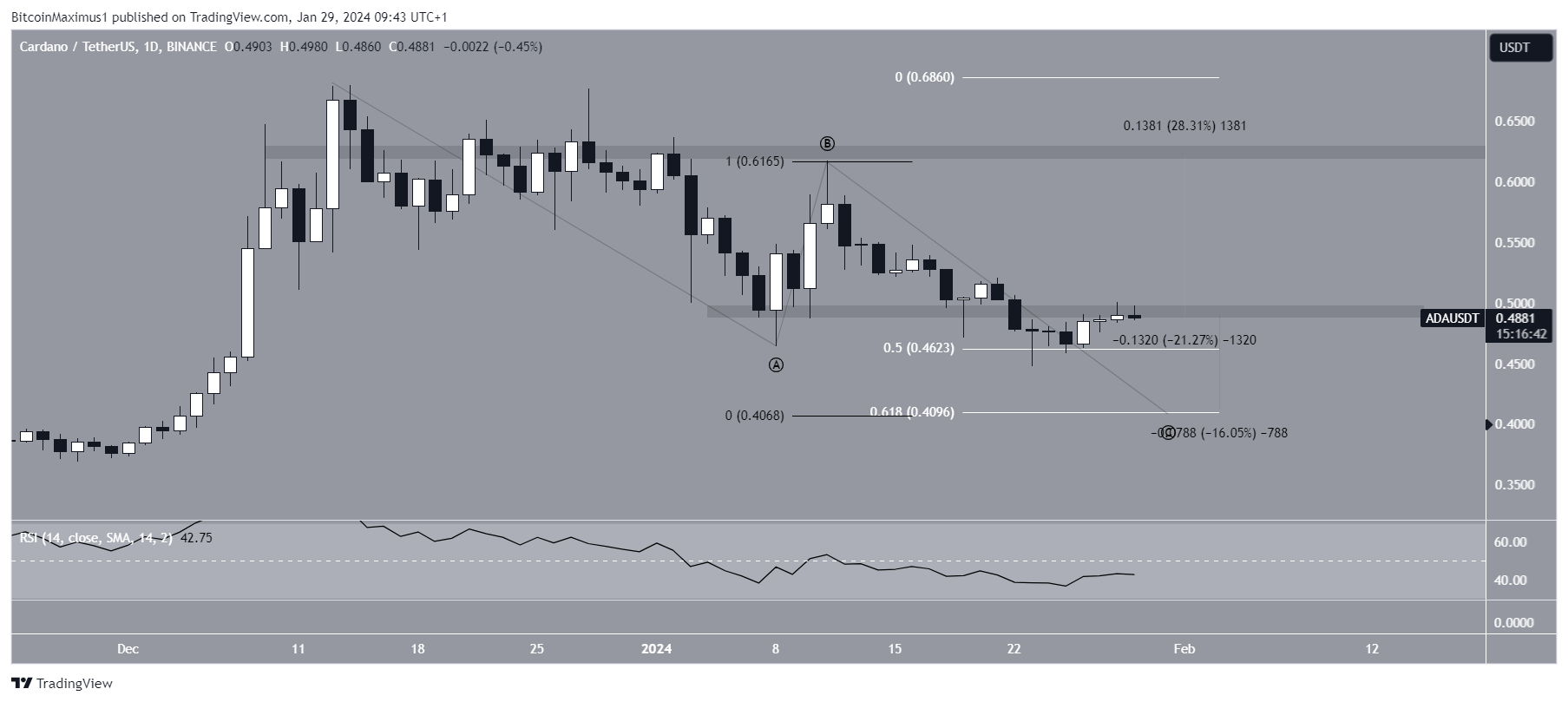

Cardano (ADA) price has been falling since December 14, 2023, reaching a lower high on December 29.

Cardano recently fell below an important horizontal support area and is validating it as resistance.

Cardano falls after multiple rejections

Technical analysis on weekly time frames shows that the ADA price has risen sharply since October 2023. However, despite numerous attempts, it has not been able to break out of a significant horizontal resistance area that has existed since May 2022.

ADA has created six consecutive long upper wicks (red icons), which are considered a sign of selling pressure. A sharp downward movement followed in January 2024.

ADA price is now approaching its previous breakout level.

The weekly Relative Strength Index (RSI) is bearish. Traders use RSI as a momentum indicator to assess whether the market is overbought or oversold and whether to accumulate or sell.

If the RSI reading is above 50 and the trend is up, bulls still have an advantage, but the opposite is true if the reading is below 50. The indicator has fallen below 70 (red circle) and is decreasing, which are all signs of a bearish trend.

Read more: How to Stake Cardano (ADA)

ADA Price Prediction: $0.50 or $0.40 What’s next?

Daily time frame technical analysis predicts a bearish ADA trend due to price action, RSI and wave count.

Elliott Wave Theory involves analyzing recurring long-term price patterns and investor sentiment to determine the direction of trends.

The most likely reading indicates that ADA is in wave C of the ABC correction structure. A 1:1 ratio on Wave A:C leads to a low of $0.41, which is consistent with the 0.618 Fib retracement support level (white).

Read more: How to Buy Cardano and Everything You Need to Know

Price action shows that ADA validates the $0.50 area as resistance after the breakdown. This is a typical retest after such a failure.

Lastly, the daily RSI is below 50 and falling, both signs of a bearish trend.

If the downward movement continues, ADA could fall 16% to the 0.618 Fib retracement support level at $0.41.

Despite this bearish ADA trend forecast, a recovery of $0.50 could lead to a nearly 30% increase to the next resistance at $0.63.

In the case of BeInCrypto‘Click here for the latest cryptocurrency market analysis.

disclaimer

In accordance with Trust Project guidelines, this price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate and unbiased reporting, but market conditions may change without notice. Always do your own research and consult with a professional before making any financial decisions. Our Terms of Use, Privacy Policy and Disclaimer have been updated.