Cardano’s price broke the $0.61 barrier on February 16, and unusual trends in derivatives market trends suggest more bullish action could follow.

Cardano (ADA) emerged as one of the best-performing megacap cryptocurrency assets this week, thanks to billions of dollars flowing into the layer 1 altcoin sector.

It remains to be seen whether ADA bulls will capitalize on the prevailing bullish catalyst to reclaim $1 for the first time since the TerraUST collapse in May 2022.

Cardano’s open interest has doubled in the last 21 days.

Since the recent local low on January 25, the price of Cardano has risen 37%, hitting a high of $0.61 during the daily period on February 16. During this period, Cardano’s ecosystem effectively added approximately $5.7 billion to its market capitalization.

Beyond spot markets, recent trends observed among derivatives show rare, bullish alignments.

CoinGlass’ open interest data tracks the notional value of active futures contracts currently listed on a specific cryptocurrency asset. As of January 25, ADA open interest was $217.1 million. In an unusual trend, it has now risen another $218.7 million, reaching a four-month high of $435.8 million at the time of writing on February 16.

A 100.7% surge in open interest means speculative traders have doubled their investments in the ADA futures market over the past 21 trading days.

A closer look shows that the rapid growth in investor interest and market participation is outpacing the rise in Cardano spot price.

ADA’s 37% price increase over the same period is notable, but pales in comparison to the impressive 100.7% increase in open interest.

Strategic investors often perceive these unusual market dynamics as strong bullish signals for two main reasons. A significant increase in open interest signals increased market activity and increasing investor confidence in ADA’s near-term price outlook, as well as a significant spread between price appreciation and open interest. Growth can indicate underlying market strength and the potential for continued upward momentum.

Cardano Price Prediction: Is $1 a Viable Target?

Market trends suggest that Cardano’s price is likely to see another rally close to $1 in the coming weeks. However, historical accumulation trends suggest that ADA may face strong resistance in the $0.67 range.

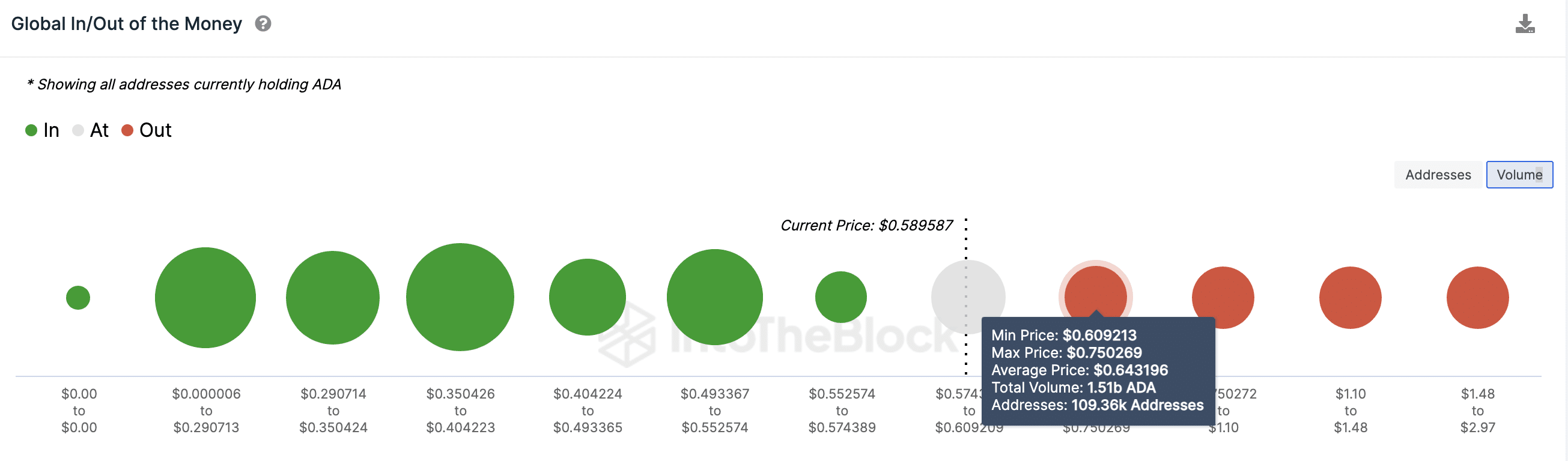

IntoTheBlock’s global GIOM (money in and out) data groups all existing investors by their entry price. GIOM shows that 109,300 existing holders acquired 1.5 billion ADA at an average price of $0.64.

Considering that this is the largest cluster of holders who purchased ADA above the current price, a decisive break above $0.65 could effectively open the door to a larger rally towards $1, as expected.

If the ADA price reverses below $0.50, the downside could invalidate this lofty forecast. However, in this scenario, 345,590 addresses acquiring 5.03 billion ADA at an average price of $0.52 could result in a significant buywall.