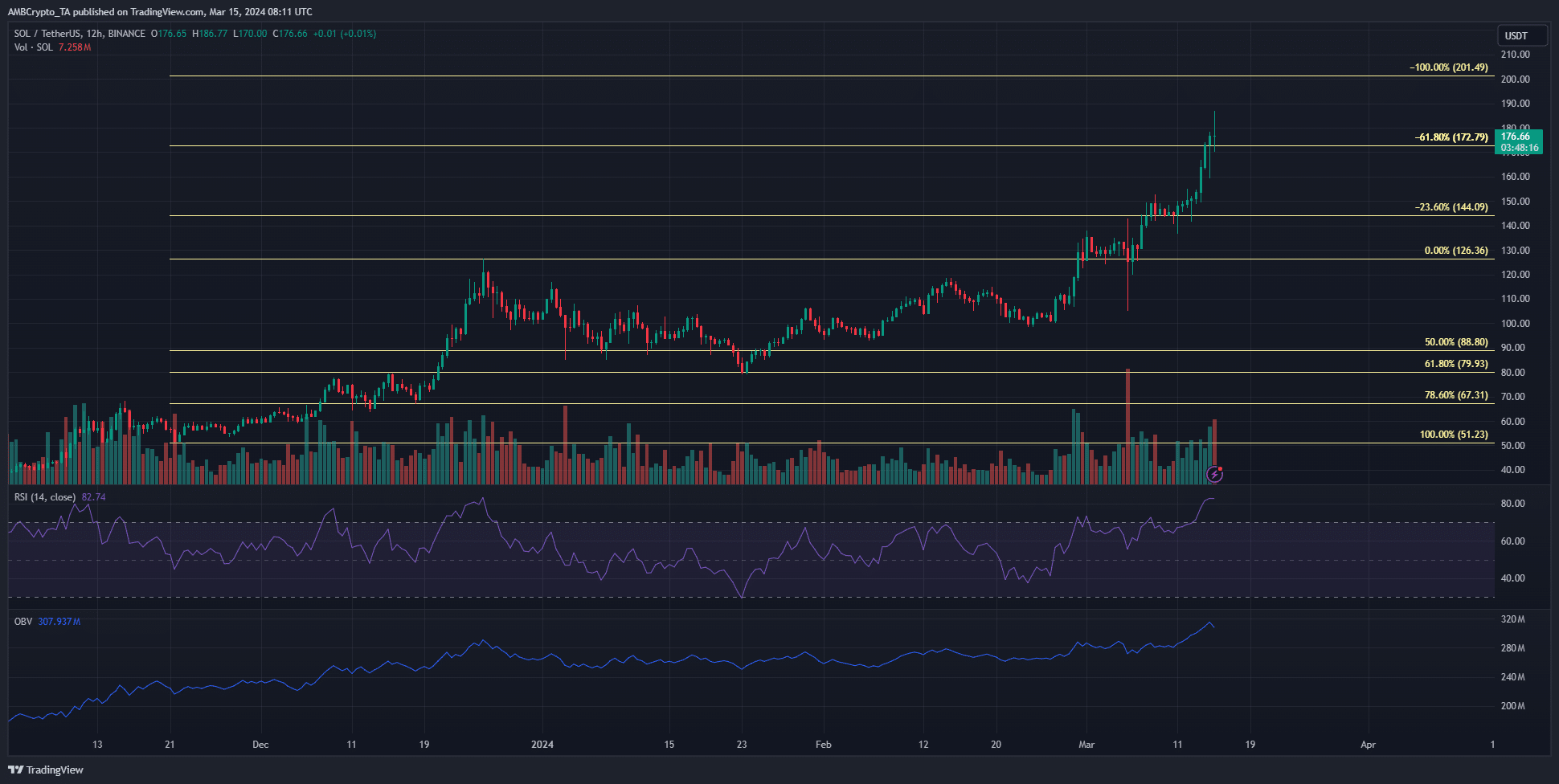

Source: SOL/USDT on TradingView

Avalanche pulled back from $56 resistance due to falling Bitcoin price, but Solana did not slow down its bullish streak. The RSI on the 12-hour chart was 82, indicating strong bullish momentum.

OBV also rose higher, signaling an influx of buyers into the market. Conversely, whales benefited, as AMBCrypto reports.

At press time, the 61.8% extension level at $172.8 had flipped into support. The $200 level is the next target, as suggested in recent reports.

Is your portfolio green? Check out our SOL Profit Calculator

Open interest slide evaluation

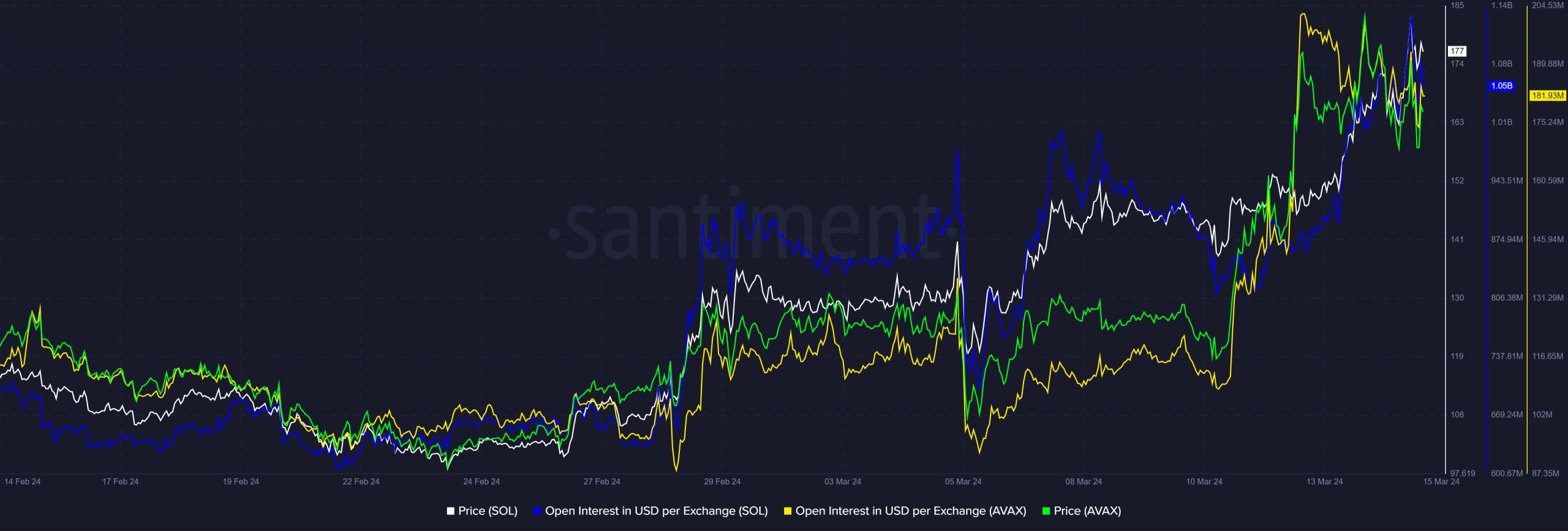

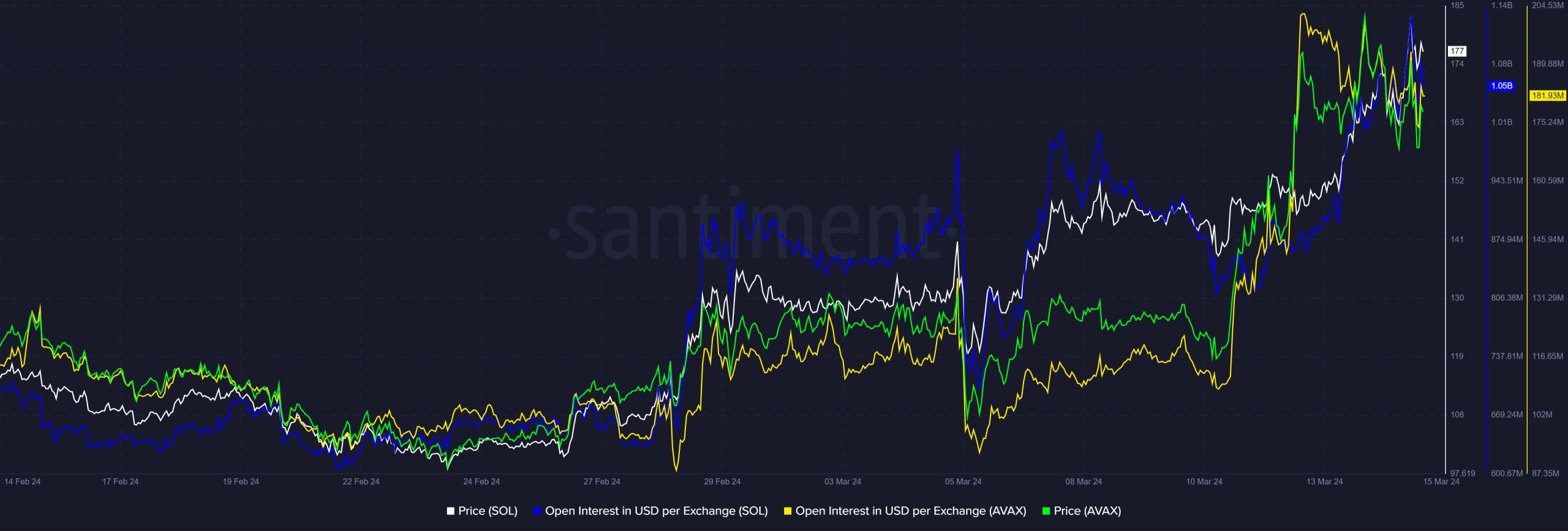

Source: Santiment

AVAX’s OI has been falling over the past three weeks. At press time, the price had fallen from $202 million to $181 million, with prices stagnating around $55. This indicates bearish expectations for the token.

Meanwhile, Solana’s open interest increased from $880 million to $1.05 billion as the price rose from $146 to $177. This was a sign that near-term confidence continues to be biased in favor of the bulls.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.